UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-22106

Tortoise Power and Energy Infrastructure Fund,

Inc.

(Exact name of registrant as specified in charter)

6363 College Boulevard, Suite 100A, Overland

Park, KS 66211

(Address of principal executive offices) (Zip code)

P. Bradley Adams

Diane Bono

6363 College Boulevard, Suite 100A, Overland

Park, KS 66211

(Name and address of agent for service)

913-981-1020

Registrant's telephone number, including area code

Date of fiscal year end: November 30

Date of reporting period: November 30, 2023

Item 1. Report to Stockholders.

(a) The report to Shareholders is attached herewith.

Annual Report | November

30, 2023

2023 Annual Report

Closed-End Funds

Tortoise

2023 Annual Report to Stockholders

This combined report provides you

with a comprehensive review of our funds that span essential assets.

TTP and TPZ distribution policies

Tortoise Pipeline & Energy Fund, Inc. (“TTP”)

and Tortoise Power and Energy Infrastructure Fund, Inc. (“TPZ”) are relying on exemptive relief permitting them to make long-term

capital gain distributions throughout the year. Each of TTP and TPZ, with approval of its Board of Directors (the “Board”),

has adopted a managed distribution policy (the “Policy”). Annual distribution amounts are expected to fall in the range of

7% to 10% of the average week-ending net asset value (“NAV”) per share for the prior fiscal semi-annual period. In accordance

with its Policy, TTP distributes a fixed amount per common share, currently $0.59, each quarter to its common shareholders. TPZ distributes

a fixed amount per common share, currently $0.105, each month to its common shareholders. These amounts are subject to change from time

to time at the discretion of the Board. Although the level of distributions is independent of TTP’s and TPZ’s performance,

TTP and TPZ expect such distributions to correlate with its performance over time. Each quarterly and monthly distribution to shareholders

is expected to be at the fixed amount established by the Board, except for extraordinary distributions in light of TTP’s and TPZ’s

performance for the entire calendar year and to enable TTP and TPZ to comply with the distribution requirements imposed by the Internal

Revenue Code. The Board may amend, suspend or terminate the Policy without prior notice to shareholders if it deems such action to be

in the best interests of TTP, TPZ and their respective shareholders. For example, the Board might take such action if the Policy had the

effect of shrinking TTP’s or TPZ’s assets to a level that was determined to be detrimental to TTP or TPZ shareholders. The

suspension or termination of the Policy could have the effect of creating a trading discount (if TTP’s or TPZ’s stock is trading

at or above net asset value), widening an existing trading discount, or decreasing an existing premium. You should not draw any conclusions

about TTP’s or TPZ’s investment performance from the amount of the distribution or from the terms of TTP’s or TPZ’s

distribution policy. Each of TTP and TPZ estimates that it has distributed more than its income and net realized capital gains; therefore,

a portion of your distribution may be a return of capital. A return of capital may occur, for example, when some or all of the money that

you invested in TTP or TPZ is paid back to you. A return of capital distribution does not necessarily reflect TTP’s or TPZ’s

investment performance and should not be confused with “yield” or “income.” The amounts and sources of distributions

reported are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax

reporting purposes will depend upon TTP’s and TPZ’s investment experience during their fiscal year and may be subject to changes

based on tax regulations. TTP and TPZ will send you a Form 1099-DIV for the calendar year that will tell you how to report these distributions

for federal income tax purposes.

2023 Annual Report | November

30, 2023

| Closed-end Fund Comparison |

| |

Name/Ticker |

Primary

focus |

Structure |

Total

investments

($ millions)(1) |

Portfolio mix

by asset type(1) |

Portfolio mix

by structure(1) |

| |

|

|

|

|

|

|

| Midstream

focused |

Tortoise Energy Infrastructure Corp.

NYSE: TYG

Inception: 2/2004 |

Energy Infrastructure |

Regulated investment company |

$491.4 |

|

|

|

Tortoise Midstream Energy Fund, Inc.

NYSE: NTG

Inception: 7/2010 |

Natural Gas Infrastructure |

Regulated investment company |

$271.9 |

|

|

|

Tortoise Pipeline

& Energy Fund, Inc.

NYSE: TTP

Inception: 10/2011 |

North

American

pipeline

companies |

Regulated investment company |

$85.6 |

|

|

| Upstream

focused |

Tortoise Energy Independence

Fund, Inc.

NYSE: NDP

Inception: 7/2012 |

North

American

oil & gas

producers |

Regulated investment company |

$67.9 |

|

|

| Energy

value chain |

Tortoise Power

and Energy Infrastructure

Fund, Inc.

NYSE: TPZ

Inception: 7/2009 |

Power

& energy infrastructure companies

(Fixed income

& equity) |

Regulated investment company |

$119.6 |

|

|

| Multi

strategy focused |

Ecofin Sustainable and Social Impact Term Fund

NYSE: TEAF

Inception: 3/2019 |

Essential

assets |

Regulated investment company |

$223.2 |

|

|

| |

|

|

|

|

|

|

(1) As of 11/30/2023

(unaudited)

Tortoise

2023 Annual Report to closed-end fund stockholders

Dear stockholder,

The 2023 fiscal year offered energy investors significant

opportunity with record levels of production, growing export demand, along with some regulatory clarity. Overall, performance ended the

year mixed with midstream higher and both broader energy and utilities lower. Higher interest rates clearly impacted relative performance.

And cash flow proved to be king. Notable events influencing performance included geopolitical tensions in Ukraine and Israel and OPEC+

decisions around crude oil supply and demand. Effects of the Inflation Reduction Act also started to surface. Finally, the U.S. energy

complex remained ever important to supporting the global economy. Sustainable infrastructure continued to face significant headwinds over

the fiscal year due to a variety of factors including inflation, elevated interest rates, and natural gas prices. Despite the difficult

market environment in the education sector, there was an increase in both the volume and credit quality of education investment opportunities

throughout 2023. The senior living industry experienced a continued rebound in the wake of COVID. Demand for senior living facilities

continued to outpace the bed supply which boded well for the sector.

Energy and power infrastructure

The broad energy sector

returned -4.3% for the annual fiscal period (as measured by the S&P 500 Energy Index). Energy was generally rangebound during the

year, bottoming down 15% in March following the regional banking crisis, and peaking higher by 5% in September following the Organization

of Petroleum Exporting Countries plus Russia’s (OPEC+) announcement to curtail crude oil supplies to the global market. The war

between Russian and Ukraine remained in focus and geopolitically was magnified when the Israel and Hamas conflict intensified in October.

That raised concerns about a broader Middle East conflict. The allocation for free cash flow remained an energy investor focus with lower

debt, dividend growth, and share buybacks being a cornerstone of management’s playbook. These policies, along with disciplined mergers

& acquisitions (M&A), were favored in the higher interest environment and in front of concerns about a slowing economy in 2024.

Global crude oil supply

and demand led energy market sentiment. In the first quarter the Organization for Economic Cooperation and Development (OECD) commercial

inventories built up marginally partly due to slower Chinese demand than expected coming out of COVID lockdowns. This resulted in a decision

by Saudi Arabia in the summer to voluntarily reduce its oil output by 1 million barrels per day (bpd) for the month of July, with the

potential for this cut to be extended. Consequently, oil stocks declined, and crude oil prices rallied in the third quarter. Though Saudi

Arabia consistently extended their cuts in the second half, concerns about a global economic slowdown along with growing production in

the United States and Guyana weighed on prices late in the year. To better balance the market, in November OPEC+ agreed to 2 million

bpd of cuts to start 2024, leaving the oil market in a constructive position on supply and demand.

U.S. crude oil production

growth exceeded expectations, growing nearly 1 million bpd in 2023 to 13.2 million bpd. That level eclipsed the previous record high

of 13.0 million bpd achieved in November of 2019. The growth resulted despite rig counts and well completions falling as the year progressed.

Simply, producers did more with less. Drilling laterals lengthened, completion times shortened and even the application of artificial

intelligence positively impacted efficiencies. The Permian basin, the largest U.S. oilfield, remained the primary driver of growth reaching

six million bpd. Aiding producer returns, oilfield service and material costs declined, resulting in lower break-even costs. The Energy

Information Agency (EIA) forecasts production in 2024 to remain steady, partly due to the lower rig count and completion activity trend

transpiring in 2023.

U.S. natural gas production

grew as well in 2023 as the U.S. exported more liquefied natural gas (LNG) than any other country in the first half. U.S. LNG production

reached nearly 12 billion cubic feet per day (bcf/d). The war in Ukraine continued to present a long-term opportunity for U.S. liquefied

natural gas. LNG exports to Europe accelerated in 2022 and remained elevated in 2023. These exports, lower industrial demand, and a relatively

warm winter in 2022/23 kept European natural gas storage inventories full throughout 2023 and well positioned to keep Europe adequately

supplied for the 2024 winter. U.S. natural gas storage inventories also entered year-end 2023 well supplied at just above the five-year

average partly due to a warm winter a year ago. Also helping inventories is growing U.S. production, that improved from 102 bcf/d to

105 bcf/d over the year. That production will help supply LNG export facilities set to come on-line starting in the second half of 2024

through year-end 2027. In that short timeframe U.S. LNG export capacity will nearly double to 25 bcf/d. The EIA forecasts natural gas

production to be mostly flat in 2024 due partly to limited visibility to near-term demand improvement and, like the drilling cadence

for oil, declining service activity.

Natural gas liquids (NGLs)

do not receive as much attention as crude oil or natural gas because they are less visible to consumers. Nonetheless, that does not diminish

their importance as NGLs are the key components in making plastics along with being a source of heat. And, at 6.8 million bpd, the U.S.

is the world’s largest producer of NGLs. Growth in 2023 surpassed 600 thousand bpd with most marginal production exported to meet

growing Asian petrochemical demand. The EIA forecasts NGL production to be stable in 2024.

The midstream energy

sector returned 7.6% for the fiscal year (as measured by the Alerian Midstream Energy Index or AMNA), topping broader energy. Growing

production volumes and inflation passed through via higher tariff rates benefitted revenues. Further, the sector’s elevated and

higher free cash flow, declining leverage, attractive valuation, and share buybacks supported performance. Finally, disciplined M&A

activity with synergies largely accruing to buyers offered a favorable environment for those seeking acquisition led growth.

(unaudited)

2023 Annual Report | November

30, 2023

Cash flow improved for

midstream companies in 2023 following volumes and tariff increases and cost and capital expenditure discipline. Management teams targeted

cash flow increasingly toward shareholders in the form of debt paydown, dividend and distribution growth, and share repurchases. Leverage

targets are now generally between 3.0x – 4.0x earnings before interest, taxes, depreciation and amortization (EBITDA) with leverage

being a full “turn” lower versus levels prior to 2020. And in addition to dividend and distribution growth, companies opportunistically

repurchased shares, as buybacks topped $4 billion from the fourth quarter of 2022 through the third quarter of 2023. With leverage targets

now largely achieved, 2024 sets up for incrementally more cash flow earmarked for dividends and buybacks.

Following hawkish interest

rate actions from the Federal Reserve, the prospects of an economic recession weighed on investor psyche during much of the fiscal year.

While multiple recessions occurred in the last 40 years, energy demand still increased in 38 out of the last 41 years (2008 and 2020

decreased). Due to actions taken during the recent 2020 recession that reduced capital expenditures and focused on debt paydown, we believe

the energy sector, and specifically midstream, is well prepared to deal with another potential recession. With the world remaining undersupplied

energy over the long-term and sector balance sheets now less levered than in past recent recessions (2001, 2008 and 2020), we believe

energy is well positioned should lower economic growth materialize.

Broader market concerns

about higher interest rates boosted midstream’s relative attractiveness. As higher rates due to inflation were passed through,

companies generated significant free cash flow that led to little to no debt or equity capital market access requirements even for maturing

debt. Additionally, the good economic growth resulted in higher energy demand. Looking at history, good performance in a higher rate

environment is not surprising. In the 18 time periods when the 10-year Treasury yield increased by 50 basis points or more since 2001,

midstream energy, represented by the Tortoise North American Pipeline Index, returned an average of 7.4%, compared to a S&P 500 Index

average return of 5.9%, and bond returns of -2.6% represented by the Bloomberg U.S. Aggregate Bond Index.

With inflation continuing

to increase in 2023, midstream provided investors inflation protection. Pipelines typically benefit from long-term contracts with inflation

protection from regulated tariff escalators. Additionally, tariffs on regulated liquid pipelines include an inflation escalator aligned

with the Producer Price Index (PPI). Federal Energy Regulatory Commission (FERC) indexing allowed for a tariff increase of over 13% beginning

on July 1, 2023. In fact, we estimate that the cumulative total allowable tariff increase since 2020 through year-end 2024 will eclipse

26%. This contract feature serves as protection against higher operating costs.

Midstream companies

remained active in M&A with many discrete assets changing hands along with a handful of corporate transactions. The commonality

among all the transactions was buyer discipline. The buyers only purchased complementary assets to existing footprints where

synergies were obvious and paid a price that made the transaction immediately accretive. Even in the corporate transactions,

premiums paid were constructive. In the largest corporate transaction, ONEOK acquired Magellan Midstream Partners at a 22% premium.

Synergies and diversification drove the rationale as both Tulsa companies transport petroleum products, with ONEOK mostly natural

gas liquids and Magellan refined products and crude oil. ONEOK also estimated a tax benefit of $1.5 billion.

One major new pipeline

received regulatory help with the signing of the Fiscal Responsibility Act (FRA) that resolved the mid-summer debt ceiling scuffle. That

Act approved all construction and operational permits and authorizations required for the Mountain Valley Pipeline (MVP). MVP would transport

2 bcf/d of natural gas from the Marcellus through West Virginia and into Virginia. Equitrans Midstream (ETRN), MVP’s operator,

now estimates pipeline completion in the first quarter of 2024. In addition, the FRA reformed the way the National Environmental Policy

Act (NEPA) interacts with agencies to approve energy projects so that project developers have more confidence in permitting processes.

Now, when two or more agencies are involved in review, one will be designated lead agency to reduce delays. Further, the timeframe for

an Environmental Impact Statement is limited to two years and an Environmental Assessment to one year, and there are limits on the number

of pages for each. Despite the improved regulatory efficiency, attaining project approvals remained challenging. For example, Navigator

CO2 Ventures cancelled its proposed $3.5 billion, 1,300-mile carbon capture pipeline due to an unpredictable regulatory and government

process. The pipeline concept involved transporting carbon dioxide emissions from ethanol plants to sites where the greenhouse gas would

be sequestered deep underground.

Sustainable infrastructure

From a macro perspective

the first half of the period was generally characterised by influences stemming from stubborn inflation, elevated interest rates, and

declining energy prices, in particular natural gas. In China, the magnitude of economic recovery following the post-COVID reopening ultimately

did not come to fruition.

Elevated borrowing costs

were concerning for businesses which ‘borrow to grow,’ as were higher equipment costs, trade issues, permitting and transmission

constraints. The period also saw banking turmoil triggered primarily by Silicon Valley Bank in early March. As such, some companies in

our investment universe could not escape these varying impulses even if their secular growth remained intact.

The second half of the

period opened with continued upward pressure on interest rates across the OECD and declining power prices in Europe. In response, our

capital-intensive sector saw challenges amidst these elevated interest rates, notably on existing asset cash flows due to higher costs

of capital, and on balance sheets due to the increased total capital needed to finance growth. Amidst such a context, the sector derated

while broader market multiples expanded.

(unaudited)

The

third calendar quarter saw a further steady increase in longer-term interest rates, which created a larger headwind to valuations and

spreads of capital formation for new projects, and overshadowed other drivers as the market reduced the present value of actual cash

flows and questioned the value of growth for companies in the sector. Within that context, purer renewables companies that do not have

other businesses have been most impacted. We therefore saw both U.S. and European valuations continue to compress. Amidst such a context

the sector struggled during the quarter.

The close of the period

saw a welcome improvement in performance, as interest rates began to stabilise and hopeful sentiment on potential future rate cuts for

2024 arose.

Looking

Ahead:

In 2024, if interest

rates stabilize and then decline, we believe that would be very supportive for the sector in the future. Stability in interest rates

should help reduce volatility by offering more consistent net present values of operating cash flows and growth. This is unfortunately

an exogenous factor, but equally is not fundamental to operating earnings before interest and taxes (EBIT).

We maintain conviction

looking ahead; electrification trends remain robust as fundamentally demand is strong, and we predict strong policy support (from the

U.S.’ IRA, across to Europe). Further, valuations for the stocks in the investment universe have come down relative to history

and relative to the broader market. We believe doubts surrounding growth are likely overly pessimistic, and that the mean-reverting aspects

of utilities and infrastructure have been historically compelling. Over-time, in our sector, share prices will tend to correlate with

earnings, and we anticipate these dynamics in 2024.

Notably, through 2023

many companies have reset priorities among growth, credit rating, and dividend. The sector will therefore enter 2024 offering a clearer

picture with potentially less volatility and a focus on execution.

Moving into 2024 and

considering valuations, strength in demand, attractive renewables development returns and where we are in the inflation and interest

rate cycles, we believe that we are approaching an inflection point and are in an attractive spot. This sector captures structural growth

in a slowing global economic environment. Companies typically deliver more stable, and more predictable non-cyclical earnings, and are

positioned to protect better in falling markets while also participating in rebounds.

Waste Transition

The trend of growth in

the number of new facilities being planned or constructed in the United States to transform waste into energy and other beneficial resources

continued in Q4 2023. However, the full growth potential of the sector was negatively impacted by certain macro economic and environmental,

social and governance (ESG) concerns.

From a macro economic

standpoint, persistently high levels of project cost inflation and market interest rates continued to cause higher capital and debt service

costs, putting downward pressure on the economic viability of new projects. As uncertainty increased, the availability of capital decreased,

and that adversely impacted the funding of new projects. As reported by ImpactAlpha, a new report from Sightline Climate indicated that

private capital provided for new first-of-a-kind climate-tech projects, including demonstration units and first-time commercializations,

declined by more than 50% in 2023. The marginal abatement of inflation and interest rates during the fourth quarter is expected to provide

tailwinds for improved capital inflows into the sector in 2024.

From an ESG standpoint,

the rush in recent years to invest in projects and companies that exhibit positive ESG attributes was diminished by significant headwinds

in 2023, both politically and in terms of verifying whether ESG claims were being achieved. The relative ESG discomfort was exhibited

most prominently within the sustainability-linked bond market, where companies can achieve lower borrowing costs by achieving ESG goals.

Per Bloomberg, global sales of sustainably-linked bonds fell by 22% in 2023, the sharpest annual decline on record. Green bond sales,

however, without the political or verification concerns of ESG-related bonds, achieved their second-highest issuance year on record in

2023 per Bloomberg, evidencing strong investor demand generally for sustainable bonds.

The fourth calendar quarter

also saw significant updates regarding fuel credits and tax credits, which provide substantial economic underpinnings for biogas and

biofuel projects in the U.S.

The California Air Resources

Board, known as CARB, released its proposed rulemaking changes to its Low Carbon Fuel Standard or “LCFS” program. While subject

to public comment and final approval, the CARB proposal significantly increases carbon intensity reduction targets, from a current 20%

by 2030 to a new target of 30% by 2030, while adding a 90% reduction target by 2045. Market expectation is that the more stringent targets

will lead to higher LCFS credit pricing, which would improve project cash flows on a go-forward basis.

Separately, the Treasury

Department and the Internal Revenue Service (IRS) released proposed regulations regarding Section 48 Investment Tax Credits, with emphasis

on clarifying what capital costs are eligible under the definition of Biogas Facilities. Market participants view such facilities as

consisting of three primary components — gas generation or collection, gas upgrading to natural gas specs, and pipeline interconnect.

However, the proposed regs exclude both gas upgrade systems and pipeline interconnections, which would sharply reduce the potential value

of related investment tax credits. A significant industry push is underway to encourage a more-broad determination of eligible project

costs, prior to final rule-making.

Finally, a growing voluntary

market for biogas and biofuels continues to lessen the sector’s reliance on fuel and tax credits, which is a net positive for sector

fundamentals. Of note, the

(unaudited)

2023 Annual Report | November

30, 2023

largest voluntary renewable

natural gas agreement on record was established between Vanguard Renewables and AstraZeneca. As publicly announced, Vanguard will supply

renewable natural gas (RNG) from three of its dairy manure anaerobic digester facilities over a 15-year term, and AstraZeneca will purchase

at least 650,000 million British thermal units of RNG annually, which is the equivalent energy necessary to heat approximately 18,000

homes per year. Similarly, Anaergia announced a voluntary agreement to sell RNG to Toyota. Although these direct, voluntary purchases

reduce cashflow upside for projects that would otherwise rely on volatile spot-market pricing, they do provide enhanced cash flow stability

and enable a more bankable sector.

Social

impact

Education

The public market for

issuance of new K-12 charter school and private school revenue bonds in Q4 2023 saw a significant rebound with 32 new issues at a par

value of $1,650,427,114, an 85% increase over the same period in 2022. For all of 2023 however, there were only 98 total issues with

par value totaling $3,376,240,114, a 26.67% decrease in par value from 2022.1 In 2023, the specialty investor portion of the

K-12 market totaled 28 new issues with a par value of $755,350,114, of which our firm accounted for 14.6%.

It is our continued assessment

that outflows from municipal bond funds played a major role in 2023’s reduced K-12 charter and private school bond issuance. Q4

outflows were $7,420,010,000 and cumulative outflows for 2023 totaled more than $11 billion.2 The interest rate roller coaster

that defined 2023 was also a significant factor. The 30-year municipal market data (MMD) daily rate, benchmark for K-12 bond offerings,

began the year at 3.50% and dropped to its low of 3.13% by early February. It then went on a steady climb through October, reaching a

high of 4.57% (an increase of 144 bps) before dropping to 3.40% to end the year.3 This volatility forced may schools to put

plans to finance or refinance facilities on hold.

A highlight for Q4 2023

was the National Alliance for Public Charter Schools’ (NAPCS) Charter School Data Digest report. For the 2021-2022 school year

(the most recent for which data was available), public charter schools served approximately 3.7 million students in 7,996 schools throughout

the nation. Charter school enrollment accounted for 7.4% of all public school students, up from 6.8% in 2019-2020. Across the nation,

charter schools continued to serve a higher proportion of low-income students (59%) and students of color (70.1%) when compared to their

district public school counterparts (50.3% and 53.8% respectively). Additionally, with Montana’s passage of new legislation in

2023, charter school laws were on the books in 46 states, Washington DC, Puerto Rico and Guam. This is a significant milestone in the

hard-fought battle to make more education opportunities available to all children that began 32 years ago with Minnesota’s first

in the nation charter school law.4

The NAPCS report also

provided a snapshot as to the management structures employed in charter schools throughout the nation. While all charter schools are

governed by a not-for-profit board, they are divided into one of three categories, depending upon their structure for day-to-day management

of the school. The first, and most common (57.4% of all charter schools), were “independent,” charter schools that are run

by a de novo management team, unique to that individual school. The second are those operating under the network of a not-for-profit

charter management organization (CMO) that establish common goals, educational models and curriculum. CMO’s accounted for 31.7%

of all charter schools, and are often amongst the most well-known and successful (e.g. KIPP, Success Academy, IDEA Schools). Finally,

10.9% of charter schools were led by a for-profit education management organization (EMO).4 Charter school boards contract

with an EMO to run the day-to-day operations of the schools and often additional services such as back-office support, hosting web platforms,

or staffing assistance. While EMOs are often the target of those opposed to charter schools, there are many high performing EMO-run charter

schools, including the several in the Top 25 high schools in America.5 While Ecofin has primarily worked with independent

charter schools, our team has significant past experience working with CMO and EMO led schools as well.

Despite market headwinds,

we saw increases in both the volume and credit quality of education investment opportunities throughout 2023. While it is too early to

know whether the Q4 bond market rebound is a sign of things to come, there should continue to be a robust number of private credit financing

opportunities for K-12 charter school and private schools that offer solid returns for investors.

Senior

Living

This past year was a

year of continued rebound for the senior living industry. Occupancy continued to improve in the wake of COVID, and our senior population

was one step closer to outpacing the current bed supply. In fact, we are just one year away from the first baby boomer turning 80 years

old. Given the current pace of new senior living development, our country will only supply 40% of the projected demand by 2030. That

is an extraordinary shortfall, and catching up to the projected demand will require more than $400 billion of investment over the next

few years.6

As of this printing, Q4 2023 occupancy statistics were not yet available. The for-profit senior living sector

recorded its ninth quarter in a row of occupancy gains in Q3 2023. Statistically, nationwide occupancy for independent living and assisted

living is 86.1% and 82.6%, respectively. Recovery has been stronger in the higher acuity and needs based assisted living setting; however,

independent living is not far behind. As of the third quarter, assisted living occupancy had recovered 8.7%, while independent living

had recovered almost half as much, up 4.6% since the pandemic lows of 2021. Based on the past two years of absorption, senior living

occupancy is projected to reach pre-pandemic levels in 2024.6

(unaudited)

Non-profit

senior living has fared better than their for-profit brethren since the pandemic hit. As of Q3 2023, non-profit continuing care retirement

communities (CCRC’s) were 90.5% occupied. Additionally, asking rents have increased more in non-profit communities, up 5.3% and

5.8% in the assisted and memory care spaces, respectively.6 Based on conversations with our operating partners, communities

continue to pass along outsized rent increases to catch up with inflation but are nearing a point of equilibrium.

Occupancy recovery has

been fueled by almost four years of slowing construction starts. In fact, 2023 recorded the lowest primary market inventory growth since

2005, when National Investment Center for Seniors Housing & Care (NIC) started recording the data. Rising interest rates, elevated

construction costs and tight lending conditions will continue to propel occupancy in the months to come. Given the incredibly low number

of units under construction, the market is setting up for a severe supply and demand imbalance just as the baby boomer population is

knocking on the doorstep.

From now until 2030,

an average of 10,000 baby boomers will turn 65 every day.8 With the combination of increased population and a slower pace

of new senior living inventory supply, we remain confident in the senior living industry’s resilience and ability to prepare for

the upcoming “Silver Tsunami” as our population continues to age.

Concluding thoughts

Energy infrastructure

remains essential for the U.S. to continue as the leading global energy producer and to meet the energy demands of consumers, both domestically

and abroad. Geopolitical events further highlighted this reality. We believe that indispensable nature offers compelling opportunities

for 2024 and beyond. We hope for improved performance of sustainable infrastructure and climate action investments. With strong demand

for renewable energy sources, we believe the sector is well positioned heading into 2024. Opportunities for investing in social impact

education and senior living projects have continued to expand. The projects help broaden educational options for families and strive

to meet the increasing housing demand for the U.S. aging demographic.

The S&P Energy Select

Sector® Index is a capitalization-weighted index of S&P 500® Index companies in the energy sector involved

in the development or production of energy products. The Tortoise North American Pipeline IndexSM is a float adjusted, capitalization-weighted

index of energy pipeline companies domiciled in the United States and Canada. The Tortoise MLP Index® is a float-adjusted,

capitalization-weighted index of energy master limited partnerships.

The Tortoise indices

are the exclusive property of Tortoise Index Solutions, LLC, which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow

Jones Indices LLC) to calculate and maintain the Tortoise MLP Index® and Tortoise North American Pipeline IndexSM

(the “Indices”). The Indices are not sponsored by S&P Dow Jones Indices or its affiliates or its third party licensors

(collectively, “S&P Dow Jones Indices LLC”). S&P Dow Jones Indices will not be liable for any errors or omission

in calculating the Indices. “Calculated by S&P Dow Jones Indices” and its related stylized mark(s) are service marks

of S&P Dow Jones Indices and have been licensed for use by Tortoise Index Solutions, LLC and its affiliates. S&P® is

a registered trademark of Standard & Poor’s Financial Services LLC (“SPFS”), and Dow Jones® is a

registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”).

It is not possible

to invest directly in an index.

Performance data quoted

represent past performance; past performance does not guarantee future results. Like any other stock, total return and market value will

fluctuate so that an investment, when sold, may be worth more or less than its original cost.

| 1 | Electronic Municipal Market Access https://emma.msrb.org/ &

MuniOS https://www.munios.com/ |

| 2 | Refinitiv Lipper US Fund Flows https://www.lipperusfundflows.com/ |

| 4 | https://data.publiccharters.org/digest/charter-school-data-digest/how-many-charter-schools-and-students-are-there/ |

| 5 | https://www.usnews.com/education/best-high-schools/national-rankings |

2023 Annual Report | November

30, 2023

Tortoise

Energy Infrastructure Corp. (TYG)

Fund description

Tortoise Energy Infrastructure Corp.

(TYG) seeks a high level of total return with an emphasis on current distributions paid to stockholders. TYG invests primarily in equity

securities in energy infrastructure companies. The fund is positioned to benefit from growing energy demand and accelerated efforts to

reduce global CO2 emissions in energy production. Energy infrastructure companies generate, transport and distribute electricity, as well

as process, store, distribute and market natural gas, natural gas liquids, refined products and crude oil.

Fund performance

The midstream energy

sector returned 7.6% for the fiscal year (as measured by the Alerian Midstream Energy Index or AMNA), topping broader energy. Growing

production volumes and inflation passed through via higher tariff rates benefitted revenues. Further, the sector’s elevated and

higher free cash flow, declining leverage, attractive valuation, and share buybacks supported performance. Finally, disciplined M&A

activity with synergies largely accruing to buyers offered a favorable environment for those seeking acquisition led growth. The fund’s

market-based and NAV-based returns (including the reinvestment of distributions) for the fiscal year were -7.8% and -1.3%, respectively.

The Tortoise MLP Index® returned 20.8% during the same period.

| 2023 fiscal year summary |

|

| Quarterly distributions paid per share |

$0.7100 |

| Distribution rate (as of 11/30/2023) |

10.1% |

| Year-over-year distribution increase (decrease) |

0.0% |

| Cumulative distributions paid per share to stockholders since inception in February 2004 |

$43.8475 |

| Market-based total return |

(7.77)% |

| NAV-based total return |

(1.29)% |

| Premium (discount) to NAV (as of 11/30/2023) |

(20.5)% |

Key asset performance drivers

| Top

five contributors |

Company

type |

| Targa

Resources Corp. |

Natural

gas pipeline |

| The

Williams Companies, Inc. |

Natural

gas pipeline |

| Energy

Transfer LP |

Natural

gas pipeline |

| Magellan

Midstream Partners, LP |

Refined

products pipeline |

| Enterprise

Products Partners LP |

Natural

gas pipeline |

| Bottom

five contributors |

Company

type |

| NextEra

Energy Partners LP |

Diversified

infrastructure |

| AES

Corp. |

Power |

| Clearway

Energy, Inc. |

Diversified

infrastructure |

| NextEra

Energy, Inc. |

Diversified

infrastructure |

| Atlantica

Sustainable Infrastructure

PLC |

Power |

Unlike the fund

return, index return is pre-expenses and taxes..

Performance data

quoted represent past performance; past performance does not guarantee future results. Like any other stock, total return and market

value will fluctuate so that an investment, when sold, may be worth more or less than its original cost. Portfolio composition is subject

to change due to ongoing management of the fund. References to specific securities or sectors should not be construed as a recommendation

by the fund or its adviser. See Schedule of Investments for portfolio weighting at the end of the fiscal quarter.

(unaudited)

Tortoise

Energy Infrastructure

Corp. (TYG) (continued)

Value

of $10,000 vs. Tortoise Energy Infrastructure Fund – Market (unaudited)

From November

30, 2013 through November 30, 2023

The chart assumes an initial investment of $10,000.

Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance

data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate,

and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher

than the performance quoted and can be obtained by calling 866-362-9331. Performance assumes the reinvestment of capital gains and income

distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption

of Fund shares.

Annualized Rates of Return as of

November 30, 2023

| |

1-Year |

3-Year |

5-Year |

10-Year |

Since Inception(1) |

| Tortoise Energy Infrastructure Fund - NAV |

-1.29% |

21.35% |

-10.50% |

-7.31% |

2.49% |

| Tortoise Energy Infrastructure Fund - Market |

-7.77% |

22.86% |

-13.83% |

-10.64% |

1.08% |

| Tortoise MLP Index® |

20.76% |

33.85% |

11.27% |

3.58% |

9.17% |

| Tortoise Decarbonization Infrastructure IndexSM (2) |

-4.35% |

N/A |

N/A |

N/A |

N/A |

| (1) | Inception date of the Fund was Feburary 25, 2004. |

| (2) | The Tortoise Decarbonization Infrastructure Index was added

to reflect the inclusion of a broader scope of energy infrastructure equities including midstream, utilities, and renewables in TYG effective

November 30, 2021. |

Fund structure and distribution

policy

The fund is structured

to qualify as a Regulated Investment Company (RIC) allowing it to pass-through to shareholders income and capital gains earned, thus

avoiding double-taxation. To qualify as a RIC, the fund must meet specific income, diversification and distribution requirements. Regarding

income, at least 90 percent of the fund’s gross income must be from dividends, interest and capital gains. The fund must meet quarterly

diversification requirements including the requirement that at least 50 percent of the assets be in cash, cash equivalents or other securities

with each single issuer of other securities not greater than 5 percent of total assets. No more than 25 percent of total assets can be

invested in any one issuer other than government securities or other RIC’s. The fund must also distribute at least 90 percent of

its investment company income. RIC’s are also subject to excise tax rules which require RIC’s to distribute approximately

98 percent of net income and net capital gains to avoid a 4 percent excise tax.

The fund has adopted

a managed distribution policy (“MDP”). Annual distribution amounts are expected to fall in the range of 7% to 10% of the

average week-ending net asset value (“NAV”) per share for the prior fiscal semi-annual period. Distribution amounts will

be reset both up and down to provide a consistent return on trailing NAV. Under the MDP, distribution amounts will normally be reset

in February and August, with no changes in distribution amounts in May and November.

Leverage

The fund’s leverage

utilization decreased $6.9 million during the six months ended Q4 2023, compared to the six months ended Q2 2023, and represented 21.9%

of total assets at November 30, 2023. At year-end, the fund was in compliance with applicable coverage ratios, 93.2% of the leverage

cost was fixed, the weighted-average maturity was 2.1 years and the weighted-average annual rate on leverage was 3.69%. These rates will

vary in the future as a result of changing floating rates, utilization of the fund’s credit facility and as leverage matures or

is redeemed. During the six month period ended November 30, 2023, $7.1 million of Senior Notes were paid in full upon maturity.

Please see the Financial

Statements and Notes to Financial Statements for additional detail regarding critical accounting policies, results of operations, leverage,

taxes and other important fund information.

For further information

regarding the fund’s leverage and distributions to stockholders, as well as a discussion of the tax impact on distributions, please

visit www.tortoiseecofin.com.

(unaudited)

2023 Annual Report | November 30, 2023

TYG Key Financial

Data (supplemental unaudited information)

(dollar amounts in thousands unless otherwise indicated)

The information presented below is supplemental

non-GAAP financial information, is not inclusive of required financial disclosures (e.g. Total Expense Ratio), and should be read in conjunction

with the full financial statements.

| |

|

2022 |

|

|

2023 |

|

| |

|

Q3(1) |

|

|

Q4(1) |

|

|

Q1(1) |

|

|

Q2(1) |

|

|

Q3(1) |

|

|

Q4(1) |

|

| Selected Financial Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions paid on common stock |

|

$ |

8,469 |

|

|

$ |

8,045 |

|

|

$ |

8,045 |

|

|

$ |

8,046 |

|

|

$ |

8,045 |

|

|

$ |

7,643 |

|

| Distributions paid on common stock per share(2) |

|

|

0.7100 |

|

|

|

0.7100 |

|

|

|

0.7100 |

|

|

|

0.7100 |

|

|

|

0.7100 |

|

|

|

0.7100 |

|

| Total assets, end of period(3) |

|

|

638,068 |

|

|

|

623,319 |

|

|

|

577,524 |

|

|

|

504,066 |

|

|

|

527,003 |

|

|

|

492,651 |

|

| Average total assets during period(3)(4) |

|

|

621,364 |

|

|

|

607,430 |

|

|

|

595,508 |

|

|

|

547,380 |

|

|

|

526,517 |

|

|

|

503,464 |

|

| Leverage(5) |

|

|

144,587 |

|

|

|

147,993 |

|

|

|

146,213 |

|

|

|

114,713 |

|

|

|

120,413 |

|

|

|

107,814 |

|

| Leverage as a percent of total assets |

|

|

22.7 |

% |

|

|

23.7 |

% |

|

|

25.3 |

% |

|

|

22.8 |

% |

|

|

22.8 |

% |

|

|

21.9 |

% |

| Operating expenses before leverage costs and current taxes(6) |

|

|

1.05 |

% |

|

|

1.16 |

% |

|

|

1.13 |

% |

|

|

1.22 |

% |

|

|

1.26 |

% |

|

|

1.73 |

% |

| Net unrealized depreciation, end of period |

|

|

(270,982 |

) |

|

|

9,330 |

|

|

|

(34,286 |

) |

|

|

(65,512 |

) |

|

|

(34,940 |

) |

|

|

(58,511 |

) |

| Net assets, end of period |

|

|

467,109 |

|

|

|

446,618 |

|

|

|

416,799 |

|

|

|

380,323 |

|

|

|

403,510 |

|

|

|

380,497 |

|

| Average net assets during period(7) |

|

|

442,939 |

|

|

|

435,678 |

|

|

|

429,315 |

|

|

|

409,946 |

|

|

|

406,929 |

|

|

|

384,850 |

|

| Net asset value per common share(2) |

|

|

39.16 |

|

|

|

39.41 |

|

|

|

36.78 |

|

|

|

33.56 |

|

|

|

35.61 |

|

|

|

35.35 |

|

| Market value per share(2) |

|

|

34.14 |

|

|

|

33.54 |

|

|

|

30.89 |

|

|

|

26.95 |

|

|

|

30.13 |

|

|

|

28.11 |

|

| Shares outstanding (000’s) |

|

|

11,928 |

|

|

|

11,332 |

|

|

|

11,332 |

|

|

|

11,332 |

|

|

|

11,332 |

|

|

|

10,765 |

|

| (1) | Q1 is the period from December through February. Q2 is the period

from March through May. Q3 is the period from June through August. Q4 is the period from September through November. |

| (2) | Adjusted to reflect 1 for 4 reverse stock split effective May

1, 2020. |

| (3) | Includes deferred issuance and offering costs on senior notes

and preferred stock. |

| (4) | Computed by averaging month-end values within each period. |

| (5) | Leverage consists of senior notes, preferred stock and outstanding

borrowings under credit facilities. |

| (6) | As a percent of total assets |

| (7) | Computed by averaging daily

net assets within each period. |

Tortoise

Midstream Energy Fund, Inc. (NTG)

Fund description

The Tortoise Midstream Energy Fund

(NTG) seeks to provide stockholders with a high level of total return with an emphasis on current distributions. NTG invests primarily

in midstream energy equities that own and operate a network of pipeline and energy related logistical infrastructure assets with an emphasis

on those that transport, gather, process and store natural gas and natural gas liquids (NGLs). NTG targets midstream energy equities,

including MLPs benefiting from U.S. natural gas production and consumption expansion, with minimal direct commodity exposure.

Fund performance

The midstream energy

sector returned 7.6% for the fiscal year (as measured by the Alerian Midstream Energy Index or AMNA), topping broader energy. Growing

production volumes and inflation passed through via higher tariff rates benefitted revenues. Further, the sector’s elevated and

higher free cash flow, declining leverage, attractive valuation, and share buybacks supported performance. Finally, disciplined M&A

activity with synergies largely accruing to buyers offered a favorable environment for those seeking acquisition led growth. The fund’s

market-based and NAV-based returns (including the reinvestment of distributions) for the fiscal year were -0.8% and 5.3%, respectively.

The Tortoise MLP Index® returned 20.8% during the same period.

| 2023 fiscal year summary |

|

| Quarterly

distributions paid per share |

$0.7700 |

| Distribution

rate (as of 11/30/2023) |

9.0% |

| Year-over-year

distribution increase (decrease) |

0.0% |

| Cumulative

distributions paid per share to stockholders since inception in July 2010 |

$24.1200 |

| Market-based

total return |

(0.83)% |

| NAV-based

total return |

5.30% |

| Premium

(discount) to NAV (as of 11/30/2023) |

(19.7)% |

Key asset performance drivers

| Top five contributors |

Company type |

| Targa Resources Corp. |

Natural gas pipeline |

| Plains GP Holdings, L.P. |

Crude oil pipeline |

| The Williams Companies, Inc. |

Natural gas pipeline |

| Energy Transfer LP |

Natural gas pipeline |

| Magellan Midstream Partners, LP |

Refined products pipeline |

| Bottom five contributors |

Company type |

| NextEra Energy Partners |

Diversified infrastructure |

| Clearway Energy, Inc. |

Diversified infrastructure |

| Atlantica

Sustainable Infrastructure PLC |

Power |

| Enbridge Inc. |

Crude oil pipeline |

| Kinder Morgan Inc. |

Natural gas pipeline |

Unlike the fund return, index return is pre-expenses

and taxes.

Performance data quoted represent past performance;

past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment,

when sold, may be worth more or less than its original cost. Portfolio composition is subject to change due to ongoing management of the

fund. References to specific securities or sectors should not be construed as a recommendation by the fund or its adviser. See Schedule

of Investments for portfolio weighting at the end of the fiscal quarter.

(unaudited)

2023 Annual Report | November

30, 2023

Tortoise

Midstream Energy Fund,

Inc. (NTG) (continued)

Value

of $10,000 vs. Tortoise Midstream Energy Fund – Market (unaudited)

From November 30, 2013 through November 30, 2023

The chart assumes an initial investment of $10,000.

Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance

data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate,

and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher

than the performance quoted and can be obtained by calling 866-362-9331. Performance assumes the reinvestment of capital gains and income

distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption

of Fund shares.

Annualized Rates of Return as of

November 30, 2023

| |

1-Year |

3-Year |

5-Year |

10-Year |

Since Inception(1) |

| Tortoise

Midstream Energy Fund – NAV |

5.30% |

27.84% |

-14.56% |

-9.63% |

-4.72% |

| Tortoise

Midstream Energy Fund – Market |

-0.83% |

30.20% |

-17.34% |

-11.34% |

-6.59% |

| Tortoise MLP Index® |

20.76% |

33.85% |

11.27% |

3.58% |

7.05% |

| |

|

|

|

|

|

| (1) | Inception date of the Fund was July 27, 2010. |

Fund structure and distribution

policy

The fund is structured

to qualify as a Regulated Investment Company (RIC) allowing it to pass-through to shareholders income and capital gains earned, thus

avoiding double-taxation. To qualify as a RIC, the fund must meet specific income, diversification and distribution requirements. Regarding

income, at least 90 percent of the fund’s gross income must be from dividends, interest and capital gains. The fund must meet quarterly

diversification requirements including the requirement that at least 50 percent of the assets be in cash, cash equivalents or other securities

with each single issuer of other securities not greater than 5 percent of total assets. No more than 25 percent of total assets can be

invested in any one issuer other than government securities or other RIC’s. The fund must also distribute at least 90 percent of

its investment company income. RIC’s are also subject to excise tax rules which require RIC’s to distribute approximately

98 percent of net income and net capital gains to avoid a 4 percent excise tax.

The fund has adopted

a managed distribution policy (“MDP”). Annual distribution amounts are expected to fall in the range of 7% to 10% of the

average week-ending net asset value (“NAV”) per share for the prior fiscal semi-annual period. Distribution amounts will

be reset both up and down to provide a consistent return on trailing NAV. Under the MDP, distribution amounts will normally be reset

in February and August, with no changes in distribution amounts in May and November.

Leverage

The fund’s leverage

utilization decreased $3.4 million during the six months ended Q4 2023 compared to the six months ended Q2 2023, and represented 19.6%

of total assets at November 30, 2023. At year-end, the fund was in compliance with applicable coverage ratios, 80.2% of the leverage

cost was fixed, the weighted-average maturity was 3.7 years and the weighted-average annual rate on leverage was 3.78%. These rates will

vary in the future as a result of changing floating rates, utilization of the fund’s credit facility and as leverage matures or

is redeemed. During the six month period ended November 30, 2023, $2.1 million of MRP shares and $3.0 million of Senior Notes were paid

in full upon maturity.

Please see the Financial

Statements and Notes to Financial Statements for additional detail regarding critical accounting policies, results of operations, leverage,

taxes and other important fund information.

For further information

regarding the fund’s leverage and distributions to stockholders, as well as a discussion of the tax impact on distributions, please

visit www.tortoiseecofin.com.

(unaudited)

NTG Key Financial

Data (supplemental unaudited information)

(dollar amounts in thousands unless otherwise indicated)

The information presented below is supplemental

non-GAAP financial information, is not inclusive of required financial disclosures (e.g. Total Expense Ratio), and should be read in conjunction

with the full financial statements.

| |

|

2022 |

|

|

2023 |

|

| |

|

Q3(1) |

|

|

Q4(1) |

|

|

Q1(1) |

|

|

Q2(1) |

|

|

Q3(1) |

|

|

Q4(1) |

|

| Selected Financial Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions paid on common stock |

|

$ |

4,345 |

|

|

$ |

4,128 |

|

|

$ |

4,128 |

|

|

$ |

4,128 |

|

|

$ |

4,128 |

|

|

$ |

3,921 |

|

| Distributions paid on common stock per share(2) |

|

|

0.7700 |

|

|

|

0.7700 |

|

|

|

0.7700 |

|

|

|

0.7700 |

|

|

|

0.7700 |

|

|

|

0.7700 |

|

| Total assets, end of period(3) |

|

|

316,411 |

|

|

|

323,122 |

|

|

|

296,682 |

|

|

|

261,858 |

|

|

|

287,287 |

|

|

|

272,818 |

|

| Average total assets during period(3)(4) |

|

|

312,932 |

|

|

|

308,008 |

|

|

|

304,884 |

|

|

|

281,520 |

|

|

|

280,548 |

|

|

|

276,916 |

|

| Leverage(5) |

|

|

64,169 |

|

|

|

62,369 |

|

|

|

66,120 |

|

|

|

56,920 |

|

|

|

60,720 |

|

|

|

53,524 |

|

| Leverage as a percent of total assets |

|

|

20.3 |

% |

|

|

19.3 |

% |

|

|

22.3 |

% |

|

|

21.7 |

% |

|

|

21.1 |

% |

|

|

19.6 |

% |

| Operating expenses before leverage costs and current taxes(6) |

|

|

1.11 |

% |

|

|

1.29 |

% |

|

|

1.19 |

% |

|

|

1.36 |

% |

|

|

1.43 |

% |

|

|

2.15 |

% |

| Net unrealized appreciation (depreciation), end of period |

|

|

145,148 |

|

|

|

27,611 |

|

|

|

6,856 |

|

|

|

(11,572) |

|

|

|

17,267 |

|

|

|

5,003 |

|

| Net assets, end of period |

|

|

240,864 |

|

|

|

237,022 |

|

|

|

221,555 |

|

|

|

200,046 |

|

|

|

225,096 |

|

|

|

217,066 |

|

| Average net assets during period(7) |

|

|

231,908 |

|

|

|

230,297 |

|

|

|

226,098 |

|

|

|

215,743 |

|

|

|

220,209 |

|

|

|

217,415 |

|

| Net asset value per common share(2) |

|

|

42.68 |

|

|

|

44.21 |

|

|

|

41.33 |

|

|

|

37.32 |

|

|

|

41.99 |

|

|

|

42.62 |

|

| Market value per common share(2) |

|

|

36.79 |

|

|

|

37.69 |

|

|

|

35.28 |

|

|

|

31.53 |

|

|

|

35.40 |

|

|

|

34.22 |

|

| Shares outstanding (000’s) |

|

|

5,643 |

|

|

|

5,361 |

|

|

|

5,361 |

|

|

|

5,361 |

|

|

|

5,361 |

|

|

|

5,093 |

|

| (1) | Q1 is the period from December through February. Q2 is the period

from March through May. Q3 is the period from June through August. Q4 is the period from September through November. |

| (2) | Adjusted to reflect 1 for 10 reverse stock split effective May

1, 2020. |

| (3) | Includes deferred issuance and offering costs on senior notes

and preferred stock. |

| (4) | Computed by averaging month-end values within each period. |

| (5) | Leverage consists of senior notes, preferred stock and outstanding

borrowings under the credit facility. |

| (6) | Computed as a percent of total assets. |

| (7) | Computed by averaging daily net assets within each period. |

2023 Annual Report | November 30, 2023

Tortoise

Pipeline & Energy Fund, Inc. (TTP)

Fund description

The Tortoise Pipeline & Energy

Fund (TTP) seeks a high level of total return with an emphasis on current distributions paid to stockholders. TTP invests primarily in

equity securities of North American pipeline companies that transport natural gas, natural gas liquids (NGLs), crude oil and refined products

and, to a lesser extent, in other energy infrastructure companies.

Fund performance

The midstream energy

sector returned 7.6% for the fiscal year (as measured by the Alerian Midstream Energy Index or AMNA), topping broader energy. Growing

production volumes and inflation passed through via higher tariff rates benefitted revenues. Further, the sector’s elevated and

higher free cash flow, declining leverage, attractive valuation, and share buybacks supported performance. Finally, disciplined M&A

activity with synergies largely accruing to buyers offered a favorable environment for those seeking acquisition led growth. The fund’s

market-based and NAV-based returns (including the reinvestment of distributions) for the fiscal year were 6.7% and 8.4%, respectively.

The Tortoise North American Pipeline IndexSM returned 4.9% for the same period.

| 2023 fiscal year summary |

|

| Quarterly

distributions paid per share |

$0.5900 |

| Distribution rate (as of 11/30/2023) |

8.4% |

| Year-over-year distribution increase (decrease) |

0.0% |

| Cumulative distributions paid per share to stockholders since inception in October 2011 |

$19.6575 |

| Market-based total return |

6.72% |

| NAV-based total return |

8.38% |

| Premium (discount) to NAV (as of 11/30/2023) |

(19.0)% |

Please refer to the inside front cover of the

report for important information about the fund’s distribution policy.

Key asset performance drivers

| Top five contributors |

Company type |

| Plains GP Holdings, L.P. |

Crude oil pipeline |

| Magellan Midstream Partners, LP |

Refined products pipeline |

| The Williams Companies, Inc. |

Natural gas pipeline |

| Targa Resources Corp. |

Natural gas pipeline |

| Energy Transfer LP |

Natural gas pipeline |

| Bottom five contributors |

Company type |

| NextEra Energy Partners LP |

Diversified Infrastructure |

| Enbridge Inc. |

Crude oil pipeline |

| TC Energy Corp. |

Natural gas pipeline |

| Sempra Energy |

Diversified Infrastructure |

| Clearway Energy, Inc. |

Diversified Infrastructure |

Unlike the fund return, index return is pre-expenses.

Performance data quoted represent past performance;

past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment,

when sold, may be worth more or less than its original cost. Portfolio composition is subject to change due to ongoing management of the

fund. References to specific securities or sectors should not be construed as a recommendation by the fund or its adviser. See Schedule

of Investments for portfolio weighting at the end of the fiscal quarter.

(unaudited)

Tortoise

Pipeline & Energy

Fund, Inc. (TTP) (continued)

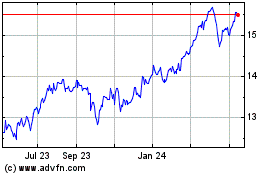

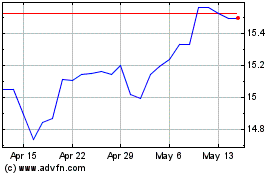

Value

of $10,000 vs. Tortoise Pipeline and Energy Fund – Market (unaudited)

From November

30, 2013 through November 30, 2023

The chart assumes an initial investment of $10,000.

Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance

data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate,

and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher

than the performance quoted and can be obtained by calling 866-362-9331. Performance assumes the reinvestment of capital gains and income

distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption

of Fund shares.

Annualized Rates of Return as of

November 30, 2023

| |

1-Year |

3-Year |

5-Year |

10-Year |

Since Inception(1) |

| Tortoise Pipeline and Energy Fund NAV |

8.38% |

28.87% |

-4.86% |

-4.48% |

-0.77% |

| Tortoise Pipeline and Energy Fund Market |

6.72% |

31.75% |

-6.42% |

-5.76% |

-2.86% |

| Tortoise North American Pipeline Index |

4.92% |

21.01% |

9.57% |

6.20% |

7.86% |

(1) Inception date of the Fund was October 26, 2011.

Fund structure and distribution

policy

The fund is structured

to qualify as a Regulated Investment Company (RIC) allowing it to pass-through to shareholders income and capital gains earned, thus

avoiding double-taxation. To qualify as a RIC, the fund must meet specific income, diversification and distribution requirements. Regarding

income, at least 90 percent of the fund’s gross income must be from dividends, interest and capital gains. The fund must meet quarterly

diversification requirements including the requirement that at least 50 percent of the assets be in cash, cash equivalents or other securities

with each single issuer of other securities not greater than 5 percent of total assets. No more than 25 percent of total assets can be

invested in any one issuer other than government securities or other RIC’s. The fund must also distribute at least 90 percent of

its investment company income. RIC’s are also subject to excise tax rules which require RIC’s to distribute approximately

98 percent of net income and net capital gains to avoid a 4 percent excise tax.

The fund has adopted

a distribution policy which is included on the inside front cover of this report. To summarize, the fund has adopted a managed

distribution policy (“MDP”). Annual distribution amounts are expected to fall in the range of 7% to 10% of the average

week-ending net asset value (“NAV”) per share for the prior fiscal semi-annual period. Distribution amounts will be

reset both up and down to provide a consistent return on trailing NAV. Under the MDP, distribution amounts will normally be reset in

February and August, with no changes in distribution amounts in May and November. The fund may designate a portion of its

distributions as capital gains and may also distribute additional capital gains in the last quarter of the year to meet annual

excise distribution requirements. Distribution amounts are subject to change from time to time at the discretion of the

Board.

Leverage

The fund’s leverage

utilization decreased $1.5 million during the six months ended Q4 2023, compared to the six months ended Q2 2023, and represented 18.5%

of total assets at November 30, 2023. At year-end, the fund was in compliance with applicable coverage ratios, 63.0% of the leverage

cost was fixed, the weighted-average maturity was 0.7 years and the weighted-average annual rate on leverage was 5.31%. These rates will

vary in the future as a result of changing floating rates, utilization of the fund’s credit facility and as leverage matures or

is redeemed.

Please see the Financial

Statements and Notes to Financial Statements for additional detail regarding critical accounting policies, results of operations, leverage

and other important fund information.

For further information

regarding the fund’s leverage and distributions to stockholders, as well as a discussion of the tax impact on distributions, please

visit www.tortoiseecofin.com.

(unaudited)

2023 Annual Report | November 30, 2023

TTP Key Financial

Data (supplemental unaudited information)

(dollar amounts in thousands unless otherwise indicated)

The information presented below is supplemental

non-GAAP financial information, is not inclusive of required financial disclosures (e.g. Total Expense Ratio), and should be read in conjunction

with the full financial statements.

| |

|

2022 |

|

|

2023 |

|

| |

|

Q3(1) |

|

|

Q4(1) |

|

|

Q1(1) |

|

|

Q2(1) |

|

|

Q3(1) |

|

|

Q4(1) |

|

| Selected Financial Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions paid on common stock |

|

$ |

1,314 |

|

|

$ |

1,249 |

|

|

$ |

1,248 |

|

|

$ |

1,249 |

|

|

$ |

1,249 |

|

|

$ |

1,186 |

|

| Distributions paid on common stock per share(2) |

|

|

0.5900 |

|

|

|

0.5900 |

|

|

|

0.5900 |

|

|

|

0.5900 |

|

|

|

0.5900 |

|

|

|

0.5900 |

|

| Total assets, end of period(3) |

|

|

97,010 |

|

|

|

93,907 |

|

|

|

87,895 |

|

|

|

81,736 |

|

|

|

88,301 |

|

|

|

86,167 |

|

| Average total assets during period(3)(4) |

|

|

96,086 |

|

|

|

93,079 |

|

|

|

90,503 |

|

|

|

86,135 |

|

|

|

86,853 |

|

|

|

86,272 |

|

| Leverage(5) |

|

|

21,343 |

|

|

|

19,843 |

|

|

|

20,143 |

|

|

|

17,443 |

|

|

|

17,343 |

|

|

|

15,943 |

|

| Leverage as a percent of total assets |

|

|

22.0 |

% |

|

|

21.1 |

% |

|

|

22.9 |

% |

|

|

21.3 |

% |

|

|

19.6 |

% |

|

|

18.5 |

% |

| Operating expenses before leverage costs(6) |

|

|

1.05 |

% |

|

|

1.32 |

% |

|

|

1.31 |

% |

|

|

1.37 |

% |

|

|

1.39 |

% |

|

|

1.30 |

% |

| Net unrealized depreciation, end of period |

|

|

17,286 |

|

|

|

19,117 |

|

|

|

13,950 |

|

|

|

9,483 |

|

|

|

17,306 |

|

|

|

17,779 |

|

| Net assets, end of period |

|

|

75,181 |

|

|

|

73,509 |

|

|

|

67,264 |

|

|

|

63,730 |

|

|

|

70,447 |

|

|

|

69,525 |

|

| Average net assets during period(7) |

|

|

73,287 |

|

|

|

71,609 |

|

|

|

69,939 |

|

|

|

66,399 |

|

|

|

69,717 |

|

|

|

69,161 |

|

| Net asset value per common share(2) |

|

|

33.75 |

|

|

|

34.73 |

|

|

|

31.78 |

|

|

|

30.11 |

|

|

|

33.29 |

|

|

|

34.58 |

|

| Market value per common share(2) |

|

|

29.18 |

|

|

|

28.58 |

|

|

|

27.09 |

|

|

|

24.81 |

|

|

|

28.36 |

|

|

|

28.02 |

|

| Shares outstanding (000s) |

|

|

2,228 |

|

|

|

2,116 |

|

|

|

2,116 |

|

|

|

2,116 |

|

|

|

2,116 |

|

|

|

2,011 |

|

| (1) | Q1 is the period from December through February. Q2 is the period

from March through May. Q3 is the period from June through August. Q4 is the period from September through November. |

| (2) | Adjusted to reflect 1 for 4 reverse stock split effective May

1, 2020. |

| (3) | Includes deferred issuance and offering costs on senior notes

and preferred stock. |

| (4) | Computed by averaging month-end values within each period. |

| (5) | Leverage consists of senior notes, preferred stock and outstanding

borrowings under the revolving credit facility. |

| (6) | Computed as a percent of total assets. |

| (7) | Computed by averaging daily net assets within each period. |

Tortoise

Energy Independence Fund, Inc. (NDP)

Fund description

The Tortoise Energy Independence Fund

(NDP) seeks a high level of total return with an emphasis on current distributions paid to stockholders. NDP invests primarily in equity

securities of upstream North American energy companies that engage in the exploration and production of crude oil, condensate, natural

gas and natural gas liquids that generally have a significant presence in North American oil and gas fields, including shale reservoirs.

Fund performance

The broad energy sector