Lloyds Executives: Big Four Banks' Covered Bond Spree Has Hurt Aussie Corporate Debt Hopes

May 04 2012 - 12:55AM

Dow Jones News

Billions of dollars of covered bonds issued by Australia's

so-called "big four" banks since last year have made it harder for

other Australian companies to tap overseas debt markets, two senior

executives at Lloyds Banking Group PLC (LYG) said on Friday.

The banks--Australia and New Zealand Banking Group Ltd (ANZ.AU),

Commonwealth Bank of Australia (CBA.AU), National Australia Bank

(NAB.AU) and Westpac Banking Corp. (WBC.AU)--have issued more than

$26 billion in covered bonds since the government relaxed

restrictions on the asset class last year, according to data from

Dealogic.

Lloyds' Australia head of debt capital market origination,

Steven Mixter, told Dow Jones Newswires that because more than a

third--or around $9.4 billion--of those bonds were denominated in

euros, the cross-currency swap rate had been pushed to a point

where it was uneconomical for other Australian companies to issue

debt in Europe.

"The Aussie banks issued a lot of covered bonds late last year

and in the first quarter of this year, so there was a lot of flow

that has put pressure on the swap market," said Mixter. "I

anticipate less of that in the second half."

Australia is home to the world's fourth-largest fund management

industry but investor allocation is heavily skewed toward equities,

with the net result being a small corporate-bond market dominated

by bank borrowers.

But increasingly stringent capital regulations enforced in the

wake of the global financial crisis have forced lenders to rein in

their balance sheets, while plummeting stock valuations have caused

a sharp drop in the number of share placements.

Market participants have been urging the government to introduce

tax breaks to encourage more buying of fixed-income securities to

help balance portfolios.

"The benefits to Australia of a deeper and more liquid domestic

corporate-bond market are very large and the urgency is important,"

NAB's head of wholesale banking Rick Sawers told a conference this

week.

Internationally, use of corporate debt is already in full swing.

Head of corporate-debt capital markets at Lloyds, Farouk Ramzan,

said corporate bonds have become the "preferred asset class" in

Europe as issuers look to "rebalance their debt between bank debt

and capital markets."

Spreads and all-in yields for BBB-rated corporates in the euro

market have now fallen to near 2009 levels, according to Lloyds

data provided to Dow Jones Newswires.

"We're seeing a fundamental paradigm shift away from bank

lending given the increased amount of capital that banks are being

required to hold and in order for issuers to diversify away from

overreliance on bank liquidity," Ramzan said in a phone

interview.

For Australian companies, which have emerged from the global

financial crisis relatively unscathed compared to their global

peers, this should be a boon. Rio Tinto (RIO.AU), Fortescue Metals

(FMG.AU), Telstra (TLS.AU) and others recently participated in

bumper bond offerings offshore, bringing the total international

issuance by Australian companies to $10.85 billion this year,

according to Dealogic data.

But Ramzan cautioned that an abortive European roadshow by

several Australian companies earlier this year, including

Transurban Group (TCL.AU), Goodman Group (GMG.AU) and retail giant

Wesfarmers Ltd (WES.AU), may have scared some investors off

Australian corporate bonds in the future.

"They talked the talk, got all the investors there, did a little

bit of teasing--but only Telstra actually issued anything in the

European theatre," he said.

-By Caroline Henshaw, Dow Jones Newswires; 61-2-8272-4689;

caroline.henshaw@dowjones.com

--Enda Curran in Sydney contributed to this article.

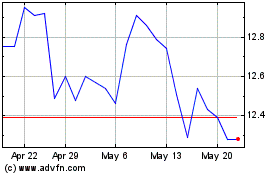

Transurban (ASX:TCL)

Historical Stock Chart

From Apr 2024 to May 2024

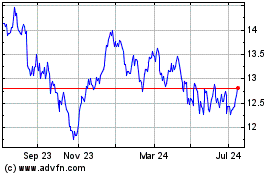

Transurban (ASX:TCL)

Historical Stock Chart

From May 2023 to May 2024