SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

April 12, 2019

Commission File Number: 001-32827

MACRO BANK INC.

(Translation of registrant’s name

into English)

Av. Eduardo Madero 1182

Buenos Aires C1106ACY

Tel: 54 11 5222 6500

(Address of registrant’s principal

executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

INDEX

|

|

1.

|

Translation of a submission from Banco Macro to the CNV dated

on April 12, 2019.

|

Buenos Aires, April 12

nd

2019

To

Fondo de Garantía de Sustentabilidad

Administración Nacional de la

Seguridad Social (ANSES)

Mr. Ignacio Álvarez Pizzo

Tucumán 500, piso 2º

S __________/____________D

Re.: NOTE N° 1682/19

Dear Mr. Álvarez Pizzo,

We write to you in reply to your request

of information regarding the General and Special Shareholders’ Meeting of Banco Macro S.A. called for April 30

th

2019. In that respect, please be advised as follows:

1. Detailed description of the shareholders

structure to date.

Please find below the information requested

as of March 31, 2019

Shareholder’s Name/

Corporate Name

|

|

Class A

Shares

|

|

|

Class B

Shares

|

|

|

Capital Stock

|

|

|

Participating

Interest

%

|

|

|

Other Shareholders (Foreign Stock Exchange)

|

|

|

|

|

|

|

194,502,140

|

|

|

|

194,502,140

|

|

|

|

29.04

|

%

|

|

ANSES-F.G.S. Law No. 26425

|

|

|

|

|

|

|

184,120,650

|

|

|

|

184,120,650

|

|

|

|

27.49

|

%

|

|

Delfin Jorge Ezequiel Carballo

|

|

|

4,895,574

|

|

|

|

106,805,523

|

|

|

|

111,701,097

|

|

|

|

16.68

|

%

|

|

Jorge Horacio Brito

|

|

|

5,366,621

|

|

|

|

105,727,603

|

|

|

|

111,094,224

|

|

|

|

16.59

|

%

|

|

Other Shareholders (Local Stock Exchange)

|

|

|

973,475

|

|

|

|

37,006,160

|

|

|

|

37,979,635

|

|

|

|

5.68

|

%

|

|

Repurchased Stock

|

|

|

|

|

|

|

30,265,275

|

|

|

|

30,265,275

|

|

|

|

4.52

|

%

|

|

TOTAL

|

|

|

11,235,670

|

|

|

|

658,427,351

|

|

|

|

669,663,021

|

|

|

|

100.00

|

%

|

2. Executed copy of the Minutes of the

Board of Directors’ Meeting calling the General and Special Shareholders’ Meeting.

Please be advised that the wording of the

minutes of the Board of Directors’ Meeting calling a General and Special Shareholders’ Meeting for April 30th 2019

at 11 AM is available in the Financial Information Highway (or AIF for its acronym in Spanish) of the CNV or Securities and Exchange

Commission of the Republic of Argentina.

3. Current composition of the Board

of Directors (regular and alternate members) including the designation dates and effective term of office.

The current composition of the Board of

Directors is as follows:

|

NAME/S AND LAST NAME

|

|

POSITION

|

|

DESIGNATION

DATE

|

|

Designation Expiry Date

– Shareholders’

Meeting evaluating the

Financial Statements of

the fiscal year

|

|

Delfín Jorge Ezequiel Carballo

|

|

CHAIRMAN

|

|

04/27/2018

|

|

12/31/2020

|

|

Jorge Pablo Brito

|

|

VICE CHAIRMAN

|

|

04/26/2016

|

|

12/31/2018

|

|

Marcos Brito

|

|

REGULAR DIRECTOR

|

|

04/28/2017

|

|

12/31/2019

|

|

Carlos Alberto Giovanelli

|

|

REGULAR DIRECTOR

|

|

04/26/2016

|

|

12/31/2018

|

|

NAME/S AND LAST NAME

|

|

POSITION

|

|

DESIGNATION

DATE

|

|

Designation Expiry Date

– Shareholders’

Meeting evaluating the

Financial Statements of

the fiscal year

|

|

Nelson Damián Pozzoli

|

|

REGULAR DIRECTOR

|

|

04/26/2016

|

|

12/31/2018

|

|

José Alfredo Sanchez

(1)

|

|

REGULAR DIRECTOR

|

|

04/26/2016

|

|

12/31/2018

|

|

Martín Estanislao Gorosito

(1)

|

|

REGULAR DIRECTOR

|

|

04/26/2016

|

|

12/31/2018

|

|

Constanza Brito

|

|

REGULAR DIRECTOR

|

|

04/27/2018

|

|

12/31/2020

|

|

Mario Luis Vicens

(1)

|

|

REGULAR DIRECTOR

|

|

04/27/2018

|

|

12/31/2020

|

|

Juan Martín Monge Varela

(1)

|

|

REGULAR DIRECTOR

|

|

04/27/2018

|

|

12/31/2020

|

|

Guillermo Stanley

(1)

|

|

REGULAR DIRECTOR

|

|

04/27/2018

|

|

12/31/2020

|

|

Alejandro Eduardo Fargosi

(1)

|

|

REGULAR DIRECTOR

|

|

04/28/2017

|

|

12/31/2019

|

|

Delfín Federico Ezequiel Carballo

|

|

REGULAR DIRECTOR

|

|

04/28/2017

|

|

12/31/2019

|

|

Santiago Horacio Seeber

|

|

ALTERNATE DIRECTOR

|

|

04/27/2018

|

|

12/31/2018

|

|

Alejandro Guillermo Chiti

(1)

|

|

ALTERNATE DIRECTOR

|

|

04/27/2018

|

|

12/31/2018

|

|

Fabian de Paul

(1)

|

|

ALTERNATE DIRECTOR

|

|

04/28/2017

|

|

12/31/2018

|

|

|

(1)

|

Independent Director.

|

4. As to the following items of the

Agenda, please be advised as follows:

a. (Item 2) “Evaluate the documentation

provided for in section 234, subsection 1 of Law No. 19550, for the fiscal year ended December 31st 2018”. If any of such

documents is not available in the Financial Information Highway (or AIF for its acronym in Spanish) of the CNV, please provide

a copy of the accounting documentation under section 234 of Law No. 19550 as duly approved and executed by the Board of Directors,

Syndics and Independent Auditor.

Taking into account the inflation rates

and the provisions of section 3.1 of the Technical Resolution No. 17 and section 2.6 of Technical Resolution No. 41, as of and

including 07/01/2018, means that all financial statements for the fiscal years or interim periods ending from and including 07/01/2018

shall be expressed in accordance with the proceeding provided for in Technical Resolution No. 6 issued by the

Federación

Argentina de Consejos Profesionales de Ciencias Económicas

.

In this scenario, please indicate whether

the financial statements to be submitted to the next General and Special Shareholders’ Meeting have been re-expressed in

uniform currency, detailing the compliance framework of the regulatory requirement originating such re-expression. If that were

the case, please indicate as well the indexing rate applied.

In the event the Company is not submitting

the Financial Statements expressed in uniform currency, then please specify the regulatory framework applied to this presentation

and expressly state the opinion of the Independent Auditor en connection with this issue.

In addition, please provide any other

information you consider relevant to evaluate this item of the Agenda.

All the documentation provided for in section

234, subsection 1 of Law 19550 to be submitted to and evaluated by the next General and Special Shareholders’ Meeting was

made available to the public in due time and manner and are currently available in the AIF.

As described in note 3 to the Consolidated

Financial Statements ended 31 December 2018, such financial statements are not expressed in uniform currency, since due to the

application of Communiqué “A” 6651 of the BCRA, financial entities must start to apply the uniform currency

reformulation method as of the fiscal year beginning January 1

st

2020.

As to the opinion of the External Auditor

in this connection, the same is contained in the External Auditors’ Report on the Consolidated Financial Statements and the

External Auditors’ Report on the Individual Financial Statements, which are part of the Financial Statements for the year

ended 31 December 2018 and are currently available in the AIF.

b. (Item 3) “Evaluate the management

of the Board and the Supervisory Committee”. Information regarding the administration and actions performed by the Board

and by the Supervisory Committee expressly identifying its members.

The Board’s administration and the

actions of the Supervisory Committee were in accordance with the provisions of the Argentine Business Company Law No. 19550, the

Capital Market Act No. 26831, the Rules and Regulations of the

Comisión Nacional de Valores

(Argentine Securities

and Exchange Commission) and the rules and regulations of the Central Bank of the Republic of Argentina (BCRA).

c. (Item 4) “Application of the

retained earnings for the fiscal year ended 31 December 2018. Total Retained Earnings: AR$ 19,204,911,966.83 which the Board proposes

may be applied as follows: a) AR$ 3,145,848,599.32 to Legal Reserve Fund; b) AR$ 3,475,668,970.21 to the Statutory Reserve Fund

- Special for first-time application of IFRS, pursuant to Communiqué “A” 6618 issued by the Central Bank of

the Republic of Argentina and c) AR$ 12,583,394,397.30 to the optional reserve fund for future profit distributions, pursuant to

Communiqué “A” 5273 issued by the Central Bank of the Republic of Argentina.”

Please provide information regarding

the motion made by the controlling shareholder as to the application of the results of the fiscal year. In connection with the

application of earnings to the optional reserve fund for future profit distribution, please inform the grounds for such motion

and the reasonableness thereof, as well as any additional information you consider relevant. All this in order to evaluate the

convenience of such application, instead of a motion to pay cash dividends. In addition, please determine the term within which

you estimate the same will be released in order to make the distribution of dividends effective. On the other hand, please provide

a statement of changes in the Optional Reserve Fund for Future Profit Distributions, if there is one. Please provide information

of the current composition of such fund, its creation date and the latest transactions or operations. Finally, please specify whether

the Company has any restriction applicable to profit distributions in force at the time of this Shareholders’ Meeting.

As mentioned in the statement of the

item of the Agenda, and in the Annual Report accompanying the Financial Statements submitted for consideration, the distribution

proposal would imply the application of AR$ 3,145,848,599.32 to the Legal Reserve Fund, AR$ 3,475,668,970.21 to a Special Statutory

Reserve Fund and AR$ 12,583,394,397.30 to an Optional Reserve Fund for future profit distributions. Please confirm if this shall

actually be the proposal to be considered or if you will make any changes thereto.

Although the above mentioned statement

mentions that retained earnings to be evaluated total AR$ 19,204,911,966.83, in the statement of changes in shareholders’

equity of the Consolidated Financial Statements for the year 2018 you indicate an amount of AR$ 18,993,985. Please inform the reason

for such difference.

As to the Special Optional Reserve Fund,

please provide a brief description of the regulatory framework supporting such Special Optional Reserve Fund and the calculation

method thereof. In the event you evaluate the creation or application of any amount to any reserve funds other than the legal reserve

fund, please provide a clear and detailed description expressing if the same is reasonable and the result of a careful management

of the business, all in accordance with sections 66, 3 and 70 of the Business Company Law.

As to application of retained earnings

to the Optional Reserve Fund for Future Profit Distributions, please inform the grounds for such motion and the reasonableness

thereof, as well as any additional information you consider relevant. All the above is requested in order to evaluate the convenience

of such application, instead of proposing that such retained earnings be applied to the payment of cash dividends. Please explain

in accordance with Communiqué “A” 5273 of the Central Bank of the Republic of Argentina.

In addition, please determine the term

within which you estimate the same will be released in order to make the distribution of dividends effective.

On the other hand, please provide a

statement of changes in the Optional Reserve Fund for Future Profit Distributions. Please provide information of the current composition

of such fund, its creation date and the latest transactions or operations.

Finally, please specify whether the

Company has any restriction applicable to profit distributions in force at the time of this Shareholders’ Meeting.

The Board’s proposal as to the application

of retained earnings for the fiscal year ended 31 December 2018 was submitted in compliance with Communiqué “A”

5273 of the Central Bank of the Republic of Argentina.

Please be advised that there shall be no

changes to the proposal submitted by the Board in connection with the application of the retained earnings for the fiscal year

ended 31 December 2018.

The difference reported as “retained

earnings” under item 4 of the Agenda for the Shareholders’ Meeting (AR$19,204,911,966.83) and the amount arising from

the Consolidated Statement of Changes in Shareholders’ Equity (AR$ 18,993,985 thousands), is the result of the elimination

of the goodwill reported in the Individual Financial Statements of Banco Macro for AR$ 210,927 thousands, from the retained earnings

in the Consolidated Statement of Changes in Shareholders’ Equity, derived from the application of the International Financial

Reporting Standards (“IFRS”). The Bank acquired 44,019 shares of Banco del Tucumán S.A. for AR$ 456,757 thousands

and this transaction was recorded in the Individual Financial Statements by the purchase method. The difference between the price

paid and the application of the purchase method determined the recording of a goodwill for the above mentioned amount.

The Special Optional Reserve Fund is based

on the provisions of the BCRA under Communiqué “A” 6618 and corresponds to the balance of the adjustments made

on the financial statements in order to adjust them to the IFRS for the first time. Therefore the Bank has fully complied with

the provisions of subsection 3 of section 66 and section 70 of the Argentine Business Company Law.

As to the creation of the Optional Reserve

Fund for Future Profit Distributions, the rules on Profit Distribution of the BCRA provide that the financial entities may distribute

profits as long as they do not exceed several limits, in order to avoid jeopardizing its solvency and liquidity. Such limits are

aimed at maintaining compliance with basic regulatory provisions and allowing financial entities the additional coverage margins.

To such effect financial entities must consider, in addition to the minimum capital surpluses, a capital conservation margin fixed

on 2.5% of the risk weighted assets, establishing an additional 1% for those entities rated as of systemic relevance, among which

we find Banco Macro. At the same time, the BCRA establishes an additional limit, known as anti-cyclical margin, which must be maintained

as coverage, though the BCRA has not yet fixed the payment percentage thereof. Pursuant to the above expressed, the Board deems

reasonable to create an Optional Reserve Fund for Future Profit Distributions on the amount suggested in item 4 of the Agenda for

the next Shareholders’ Meeting.

The separation of a portion of such optional

reserve fund for future profit distributions in order to allow the payment of dividends shall be evaluated by the Shareholders’

Meeting in due time.

Pursuant to the minutes of the General

and Special Shareholders’ Meeting held on April 16

th

2012 as published in the AIF, the Company created an “Optional

Reserve Fund for Future Profit Distributions” on the amount of AR$ 2,443,140,742.68. In addition, we inform that the “Optional

Reserve Fund for Future Profit Distributions” account was increased as a result of the resolution approved by the General

and Special Shareholders’ Meeting dated April 11

th

2013 and the General and Special Shareholders’ Meetings

dated April 29

th

2014, April 23

rd

2015, April 26

th

2016, April 28

th

2017 and April

28

th

2018, which added to such account, the amount of AR$ 1,170,680,720.00; AR$ 1,911,651,322.50, AR$ 2,736,054,342.94,

AR$ 3,903,591,780.29, AR$ 5,371,581,684.69 and AR$ 7,511,017,454.84, respectively. In turn, the Shareholders’ Meetings held

on April 29

th

2014, April 23

rd

2015, April 26

th

2016, April 28

th

2017 and April 28

th

2018 resolved to separate a portion of such reserve fund equal to AR$ 596,254,288.56, AR$ 596,254,288.56, AR$ 643,019,330.80, AR$

701,475,633.60 and AR$ 3,348,315,105.00, respectively, in order to pay a cash dividend. In the fiscal year 2018 the Company applied

AR$ 4,407,907,704.25 pursuant to section 64 of Law No. 26831. In the fiscal year 2016 such optional reserve fund was adjusted in

AR$ 368,546,288.56, since the BCRA authorized the payment of a cash dividend of AR$ 227,708,000 for the year 2014, which was paid

in March 2016. All the above-mentioned resolutions were published in the AIF in due time and manner according to law.

The Bank has no restrictions regarding

the distribution of dividends as to the amount to be distributed having to comply with the provisions of Communiqué “A”

6464 of the BCRA.

d. (Item 5) Separate a portion of the

optional reserve fund for future profit distributions in order to allow the application of AR$ 6,393,977,460 to the payment of

a cash dividend, within 10 business days of its approval by the Shareholders’ Meeting. Delegate to the Board of Directors

the power to determine the date of the effective availability to the Shareholders of the cash dividend.”

Please inform the grounds for this motion

and the reasonableness thereof, as well as any additional information you consider relevant in that connection. Confirm as well

if the delegation to the Board of the power to determine the date of the effective availability of the cash dividend shall be within

the term of 10 business days from approval by the shareholders’ meeting.

The motion to separate a portion of the

optional reserve fund for future profit distributions, in order to allow the application of AR$ 6,393,977,460 to the payment of

a cash dividend, is grounded on the changes in the results and the preservation of satisfactory liquidity and solvency indicators.

Delegation to the Board of the power to determine the date of the effective availability of the cash dividend shall be within the

term of 10 business days from approval by the shareholders’ meeting, in accordance with the provisions of section 92 of BYMA’s

Listing Rules and Regulations.

e. (Item 6) “Evaluate the remunerations

of the members of the Board of Directors for the fiscal year ended December 31st 2018 within the limits as to profits, pursuant

to section 261 of Law No. 19550 and the Rules of the

Comisión Nacional de Valores

(Argentine Securities Exchange

Commission).”

Please provide proposal regarding the

remuneration of the members of the Board for their work during the fiscal year 2018. Please inform the aggregate amount of remunerations

to the Board and a breakdown by technical and administrative functions. Also, please inform the number of Board members that are

paid a remuneration and how many of them are paid for technical and administrative tasks. Please further inform whether the remunerations

of the Board include fees to the members of the Audit Committee. If so, please inform how many of them are also paid a remuneration

for being members of such committee.

Please inform whether there are Directors

employed by the Bank and, in case there are, please inform the salary amount paid in each case.

Additionally, provide the amounts paid

as Board fees and fees for technical and administrative functions for the fiscal year 2017.

Finally, confirm whether the aggregate

amount approved for the fiscal years 2017, was AR$ 393,452,078.

All the above in order to be analyzed

in connection with market values and the limits provided for under section 261 of the Argentine Business Company Law.

The proposed remuneration for the directors

for the above mentioned fiscal year was made available to the public in due time and manner according to law through the publication

of the proposed remuneration in the AIF, pursuant to the Rules of the Argentine Securities and Exchange Commission.

In the financial statements for the year

ended 31 December 2018 the amount of AR$ 659,862,001 is recorded in the Statement of Income as fees payable to the Board of Directors.

The proposed remuneration, as in previous years, does not exceed the limits established under section 261 of Law 19550.

All directors perform technical and administrative

functions, except Messrs. Alejandro Fargosi, Martín Gorosito and Juan Martín Monge Varela.

The members of the Audit Committee are

not paid any additional fees apart from those they are paid as directors.

No member of the Board is employed by the

Bank.

As to the breakdown of the amount to be

paid separately to each director, we shall comply in due time with all the provisions set forth in section 75 of Decree No. 1023/2013,

as provided under the Interpretation Criterion No. 45 of the CNV.

As evidenced by the Minutes of the General

and Special Shareholders’ Meeting held on April 27

th

2018, as published in the AIF, the global amount approved

for the fiscal year 2017 was AR$ 393,452,078.

f. (Item 7) “Evaluate the remunerations

of the members of the Supervisory Committee for the fiscal year ended December 31st 2018.”

As to the proposal regarding the remunerations

of the members of the Supervisory Committee, please provide a breakdown of such proposed amount; a breakdown of such proposed amount

by member of the Supervisory Committee and of any advance payment by member during the year 2018. In addition, please confirm whether

the amount paid as remuneration to the Supervisory Committee during the fiscal year 2017 was AR$ 1,305,540.

As to the breakdown of the amount to be

paid to each member of the Supervisory Committee, we shall comply in due time with all the provisions set forth in section 75 of

Decree No. 1023/2013, as provided under the Interpretation Criterion No. 45 of the CNV.

In the financial statements for the year

ended 31 December 2018 the amount of AR$ 1,305,540 is recorded as fees payable to the members of the Supervisory Committee for

their work as members of such committee during such fiscal year.

As evidenced by the Minutes of the General

and Special Shareholders’ Meeting held on April 27th 2018, as published in the AIF, the amount approved for the fiscal year

2017 was AR$ 1,305,540.

g. (Item 8) ““Evaluate the

remuneration of the independent auditor for the fiscal year ended December 31st 2018”.

Please provide the proposal of the remuneration

to be paid to the independent auditor for the audit of the financial statements of the year 2018, indicating whether there were

any changes in tasks as compared with those performed for the immediately preceding financial statements. If there is a considerable

increase, please provide an explanation for such increase. Additionally, please confirm whether the amount approved for the year

2017 was AR$ 16,740,128.

The remuneration to be paid to the independent

auditor for the year ended 31 December 2018 amounts to AR$ 24,716,000 plus VAT and there has been no changes in tasks or functions

compared to those performed for the immediately preceding financial statements.

As evidenced by the Minutes of the General

and Special Shareholders’ Meeting held on April 27th 2018, as published in the AIF, the amount approved for the fiscal year

2017 was AR$ 16,740,128.

h. (Item 9) “Appoint five regular

directors and three alternate directors who shall hold office for three fiscal years.”

Please provide information about the

nominees proposed as members of the Board of Directors.

As evidenced by the relevant event published

in the AIF last April 3

rd

on that date the shareholders Jorge Horacio Brito and Delfín Jorge Ezequiel Carballo

informed the Board that, in connection with the next General and Special Shareholders’ Meeting of the Bank, they intend to

propose as regular directors, to hold office for three fiscal years, the designation of Messrs. Jorge Pablo Brito, Carlos Alberto

Giovanelli, Nelson Damián Pozzoli and José Alfredo Sánchez; and to propose the designation of Messrs. Santiago

Horacio Seeber and Fabián Alejandro de Paul as alternate directors. Additionally, such shareholders informed that in the

event that, at time of holding the Shareholders’ Meeting, the CNV issues a negative decision as to the independence of Mr.

José Alfredo Sánchez, then Mr. Fabián Alejandro de Paul shall be nominated to replace Mr. Sánchez and

act as regular director for three fiscal years. And, therefore, Mr. Alan Whamond shall be nominated to fill the position of alternate

director in the place of Mr. Fabián Alejandro de Paul, for three fiscal years.

i. (Item 10) “Establish the number

and designate the regular and alternate members of the Supervisory Committee who shall hold office for one fiscal year”.

Please provide information regarding

the members who shall compose the Supervisory Committee.

The proposal shall be made by the shareholders

at the General and Special Shareholders’ Meeting called for April 30

th

2018.

j. (Item 11) “Appoint the independent

auditor for the fiscal year to end on December 31st 2019”.

Please provide the relevant proposal

for the designation of the independent auditor for the year 2019.

Pursuant to the sworn statements published

in the AIF, the Accountants Carlos Marcelo Szpunar and Pablo Mario Moreno, members of the audit company Pistrelli, Henry Martin

y Asociados S.R.L., shall be proposed as candidates to be designated as Regular Independent Auditor and Alternate Independent Auditor,

respectively.

k. (Item 12) “Determine the Audit

Committee’s budget.” Please inform the amount of the Budget for the Audit Committee for the year 2019, as well as the

amount actually disbursed under this description during the fiscal year 2018. Finally confirm whether the amount approved for the

fiscal year2018 was AR$ 1,384,000.

The proposed budget of the Audit Committee

shall be AR$ 1,890,000.

The amount actually disbursed under this

description during the fiscal year 2018 was: AR$ 1,116,420.

As evidenced by the Minutes of the General

and Special Shareholders’ Meeting held on April 27th 2018, as published in the AIF, the amount approved for the fiscal year

2018 was AR$ 1,384,000.

l. (Item 13) “Evaluate the Preliminary

Merger Agreement pursuant to which Banco del Tucumán S.A. shall be merged with and into Banco Macro S.A., dated March 8,

2019 and the special consolidated financial statements of merger prepared as of December 31, 2018 and based on the separate financial

statements prepared by each merging company as of the same date.”

Please provide a copy of the preliminary

merger agreement if such agreement has not been published in the CNV’s AIF.

Please provide as well a copy of the

special consolidated financial statements of merger for the period ended December 31st 2018 and of the individual financial statements

of each company with the relevant accompanying Auditor’s Report and Supervisory Committee Report. This shall apply in case

such financial statements have not published in the CNV’s AIF.

Please explain as well the reasons of

the merger and provide a detailed description of the shareholding structure before and after the merger, indicating the effects

on the participating interest of FGS ANSES.

Finally, please attach any additional

information you consider relevant to evaluate this item of the Agenda.

Please be advised that the Preliminary

Merger Agreement and the Separate Financial Statements prepared as of December 31, 2018 of each merging company, together with

the relevant External Auditor’s Report and Supervisory Committee Report were timely published in CNV’s AIF.

Attached as Exhibit I please find a copy

of the Special Consolidated Financial Statements of Merger prepared as of December 31, 2018.

The reasons that motivated the merger are

described in the minutes of the Board of Directors’ Meeting held last March 8

th

and in the Preliminary Merger

Agreement, both duly published in CNV’s AIF.

The shareholder structure and votes before

and after the merger are shown in the table below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of Votes

|

|

|

Shares

|

|

Capital Stock

AR$

|

|

|

%

|

|

|

Capital

Increase

AR$

|

|

|

AR$

|

|

|

Capital

%

|

|

|

Before Capital

Increase

|

|

|

After Capital

Increase

|

|

|

Class A

|

|

|

11,235,670

|

|

|

|

1.6778095

|

%

|

|

|

0

|

|

|

|

11,235,670

|

|

|

|

1.677770

|

%

|

|

|

56,178,350

|

|

|

|

56,178,350

|

|

|

Class B

|

|

|

658,427,351

|

|

|

|

98.322190

|

%

|

|

|

15,662

|

|

|

|

658,443,013

|

|

|

|

98.322230

|

%

|

|

|

658,427,351

|

|

|

|

658,443,013

|

|

|

Total

|

|

|

669,663,021

|

|

|

|

100

|

%

|

|

|

15,662

|

|

|

|

669,678,683

|

|

|

|

100

|

%

|

|

|

714,605,701

|

|

|

|

714,621,363

|

|

Since 15,662 new shares to be issued as

a result of the capital increase derived from the merger shall be delivered to the minority shareholders of the merged company

–Banco del Tucumán S.A.-, the participating interest held by the shareholders of Banco Macro S.A.at the time of the

capital increase shall not be modified (excluding the minority shareholders of the merged company, if they hold shares of Banco

Macro S.A.). Furthermore, taking into account the number of new shares to be issued, the participating interests and votes shall

not suffer material changes.

m. (Item 14) “Evaluate the exchange

relationship between the shares of Banco Macro S.A. and Banco del Tucumán S.A.”

Please specify the exchange relationship,

if already defined, as well as the mechanisms used to determine such exchange relationship.

Attached as Exhibit II please find a copy

of the Share Swap Report.

n. (Item 15) “Capital increase

from AR$ 669,663,021 to AR$ 669,678,683, as a result of the merger of Banco del Tucumán S.A. into Banco Macro S.A. through

the issuance of 15,662 Class B ordinary book-entry shares of par value AR$ 1 each, entitled to one vote per share, which shall

rank pari passu with the outstanding shares at the time of the issuance of the former, to be delivered to the minority shareholders

of the merged company in exchange for their shareholdings in the merged company. Apply for the incorporation of the new shares

to the public offering regime and listing in the stock exchange. Delegate to the Board of Directors the preparation and fulfillment

of all necessary documents to evidence such exchange.”

Please specify the reasons for the capital

increase as well as the implication thereof for the shareholders. Please provide a description of the methods to be used to carry

out the above described increase. Please provide as well a detailed description of the shareholders structure resulting after such

capital increase, including a summary table indicating the relevant percentages of the controlling shareholder and float, by class,

number of votes and number of shares.

The capital increase from AR$ 669,663,021

to AR$ 669,678,683 shall be carried out in order to deliver in exchange 15,662 Class B common shares to the minority shareholders

of the merged company.

In connection with the composition of the

shareholders structure, please refer to the answer provided under paragraph above.

o. (Item 16) “Grant to the Board

of Directors all necessary powers and authority for it to make all the amendments and changes eventually suggested by the competent

authorities. Grant all necessary powers to execute and deliver the Final Agreement of Merger and carry out any acts or proceedings

that may be necessary for the approval of the merger before the competent authorities, signing all public and private instruments

that may be appropriate or convenient, being also authorized to accept and appeal eventual resolutions issued by such competent

authorities.”

Please explain who shall be the persons

and the positions they hold to perform all the necessary acts and proceedings in connection with the merger before the controlling

and regulatory authorities and provide also a detailed description of the powers to be granted.

The motion shall be submitted by the shareholders

at the next General and Special Shareholders’ Meeting called for next April 30

th

.

p. (Item 17) “Capital decrease

due to the cancellation of AR$ 30,265,275 representative of 30,265,275 Class B shares, with a par value of Ps. 1 (one Peso) each

and entitled to 1 (one) vote per share.”

Please specify the reasons for the capital

decrease as well as the implication thereof for the shareholders. Provide also a description of the methods to be used to carry

out the above described decrease.

Additionally, please explain the reasons

of the merger and provide a detailed description of the shareholding structure before and after the merger, indicating the effects

on the participating interest of FGS ANSES.

The capital reduction of AR$ 30,265,275

representing 30,265,275 class B shares to be proposed at the next Shareholders’ Meeting of the Bank called for April 30

th

2019, is based on the fact that during the year 2018 the listing prices of shares in the stock market, particularly the shares

representing the capital stock of financial entities, suffered a strong impact due to negative circumstances of the macroeconomic

context. Pursuant to the above mentioned circumstances, the price of the Bank’s shares suffered a significant decline and

strong fluctuations and, in the face of such situation, the Board took the necessary actions in order to counter the effects of

such circumstances which, though external to the Bank, caused a decline in the price of its shares and the fluctuation thereof.

In that sense, the Bank’s Board of Directors decided to repurchase its own shares at the meetings held on August 8, August

30, October 17 and December 20, 2018, in accordance with the provisions of Section 64 of Law No. 26831 “Capital Markets”,

and the Rules of the CNV, acquiring the number of shares mentioned above.

Having purchased such shares, the existing

alternatives for the repurchased shares, under the rules and regulations in force, are the following: a) to sell them; b) to distribute

them; or c) reduce the capital stock and cancel them. Among such alternatives, the Board believes the capital reduction to be the

only alternative that contributes –on a permanent manner- to reduce the potential offering of instruments in the market,

in order to stabilize the price thereof in a number that adequately reflects the Entity’s financial solvency and growth potential.

As to the implications for the shareholders,

please be advised that the capital reduction shall not impact the number of shares held by the existing shareholders (excluding

the minority shareholders of Banco del Tucumán S.A., if the own shares of Banco Macro S.A.). Nevertheless, the above described

capital reduction shall cause an increase in the participating interest of the existing shareholders of Banco Macro at the time

of such capital reduction.

q. (Item 18) “Evaluate the amendment

of sections 4, 9, 10, 19, 20, 21 and 33 of the By-laws.”

Please provide the final wording of

the sections to be amended, the reasons for the proposed amendment and any additional information relevant to this item of the

Agenda.

Please find attached as Exhibit III the

draft version of the amended by-laws in a comparative table including the current by-laws, the amended by-laws proposed and a markup

version.

r. (Item 19) “Adoption of the

amended and restated by-laws.”

Please provide the final version thereof

and any additional information relevant to this item of the Agenda.

Please find attached as Exhibit IV the

amended and restated by-laws to be submitted for consideration at the next Shareholders’ Meeting.

s. (Item 20) “Authorization to

carry out all acts and filings that are necessary to obtain the administrative approval and registration of the resolutions adopted

at the Shareholders’ Meeting.”

Please provide the names of the persons

authorized as well as a detail description of the powers thereof.

The proposal shall be made by the shareholders

at the General and Special Shareholders’ Meeting called for next April 30

th

.

Sincerely,

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

Date: April 12, 2019

|

|

MACRO BANK INC.

|

|

|

|

|

|

|

By:

|

/s/ Jorge Francisco Scarinci

|

|

|

Name: Jorge Francisco Scarinci

|

|

|

Title: Chief Financial Officer

|

Banco Macro (NYSE:BMA)

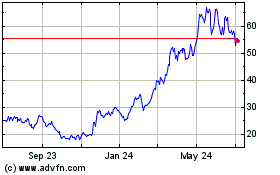

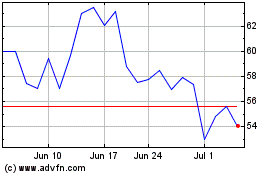

Historical Stock Chart

From Aug 2024 to Sep 2024

Banco Macro (NYSE:BMA)

Historical Stock Chart

From Sep 2023 to Sep 2024