SUI Slips After Hitting All-Time High: TVL Tumbles 12% – Token Price In The Gutter?

April 09 2024 - 9:00AM

NEWSBTC

The burgeoning world of Decentralized Finance (DeFi) has witnessed

a rollercoaster ride for newcomer Sui, a Layer 1 blockchain

designed to scale DeFi applications. After a stellar start to 2024,

Sui’s Total Value Locked (TVL) – a metric reflecting the total

value of crypto assets deposited in its DeFi protocols – surged to

a record $724 million in late March. However, this celebratory

moment proved fleeting, as the platform has since experienced a

downward trend. Related Reading: Don’t Miss The Boat! Ethereum

Whales Signal Bullish Run With $40 Million Bet SUI TVL Takes A

Tumble Despite the recent decline, Sui’s TVL currently sits at a

healthy $654 million, according to DeFiLlama. This translates to a

12% drop from its peak, showcasing a correction following its

initial surge. However, it’s important to note that Sui remains in

a positive light compared to some established players. SUI TVL.

Source: Defillama Silver Linings For Sui While the recent dip might

raise concerns, Sui boasts a more optimistic outlook when

considering a broader timeframe. Compared to its New Year’s Day

value, the current TVL represents a significant 25.5% increase.

This upward trajectory extends further back, with a staggering 68%

growth since the beginning of the year. This impressive background

performance fuels optimism for Sui’s potential to regain its

momentum, potentially propelling it towards a coveted spot amongst

the top 10 DeFi chains. Total crypto market cap is currently at

$2.571 trillion. Chart: TradingView SUI Token Mirrors Market Trends

The price of Sui’s native token (SUI) reflects a similar pattern to

its TVL. Currently trading at $1.65, SUI has shed nearly 30% of its

value compared to its all-time high of $2.20 reached in late March.

Despite the recent slump, SUI has managed a modest 2% daily

increase. However, zooming out reveals a 11% loss over the past

week. SUI price action in the last week. Source: CoinMarketCap. Can

Sui Recover its DeFi Mojo? Regaining the lost TVL will be a key

test for Sui’s development team. Identifying the reasons behind the

user exodus is essential. Were there any security concerns or

technical glitches that caused users to pull their funds?

Transparency and addressing these issues head-on will be critical

for rebuilding user confidence. Related Reading: Filecoin Bull Run

On The Horizon? Analyst Sees 250% Surge Building A Thriving DEX

Ecosystem Is Vital Meanwhile, a vibrant DEX ecosystem is another

pillar for Sui’s future. Decentralized Exchanges allow users to

trade cryptocurrencies directly with each other, without the need

for a centralized intermediary. Fostering a healthy DEX landscape

will attract more users and liquidity to the Sui blockchain,

ultimately boosting its TVL. Enticing established DEX protocols to

migrate to Sui or supporting the development of native DEX

solutions could be effective strategies. Featured image from

Pixabay, chart from TradingView

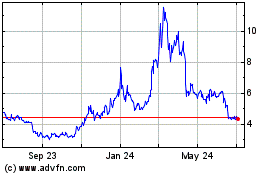

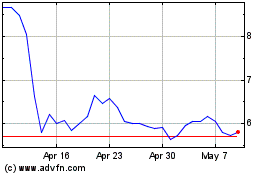

Filecoin (COIN:FILUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Filecoin (COIN:FILUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024