TIDMVAL

RNS Number : 7026N

ValiRx PLC

26 September 2019

VALIRX PLC

("ValiRx", "the Company" or "the Group")

HALF YEARLY REPORT FOR THE PERIODED 30 JUNE 2019

London, UK., 26 September 2019: ValiRx Plc (AIM: VAL), a life

science company, which focuses on clinical stage cancer therapeutic

development, taking proprietary and novel technology for precision

medicines towards commercialisation and partnering, today announces

its Half Yearly Report for the period ended 30 June 2019 and

provides an update e on significant post-period events.

HIGHLIGHTS

Operational Highlights

-- MHRA and REC approve a major update to the trial of VAL201

including the appointment of a Principal Investigator to the

clinical team, with results from the first clinical trial of the

compound being prepared for an independent evaluation following the

completion of the current patient group.

-- The period saw further strengthening of ValiRx's IP patent

portfolio. Grant allowances for VAL301 were permitted for the

European Union, China and the Russian Federation, building on an

earlier patent granted in 2018 for the US. VAL201 had its IP

protection extended during the period, with a patent grant allowed

in the US for the use of the compound in the prevention and

treatment of metastatic cancer. This allowance builds on previously

granted worldwide rights for the use of the compound against

prostate cancer.

-- ValiRx acquired the IP assets of FIT Biotech OY (announced 2

May 2019) to complement its other drug discovery (drug enhancing)

technologies and is currently in discussions with a potential JV

partner over further developing certain of the Company's

genetic-based diagnostic assets

Financial Highlights

-- Loss before income tax narrowed substantially by 56.9% to

GBP927,342 (H1 2018: GBP2,155,788); largely as a result of a profit

on the sale of fixed asset investments and no requirement to

manufacture additional VAL201 drug as sufficient quantities were

produced in H2 2018;

-- Total comprehensive loss for the period of GBP750,569 (H1 2018: GBP1,914,453);

-- Cash and cash equivalents as at 30 June 2019 of GBP171,443 (H1 2018: GBP590,615); and

-- Loss per share - basic and diluted reduced by 78.4% to (0.11)p (H1 2018: (0.51)p.

Post-Period highlights

-- R&D Tax Credit of GBP423,000 received in September 2019

-- The Company announced (10 September 2019) that in addition to

pharmacokinetic and toxicology data, clinical trial results show

VAL201 behaves as predicted in reducing prostate cancer progression

- evidence that is supported from tumour imaging (MRI and CT) in

subjects.

-- VAL301's clinical team signed an agreement in July 2019 with

Aptus Clinical Ltd ("Aptus"), the UK based, clinical Contract

Research Organisation ("CRO"), to effectuate a clinical development

plan for VAL301 incorporating a Phase I/II study design concept in

Endometriosis.

-- Two placings and a subscription raised GBP1.226m of gross

proceeds with existing and new investors. The funds were raised for

working capital needs and to progress the development of the

Company's therapeutic drug portfolio.

Oliver de Giorgio-Miller, Non-Executive Chairman of ValiRx,

commented:

"Throughout the reporting period, ValiRx has continued to

sustain valuable momentum in terms of progressing its therapeutic

assets and along their respective clinical and pre-clinical

pathways. We have made important strides forward across both our

therapeutic and technology portfolios, with the expectation that

these will deliver added-value in the near term for our

shareholders."

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

***S ***

For more information, please contact:

ValiRx plc Tel: +44 (0) 20 3008 4416

www.valirx.com

Dr Satu Vainikka, Chief Executive Tel: +44 (0) 20 3008 4416

Tarquin Edwards, Head of Communications. Tel: +44 (0) 7879 458

364

tarquin.edwards@valirx.com

Cairn Financial Advisers LLP (Nominated Tel: +44 (0) 20 7213 0880

Adviser)

Liam Murray/Jo Turner/Ludovico Lazzaretti

Novum Securities Limited (Broker) Tel: +44 (0) 20 7399 9400

Colin Rowbury

Notes for Editors

About ValiRx

ValiRx is a biotechnology oncology focused company specialising

in developing novel treatments for cancer and associated

biomarkers. It aims to make a significant contribution in

"precision" medicine and science, namely to engineer a breakthrough

into human health and well-being, through the early detection of

cancer and its therapeutic intervention.

The Company's business model focuses on out-licensing

therapeutic candidates early in the development process. By aiming

for early-stage value creation, the company reduces risk

considerably while increasing the potential for realising value.

The group is already in licensing discussions with major players in

the oncology field.

ValiRx's two classes of drugs in development, which each have

the potential for meeting hitherto unmet medical needs by existing

methods, have worldwide patent filings and agreed commercial

rights. They originate or derive from Word class institutions, such

as Cancer Research UK and Imperial College.

Until recently, cancer treatments relied on non-specific agents,

such as chemotherapy. With the development of target-based agents,

primed to attack cancer cells only, less toxic and more effective

treatments are now possible. New drugs in this group-such as those

in ValiRx's pipeline-promise to greatly improve outcomes for cancer

patients.

The Company listed on the AIM Market of the London Stock

Exchange in October 2006 and trades under the ticker symbol:

VAL.

CHAIRMAN'S STATEMENT FOR THE HALF YEARED 30 JUNE 2019

Throughout the reporting period, ValiRx has continued to sustain

valuable momentum in terms of progressing its therapeutic assets

and along their respective clinical and pre-clinical pathways.

VAL201

We were very pleased to announce in June 2019 that based on our

clinical results for VAL201, a substantial amendment to the

clinical trial protocol had received regulatory approval from the

Medicines and Healthcare products Regulatory Agency ("MHRA") and

the Research Ethics Committee ("REC").

Following approval of this substantial amendment, an

authoritative prostate cancer specialist, Dr Mark Linch was

appointed Principal Investigator to the clinical trial team at

University College London Hospital ("UCLH"). Dr Linch is the

Consultant Medical Oncologist specialising in the treatment of

prostate and bladder cancer at UCLH and as a recognised specialist,

we are pleased to benefit from his deep understanding and

experience of the condition.

To date, the results generated by the trial, showed that the

compound is safe and can be given to humans at a therapeutic level

and beyond. The approval given to relax the restrictions previously

applied to the trial, means that a more effective use of VAL201 can

be achieved, with respect to concentration and timing and regarding

increased flexibility in the administration of the drug. The trial

is providing practical information back to the trialling of VAL201,

so that the next stage of clinical development, in which ValiRx

will endeavour to show how effective the compound actually is, can

be entered into with confidence and support from all those

involved.

Building on this progress, ValiRx was able to announce in

September 2019, that in addition to pharmacokinetic and toxicology

data, clinical trial results to date show that VAL201 behaves as

predicted in reducing prostate cancer progression - evidence that

is supported from tumour imaging (MRI and CT) in subjects. The full

data set is currently being reviewed and collated and additional

data surrounding the possibility of an effect on metastatic tumour

lesions is being collated in the few subjects exhibiting such

tumours. This phase I/II trial will be finalised from a regulatory

viewpoint with the trial focused on confirming and validating the

optimum treatment regime and its particular use in clinical

practice. Data relating to the pharmacology, pharmacokinetics and

pharmacodynamics will be published as it is collated, verified and

submitted.

VAL301

In July 2019 and just after the period end, VAL301's clinical

team signed an agreement with Aptus Clinical Ltd ("Aptus"), the UK

based, clinical Contract Research Organisation ("CRO"), to

effectuate a clinical development plan for VAL301 incorporating a

Phase I/II study design concept in endometriosis. With VAL301 being

derived from the same active pharmaceutical ingredient as VAL201,

the positive results from the VAL201 trial will be used to

strengthen the clinical application of the VAL301 development

programme and this agreement with Aptus represents an important

stage in the preparation of the VAL301 compound for a clinical

study.

Pre-clinical studies of the compound indicated that treatment

with VAL301 should not affect bone density or fertility, two of the

major problems associated with current medical treatments for

endometriosis and ValiRx intends to develop VAL301 as a

non-invasive, effective and better tolerated treatment for this

debilitating condition.

Acquisition of IP & Joint Venture Discussions

In May 2019, ValiRx acquired the IP assets of FIT Biotech OY

("FIT Bio"). FIT Bio had been publicly listed on the First North

Finland marketplace and had been developing gene delivery

technologies for a number of indications and was positioning its

technology as an alternative to biologics, such as vaccines,

antibodies and protein-based drugs. Indeed, FIT Bio's principle

technology - its Gene Transport Unit platform - had seen an initial

product enter into clinical trials.

In addition to the IP assets of FIT Bio, ValiRx currently owns a

potentially complementary portfolio of other genetic-based

diagnostic assets. The Company is currently in discussions with a

potential joint venture partner over the profitable collaboration,

development and exploitation of these assets.

Financial review

At period end, ValiRx had net assets of GBP4,378,572 (2018:

GBP4,647,127) of which GBP171,443 (2018: GBP590,615) comprised cash

and equivalents. The Company was also pleased to announce (on 24

September 2019) its post period receipt of proceeds from a R&D

Tax Credit of GBP0.423m.

The operating loss for the period narrowed substantially by 49%

to GBP1,071,334 (2018: GBP2,104,689) reflecting stringent

budgeting, while conducting the necessary discussions with the MHRA

on VAL201 and with Aptus on VAL301 to advance both assets in

clinical trials. The Company's loss before income tax similarly was

substantially reduced to GBP927,342 (H1 2018: GBP2,151,788) largely

as a result of a profit on the sale of fixed asset investments and

no requirement to manufacture additional VAL201 drug as sufficient

quantities were produced in H2 2018.

The Company continues to carefully monitor its working capital

position.

Outlook

The Board is pleased with the progress of the Company in the

first half of the year. We have made important strides forward

across both our therapeutic and technology portfolios, with the

expectation that these will deliver added value in the near term

for our shareholders.

Oliver de Giorgio-Miller

Non-Executive Chairman

26 September 2019

Valirx Plc

Consolidated statement of comprehensive income

Year ended

Six months ended 30

June 31 December

---------------------------------------------------- ------------------------

Note 2019 2018 2018

(unaudited) (unaudited) (audited)

GBP GBP GBP

Continuing operations

Research and development (206,666) (851,688) (1,698,791)

Administrative expenses (864,668) (920,760) (2,166,798)

Share option charge - (332,241) -

Operating loss (1,071,334) (2,104,689) (3,865,589)

Fair value loss on

derivative

financial assets - (46,892) (442,229)

Profit on the sale of

fixed asset

investments 153,416 - -

Provision for bad debt - - (506,755)

Finance costs (9,424) (207) (14,565)

-------------------------- ------------------------ --------------------------

Loss before income

taxation (927,342) (2,151,788) (4,829,138)

Income tax credit 3 150,000 206,000 461,296

-------------------------- ------------------------ --------------------------

Loss on ordinary

activities after

taxation (777,342) (1,945,788) (4,367,842)

Non-controlling

interests 26,773 31,335 69,020

-------------------------- ------------------------ --------------------------

Loss for the period and

total

comprehensive income

attributable

to owners of the parent (750,569) (1,914,453) (4,298,822)

========================== ======================== ==========================

Loss per share - basic

and diluted 4 (0.11)p (0.51)p (0.94)p

========================== ======================== ==========================

Valirx Plc

Consolidated statement of changes in shareholders' equity

Share Reverse

Share Share Retained Merger option acquisition Non-controlling

capital premium earnings reserve reserve reserve interest Total

GBP GBP GBP GBP GBP GBP GBP GBP

Unaudited

Balance at

1 January

2019 8,680,694 19,779,905 (27,461,771) 637,500 885,963 602,413 (93,764) 3,030,940

Loss for

the

period - - (750,569) - - - (26,773) (777,342)

Issue of

shares 425,762 1,012,738 - - - - - 1,438,500

Costs of

shares

issued - (332,285) - - - - - (332,285)

Share

based

payment - (39,268) - - 39,268 - - -

Balance at

30 June

2019 9,106,456 20,421,090 (28,212,340) 637,500 925,231 602,413 (120,537) 3,359,813

====================== ====================== ====================== ====================== ====================== ====================== ====================== ======================

Unaudited

Balance at

1 January

2018 8,432,708 16,419,494 (23,378,744) 637,500 464,000 602,413 (24,744) 3,152,627

Loss for

the

period - - (1,914,453) - - - (31,335) (1,945,788)

Issue of

shares 104,653 2,354,512 - - - - - 2,459,165

Costs of

shares

issued - (239,853) - - - - - (239,853)

Exercise

of share

options

and

warrants - 147,394 - - (147,394) - - -

Lapse of

share

options - - 2,400 - (2,400) - - -

Share

based

payment - - - - 394,094 - - 394,094

Balance at

30 June

2018 8,537,361 18,681,547 (25,290,797) 637,500 708,300 602,413 (56,079) 3,820,245

====================== ====================== ====================== ====================== ====================== ====================== ====================== ======================

Audited

Balance at

1 January

2018 8,432,708 16,419,494 (23,378,744) 637,500 464,000 602,413 (24,744) 3,152,627

Loss for

the year - - (4,298,822) - - - (69,020) (4,367,842)

Issue of

shares 247,986 3,861,177 - - - - - 4,109,163

Costs of

shares

issued - (500,766) - - - - - (500,766)

Lapse of

share

options - - 215,795 - (215,795) - -

Share

based

payment - - - - 637,758 - - 637,758

Balance at

31

December

2018 8,680,694 19,779,905 (27,461,771) 637,500 885,963 602,413 (93,764) 3,030,940

====================== ====================== ====================== ====================== ====================== ====================== ====================== ======================

Valirx Plc

Consolidated statement of financial position

As at 30 June 31 December

--------------------------------------------------- ------------------------

2019 2018 2018

(unaudited) (unaudited) (audited)

GBP GBP GBP

ASSETS

Non-current assets

Goodwill 1,602,522 1,602,522 1,602,522

Intangible assets 1,813,405 1,379,876 1,623,950

Property, plant and equipment - - -

------------------------ ------------------------- ------------------------

3,415,927 2,982,398 3,226,472

------------------------ ------------------------- ------------------------

Current assets

Trade and other receivables 180,009 746,532 174,089

Tax receivable 611,193 257,244 461,193

Derivative financial assets - 70,338 -

Cash and cash equivalents 171,443 590,615 372,872

------------------------

962,645 1,664,729 1,008,154

------------------------ ------------------------- ------------------------

Total assets 4,378,572 4,647,127 4,234,626

======================== ========================= ========================

SHAREHOLDERS' EQUITY

Share capital 9,106,456 8,537,361 8,680,694

Share premium account 20,421,090 18,681,547 19,779,905

Merger reserve 637,500 637,500 637,500

Reverse acquisition reserve 602,413 602,413 602,413

Share option reserve 925,231 708,300 885,963

Retained earnings (28,212,340) (25,290,797) (27,461,771)

------------------------ ------------------------- ------------------------

3,480,350 3,876,324 3,124,704

Non-controlling interest (120,537) (56,079) (93,764)

------------------------ ------------------------- ------------------------

Total equity 3,359,813 3,820,245 3,030,940

------------------------ ------------------------- ------------------------

LIABILITIES

Current liabilities

Trade and other payables 804,841 826,882 889,987

Borrowings 213,918 - 313,699

------------------------ ------------------------- ------------------------

1,018,759 826,882 1,203,686

------------------------ ------------------------- ------------------------

Total equity and liabilities 4,378,572 4,647,127 4,234,626

======================== ========================= ========================

Valirx Plc

Consolidated cash flow statement

Year ended

Six months ended 30 June 31 December

------------------------------------------------ -----------------------

2019 2018 2018

(unaudited) (unaudited) (audited)

GBP GBP GBP

Cash flows from operating

activities

Operating loss (1,071,334) (2,104,689) (3,865,589)

Amortisation of intangible fixed

assets 92,012 84,800 142,988

Increase in receivables (5,920) (25,005) (31,996)

Decrease in payables within one year (85,146) (567,384) (504,279)

Other non-cash movements - 43,991 (957)

Share option charge - 332,342 482,993

----------------------- ----------------------- -----------------------

Net cash outflows from operations (1,070,388) (2,235,945) (3,776,840)

Tax credit received - 372,850 424,197

Interest paid (1,205) (207) (866)

----------------------- ----------------------- -----------------------

Net cash outflow from operating

activities (1,071,593) (1,863,302) (3,353,509)

----------------------- ----------------------- -----------------------

Cash flows from investing

activities

Purchase of intangible fixed assets (281,467) (139,393) (324,028)

Sale of non-current investments 153,416 - -

----------------------- ----------------------- -----------------------

Net cash outflow from investing

activities (128,051) (139,393) (324,028)

----------------------- ----------------------- -----------------------

Cash flows from financing

activities

Share issue 1,226,000 2,070,000 3,720,000

Costs of shares issued (119,785) (178,100) (346,001)

Repayment of loan notes (108,000) - (25,000)

----------------------- ----------------------- -----------------------

Net cash generated from financing

activities 998,215 1,891,900 3,348,999

----------------------- ----------------------- -----------------------

Net decrease in cash and cash

equivalents (201,429) (110,795) (328,538)

Cash and cash equivalents at start

of period 372,872 701,410 701,410

----------------------- ----------------------- -----------------------

Cash and cash equivalents at end of

period 171,443 590,615 372,872

======================= ======================= =======================

Valirx Plc

Notes to the interim financial statements

1 General information

Valirx Plc is a company incorporated in the United Kingdom,

which is listed on the Alternative Investment Market of the London

Stock Exchange Plc. The address of its registered office is

Stonebridge House, Chelmsford Road, Hatfield Heath, England, CM22

7BDFinancial information

The interim consolidated financial information for the six

months ended 30 June 2019 has not been audited or reviewed and does

not constitute statutory accounts within the meaning of Section 434

of the Companies Act 2006. The Group's statutory accounts for the

year ended 31 December 2018 have been delivered to the Registrar of

Companies. The report of the independent auditors on those

financial statements was unqualified and did not contain a

statement under Sections 498 (2) or (3) of the Companies Act

2006.

The interim financial statements have been prepared in

accordance with International Financial Reporting Standards

('IFRS') as adopted by the European Union, IFRIC interpretations

and the Companies Act 2006 applicable to companies reporting under

IFRS and under the historical cost convention. The accounting

policies applied in preparing the interim financial information are

consistent with those set out in the statutory accounts of the

Company for the year ended 31 December 2018.

The interim consolidated financial statements are presented in

pounds sterling because that is the currency of the primary

economic environment in which the group operates.

2 Taxation

Six months Six months

ended ended Year ended

30 June 30 June 31 December

------------------ --------------------- ------------

2019 2018 2018

(unaudited) (unaudited) (audited)

GBP GBP GBP

United Kingdom corporation tax

at 19%

Current period - R & D Tax

credit (150,000) (206,000) (461,193)

Prior period - R & D Tax credits - - (103)

------------------ --------------------- ------------

Income tax credit (150,000) (206,000) (461,296)

================== ===================== ============

3 Loss per ordinary share

The loss and number of shares used in the calculation of loss

per share are as follows:

Six months Six months

ended ended Year ended

30 June 30 June 31 December

------------------- --------------- ------------------

2019 2018 2018

(unaudited) (unaudited) (audited)

Basic:

Loss for the financial period (777,342) (1,945,788) (4,367,842)

Non-controlling interest 26,773 31,335 69,020

------------------- --------------- ------------------

(750,569) (1,914,453) (4,298,822)

=================== =============== ==================

Weighted average number of shares 691,640,169 384,343,833 458,715,753

Loss per share (0.11)p (0.51)p (0.94)p

=================== =============== ==================

The outstanding share options and share warrants would have no

dilutive effect on the loss per share.

4 Dividends

The directors do not propose to declare a dividend in respect of

the period.

5 Share capital

30 June 2019 30 June 2018

--------------------------------------- --------------------------------------

Number GBP Number GBP

(unaudited) (unaudited) (unaudited) (unaudited)

Allotted, called up

and fully paid

Ordinary shares of

0.1p each 1,024,057,953 1,024,059 454,962,717 454,964

Deferred shares of

5.0p each 58,378,365 2,918,918 58,378,365 2,918,918

Deferred shares of

0.9p each 157,945,030 1,421,505 157,945,030 1,421,505

Deferred shares of

12.4p each 30,177,214 3,741,974 30,177,214 3,741,974

==================== ==================

9,106,456 8,537,361

================= ==================

31 December 2018

---------------------------------------

Number GBP

Allotted, called up

and fully paid (unaudited) (unaudited)

Ordinary shares of

0.1p each 598,296,049 598,297

Deferred shares of

5.0p each 58,378,365 2,918,918

Deferred shares of

0.9p each 157,945,030 1,421,505

Deferred shares of

12.4p each 30,177,214 3,741,974

====================

8,680,694

=================

-- On 28 February 2019, the Company raised GBP0.50 million,

before expenses, by way of a placing of 83,333,333 ordinary shares

of 0.1p each at a price of 0.60p per share;

-- On 1 May 2019, the Company raised GBP0.426 million, before

expenses, under the Subscription Agreement previously reported, by

the issue of 71,000,000 at a price of 0.60p per share;

-- On 18 June 2019, the Company raised GBP0.30 million, before

expenses, by way of a placing of 150,000,000 ordinary shares of

0.1p each at a price of 0.20p per share;

-- On 25 June 2019, the Company issued 121,428,571 ordinary

shares of 0.1p each at a price of 0.175p per share in consideration

for the termination of the Subscription Agreement at an agreed fee

of GBP212,500.

6 Copies of interim results

Copies of the interim results can be obtained from the website

www.valirx.com. From this site you may access our financial reports

and presentations, recent press releases and details about the

company and its operations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR BIGDCSXDBGCU

(END) Dow Jones Newswires

September 26, 2019 02:01 ET (06:01 GMT)

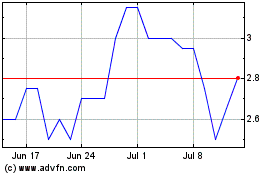

Valirx (LSE:VAL)

Historical Stock Chart

From Aug 2024 to Sep 2024

Valirx (LSE:VAL)

Historical Stock Chart

From Sep 2023 to Sep 2024