Electra Private Equity PLC Epiris announces the realisation of Allflex (2504A)

March 23 2017 - 3:00AM

UK Regulatory

TIDMELTA

RNS Number : 2504A

Electra Private Equity PLC

23 March 2017

PRESS RELEASE

23 March 2017

Epiris announces the realisation of Allflex

Epiris is pleased to announce that it has sold Electra Private

Equity PLC's ("Electra") remaining stake in Allflex Corporation

("Allflex") to an existing shareholder.

Electra has received proceeds of GBP70.3 million from the sale,

an uplift of GBP1.5 million or 2% on the valuation of its

investment in Allflex at 30 September 2016, equivalent to an

increase in NAV per share of 3 pence. Including proceeds already

received, this equates to a return of 1.9x original cost on

Electra's 2013 investment in Allflex; an IRR of 23%.

Allflex is the global leader in animal intelligence and

monitoring technologies for livestock, pets, fish and other

species. It designs, produces and distributes a variety of products

such as radio-frequency identification (RFID) and visual ear tags,

tissue sampling devices, RFID implants, monitoring devices, milk

meters, and other farm management equipment. Allflex operates in 80

countries and employs over 1,800 people worldwide.

David Symondson, Chris Hanna and Nicola Gray are responsible for

the investment in Allflex.

Epiris refers to Epiris Managers LLP acting on behalf of its

client Electra Private Equity PLC.

Ends.

For further information please contact:

Andrew Honnor, Matthew Goodman, Matthieu Roussellier,

Greenbrook Communications +44 (0)20 7952 2000

Andrew Kenny and Nicholas Board, Epiris +44 (0)20 7306 3932

Note to Editors:

About Epiris

Epiris is a top-decile private equity fund manager*.

Epiris, together with its predecessor firms, has managed the

business and affairs of Electra Private Equity PLC, a listed

private equity investment trust, for four decades. Epiris has also

managed private equity investment programmes for pension funds,

financial institutions and family offices. During this time Epiris

has invested in excess of GBP5 billion in over 200 deals. Since

2011, Epiris has invested GBP1 billion in buyouts and

co-investments and loan-to-own debt investments, in respect of

which it has delivered a gross IRR of 37%**.

As at 30 September 2016, the firm had funds under management of

GBP2.4 billion.

For further information please visit www.epiris.co.uk.

Issued by Epiris Managers LLP which is authorised and regulated

by the Financial Conduct Authority.

* Refers to the 2009 and 2012 investment pools comprising Buyout

& Co-investment, Secondary and Debt investments managed on

behalf of Electra Private Equity PLC; comparator data supplied by

Preqin.

** As at 30 September 2016 adjusted for subsequent investments

and realisations. Gross IRR does not reflect adjustments for

investment management and administration costs. Past performance is

no guarantee of future results.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSEFFWEFWSEFD

(END) Dow Jones Newswires

March 23, 2017 03:00 ET (07:00 GMT)

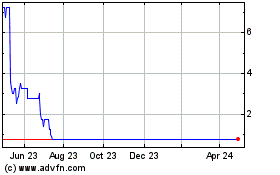

Unbound (LSE:UBG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Unbound (LSE:UBG)

Historical Stock Chart

From Apr 2023 to Apr 2024