Tern PLC: Subscription for GBP1.5 million and H1 2020 Portfolio Update (1097105)

July 20 2020 - 4:00AM

UK Regulatory

Tern PLC (TERN)

Tern PLC: Subscription for GBP1.5 million and H1 2020 Portfolio Update

20-Jul-2020 / 09:00 GMT/BST

Dissemination of a Regulatory Announcement that contains inside information

according to REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF ARTICLE 7

OF THE MARKET ABUSE REGULATIONS (EU) NO. 596/2014 ("MAR"). IN ADDITION,

MARKET SOUNDINGS WERE TAKEN IN RESPECT OF THE MATTERS CONTAINED IN THIS

ANNOUNCEMENT, WITH THE RESULT THAT CERTAIN PERSONS BECAME AWARE OF SUCH

INSIDE INFORMATION. UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN AND SUCH PERSONS

SHALL THEREFORE CEASE TO BE IN POSSESSION OF INSIDE INFORMATION.

20 July 2020

Tern Plc ("Tern" or the "Company")

Subscription for GBP1.5 million and H1 2020 Portfolio Update

Tern Plc (AIM:TERN), the investment company specialising in the Internet of

Things ("IoT"), announces that it has raised GBP1.5 million before expenses

through a subscription of 17,647,058 new ordinary shares of 0.02p each (the

"Subscription Shares") at a price of 8.5 pence per new ordinary share (the

"Issue Price") (the "Subscription"), conditional upon admission to AIM.

Tern also provides an update on the activities of the Company and its

portfolio companies during the six months ended 30 June 2020 (H1 2020),

ahead of publishing its interim results on 21 September 2020.

Highlights

· The funds raised via the Subscription are intended to be used to

facilitate a new investment to expand Tern's portfolio and will also:

· provide additional working capital generally; and

· facilitate follow-on investment opportunities in Tern's principal

portfolio companies as appropriate

· 62% year-on-year increase in turnover of principal portfolio companies1

for H1 2020. The Directors view this as an important positive result given

the slow down across the economy during this period

· 7% year-on-year increase in employees within principal portfolio

companies, a key growth measurement (H1 2019: 9%). This measure has been

impacted in the latter half of the period by a slowdown in recruitment to

ensure prudent management through the Covid-19 period

1 * Principal portfolio companies excludes Push Technology Limited, in which

Tern has a <1% holding and minimal influence.

Portfolio Highlights for H1 2020

· Device Authority significantly expanded its sales channel - KeyScaler is

now available on the Microsoft Azure Marketplace, an online store

· FundamentalVR received centre accreditation from the Royal College of

Surgeons of England and its orthopaedic education simulations were awarded

accreditation status by the American Academy of Orthopaedic Surgeons

(AAOS)

· Wyld signed an agreement with Highland Health Ventures Limited (HHVL) to

test and deploy its Wyld mesh technology into certain care homes in

Scotland

· InVMA signed a partnership agreement with Senseye [1] Limited, the

industrial software company specialising in predictive maintenance

Tern's CEO Al Sisto said:

"We are very pleased to have secured this support via the Subscription for

future investment opportunities and look forward to providing updates when

we finalise a transaction. Having successfully supported our existing

portfolio companies over recent months, many of which are making important

contributions to help their customers and partners navigate this challenging

time, we believe our investment thesis to provide an active platform for

early stage, high potential IoT businesses has been validated. We are

therefore excited to build on this by adding exciting, high growth companies

to our portfolio and in doing so, to further de-risk our business."

Further Information about the Subscription

The Directors intend to use the net proceeds of the Subscription to

facilitate securing a new investment to expand Tern's portfolio. The

Subscription will also provide additional general working capital and

strengthen the Company's balance sheet to enable the Company to pursue

follow-on investment opportunities in the Company's principal portfolio

companies, as appropriate, from a position of negotiating strength. Tern has

a strong pipeline of new investment opportunities and anticipates securing

at least one new investment before the year end.

Application will be made for the 17,647,058 Subscription Shares to be

admitted to AIM ("Admission") and it is expected that Admission will take

place and trading in the Subscription Shares will commence on 24 July 2020.

In accordance with the Financial Conduct Authority's Disclosure, Guidance

and Transparency Rules, the Company confirms that on completion of the

Subscription and following Admission, the Company's enlarged issued ordinary

share capital will comprise 300,999,434 ordinary shares of 0.02p each. The

Company does not hold any shares in Treasury. Therefore, from Admission, the

total number of voting rights in the Company will be 300,999,434. Following

the completion of the Subscription and Admission, the above figure may be

used by shareholders in the Company as the denominator for the calculations

to determine if they are required to notify their interest in, or a change

to their interest in the Company, under the Disclosure Guidance and

Transparency Rules.

H1 2020 Update

Tern has experienced a solid start to the year, despite the current

unprecedented times. Tern's Board has continued to hold regular sessions

with the senior leadership teams of its principal portfolio companies to

share insights on employee wellbeing, business agility and to leverage the

synergies within its portfolio companies' businesses to help them adapt to

the new challenges presented by the Covid-19 crisis.

The Company has also monitored costs closely during the Covid-19 pandemic

with continued Director salary reductions and mitigation activities in the

principal portfolio companies, primarily salary reductions and some limited

use of furlough schemes where relevant. It has also supported its portfolio

companies in applying for Innovate UK grants, where applicable, to support

their ongoing innovative projects.

Tern had an unaudited cash balance of GBP0.8 million on 30 June 2020 which

will be strengthened by the net proceeds of the Subscription announced

today. The year-on-year increase in turnover of the principal portfolio

companies1 for the first six months of 2020 was 62%. The Directors view this

as a positive result given the slow down across the economy during this

period. The year-on-year increase in employees within the principal

portfolio companies1, a key growth measurement, increased by 7% in the six

months to June 2019. This measure has been impacted in the latter half of

the period by a slowdown in recruitment to ensure prudent management through

the Covid-19 period.

Portfolio update

Device Authority ("DA")

Tern holding: 56.8%

Outstanding loan: $3.6 million

Sector: Security and Device Operations Management

Invested Since: September 2014

In June 2020 Device Authority announced the availability of KeyScaler in the

Microsoft Azure Marketplace [2], an online store providing applications and

services for use on Azure. The marketplace significantly expands DA's sales

channel as it lets customers worldwide discover, try, and deploy KeyScaler

solutions that are certified and optimized to run on Azure. The company has

also secured contract renewals via key channel partners and their customers

during the period.

FundamentalVR ("FVR")

Tern holding: 26.9%

Sector: Healthcare IoT

Invested Since: May 2018

In April 2020, FVR announced the expansion of the Fundamental Surgery [3]

platform, with the addition of a new education modality @HomeVR. In this

time where rapid learning and remote access has never been more relevant,

this has enabled health care professionals to prepare to use new equipment

and undertake new procedures. Its multiuser support enables its enterprise

customers to provide virtual master classes to accelerate the adoption of

new products and procedures. This ability to access training remotely

worldwide via the cloud enables collaboration in a virtual operating room or

clinic with no requirement for physical presence. In the current Covid-19

environment, its shared virtual setting also improves the overall

communication process among surgeons and trainees.

In June 2020, FundamentalVR achieved another important milestone as all the

orthopaedic education simulations available on the Fundamental Surgery

platform have been reviewed by the American Academy of Orthopaedic Surgeons

(AAOS) and awarded accreditation status. This recognition demonstrates the

AAOS's commitment to innovation in medical education and will allow

orthopaedic surgeons to collect continuing medical education (CME) credits

while utilising the unique cutting-edge haptic FVR platform. This was

followed in July 2020 by the company receiving centre accreditation from the

Royal College of Surgeons of England. This kite mark of quality has been

adopted by many leading organisations that develop world-class surgical

education courses, solutions and platforms.

Wyld Networks ("Wyld")

Holding: 100%

Outstanding loan: GBP1.1 million

Sector: IoT Communications Enablement

Invested Since: June 2016

In May 2020, Wyld announced that it had signed an agreement with Highland

Health Ventures Ltd [4] (HHVL) to test and deploy its Wyld mesh technology

into care homes in Scotland to help protect residents, staff and visitors,

and prevent the spread of Covid-19 or other viruses. The patented solution

connects smartphones directly to smartphones, without the need for WiFi or

cellular connectivity, to create an infrastructure-lite wireless mesh

communication network, as well as provide social distance monitoring and

alerting.

HHVL is an independent company with a Collaboration Agreement with NHS

Highland [5] for the purpose of developing innovations in healthcare.

In July 2020, Wyld announced the launch of Wyld Mesh and Fusion, its

innovative mobile mesh networking technology, data curation and content

delivery platform. Wyld Mesh and Fusion provides businesses with an

innovative way to generate new revenue streams, operate more efficiently,

get back to work safely and monitor social distancing practices. Wyld Mesh

harnesses the power of mobile devices to create wireless mesh communication

networks with applications in enterprise, healthcare, retail, education,

events and industry.

In the first half of the year Wyld also announced it had signed an agreement

with a global satellite operator to co-develop and co-market a LoraWAN

direct to satellite solution that is intended to bring the cost of satellite

IoT services in line with terrestrial based IoT solutions, aimed at opening

up a new frontier in the deployment of IoT solutions.

InVMA

Holding: 50%

Outstanding loan: GBP50,000

Sector: IoT enablement

Invested Since: September 2017

In June 2020, InVMA announced that it had signed a partnership agreement

with Senseye [1] Limited, the Industry 4.0 software company using

machine-learning algorithms for predictive maintenance. Via this

partnership, InVMA customers will now be able to more easily, and cost

effectively, capture and share their shop-floor and machine performance

data, driving better predictive maintenance insights to improve shop floor

productivity, product quality and to proactively reduce downtime.

Although Covid-19 has had a material impact on the industrial sector,

interest in remote monitoring remains. InVMA has carefully managed demand

for their services and products while effectively utilising government

furlough support as required. During this time InVMA has continued to focus

on the growth of its Software as a Service (SaaS) product AssetMinder(R)

[6], at a time when the Directors believe that remote monitoring has rapidly

moved to the forefront of industrial and manufacturing agendas.

AssetMinder(R) [6] enables its customers to remotely collect, monitor and

aggregate real-time data on assets, devices and equipment; providing

predictive insights to drive intelligence-based decisions across individual

machines and manufacturing lines to a portfolio of facilities.

Information for Distributors

Solely for the purposes of the product governance requirements contained

within: (a) EU Directive 2014/65/EU on markets in financial instruments, as

amended ("MiFID II"); (b) Articles 9 and 10 of Commission Delegated

Directive (EU) 2017/593 supplementing MiFID II; and (c) local implementing

measures (together, the "Product Governance Requirements"), and disclaiming

all and any liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the Product Governance Requirements)

may otherwise have with respect thereto, the Subscription Shares have been

subject to a product approval process by Allenby Capital Limited, which has

determined that the Subscription Shares are: (i) compatible with an end

target market of retail investors and investors who meet the criteria of

professional clients and eligible counterparties, each as defined in MiFID

II; and (ii) eligible for distribution through all distribution channels as

are permitted by MiFID II (the "Target Market Assessment"). Notwithstanding

the Target Market Assessment, investors should note that: the price of the

Subscription Shares may decline and investors could lose all or part of

their investment; Subscription Shares offer no guaranteed income and no

capital protection; and an investment in Subscription Shares is compatible

only with investors who do not need a guaranteed income or capital

protection, who (either alone or in conjunction with an appropriate

financial or other adviser) are capable of evaluating the merits and risks

of such an investment and who have sufficient resources to be able to bear

any losses that may result therefrom. The Target Market Assessment is

without prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Subscription.

Furthermore, it is noted that, notwithstanding the Target Market Assessment,

only investors who have met the criteria of professional clients and

eligible counterparties have been procured. For the avoidance of doubt, the

Target Market Assessment does not constitute: (a) an assessment of

suitability or appropriateness for the purposes of MiFID II; or (b) a

recommendation to any investor or group of investors to invest in, or

purchase, or take any other action whatsoever with respect to Subscription

Shares.

Enquiries

Tern Plc via Newgate Communications

Al Sisto/Sarah Payne

Allenby Capital Tel: 020 3328 5656

(Nomad and joint broker)

David Worlidge/Alex Brearley

Whitman Howard Tel: 020 7659 1234

(Joint broker)

Nick Lovering/Christopher Furness

Newgate Communications Tel: 020 3757 6880

Elisabeth Cowell/Megan Kovach

ISIN: GB00BFPMV798

Category Code: MSCU

TIDM: TERN

LEI Code: 2138005F87SODHL9CQ36

Sequence No.: 76631

EQS News ID: 1097105

End of Announcement EQS News Service

1: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=39fa1240389005ff818545a92e14bd6a&application_id=1097105&site_id=vwd&application_name=news

2: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=fc48fc2952088d7d230ae54caaf4c206&application_id=1097105&site_id=vwd&application_name=news

3: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=21ff35cb8ed6814ae219d4b9be6a710d&application_id=1097105&site_id=vwd&application_name=news

4: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=7fecc6d82a6dc9f30b35153433663ac0&application_id=1097105&site_id=vwd&application_name=news

5: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=6561c981a58b142c1a3f7f365f6220e6&application_id=1097105&site_id=vwd&application_name=news

6: https://eqs-cockpit.com/cgi-bin/fncls.ssp?fn=redirect&url=54df7ee4269e9b726ad227d555b74d35&application_id=1097105&site_id=vwd&application_name=news

(END) Dow Jones Newswires

July 20, 2020 04:00 ET (08:00 GMT)

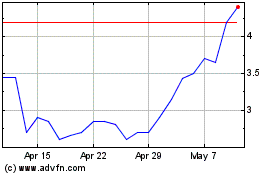

Tern (LSE:TERN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Tern (LSE:TERN)

Historical Stock Chart

From Sep 2023 to Sep 2024