Standard Chartered Lowers Selling Price for Stake in PT Bank Permata

April 20 2020 - 9:41AM

Dow Jones News

By Adriano Marchese

Standard Chartered PLC said Monday that it has agreed to reduce

the selling price for its interest in PT Bank Permata Tbk.

The Asia-focused bank said that its subsidiary, Standard

Chartered Bank, and its partner PT Astra International Tbk have

agreed with Bangkok Bank to amend the terms of the agreement of

Dec. 12 in which they agreed to sell their aggregate 89.12% equity

in PT Bank Permata.

The purchase price has been revised to 1.63 times Permata's

shareholders' equity as at March 31, down from 1.77 times, Standard

Chartered said. The company said that the latest estimated

consideration payable in cash is around $1.06 billion.

In December, Standard Chartered said that it had agreed to sell

its 44.56% interest in Indonesia's Bank Permata for $1.3 billion to

Bangkok Bank.

The 18% reduction in estimated proceeds is attributed to the

revised valuation multiple, as well as a reduction in Permata's

shareholders' equity after adopting IFRS 9 and the recent

depreciation of the Indonesian Rupiah against the dollar, the

company said.

Write to Adriano Marchese at adriano.marchese@wsj.com

(END) Dow Jones Newswires

April 20, 2020 09:26 ET (13:26 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

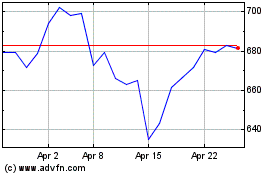

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Aug 2024 to Sep 2024

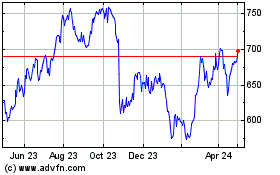

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Sep 2023 to Sep 2024