Current Report Filing (8-k)

February 25 2020 - 12:02PM

Edgar (US Regulatory)

0000823768

false

0000823768

2020-02-18

2020-02-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): February 19, 2020

Waste Management, Inc.

(Exact Name of Registrant as Specified

in Charter)

|

Delaware

|

|

1-12154

|

|

73-1309529

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

1001 Fannin, Houston, Texas

|

|

77002

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s Telephone number, including

area code: (713) 512-6200

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

|

WM

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.02.

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

On

February 19, 2020, the Management Development and Compensation Committee (the “Committee”) of the Board of Directors

of Waste Management, Inc. (the “Company”) granted equity awards under the Company’s 2014 Stock Incentive Plan

to each of the Company’s currently-serving named executive officers, as identified in the Company’s most recent proxy

statement (collectively, the “Executives”).

Each

of the Executives, which includes James C. Fish, Jr., President and Chief Executive Officer; John J. Morris, Jr., Executive Vice

President and Chief Operating Officer and Devina A. Rankin, Executive Vice President and Chief Financial Officer, received performance

share units and stock options. The number of performance share units granted to each of the Executives is as follows: Mr. Fish

— 49,586; Mr. Morris — 14,546 and Ms. Rankin — 13,224. The material terms of the performance share units are

described below.

|

Performance Share Units

|

|

|

|

Performance Calculation Date (“PCD”)

|

|

As of December 31, 2022; award (if any) paid out after completion of the audit of the Company’s 2022 year-end financial statements and certification by the Committee of actual level of achievement (“payment date”).

|

|

|

|

|

|

Performance Measure

|

|

50% of the PSUs will have an adjusted free cash flow performance measure, and 50% of the PSUs will have a total shareholder return relative to the S&P 500 performance measure, in each case as set forth in the award agreement filed as an exhibit hereto.

|

|

|

|

|

|

Range of Possible Awards

|

|

0 — 200% of targeted amount, plus accrued dividend equivalents, based on actual results achieved.

|

|

|

|

|

|

Termination of Employment

|

|

|

|

|

|

|

|

Death or Disability before PCD

|

|

Payable in full on payment date based on actual results as if participant had remained an active employee through PCD.

|

|

|

|

|

|

Involuntary Termination for Cause or Voluntary Resignation before PCD

|

|

Immediate forfeiture.

|

|

|

|

|

|

Involuntary Termination other than for Cause before PCD

|

|

Payable on payment date based on actual results, prorated based on portion of performance period completed prior to termination of employment.

|

|

|

|

|

|

Retirement (as defined in the award agreement) before PCD

|

|

If Retirement occurs on or after December 31, 2020, payable in full on payment date based on actual results as if participant had remained an active employee through PCD. If Retirement occurs before December 31, 2020, payable on payment date based on actual results, prorated based on the number of days worked during 2020 (the first year of the performance period) divided by 365.

|

|

Change in Control before PCD

|

|

Performance measured prior to the change in control and paid on prorated basis on actual results achieved up to such date. Thereafter, participant also generally receives a replacement award of restricted stock units in the successor entity generally equal to the number of PSUs that would have been earned had no change in control occurred and target performance levels had been met from the time of the change of control through December 31, 2022, adjusted for any conversion factors in the change in control transaction. The new restricted stock units in the successor entity would vest on December 31, 2022.

|

The

Committee also granted stock options to the Executives to purchase the following number of shares of the Company’s common

stock: Mr. Fish — 94,817; Mr. Morris — 27,813 and Ms. Rankin — 25,284. The material terms of the stock

options are described below.

|

Stock Options

|

|

|

|

Vesting Schedule

|

|

25% on first anniversary;

25% on second anniversary; and

50% on third anniversary.

|

|

|

|

|

|

Term

|

|

10 years from date of grant.

|

|

|

|

|

|

Exercise Price

|

|

Fair Market Value on date of grant - $126.005.

|

|

|

|

|

|

Termination of Employment

|

|

|

|

Death or Disability

|

|

All options immediately vest and remain exercisable for one year, but in no event later than the original term.

|

|

|

|

|

|

Qualifying Retirement

|

|

Continued vesting and exercisability for three years, but in no event later than the original term.

|

|

|

|

|

|

Involuntary Termination other than for Cause or Voluntary Resignation

|

|

All vested options remain exercisable for 90 days, but in no event later than the original term.

|

|

|

|

|

|

Involuntary Termination for Cause

|

|

All options are forfeited, whether or not exercisable.

|

|

|

|

|

|

Involuntary Termination or Resignation for Good Reason following a Change in Control

|

|

All options immediately vest and remain exercisable for three years, but in no event later than the original term.

|

The

form of award agreement for the equity awards granted to Mr. Fish, Mr. Morris and Ms. Rankin is filed as Exhibit 10.1 to this

report. The descriptions of the material terms of the awards are qualified in their entirety by reference to the award agreement,

incorporated herein by reference.

Item 9.01.

Financial Statements and Exhibits.

(d) Exhibits

Exhibit Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, hereunto duly authorized.

|

|

WASTE MANAGEMENT,

INC.

|

|

|

|

|

|

Date: February 25,

2020

|

By:

|

/s/

Charles C. Boettcher

|

|

|

|

Charles

C. Boettcher

|

|

|

|

Executive

Vice President, Corporate Development

|

|

|

|

and

Chief Legal Officer

|

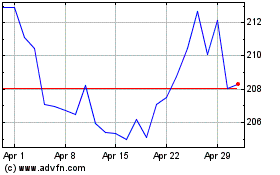

Waste Management (NYSE:WM)

Historical Stock Chart

From Aug 2024 to Sep 2024

Waste Management (NYSE:WM)

Historical Stock Chart

From Sep 2023 to Sep 2024