Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

March 11 2024 - 10:08AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Statement No. 333-275898

|

Key Terms (Subject to Change):

|

|

Issuer:

|

Royal Bank of Canada (“RBC”)

|

|

CUSIP:

|

78017FKZ5

|

|

Trade Date:

|

March 25, 2024

|

|

Issue Date:

|

March 28, 2024

|

|

Valuation Date:

|

September 25, 2026

|

|

Maturity Date:

|

September 30, 2026

|

|

Reference Asset:

|

Solactive Equal Weight U.S. Semi Conductor Select AR Index

|

|

Coupon Observation Dates

and Coupon Payment

Dates:

|

Monthly, as set forth in the preliminary terms supplement

|

|

Call Observation Dates

and Call Settlement Dates:

|

Quarterly, beginning on September 25, 2024, as set forth in the preliminary terms supplement

|

|

Contingent Coupon Rate:

|

10.25% per annum. The Contingent Coupon will be paid on each Coupon Payment Date if the closing level of the Reference Asset is greater than or equal to the Coupon Barrier.

|

|

Automatic Call Feature:

|

If the closing level of the Reference Asset is greater than or equal to the Initial Level beginning on September 25, 2024 and on any quarterly Call Observation Date

thereafter, the Notes will be automatically called, for 100% of the principal amount, plus the Contingent Coupon applicable to the corresponding Coupon Observation Date. For the avoidance of doubt, if the Notes are called prior to maturity, we will pay you for each $1,000 in principal amount of the Notes the Contingent Coupon otherwise on the

applicable Payment Date and you will not receive any Contingent Coupons after that payment.

|

| |

Call Settlement Dates:

|

The Coupon Payment Date corresponding to that Call Observation Date.

|

| |

Coupon Barrier and

Trigger Levels:

|

70% of the Initial Level.

|

| |

Payment at Maturity:

|

If the Notes are not previously called, we will pay you at maturity, in addition to any Contingent Coupon due on the Maturity Date, an amount in cash based on the Final Level of the

Reference Asset.

If the Final Level is greater than or equal to the Trigger Level, $1,000.

If the Final Level is less than the Trigger Level, you will lose 1% of the principal amount of the Notes for each 1% decrease in the level of the Reference Asset from the Initial

Level to the Final Level.

|

| |

Initial Level:

|

The closing level of the Reference Asset on the Trade Date.

|

| |

Final Level:

|

The closing level of the Reference Asset on the Valuation Date.

|

|

Product Characteristics

|

| • |

If the Reference Asset closes at or above the Coupon Barrier as of a given Coupon Observation Date, the Notes will pay the Contingent Coupon on the applicable Coupon Payment Date.

|

| • |

If the closing level of the Reference Asset on any quarterly Call Observation Date (beginning on September 25, 2024) is at or above the Initial Level, the Notes will be automatically

called at the principal amount plus the Contingent Coupon on the applicable Call Settlement Date.

|

| • |

If the Notes are not automatically called and the Final Level is greater than or equal to the Trigger Level, the Notes will pay the principal amount plus the Contingent Coupon.

|

| • |

If the Final Level is less than the Trigger Level, you could lose your entire investment.

|

|

Hypothetical Scenario Analysis

|

|

DETERMINING PAYMENT FOR EACH OBSERVATION DATE

The Notes will not be automatically called and you will not receive the relevant Contingent Coupon for the applicable Coupon Observation Date.

DETERMINING PAYMENT AT MATURITY

You will lose 1% of the principal amount of your notes for each 1% decrease in the level of the Reference Asset.

Investors could lose some or all of their investment at maturity if there has been a decline in the level of the Reference Asset.

| • |

This investment may result in a loss of up to 100% of principal. If the Notes are not automatically called and the Final Level is less than the Trigger Level, the amount of cash that

you receive at maturity will represent a loss of your principal that is proportionate to the decrease in the closing level of the Reference Asset from the Trade Date to the Valuation Date.

|

| • |

The Notes do not guarantee the payment of any Contingent Coupons over their term. You will not receive the Contingent Coupon in respect of any Coupon Observation Date where the

closing level of the Reference Asset is less than the Coupon Barrier.

|

| • |

The return potential of the Notes is limited to the Contingent Coupons, and you will not participate in any appreciation in the level of the Reference Asset, which may be

significant.

|

| • |

Although the return on the Notes will be based on the performance of the Reference Asset, the payment of any amount due on the Notes is subject to RBC’s credit risk. Investors are

dependent on RBC’s ability to pay all amounts due on the Notes.

|

| • |

Please see next page for additional risks.

|

Product Risks

| • |

You May Receive Less than the Principal Amount at Maturity.

|

| • |

The Notes Are Subject to an Automatic Call.

|

| • |

You May Not Receive Any Contingent Coupons.

|

| • |

The Call Feature and the Contingent Coupon Feature Limit Your Potential Return.

|

| • |

Your Return on the Notes May Be Lower than the Return on a Conventional Debt Security of Comparable Maturity.

|

| • |

Payments on the Notes Are Subject to Our Credit Risk, and Changes in Our Credit Ratings Are Expected to Affect the Market Value of the Notes.

|

| • |

There May Not Be an Active Trading Market for the Notes-Sales in the Secondary Market May Result in Significant Losses.

|

| • |

The Initial Estimated Value of the Notes Will Be Less than the Price to the Public.

|

| • |

The Initial Estimated Value of the Notes Set Forth on the Cover Page of the Final Pricing Supplement Will Be an Estimate Only, Calculated as of the Time the Terms of the Notes Are

Set.

|

| • |

Our Business Activities May Create Conflicts of Interest.

|

| • |

We May Issue Research that Is Inconsistent with an Investment in the Notes.

|

| • |

The Reference Asset Has a Limited Operating History and May Perform in Unanticipated Ways.

|

| • |

The Reference Asset Is Subject to an Adjustment Factor That Will Adversely Affect the Reference Asset Performance.

|

| • |

Any Potential Benefit From the Gross Total Return Feature of the Underlying Index Will Be Reduced by the Adjustment Factor Applied to the Reference Asset.

|

| • |

Dividends and Distributions of the Underlying Index Constituents May Vary When Compared to Historical Levels.

|

| • |

The Underlying Index Constituents Are Not Expected to Change During the Term of the Notes, and Are Limited in Number.

|

| • |

There Is No Guarantee That the Index Methodology Will Be Successful.

|

| • |

An Investment in the Notes Is Subject to Risks Associated with a Specific Economic Industry.

|

| • |

Even Though the Reference Asset and the Underlying Index Include "U.S." In Their Respective Names, an Investment in Notes Is Subject to Risks Relating to Non-U.S. Securities Markets.

|

| • |

Owning the Notes Is Not the Same as Owning the Underlying Index Constituents.

|

| • |

The Payments on the Notes Are Subject to Postponement due to Market Disruption Events and Adjustments.

|

The risks set forth in this document are only intended as summaries of some of the risks relating to an investment in the Notes. Prior to

investing in the Notes, you should, in particular, review the “Product Risks” above, the “Selected Risk Considerations” section in the terms supplement and the “Risk Factors” section of the product prospectus supplement, which set forth

additional risks relating to an investment in the Notes. This document is only intended to be read together with the preliminary terms supplement and related documents, which may be accessed here.

The Index Sponsor and the Bank have entered into a license agreement providing the Bank, in exchange for a fee, with the right to use the Reference

Asset in connection with the Notes. The Index Sponsor does not guarantee the accuracy or completeness of the Reference Asset or the Underlying Index, any data included therein, or any data from which it is derived, and the Index Sponsor has no

liability for any errors, omissions, or interruptions therein. The Index Sponsor does not make any warranty, express or implied, as to results to be obtained from use of information provided by the Index Sponsor in respect of the Reference

Asset or the Underlying Index and the Index Sponsor expressly disclaims all warranties of suitability with respect thereto. The Reference Asset and the Underlying Index are calculated by the Index Sponsor. The Notes are not sponsored, promoted,

sold or supported in any other manner by the Index Sponsor nor does the Index Sponsor offer any express or implicit guarantee or assurance either with regard to the results of using the Reference Asset and/or Underlying Index trade mark or the

closing level at any time or in any other respect. The Reference Asset and the Underlying Index are calculated and published by the Index Sponsor. The Index Sponsor uses its best efforts to ensure that the Reference Asset and the Underlying

Index are calculated correctly. Irrespective of its obligations towards Royal Bank of Canada, the Index Sponsor has no obligation to point out errors in the Reference Asset or the Underlying Index to third parties including but not limited to

investors and/or financial intermediaries of the Notes. Neither publication of the Reference Asset or the Underlying Index by the Index Sponsor nor the use of the Reference Asset or the Reference Asset trade marks for the purpose of use in

connection with the Notes constitutes a recommendation by the Index Sponsor to invest capital in the Notes nor does it in any way represent an assurance or opinion of the Index Sponsor with regard to any investment in the Notes. The name

“Solactive” is a registered trademark of the Index Sponsor. The Index Sponsor is registered with and regulated by the German Federal Financial Supervisory Authority.

Royal Bank of Canada has filed a registration statement (including a product prospectus supplement, a prospectus supplement, and a prospectus) with

the SEC for the offering to which this document relates. Before you invest, you should read those documents and the other documents relating to this offering that we have filed with the SEC for more complete information about us and this

offering. You may obtain these documents without cost by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, Royal Bank of Canada, any agent or any dealer participating in this offering will arrange to send you the product

prospectus supplement, the prospectus supplement and the prospectus if you so request by calling toll-free at 1-877-688-2301.

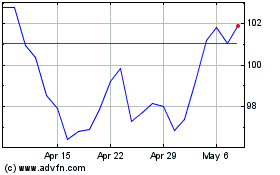

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Apr 2023 to Apr 2024