Current Report Filing (8-k)

May 15 2020 - 12:19PM

Edgar (US Regulatory)

0000702165

false

0000702165

2020-05-14

2020-05-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 15, 2020 (May 14,

2020)

________________________________

NORFOLK

SOUTHERN CORPORATION

(Exact name of registrant as specified in its

charter)

______________________________________

|

Virginia

|

1-8339

|

52-1188014

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission File Number)

|

(IRS Employer

Identification Number)

|

|

|

|

|

|

Three

Commercial Place

|

|

757-629-2680

|

|

Norfolk,

Virginia

23510-9241

|

|

(Registrant's telephone

number, including area code)

|

|

(Address of principal

executive offices)

|

|

|

No Change

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol

|

|

Name of each exchange

on which registered

|

|

Norfolk Southern Corporation Common Stock (Par Value $1.00)

|

|

NSC

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors

or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On May 14, 2020, Norfolk Southern

Corporation (the “Corporation”) adopted the Norfolk Southern Executive Severance Plan (the “Severance Plan”),

which is applicable to the Company’s executive vice presidents, and which may be applicable to a senior vice president of

the Company.

The

Company previously did not maintain any severance arrangements specifically for its senior or executive vice presidents.

The Board’s purpose in adopting the Severance Plan is to meet the needs of the Company, its executives and prospective

executives, by providing a severance arrangement similar to that offered by competitors for

executive talent, and which allows the Company’s executives to continue to exercise their judgment and perform their responsibilities

without the potential for distraction that can arise from concerns regarding their personal circumstances.

In

reviewing the Severance Plan, the Compensation Committee of the Company’s Board of Directors consulted with its independent

compensation consultant, Pay Governance, LLC, to develop market-based severance benefits that are competitive and that reflect

broader U.S. industry practices.

The Severance Plan provides the following

severance benefits if an eligible executive’s employment with the Company is terminated by the Company other than for “cause”

or for disability under the Company’s long-term disability plan, or is terminated by the executive for “good reason”

(each term as defined in the Severance Plan):

(1)

Cash Severance. The executive would receive a cash severance

amount equal to the sum of:

|

|

a.

|

two times the executive’s base salary,

|

|

|

b.

|

a pro rata portion of the bonus for the year of termination, as calculated

pursuant to the terms of the Severance Plan, provided that the executive is not retirement eligible or otherwise eligible for a

bonus award in accordance with the terms of the Executive Management Incentive Plan for reasons other than retirement,

|

|

|

c.

|

a payment of $30,000 for outplacement services, and

|

|

|

d.

|

a payment of $36,000 for health coverage.

|

(2) Equity Awards. The executive

would receive cash payment equal to the sum of:

|

|

a.

|

the value of the executive’s

outstanding stock options and restricted stock units, using the closing price per share of

the stock on the New York Stock Exchange on the date of the executive’s termination, and

|

|

|

b.

|

the value of the executive’s performance share units, prorated by the number of months

worked in the 3-year award period, and multiplied by the total earnout percentage as reflected on the books of the Company for

the prior quarter.

|

However, if an

executive terminated before October 1, any restricted stock units or performance share units granted in the year of the termination

would be forfeited in accordance with the terms of such awards. Moreover, an executive would not be entitled to the cash

payout of the equity awards if the executive is entitled to continued or accelerated vesting of stock options, continued vesting

of restricted stock units, or payout of performance share units in accordance with the terms of the Norfolk Southern Corporation

Long-Term Incentive Plan, including if the executive is eligible to retire; in that instance, the terms of the awards under the

Long-Term Incentive Plan would govern.

The executive’s receipt of the

foregoing benefits are subject to the executive’s execution of a release of any claims against the Company, and including

compliance with restrictive covenants, including non-disparagement, non-competition and confidentiality covenants. The Severance

Plan does not provide any benefits in the event of a change in control of the Company.

The Board previously established a guideline under which the Board

would seek shareholder approval of future severance benefits if the value of such severance benefits would exceed 2.99 times the

sum of the executive’s salary plus bonus. The Board considered that the cash payout of the equity awards for a long-serving

executive who had received awards under the Long-Term Incentive Plan and who was not retirement eligible, when added to the cash

severance, could cause the benefits payable under the Severance Plan to exceed the limit set forth in the guideline. The Board

determined that it was in the best interests of the Company to waive the guideline with respect to the adoption of the Severance

Plan for the reasons set forth above.

The foregoing description of the Severance Plan is qualified in

its entirety by the full text of the Severance Plan, a copy of which is filed as Exhibit 10.1 hereto and

is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

NORFOLK SOUTHERN CORPORATION

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

/s/ Denise W. Hutson

|

|

|

Name: Denise W. Hutson

|

|

|

Title: Corporate Secretary

|

Date: May 15, 2020

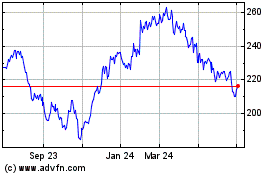

Norfolk Southern (NYSE:NSC)

Historical Stock Chart

From Aug 2024 to Sep 2024

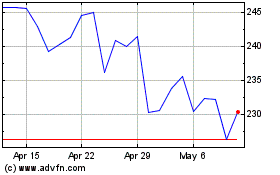

Norfolk Southern (NYSE:NSC)

Historical Stock Chart

From Sep 2023 to Sep 2024