UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

ASANA, INC.

(Name of Issuer)

Class A Common Stock, $0.00001 par value per share

(Title of Class of Securities)

04342Y104

(CUSIP Number)

Eleanor Lacey

c/o Asana, Inc.

633

Folsom Street, Suite 100

San Francisco, CA 94107

Telephone: (415) 525-3888

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

February 24, 2022

(Date of Event Which Requires Filing of This Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

Page 1

CUSIP No. 04342Y104

|

|

|

|

|

|

|

| 1. |

|

Name of Reporting Persons

Dustin A. Moskovitz |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (See Instructions) (a) ☐ (b) ☒

|

| 3. |

|

SEC USE ONLY

|

| 4. |

|

Source of Funds (See

Instructions) PF, AF, OO |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization United States |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

With: |

|

7. |

|

Sole Voting Power

93,376,817 (1)(2)(3) |

| |

8. |

|

Shared Voting Power

0 |

| |

9. |

|

Sole Dispositive Power

91,655,901(1)(2) |

| |

10. |

|

Shared Dispositive Power

1,720,916(2) |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

93,376,817(1)(2)(3) |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares (See Instructions)

☐ |

| 13. |

|

Percent of

Class Represented by Amount in Row (11) 54.7% (3)(4) |

| 14. |

|

Type of Reporting Person

(See Instructions) IN |

| (1) |

Includes (i) 19,839,676 shares of Class A Common Stock held of record by Mr. Moskovitz, (ii)

4,147,046 shares of Class A Common Stock held of record by Dustin A. Moskovitz TTEE Dustin A. Moskovitz Trust DTD 12/27/05 (the “Dustin Moskovitz Trust”), (iii) 21,395,830 shares of Class B Common Stock held of record by

Mr. Moskovitz, (iv) 42,030,755 shares of Class B Common Stock held of record by the Dustin Moskovitz Trust, (v) 2,604,170 shares of Class B Common Stock held of record by the Dustin Moskovitz Roth IRA, (vi) 460,000 shares of

Class B Common Stock held of record by the Justin Rosenstein Trust, and (vii) 1,178,424 shares of Class B Common Stock held of record by the Justin Rosenstein Trust 2. Mr. Moskovitz is the trustee of the Justin Rosenstein Trust and the

Justin Rosenstein Trust 2 and may be deemed to have voting power and dispositive power over the shares held by these trusts. |

Page 2

| (2) |

Includes 1,720,916 shares of Class A Common Stock held of record by Good Ventures Foundation, a charitable

foundation, over which Mr. Moskovitz holds an irrevocable proxy pursuant to a voting agreement as described in Item 6 below. Mr. Moskovitz and his spouse serve as directors on the board of Good Ventures Foundation and may be deemed to have

shared dispositive power with respect to the shares held of record by the charitable foundation. |

| (3) |

Each share of Class B Common Stock is convertible into one share of Class A Common Stock upon the

option of the holder and has no expiration date. Each share of Class B Common Stock is entitled to 10 votes per share, whereas each share of Class A Common Stock is entitled to one vote per share. |

| (4) |

Assumes conversion of all of the Reporting Person’s Class B Common Stock into Class A Common

Stock. Based on 102,979,720 shares of Class A Common Stock issued and outstanding as of February 25, 2022 as reported by the Issuer to the Reporting Person. |

Page 3

Explanatory Note

This Amendment No. 1 to Schedule 13D (the “Amendment”) is being filed By Dustin A. Moskovitz pursuant to Rule 13d-2(a) of the Act to report a material change to Mr. Moskovitz’s beneficial ownership since the filing of the Statement on Schedule 13D with the Securities and Exchange Commission on February 14,

2022 (the “Schedule 13D”). Information contained in the Schedule 13D remains effective except to the extent that it is amended, restated, or superseded by the information contained in this Amendment.

| Item 3. |

Source and Amount of Funds or Other Consideration |

The first paragraph of Item 3 is hereby amended and restated in its entirety to the following:

Open-Market Purchases

The shares

of Class A Common Stock acquired by the Reporting Person at any time following the date that is 60 days prior to the Trigger Acquisition Date and through the date of this filing (except for the shares acquired in connection with the conversion

of certain senior mandatory convertible promissory notes, as detailed below) were acquired in the open market pursuant to 10b5-1 trading plans. The aggregate price for all shares of Class A Common Stock

acquired by the Reporting Person on and since the Trigger Acquisition Date pursuant to 10b5-1 trading plans was $1,188,809,342.03, paid using the Reporting Person’s personal funds. The aggregate price for

all shares of Class A Common Stock acquired by Good Ventures Foundation on and since the Trigger Acquisition Date pursuant to 10b5-1 trading plans was $69,253.335.80, paid using its working capital.

| Item 5. |

Interest in Securities of the Issuer |

Paragraph (a) of Item 5 is amended and supplemented as follows:

(a) As of the date hereof, the Reporting Person is the beneficial owner of 93,376,817 shares of Class A Common Stock of the issuer (the

“Shares”), constituting approximately 54.7% of the outstanding shares of Class A Common Stock of the Issuer.

(b) As of the

date hereof, the Reporting Person has sole voting power with respect to all of the Shares, sole dispositive power with respect to 93,376,817 of the Shares, and may be deemed to have shared dispositive power with respect to 1,720,916 of the Shares.

(c) Schedule I to this Amendment, which is incorporated herein by reference, sets forth certain information with respect to acquisitions

of shares of Class A Common Stock by the Reporting Person during the past 60 days pursuant to 10b5-1 trading plans. Other than the acquisitions of Class A Common Stock as reported and described under

this Item 5 and in Schedule I, the Reporting Person has not effected any other transactions in the shares of the Issuer during the past 60 days or since the most recent filing of Schedule 13D, whichever is less.

(d) Other persons have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the

1,720,916 shares of Class A Common Stock held by Good Ventures Foundation. However, none of such persons’ individual interest relates to more than 5% of the class of securities for which this Schedule 13D is filed.

(e) Not applicable.

Page 4

Signature

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

|

|

| Date: March 7, 2022 |

|

|

|

/s/ Dustin A. Moskovitz |

|

|

|

|

|

|

Dustin A. Moskovitz |

Page 5

SCHEDULE I

The following table sets forth certain information with respect to acquisitions of shares of Class A Common Stock by the Reporting Person pursuant to 10b5-1 trading plans.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Transaction Date |

|

Transaction Type |

|

Number

of Shares |

|

|

Price per

Share (1) |

|

|

Price Range |

|

|

Cumulative

Shares

Beneficially

Owned

Following

Transaction |

|

|

% Beneficially

Owned

Following

Transaction

(2) |

|

| 2/16/2022 |

|

Open Market Purchase |

|

|

15,200 |

|

|

$ |

70.17 |

|

|

$ |

69.52 |

|

|

- |

|

$ |

70.51 |

|

|

|

91,392,017 |

|

|

|

53.6 |

% |

| |

Open Market Purchase |

|

|

53,556 |

|

|

$ |

71.04 |

|

|

$ |

70.52 |

|

|

- |

|

$ |

71.50 |

|

|

|

91,445,573 |

|

|

|

53.6 |

% |

| |

Open Market Purchase |

|

|

83,120 |

|

|

$ |

72.03 |

|

|

$ |

71.52 |

|

|

- |

|

$ |

72.50 |

|

|

|

91,528,693 |

|

|

|

53.7 |

% |

| |

Open Market Purchase |

|

|

181,006 |

|

|

$ |

73.16 |

|

|

$ |

72.53 |

|

|

- |

|

$ |

73.52 |

|

|

|

91,709,699 |

|

|

|

53.8 |

% |

| |

Open Market Purchase |

|

|

167,118 |

|

|

$ |

73.93 |

|

|

$ |

73.53 |

|

|

- |

|

$ |

74.48 |

|

|

|

91,876,817 |

|

|

|

53.9 |

% |

| 2/17/2022 |

|

Open Market Purchase |

|

|

41,065 |

|

|

$ |

66.43 |

|

|

$ |

65.84 |

|

|

- |

|

$ |

66.835 |

|

|

|

91,917,882 |

|

|

|

53.9 |

% |

| |

Open Market Purchase |

|

|

75,461 |

|

|

$ |

67.14 |

|

|

$ |

66.84 |

|

|

- |

|

$ |

67.83 |

|

|

|

91,993,343 |

|

|

|

53.9 |

% |

| |

Open Market Purchase |

|

|

52,735 |

|

|

$ |

68.35 |

|

|

$ |

67.84 |

|

|

- |

|

$ |

68.83 |

|

|

|

92,046,078 |

|

|

|

54.0 |

% |

| |

Open Market Purchase |

|

|

34,052 |

|

|

$ |

69.43 |

|

|

$ |

68.85 |

|

|

- |

|

$ |

69.82 |

|

|

|

92,080,130 |

|

|

|

54.0 |

% |

| |

Open Market Purchase |

|

|

82,780 |

|

|

$ |

70.34 |

|

|

$ |

69.85 |

|

|

- |

|

$ |

70.83 |

|

|

|

92,162,910 |

|

|

|

54.0 |

% |

| |

Open Market Purchase |

|

|

76,281 |

|

|

$ |

71.21 |

|

|

$ |

70.85 |

|

|

- |

|

$ |

71.8 |

|

|

|

92,239,191 |

|

|

|

54.1 |

% |

| |

Open Market Purchase |

|

|

49,448 |

|

|

$ |

72.61 |

|

|

$ |

71.91 |

|

|

- |

|

$ |

72.89 |

|

|

|

92,288,639 |

|

|

|

54.1 |

% |

| |

Open Market Purchase |

|

|

47,476 |

|

|

$ |

73.27 |

|

|

$ |

72.98 |

|

|

- |

|

$ |

73.97 |

|

|

|

92,336,115 |

|

|

|

54.1 |

% |

| |

Open Market Purchase |

|

|

40,702 |

|

|

$ |

74.35 |

|

|

$ |

73.99 |

|

|

- |

|

$ |

74.77 |

|

|

|

92,376,817 |

|

|

|

54.2 |

% |

| 2/18/2022 |

|

Open Market Purchase |

|

|

27,603 |

|

|

$ |

63.53 |

|

|

$ |

62.95 |

|

|

- |

|

$ |

63.94 |

|

|

|

92,404,420 |

|

|

|

54.2 |

% |

| |

Open Market Purchase |

|

|

68,910 |

|

|

$ |

64.58 |

|

|

$ |

63.98 |

|

|

- |

|

$ |

64.975 |

|

|

|

92,473,330 |

|

|

|

54.2 |

% |

| |

Open Market Purchase |

|

|

48,606 |

|

|

$ |

65.22 |

|

|

$ |

64.98 |

|

|

- |

|

$ |

65.96 |

|

|

|

92,521,936 |

|

|

|

54.2 |

% |

| |

Open Market Purchase |

|

|

32,200 |

|

|

$ |

66.58 |

|

|

$ |

66.00 |

|

|

- |

|

$ |

66.99 |

|

|

|

92,554,136 |

|

|

|

54.3 |

% |

| |

Open Market Purchase |

|

|

37,997 |

|

|

$ |

67.37 |

|

|

$ |

67.00 |

|

|

- |

|

$ |

67.99 |

|

|

|

92,592,133 |

|

|

|

54.3 |

% |

| |

Open Market Purchase |

|

|

24,603 |

|

|

$ |

68.49 |

|

|

$ |

68.00 |

|

|

- |

|

$ |

68.99 |

|

|

|

92,616,736 |

|

|

|

54.3 |

% |

| |

Open Market Purchase |

|

|

10,081 |

|

|

$ |

69.27 |

|

|

$ |

69.00 |

|

|

- |

|

$ |

69.59 |

|

|

|

92,626,817 |

|

|

|

54.3 |

% |

Page 6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2/24/2022 (3) |

|

Open Market Purchase |

|

|

14,107 |

|

|

$ |

43.21 |

|

|

$ |

42.89 |

|

|

- |

|

$ |

43.88 |

|

|

|

92,640,924 |

|

|

|

54.3 |

% |

| |

Open Market Purchase |

|

|

1,666 |

|

|

$ |

44.41 |

|

|

$ |

43.89 |

|

|

- |

|

$ |

44.56 |

|

|

|

92,642,590 |

|

|

|

54.3 |

% |

| |

Open Market Purchase |

|

|

17,757 |

|

|

$ |

45.51 |

|

|

$ |

45.27 |

|

|

- |

|

$ |

46.26 |

|

|

|

92,660,347 |

|

|

|

54.3 |

% |

| |

Open Market Purchase |

|

|

17,507 |

|

|

$ |

46.70 |

|

|

$ |

46.30 |

|

|

- |

|

$ |

47.29 |

|

|

|

92,677,854 |

|

|

|

54.3 |

% |

| |

Open Market Purchase |

|

|

44,245 |

|

|

$ |

47.80 |

|

|

$ |

47.34 |

|

|

- |

|

$ |

48.33 |

|

|

|

92,722,099 |

|

|

|

54.4 |

% |

| |

Open Market Purchase |

|

|

104,918 |

|

|

$ |

48.74 |

|

|

$ |

48.34 |

|

|

- |

|

$ |

49.26 |

|

|

|

92,827,017 |

|

|

|

54.4 |

% |

| |

Open Market Purchase |

|

|

161,446 |

|

|

$ |

49.95 |

|

|

$ |

49.34 |

|

|

- |

|

$ |

50.33 |

|

|

|

92,988,463 |

|

|

|

54.5 |

% |

| |

Open Market Purchase |

|

|

100,810 |

|

|

$ |

50.77 |

|

|

$ |

50.37 |

|

|

- |

|

$ |

51.34 |

|

|

|

93,089,273 |

|

|

|

54.6 |

% |

| |

Open Market Purchase |

|

|

23,392 |

|

|

$ |

51.66 |

|

|

$ |

51.38 |

|

|

- |

|

$ |

52.36 |

|

|

|

93,112,665 |

|

|

|

54.6 |

% |

| |

Open Market Purchase |

|

|

14,152 |

|

|

$ |

52.93 |

|

|

$ |

52.40 |

|

|

- |

|

$ |

53.36 |

|

|

|

93,126,817 |

|

|

|

54.6 |

% |

| 2/25/2022 |

|

Open Market Purchase |

|

|

73,222 |

|

|

$ |

51.53 |

|

|

$ |

50.95 |

|

|

- |

|

$ |

51.93 |

|

|

|

93,200,039 |

|

|

|

54.6 |

% |

| |

Open Market Purchase |

|

|

87,934 |

|

|

$ |

52.44 |

|

|

$ |

51.99 |

|

|

- |

|

$ |

52.986 |

|

|

|

93,287,973 |

|

|

|

54.7 |

% |

| |

Open Market Purchase |

|

|

35,351 |

|

|

$ |

53.36 |

|

|

$ |

53.00 |

|

|

- |

|

$ |

53.99 |

|

|

|

93,323,324 |

|

|

|

54.7 |

% |

| |

Open Market Purchase |

|

|

29,986 |

|

|

$ |

54.50 |

|

|

$ |

54.00 |

|

|

- |

|

$ |

54.99 |

|

|

|

93,353,310 |

|

|

|

54.7 |

% |

| |

Open Market Purchase |

|

|

23,507 |

|

|

$ |

55.29 |

|

|

$ |

55.00 |

|

|

- |

|

$ |

55.53 |

|

|

|

93,376,817 |

|

|

|

54.7 |

% |

| (1) |

In certain cases the indicated price is the weighted average of the prices for multiple transactions on the

indicated date. The range of actual prices is indicated in the “Price Range” column. The Reporting Persons undertake to provide upon request by the staff of the Commission full information regarding the number of Shares purchased or sold

at each separate price. |

| (2) |

Assumes conversion of all of the Reporting Person’s Class B Common Stock into Class A Common

Stock. Based on the number of shares of Class A Common Stock issued and outstanding as of the date of the transaction as reported by the Issuer to the Reporting Person. |

| (3) |

The transactions effected on this date increased the Reporting Person’s beneficial ownership by more than

1% from what was reported in the original Schedule 13D. |

Page 7

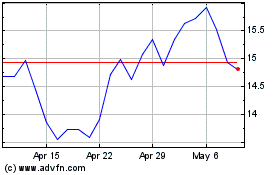

Asana (NYSE:ASAN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Asana (NYSE:ASAN)

Historical Stock Chart

From Sep 2023 to Sep 2024