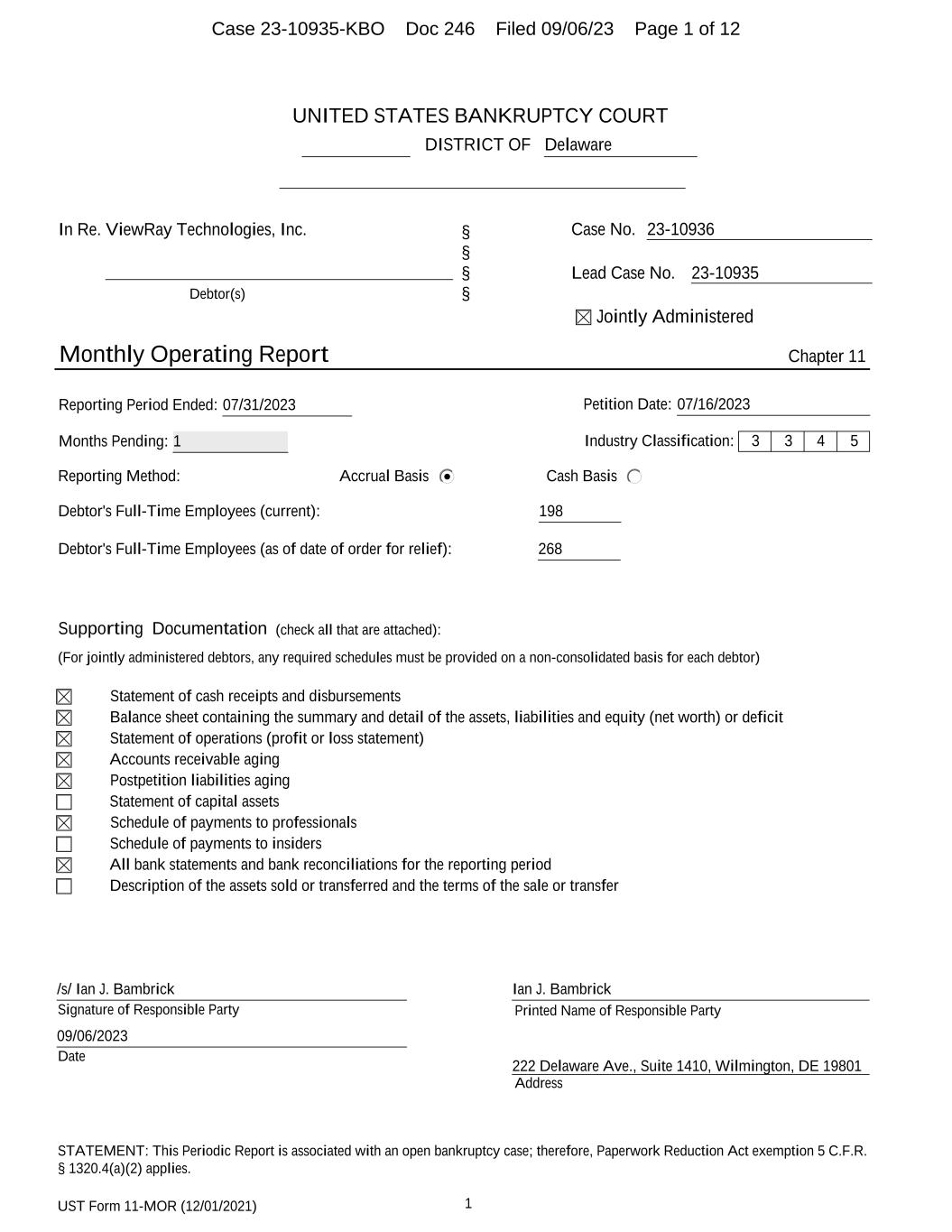

UST Form 11-MOR (12/01/2021) 1 UNITED STATES BANKRUPTCY COURT DISTRICT OF Delaware In Re. ViewRay Technologies, Inc. Debtor(s) § § § § Case No. 23-10936 Lead Case No. 23-10935 Jointly Administered Monthly Operating Report Chapter 11 Reporting Period Ended: 07/31/2023 Petition Date: 07/16/2023 Months Pending: 1 Industry Classification: 3 3 4 5 Reporting Method: Accrual Basis Cash Basis Debtor's Full-Time Employees (current): 198 Debtor's Full-Time Employees (as of date of order for relief): 268 Supporting Documentation (check all that are attached): (For jointly administered debtors, any required schedules must be provided on a non-consolidated basis for each debtor) Statement of cash receipts and disbursements Balance sheet containing the summary and detail of the assets, liabilities and equity (net worth) or deficit Statement of operations (profit or loss statement) Accounts receivable aging Postpetition liabilities aging Statement of capital assets Schedule of payments to professionals Schedule of payments to insiders All bank statements and bank reconciliations for the reporting period Description of the assets sold or transferred and the terms of the sale or transfer Signature of Responsible Party Printed Name of Responsible Party Date Address /s/ Ian J. Bambrick 09/06/2023 Ian J. Bambrick 222 Delaware Ave., Suite 1410, Wilmington, DE 19801 STATEMENT: This Periodic Report is associated with an open bankruptcy case; therefore, Paperwork Reduction Act exemption 5 C.F.R. § 1320.4(a)(2) applies. Case 23-10935-KBO Doc 246 Filed 09/06/23 Page 1 of 12

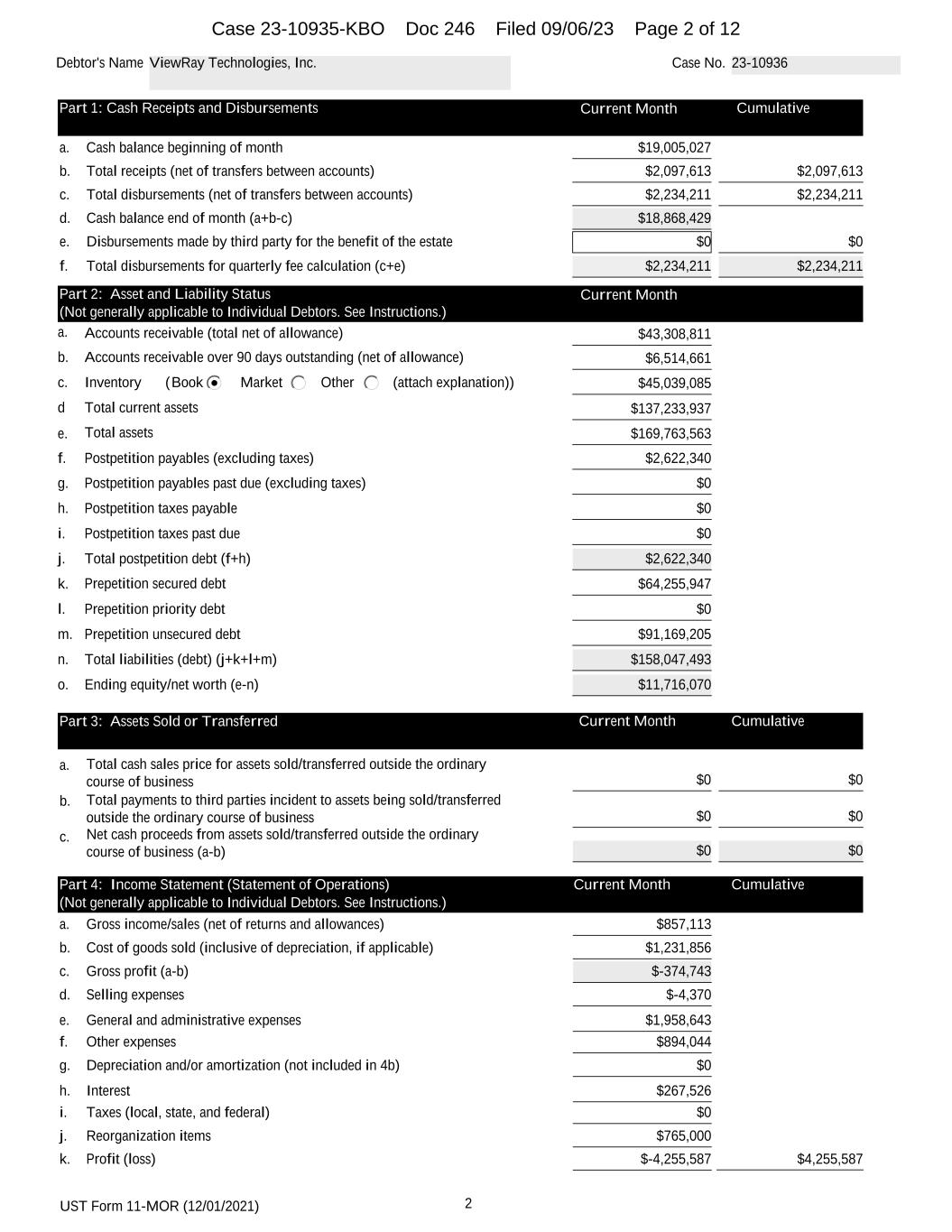

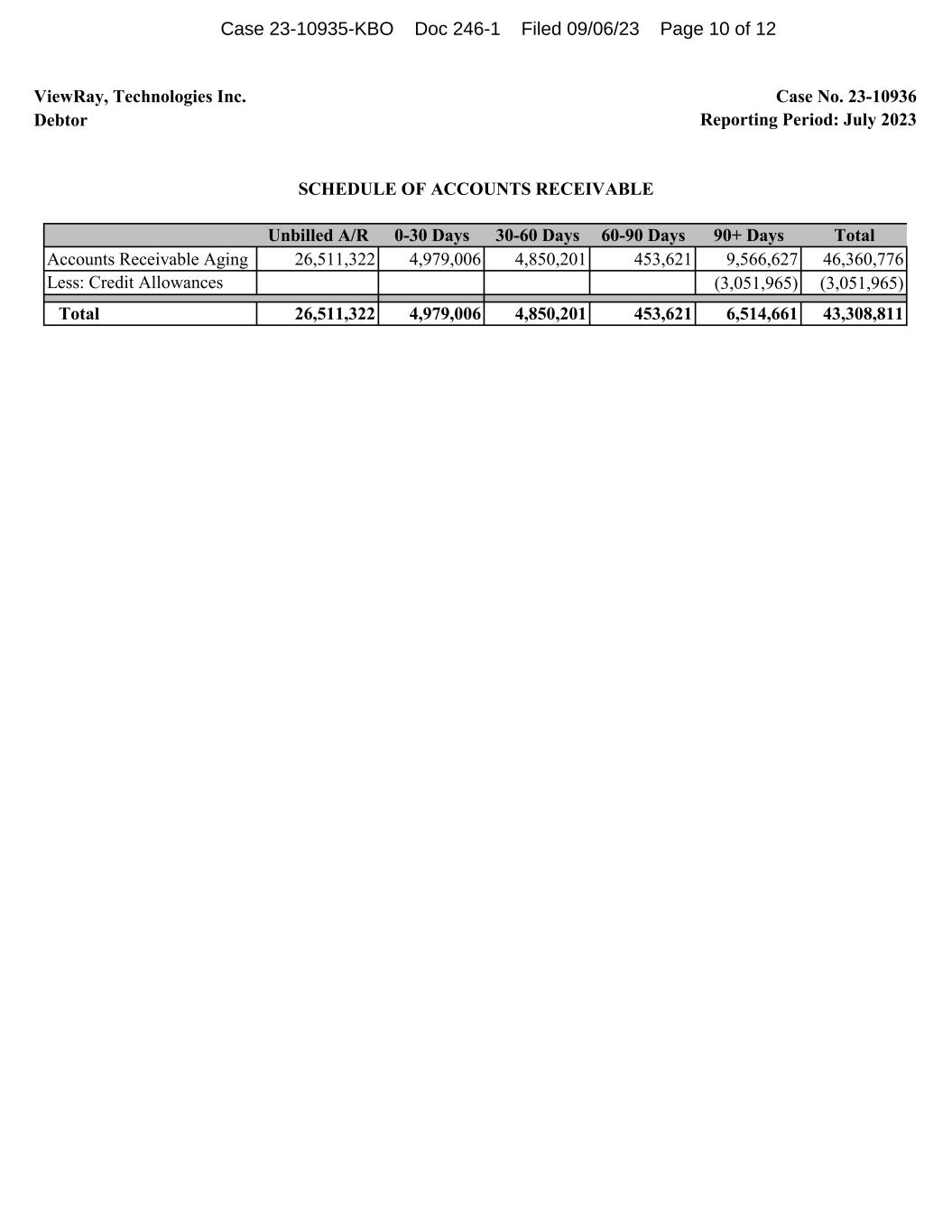

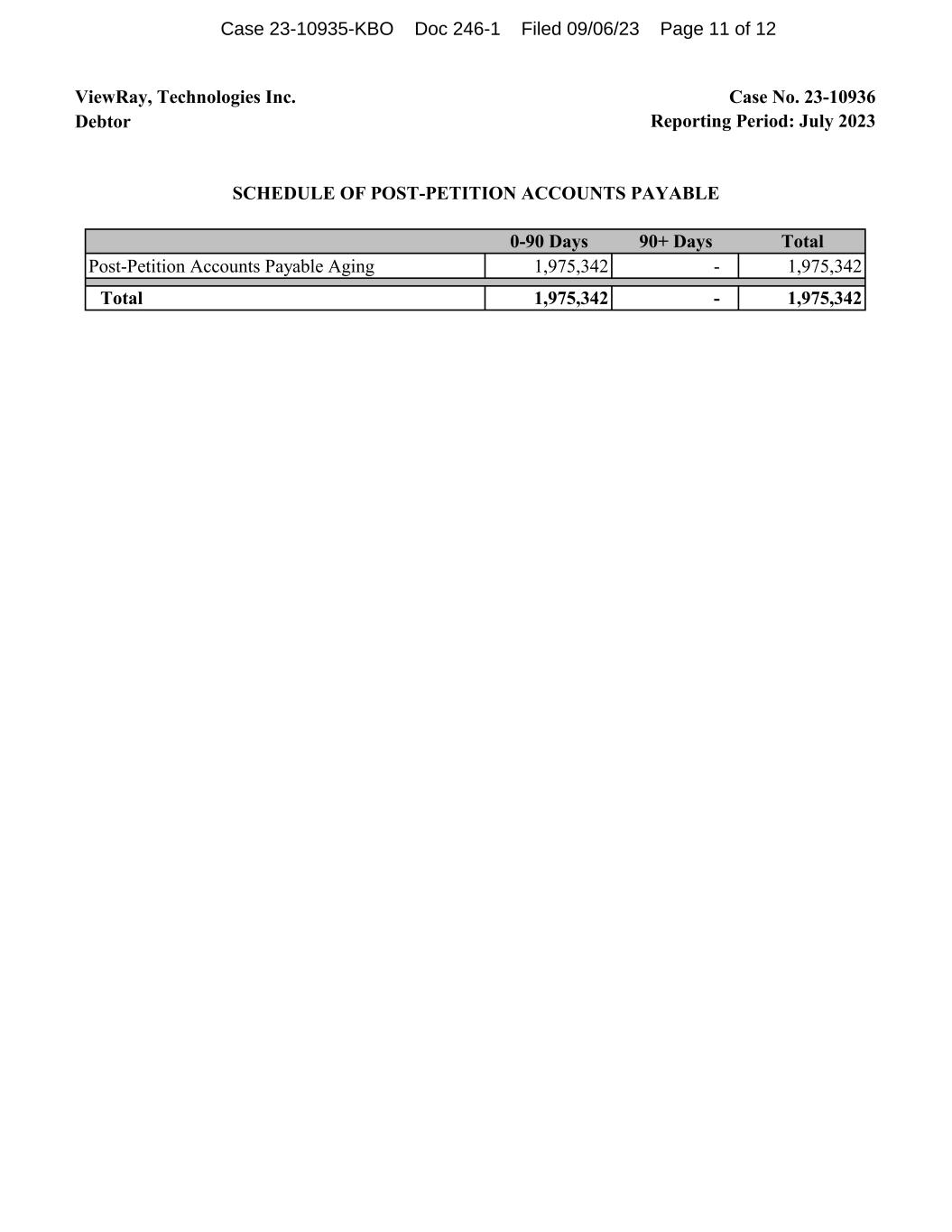

UST Form 11-MOR (12/01/2021) 2 Debtor's Name ViewRay Technologies, Inc. Case No. 23-10936 Part 1: Cash Receipts and Disbursements Current Month Cumulative a. Cash balance beginning of month $19,005,027 b. Total receipts (net of transfers between accounts) $2,097,613 $2,097,613 c. Total disbursements (net of transfers between accounts) $2,234,211 $2,234,211 d. Cash balance end of month (a+b-c) $18,868,429 e. Disbursements made by third party for the benefit of the estate $0 $0 f. Total disbursements for quarterly fee calculation (c+e) $2,234,211 $2,234,211 Part 2: Asset and Liability Status Current Month (Not generally applicable to Individual Debtors. See Instructions.) a. Accounts receivable (total net of allowance) $43,308,811 b. Accounts receivable over 90 days outstanding (net of allowance) $6,514,661 c. Inventory ( (attach explanation))Book Market Other $45,039,085 d Total current assets $137,233,937 e. Total assets $169,763,563 f. Postpetition payables (excluding taxes) $2,622,340 g. Postpetition payables past due (excluding taxes) $0 h. Postpetition taxes payable $0 i. Postpetition taxes past due $0 j. Total postpetition debt (f+h) $2,622,340 k. Prepetition secured debt $64,255,947 l. Prepetition priority debt $0 m. Prepetition unsecured debt $91,169,205 n. Total liabilities (debt) (j+k+l+m) $158,047,493 o. Ending equity/net worth (e-n) $11,716,070 Part 3: Assets Sold or Transferred Current Month Cumulative a. Total cash sales price for assets sold/transferred outside the ordinary course of business $0 $0 b. Total payments to third parties incident to assets being sold/transferred outside the ordinary course of business $0 $0 c. Net cash proceeds from assets sold/transferred outside the ordinary course of business (a-b) $0 $0 Part 4: Income Statement (Statement of Operations) Current Month Cumulative (Not generally applicable to Individual Debtors. See Instructions.) a. Gross income/sales (net of returns and allowances) $857,113 b. Cost of goods sold (inclusive of depreciation, if applicable) $1,231,856 c. Gross profit (a-b) $-374,743 d. Selling expenses $-4,370 e. General and administrative expenses $1,958,643 f. Other expenses $894,044 g. Depreciation and/or amortization (not included in 4b) $0 h. Interest $267,526 i. Taxes (local, state, and federal) $0 j. Reorganization items $765,000 k. Profit (loss) $-4,255,587 $4,255,587 Case 23-10935-KBO Doc 246 Filed 09/06/23 Page 2 of 12

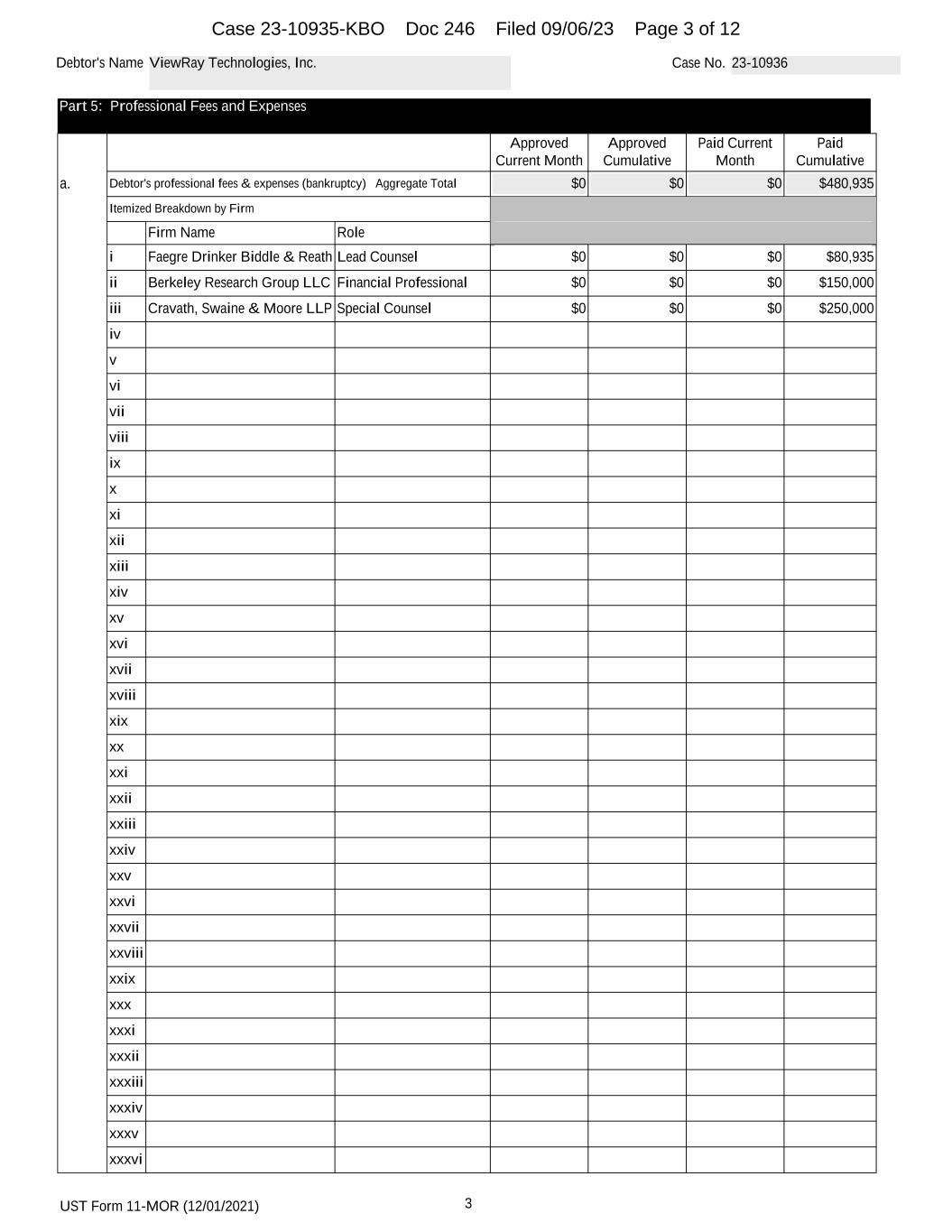

UST Form 11-MOR (12/01/2021) 3 Debtor's Name ViewRay Technologies, Inc. Case No. 23-10936 Part 5: Professional Fees and Expenses Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative a. Debtor's professional fees & expenses (bankruptcy) Aggregate Total $0 $0 $0 $480,935 Itemized Breakdown by Firm Firm Name Role i Faegre Drinker Biddle & Reath Lead Counsel $0 $0 $0 $80,935 ii Berkeley Research Group LLC Financial Professional $0 $0 $0 $150,000 iii Cravath, Swaine & Moore LLP Special Counsel $0 $0 $0 $250,000 iv v vi vii viii ix x xi xii xiii xiv xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi Case 23-10935-KBO Doc 246 Filed 09/06/23 Page 3 of 12

UST Form 11-MOR (12/01/2021) 4 Debtor's Name ViewRay Technologies, Inc. Case No. 23-10936 xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii Case 23-10935-KBO Doc 246 Filed 09/06/23 Page 4 of 12

UST Form 11-MOR (12/01/2021) 5 Debtor's Name ViewRay Technologies, Inc. Case No. 23-10936 lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii xcix c ci Approved Current Month Approved Cumulative Paid Current Month Paid Cumulative b. Debtor's professional fees & expenses (nonbankruptcy) Aggregate Total Itemized Breakdown by Firm Firm Name Role i ii iii iv v vi vii viii ix x xi xii xiii xiv Case 23-10935-KBO Doc 246 Filed 09/06/23 Page 5 of 12

UST Form 11-MOR (12/01/2021) 6 Debtor's Name ViewRay Technologies, Inc. Case No. 23-10936 xv xvi xvii xviii xix xx xxi xxii xxiii xxiv xxv xxvi xxvii xxviii xxix xxx xxxi xxxii xxxiii xxxiv xxxv xxxvi xxxvii xxxvii xxxix xl xli xlii xliii xliv xlv xlvi xlvii xlviii xlix l li lii liii liv lv lvi Case 23-10935-KBO Doc 246 Filed 09/06/23 Page 6 of 12

UST Form 11-MOR (12/01/2021) 7 Debtor's Name ViewRay Technologies, Inc. Case No. 23-10936 lvii lviii lix lx lxi lxii lxiii lxiv lxv lxvi lxvii lxviii lxix lxx lxxi lxxii lxxiii lxxiv lxxv lxxvi lxxvii lxxvii lxxix lxxx lxxxi lxxxii lxxxii lxxxiv lxxxv lxxxvi lxxxvi lxxxvi lxxxix xc xci xcii xciii xciv xcv xcvi xcvii xcviii Case 23-10935-KBO Doc 246 Filed 09/06/23 Page 7 of 12

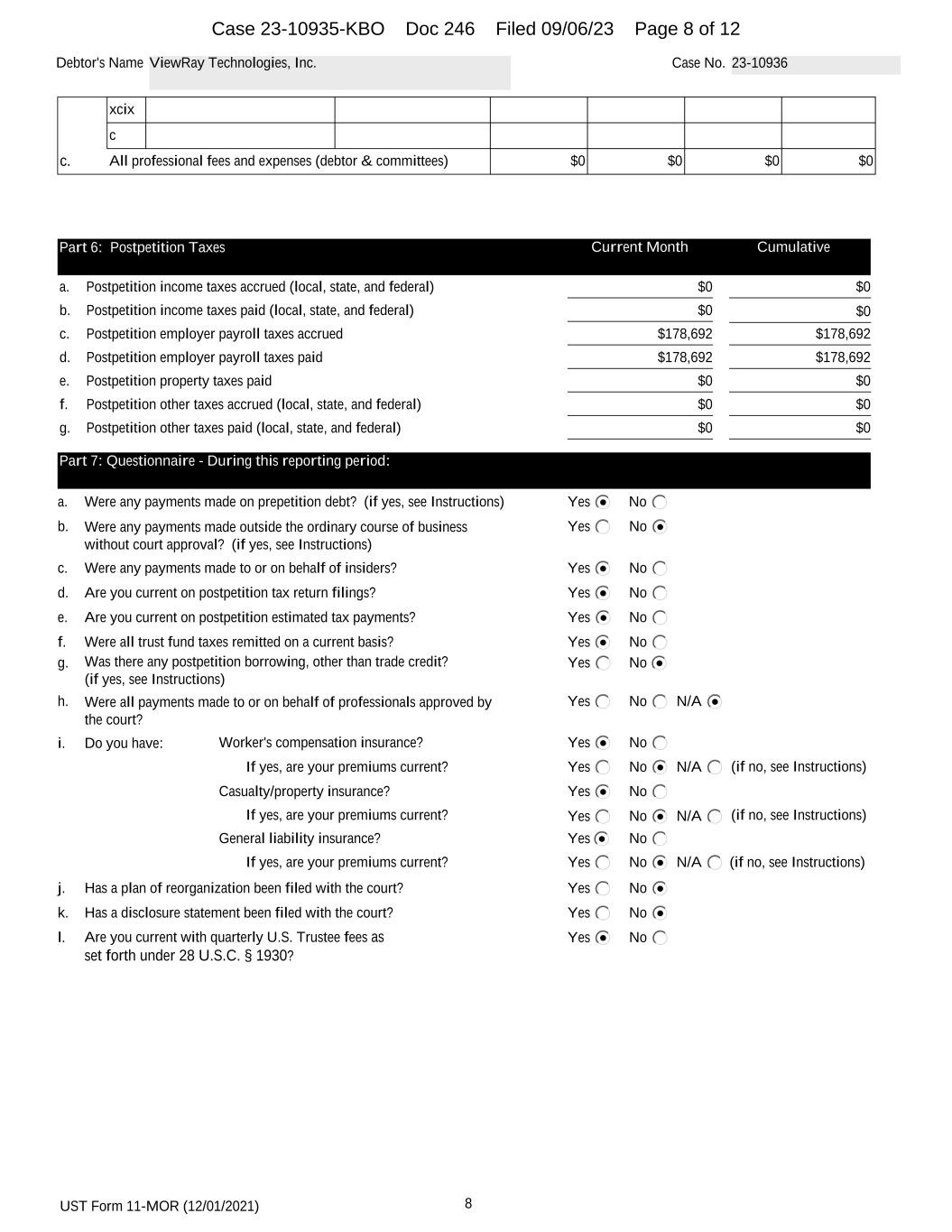

UST Form 11-MOR (12/01/2021) 8 Debtor's Name ViewRay Technologies, Inc. Case No. 23-10936 xcix c c. All professional fees and expenses (debtor & committees) $0 $0 $0 $0 Part 6: Postpetition Taxes Current Month Cumulative a. Postpetition income taxes accrued (local, state, and federal) $0 $0 b. Postpetition income taxes paid (local, state, and federal) $0 $0 c. Postpetition employer payroll taxes accrued $178,692 $178,692 d. Postpetition employer payroll taxes paid $178,692 $178,692 e. Postpetition property taxes paid $0 $0 f. Postpetition other taxes accrued (local, state, and federal) $0 $0 g. Postpetition other taxes paid (local, state, and federal) $0 $0 Part 7: Questionnaire - During this reporting period: a. Were any payments made on prepetition debt? (if yes, see Instructions) Yes No b. Yes NoWere any payments made outside the ordinary course of business without court approval? (if yes, see Instructions) c. Yes NoWere any payments made to or on behalf of insiders? d. Yes NoAre you current on postpetition tax return filings? e. Yes NoAre you current on postpetition estimated tax payments? f. Were all trust fund taxes remitted on a current basis? Yes No g. Yes NoWas there any postpetition borrowing, other than trade credit? (if yes, see Instructions) h. Were all payments made to or on behalf of professionals approved by the court? Yes No N/A i. Do you have: Worker's compensation insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) Casualty/property insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) General liability insurance? Yes No If yes, are your premiums current? Yes No N/A (if no, see Instructions) j. Has a plan of reorganization been filed with the court? Yes No k. Has a disclosure statement been filed with the court? Yes No l. Are you current with quarterly U.S. Trustee fees as set forth under 28 U.S.C. § 1930? Yes No Case 23-10935-KBO Doc 246 Filed 09/06/23 Page 8 of 12

UST Form 11-MOR (12/01/2021) 9 Debtor's Name ViewRay Technologies, Inc. Case No. 23-10936 Part 8: Individual Chapter 11 Debtors (Only) a. Gross income (receipts) from salary and wages $0 b. Gross income (receipts) from self-employment $0 c. Gross income from all other sources $0 d. Total income in the reporting period (a+b+c) $0 e. Payroll deductions $0 f. Self-employment related expenses $0 g. Living expenses $0 h. All other expenses $0 i. Total expenses in the reporting period (e+f+g+h) $0 j. Difference between total income and total expenses (d-i) $0 k. List the total amount of all postpetition debts that are past due $0 l. Are you required to pay any Domestic Support Obligations as defined by 11 U.S.C § 101(14A)? Yes No m. Yes No N/AIf yes, have you made all Domestic Support Obligation payments? Privacy Act Statement 28 U.S.C. § 589b authorizes the collection of this information, and provision of this information is mandatory under 11 U.S.C. §§ 704, 1106, and 1107. The United States Trustee will use this information to calculate statutory fee assessments under 28 U.S.C. § 1930(a)(6). The United States Trustee will also use this information to evaluate a chapter 11 debtor's progress through the bankruptcy system, including the likelihood of a plan of reorganization being confirmed and whether the case is being prosecuted in good faith. This information may be disclosed to a bankruptcy trustee or examiner when the information is needed to perform the trustee's or examiner's duties or to the appropriate federal, state, local, regulatory, tribal, or foreign law enforcement agency when the information indicates a violation or potential violation of law. Other disclosures may be made for routine purposes. For a discussion of the types of routine disclosures that may be made, you may consult the Executive Office for United States Trustee's systems of records notice, UST-001, "Bankruptcy Case Files and Associated Records." See 71 Fed. Reg. 59,818 et seq. (Oct. 11, 2006). A copy of the notice may be obtained at the following link: http:// www.justice.gov/ust/eo/rules_regulations/index.htm. Failure to provide this information could result in the dismissal or conversion of your bankruptcy case or other action by the United States Trustee. 11 U.S.C. § 1112(b)(4)(F). I declare under penalty of perjury that the foregoing Monthly Operating Report and its supporting documentation are true and correct and that I have been authorized to sign this report on behalf of the estate. /s/ Cassie Mahar Signature of Responsible Party Interim Chief Financial Officer Printed Name of Responsible Party 09/06/2023 DateTitle Cassie Mahar Case 23-10935-KBO Doc 246 Filed 09/06/23 Page 9 of 12

UST Form 11-MOR (12/01/2021) 10 Debtor's Name ViewRay Technologies, Inc. Case No. 23-10936 PageOnePartOne PageOnePartTwo PageTwoPartOne PageTwoPartTwo Case 23-10935-KBO Doc 246 Filed 09/06/23 Page 10 of 12

UST Form 11-MOR (12/01/2021) 11 Debtor's Name ViewRay Technologies, Inc. Case No. 23-10936 Bankruptcy51to100 NonBankruptcy1to50 NonBankruptcy51to100 Bankruptcy1to50 Case 23-10935-KBO Doc 246 Filed 09/06/23 Page 11 of 12

UST Form 11-MOR (12/01/2021) 12 Debtor's Name ViewRay Technologies, Inc. Case No. 23-10936 PageFour PageThree Case 23-10935-KBO Doc 246 Filed 09/06/23 Page 12 of 12

ViewRay, Technologies Inc. Case No. 23-10936 Debtor Reporting Period: July 2023 MONTHLY OPERATING REPORT TABLE OF CONTENTS Supporting Documentation Page # Notes to the Monthly Operating Report 1-3 Part 1: Schedule of Cash Receipts And Disbursements 4 Part 2: Asset and Liability Status (Balance Sheet) 5 Part 4: Income Statement (Statement of Operations) 6 Part 5: Professional Fees 7 Schedule of Bank Accounts 8 Schedule of Accounts Receivable 9 Schedule of Post-Petition Accounts Payable 10 Schedule of Pre-Petition Payments 11 Case 23-10935-KBO Doc 246-1 Filed 09/06/23 Page 1 of 12

ViewRay, Technologies Inc. Case No. 23-10936 Debtor Reporting Period: July 2023 MONTHLY OPERATING REPORT Notes to the Monthly Operating Report This report includes activity from the following Debtor and their related Case Number: Debtor Case Number ViewRay, Technologies Inc. 23-10936 Notes to the MOR: On July 16, 2023 (the “Petition Date”), each of the Debtors filed a voluntary petition for relief under chapter 11 of the Bankruptcy Code. The Debtors are operating their business and managing their properties as debtors-in- possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code. On July 18, 2023, the court entered an order [Docket No. 24] authorizing joint administration and procedural consolidation of these chapter 11 cases pursuant to sections 101(2), 105(a), and 342(c)(1) of the Bankruptcy Code, rules 1015(b), and 2002(n) of the Federal Rules of Bankruptcy Procedure, and Local Rule 1015-1. The Debtors are filing their Monthly Operating Report solely for the purposes of complying with the monthly operating reporting requirements applicable in the Debtors' chapter 11 cases. The financial and supplemental information contained herein is presented on a preliminary and unaudited basis, remains subject to future adjustments and may not comply in all material respects with generally accepted accounting principles in the United States of America (“U.S. GAAP”) or International Financial Reporting Standards (“IFRS”). This Monthly Operating Report should not be relied on by any persons for information relating to future financial conditions, events, or performance of any of the Debtors or their affiliates. The financial information has been derived from the books and records of the Debtors. This information, however, has not been subject to certain procedures that would typically be applied to financial information in accordance with U.S. GAAP or IFRS, and upon application of such procedures, the Debtors believe that the financial information could be subject to changes, which could be material. The information furnished in this report includes primarily normal recurring adjustments, but does not include all adjustments that would typically be made for financial statements prepared in accordance with U.S. GAAP or IFRS. The preparation of the Financial Statements and MOR required the Debtors to make commercially reasonable estimates and assumptions with respect to the reported amounts of assets and liabilities, the amount of contingent assets and contingent liabilities at month end, and the reported amounts of revenues and expenses during the applicable reporting periods. Actual results could differ from such estimates. This MOR only contains financial information of the Debtor. The Debtors reserve all rights to amend or supplement this Monthly Operating Report in all respects, as may be necessary or appropriate. Nothing contained in this Monthly Operating Report shall constitute a waiver of any of the Debtors' rights or an admission with respect to their chapter 11 cases. Case 23-10935-KBO Doc 246-1 Filed 09/06/23 Page 2 of 12

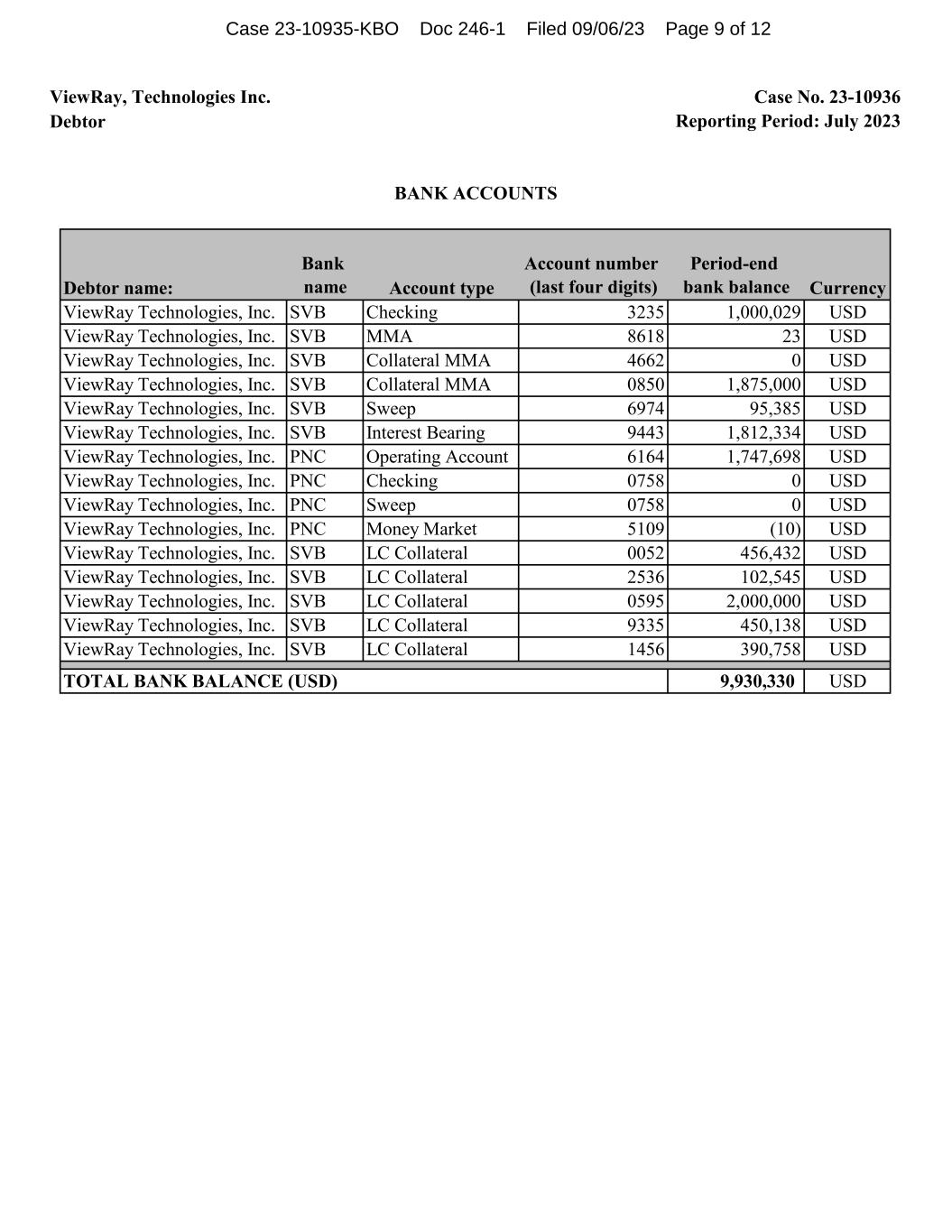

ViewRay, Technologies Inc. Case No. 23-10936 Debtor Reporting Period: July 2023 MONTHLY OPERATING REPORT Notes to the Monthly Operating Report This report includes activity from the following Debtor and their related Case Number: Debtor Case Number ViewRay, Technologies Inc. 23-10936 Notes to MOR Part 2 & MOR Part 4: The information contained in MOR Part 2 & MOR Part 4 is provided to fulfill the requirements of the Office of the United States Trustee. All information contained in MOR Part 2 & MOR Part 4 is unaudited and subject to future adjustment. The Debtors' balance sheet reported $18,868,429 of total cash at month end. Note that the difference between this figure and the $9,930,330 total noted in the bank statements consists of in-transit cash held in a money market account that was not shown in bank statements at month end. This cash is swept overnight and was returned to the Debtor's account the subsequent business day alongside additional interest earned in overnight lending. Refer to the reconciliation in Part 1 for a reconciliation between the bank statements and book cash. The Liabilities Subject to Compromise section of the balance sheet refers to various accounts payable, accrued expenses, and long-term notes payable classified as such under ASC 852-10 due to uncertainty of repayment given the Chapter 11 proceeding. The Debtors classified all Liabilities Subject to Compromise as prepetition unsecured debt on the MOR form, outside of prepetition secured debt. While the Debtors consider the majority of these liabilities prepetition unsecured amounts, other liabilities therein may be recognized in the future as the debtors continue to operate, such as deferred revenue, accrued expenses and lease liabilities. The Debtors also classified postpetition accrued expenses as payables on the MOR form, but distinguish between postpetition accrued expenses and trade payables on the balance sheet. The prepetition secured debt figure shown in Part 2 includes accrued interest that is subject to the lenders' right to charge default interest. Notes to MOR Part 1: At month end, the Debtors maintained a restricted cash balance of $2,399,873. $1,399,873 of this figure collateralized outstanding letters of credit related to its operating leases and its contractual obligations with distributors and customers. Another $1,000,000 collateralized the Company's credit card programs. Restricted cash is represented as part of noncurrent assets on the balance sheet. Case 23-10935-KBO Doc 246-1 Filed 09/06/23 Page 3 of 12

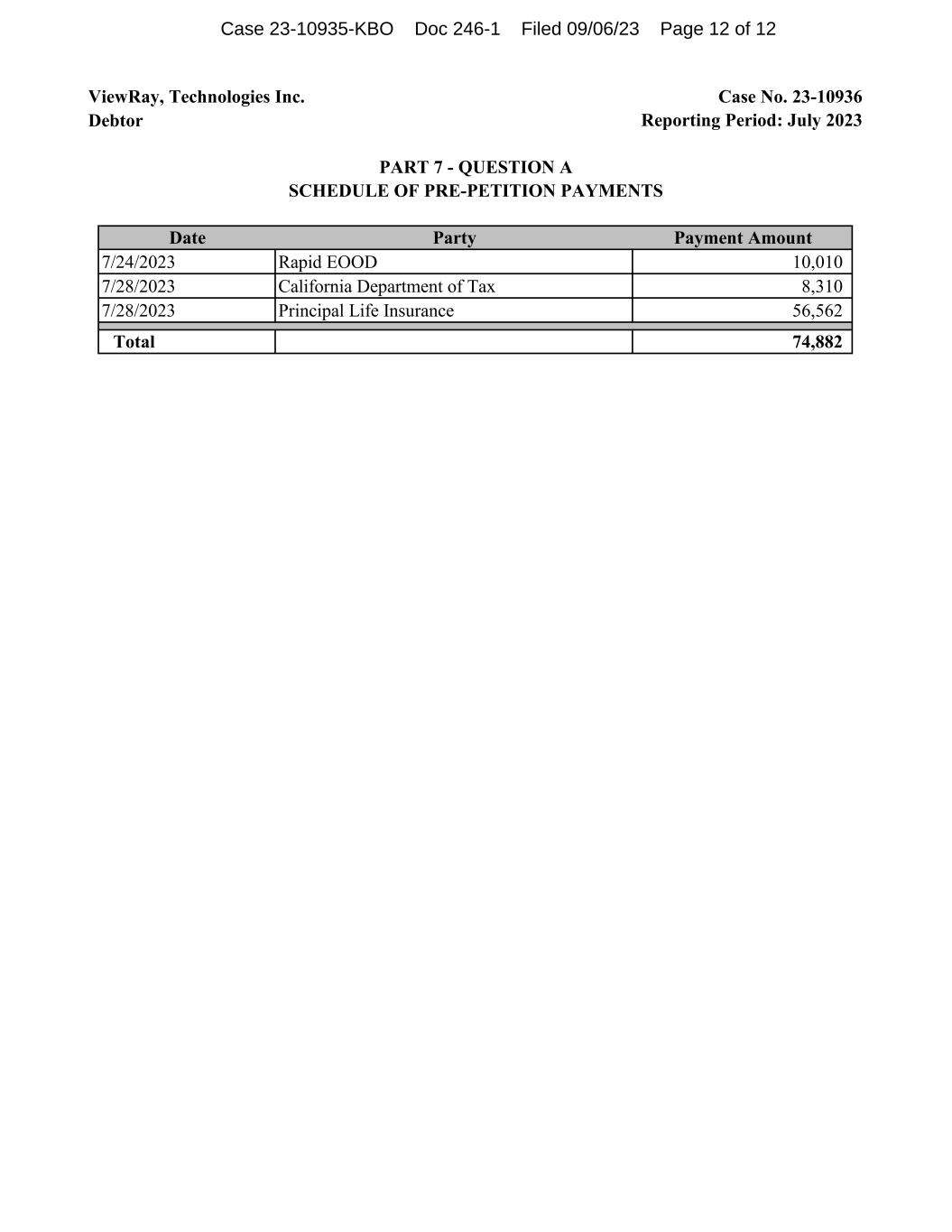

ViewRay, Technologies Inc. Case No. 23-10936 Debtor Reporting Period: July 2023 MONTHLY OPERATING REPORT Notes to the Monthly Operating Report This report includes activity from the following Debtor and their related Case Number: Debtor Case Number ViewRay, Technologies Inc. 23-10936 At the end of the reporting period, the Debtors had $60,115.16 payable for various insurance premiums that have since been paid during the month of August. This was allowed for and authorized by the Interim Insurance Order [Docket No. 51]. The Debtors also made payments to certain insiders as authorized by the Interim Employee Wage Order [Docket No. 53]. For purposes of this MOR, the Debtors defined “insiders” pursuant to section 101(31) of the Bankruptcy Code as: (a) directors; (b) officers; (c) persons in control of the Debtors; (d) relatives of the Debtors' directors, officers, or persons in control of the Debtors; and (e) Debtor and non-Debtor affiliates of the foregoing. Moreover, the Debtors do not take a position with respect to: (a) any insider's influence over the control of the Debtors; (b) the management responsibilities or functions of any such insider; (c) the decision making or corporate authority of any such insider; or (d) whether the Debtors or any such insider could successfully argue that he or she is not an “insider” under applicable law, with respect to any theories of liability, or for any other purpose. Notes to MOR Part 5: The Debtors made no payments to estate bankruptcy professionals or non-bankruptcy professionals from the Petition Date to July 31, 2023. Professional fee payments listed as cumulative indicate fee retainers paid prepetition. Notes to MOR Part 7: The Debtors also made three payments for prepetition services totaling $74,882.12 during the period. The first payment was for prepetition rent for the Bulgarian facility of $10,009.61 to ensure continued operations of their international business. Additionally, the Debtors paid $8,310.23 in prepetition taxes owed to the California Department of Tax. The Debtors also paid $56,562.28 in contributions to match 401(k) amounts to employees severed in connection with restructuring efforts just prior to petition date as severance compensation. These prepetition payments were allowed for under various first day orders [Docket Nos. 52, 53, & 56]. Case 23-10935-KBO Doc 246-1 Filed 09/06/23 Page 4 of 12

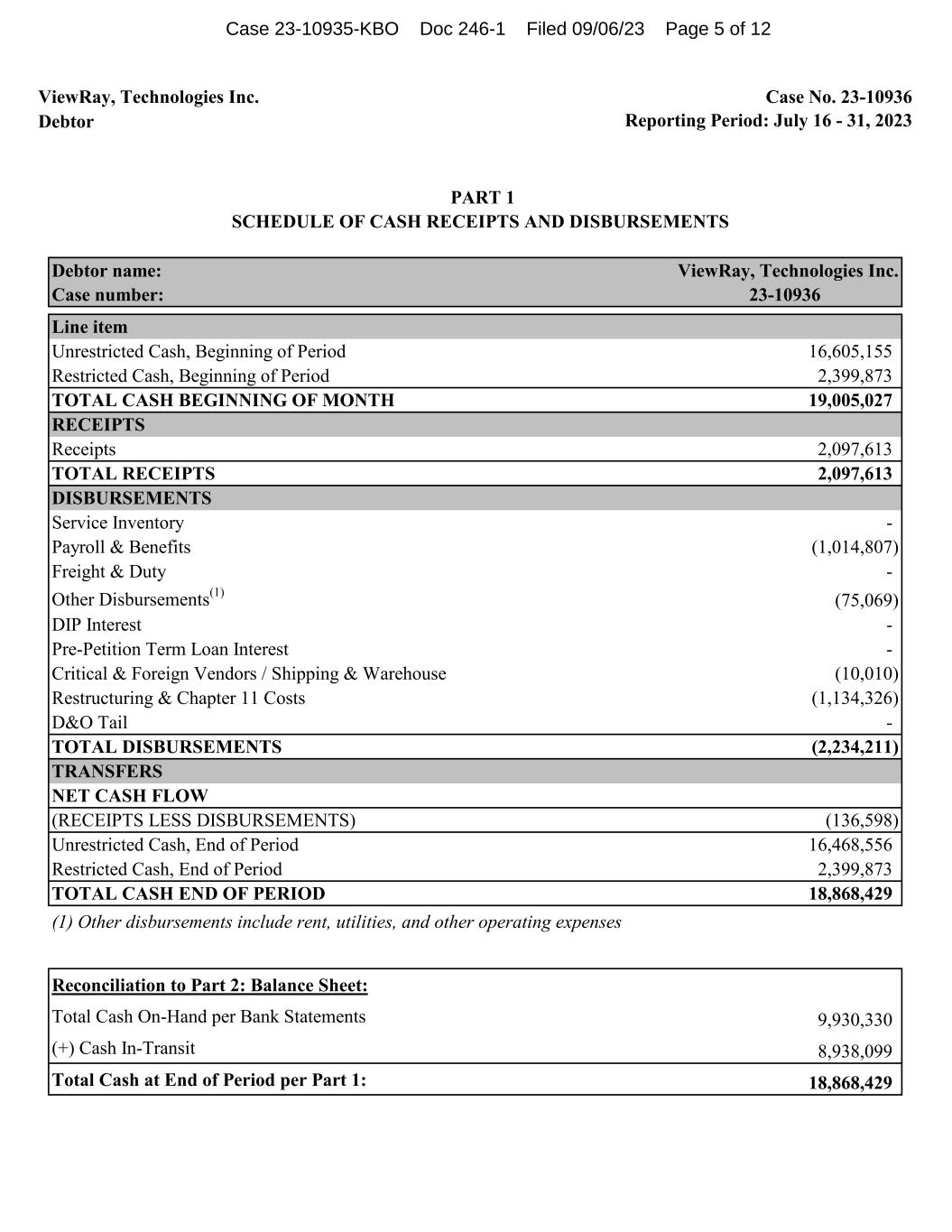

ViewRay, Technologies Inc. Case No. 23-10936 Debtor Reporting Period: July 16 - 31, 2023 PART 1 SCHEDULE OF CASH RECEIPTS AND DISBURSEMENTS Debtor name: ViewRay, Technologies Inc. Case number: 23-10936 Line item Unrestricted Cash, Beginning of Period 16,605,155 Restricted Cash, Beginning of Period 2,399,873 TOTAL CASH BEGINNING OF MONTH 19,005,027 RECEIPTS Receipts 2,097,613 TOTAL RECEIPTS 2,097,613 DISBURSEMENTS Service Inventory - Payroll & Benefits (1,014,807) Freight & Duty - Other Disbursements(1) (75,069) DIP Interest - Pre-Petition Term Loan Interest - Critical & Foreign Vendors / Shipping & Warehouse (10,010) Restructuring & Chapter 11 Costs (1,134,326) D&O Tail - TOTAL DISBURSEMENTS (2,234,211) TRANSFERS NET CASH FLOW (RECEIPTS LESS DISBURSEMENTS) (136,598) Unrestricted Cash, End of Period 16,468,556 Restricted Cash, End of Period 2,399,873 TOTAL CASH END OF PERIOD 18,868,429 (1) Other disbursements include rent, utilities, and other operating expenses Reconciliation to Part 2: Balance Sheet: Total Cash On-Hand per Bank Statements 9,930,330 (+) Cash In-Transit 8,938,099 Total Cash at End of Period per Part 1: 18,868,429 Case 23-10935-KBO Doc 246-1 Filed 09/06/23 Page 5 of 12

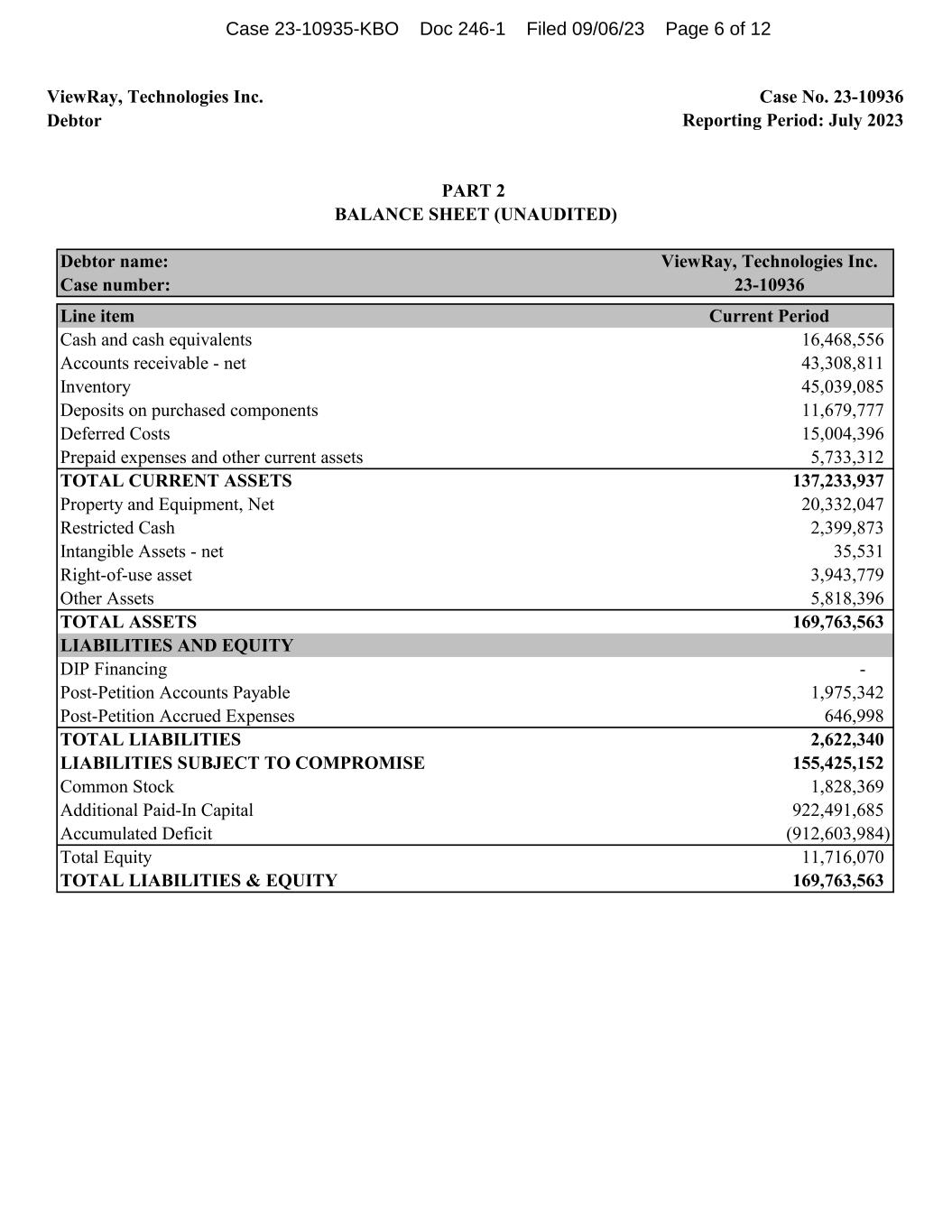

ViewRay, Technologies Inc. Case No. 23-10936 Debtor Reporting Period: July 2023 PART 2 BALANCE SHEET (UNAUDITED) Debtor name: ViewRay, Technologies Inc. Case number: 23-10936 Line item Current Period Cash and cash equivalents 16,468,556 Accounts receivable - net 43,308,811 Inventory 45,039,085 Deposits on purchased components 11,679,777 Deferred Costs 15,004,396 Prepaid expenses and other current assets 5,733,312 TOTAL CURRENT ASSETS 137,233,937 Property and Equipment, Net 20,332,047 Restricted Cash 2,399,873 Intangible Assets - net 35,531 Right-of-use asset 3,943,779 Other Assets 5,818,396 TOTAL ASSETS 169,763,563 LIABILITIES AND EQUITY DIP Financing - Post-Petition Accounts Payable 1,975,342 Post-Petition Accrued Expenses 646,998 TOTAL LIABILITIES 2,622,340 LIABILITIES SUBJECT TO COMPROMISE 155,425,152 Common Stock 1,828,369 Additional Paid-In Capital 922,491,685 Accumulated Deficit (912,603,984) Total Equity 11,716,070 TOTAL LIABILITIES & EQUITY 169,763,563 Case 23-10935-KBO Doc 246-1 Filed 09/06/23 Page 6 of 12

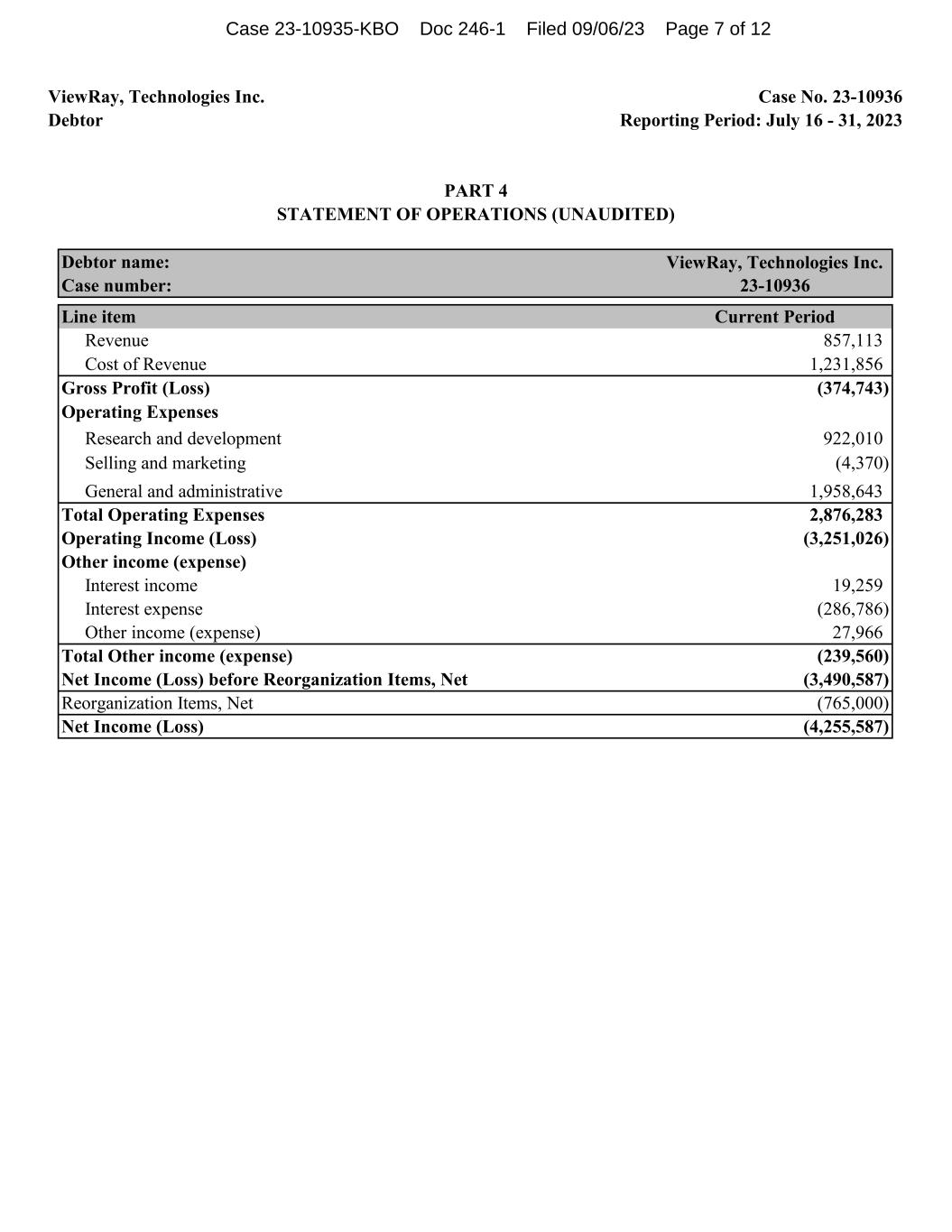

ViewRay, Technologies Inc. Case No. 23-10936 Debtor Reporting Period: July 16 - 31, 2023 PART 4 STATEMENT OF OPERATIONS (UNAUDITED) Debtor name: ViewRay, Technologies Inc. Case number: 23-10936 Line item Current Period Revenue 857,113 Cost of Revenue 1,231,856 Gross Profit (Loss) (374,743) Operating Expenses Research and development 922,010 Selling and marketing (4,370) General and administrative 1,958,643 Total Operating Expenses 2,876,283 Operating Income (Loss) (3,251,026) Other income (expense) Interest income 19,259 Interest expense (286,786) Other income (expense) 27,966 Total Other income (expense) (239,560) Net Income (Loss) before Reorganization Items, Net (3,490,587) Reorganization Items, Net (765,000) Net Income (Loss) (4,255,587) Case 23-10935-KBO Doc 246-1 Filed 09/06/23 Page 7 of 12

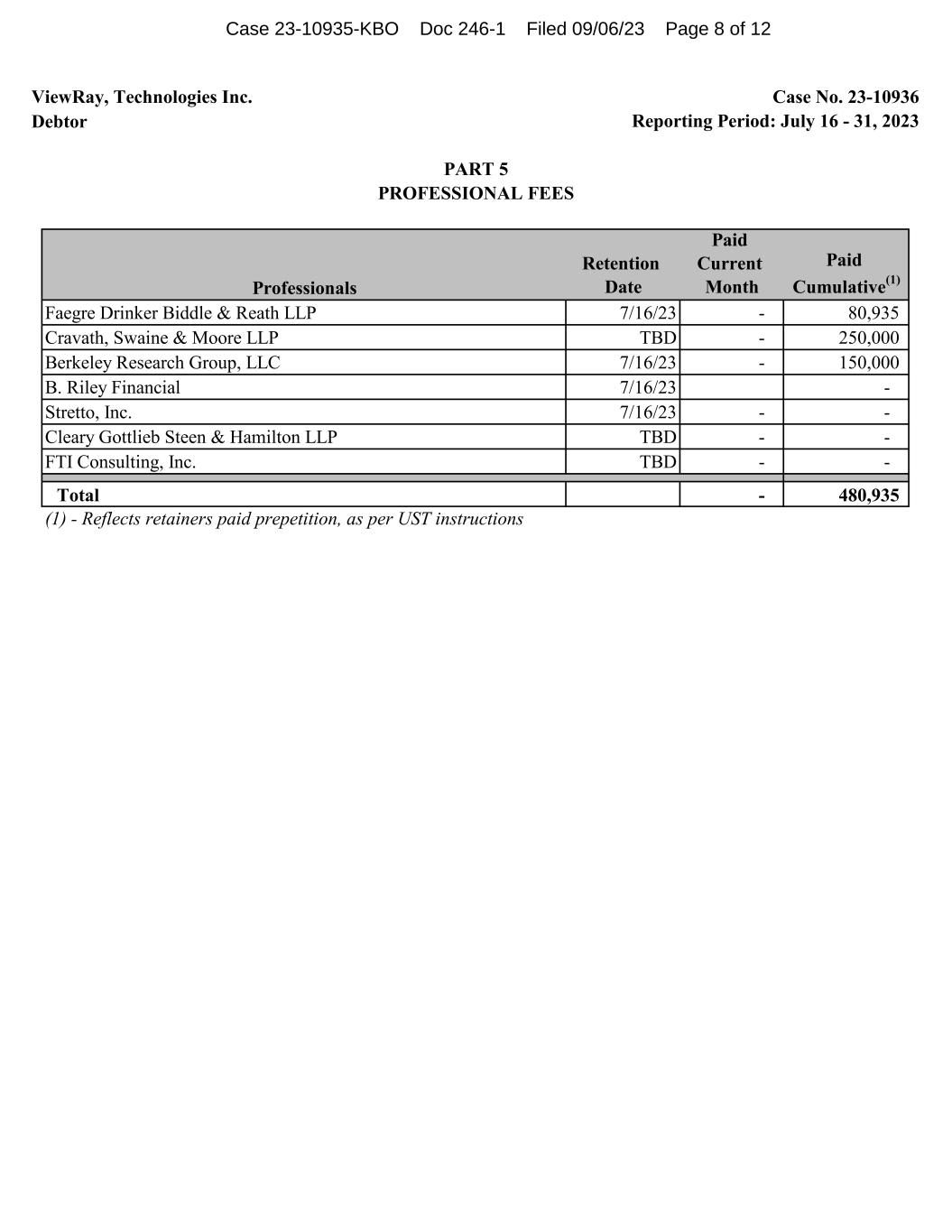

ViewRay, Technologies Inc. Case No. 23-10936 Debtor Reporting Period: July 16 - 31, 2023 PART 5 PROFESSIONAL FEES Professionals Retention Date Paid Current Month Paid Cumulative(1) Faegre Drinker Biddle & Reath LLP 7/16/23 - 80,935 Cravath, Swaine & Moore LLP TBD - 250,000 Berkeley Research Group, LLC 7/16/23 - 150,000 B. Riley Financial 7/16/23 - Stretto, Inc. 7/16/23 - - Cleary Gottlieb Steen & Hamilton LLP TBD - - FTI Consulting, Inc. TBD - - Total - 480,935 (1) - Reflects retainers paid prepetition, as per UST instructions Case 23-10935-KBO Doc 246-1 Filed 09/06/23 Page 8 of 12

ViewRay, Technologies Inc. Case No. 23-10936 Debtor Reporting Period: July 2023 Debtor name: Bank name Account type Account number (last four digits) Period-end bank balance Currency ViewRay Technologies, Inc. SVB Checking 3235 1,000,029 USD ViewRay Technologies, Inc. SVB MMA 8618 23 USD ViewRay Technologies, Inc. SVB Collateral MMA 4662 0 USD ViewRay Technologies, Inc. SVB Collateral MMA 0850 1,875,000 USD ViewRay Technologies, Inc. SVB Sweep 6974 95,385 USD ViewRay Technologies, Inc. SVB Interest Bearing 9443 1,812,334 USD ViewRay Technologies, Inc. PNC Operating Account 6164 1,747,698 USD ViewRay Technologies, Inc. PNC Checking 0758 0 USD ViewRay Technologies, Inc. PNC Sweep 0758 0 USD ViewRay Technologies, Inc. PNC Money Market 5109 (10) USD ViewRay Technologies, Inc. SVB LC Collateral 0052 456,432 USD ViewRay Technologies, Inc. SVB LC Collateral 2536 102,545 USD ViewRay Technologies, Inc. SVB LC Collateral 0595 2,000,000 USD ViewRay Technologies, Inc. SVB LC Collateral 9335 450,138 USD ViewRay Technologies, Inc. SVB LC Collateral 1456 390,758 USD TOTAL BANK BALANCE (USD) 9,930,330 USD BANK ACCOUNTS Case 23-10935-KBO Doc 246-1 Filed 09/06/23 Page 9 of 12

ViewRay, Technologies Inc. Case No. 23-10936 Debtor Reporting Period: July 2023 SCHEDULE OF ACCOUNTS RECEIVABLE Unbilled A/R 0-30 Days 30-60 Days 60-90 Days 90+ Days Total Accounts Receivable Aging 26,511,322 4,979,006 4,850,201 453,621 9,566,627 46,360,776 Less: Credit Allowances (3,051,965) (3,051,965) Total 26,511,322 4,979,006 4,850,201 453,621 6,514,661 43,308,811 Case 23-10935-KBO Doc 246-1 Filed 09/06/23 Page 10 of 12

ViewRay, Technologies Inc. Case No. 23-10936 Debtor Reporting Period: July 2023 SCHEDULE OF POST-PETITION ACCOUNTS PAYABLE 0-90 Days 90+ Days Total Post-Petition Accounts Payable Aging 1,975,342 - 1,975,342 Total 1,975,342 - 1,975,342 Case 23-10935-KBO Doc 246-1 Filed 09/06/23 Page 11 of 12

ViewRay, Technologies Inc. Case No. 23-10936 Debtor Reporting Period: July 2023 PART 7 - QUESTION A SCHEDULE OF PRE-PETITION PAYMENTS Date Party Payment Amount 7/24/2023 Rapid EOOD 10,010 7/28/2023 California Department of Tax 8,310 7/28/2023 Principal Life Insurance 56,562 Total 74,882 Case 23-10935-KBO Doc 246-1 Filed 09/06/23 Page 12 of 12