0001102993falseTRUE00011029932024-02-282024-02-280001102993us-gaap:CommonStockMember2024-02-282024-02-280001102993us-gaap:RightsMember2024-02-282024-02-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_____________________

FORM 8-K

_____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 28, 2024

_____________________

LivePerson, Inc.

(Exact Name of Registrant as Specified in its Charter)

_____________________

| | | | | | | | |

| Delaware | 0-30141 | 13-3861628 |

(State or other jurisdiction

of incorporation) | (Commission File Number) | (I.R.S. Employer

Identification No.) |

530 7th Ave, Floor M1

New York, New York 10018

(Address of principal executive offices, with zip code)

(212) 609-4200

Registrant's telephone number, including area code

N/A

(Former name or former address, if changed since last report)

_____________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | LPSN | | The Nasdaq Stock Market LLC |

| Rights to Purchase Series A Junior Participating Preferred Stock | | None | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

A copy of the press release issued by LivePerson, Inc. (the “Registrant”) on February 28, 2024, announcing its results of operations and financial condition for the year ended December 31, 2023, is included herewith as Exhibit 99.1 and is incorporated herein by reference. The information included in this Current Report on Form 8-K (including Exhibit 99.1 hereto) that is furnished pursuant to this Item 2.02 shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing of the Registrant, whether made before or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference into such filing.

Item 9.01. Financial Statements and Exhibits.

| | | | | |

| (d) Exhibits. The following documents are included as exhibits to this report: |

| | |

| 99.1* | |

| 104** | |

* Furnished herewith

** Filed herewith

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | LIVEPERSON, INC. (Registrant) |

| | | | | | | | | | | |

| Date: | February 28, 2024 | By: | /s/ JOHN SABINO |

| | | John Sabino |

| | | Chief Executive Officer |

| | | (Principal Executive Officer) |

LivePerson Announces Fourth Quarter 2023 Financial Results

-- Total Revenue of $95.5M, above the midpoint of our guidance range --

-- Adjusted EBITDA above the midpoint of our guidance range --

NEW YORK, February 28, 2024, -- LivePerson, Inc. (NASDAQ: LPSN) (“LivePerson” the “Company”, “we” or “us”), the enterprise leader in digital customer conversations, today announced financial results for the fourth quarter ended December 31, 2023.

Fourth Quarter Highlights

Total revenue was $95.5 million for the fourth quarter of 2023, above the midpoint of our prior guidance and a decrease of 22.1% as compared to the same period last year driven by our exit of lower-margin and non-core business lines.

LivePerson signed 62 deals in total for the fourth quarter, consisting of 16 new and 46 existing customer contracts, including 3 seven-figure deals. Trailing-twelve-months average revenue per enterprise and mid-market customer increased 11.9% for the fourth quarter to $610,000, up from approximately $545,000 for the comparable prior-year period. Beginning with the second quarter of 2022, in order to provide a more consistent and meaningful measure of ARPC, we started calculating this metric using only B2B Core recurring revenue, which is consistent with the revenue base for calculating Net Revenue Retention.

“This is a critical time in LivePerson’s history, and I’m honored to be leading the company through its transformation by driving results through improved commercial and operational execution,” said CEO John Sabino. “There is a multi-billion dollar market opportunity ahead of us as we execute on our go-to-market strategy, lean into our product’s integration and orchestration capabilities, and strengthen our capital structure. I am excited to share that these operational initiatives are already underway, and I am confident they will place LivePerson on a path to profitable growth.”

“I’m excited to partner with John on the path ahead and I share the board’s confidence in his leadership,” said CFO and COO John Collins. “The rapid growth in our market, coupled with repeated validation of our product by customers, investors, and third party research, makes it clear that LivePerson has a compelling growth opportunity following the rebuild of its sales and customer success motion.”

Customer Expansion

During the fourth quarter, the Company signed 62 total deals for the quarter, including 3 seven-figure deals, 46 expansion & renewals and 16 new logo deals. New logo deals included:

•A globally recognized designer;

•A major telecom services provider in Southeast Asia, through a partnership; and

•A leading personal loan provider, through a partnership.

The Company also expanded/renewed business with:

•Several financial services companies including one of the world’s largest banks, a large U.K. financial services provider, a growing U.S. credit card issuer, a major U.S. credit union, and a large Australian retail bank; as well as

•A leading U.K. connectivity provider;

•A large U.S. luxury jewelry company; and

•A leading technology company.

Net Loss and Adjusted Operating Loss

Net loss for the fourth quarter of 2023 was $40.5 million or $0.48 per share, as compared to a net loss of $41.7 million or $0.55 per share for the fourth quarter of 2022. Adjusted operating loss, a non-GAAP financial metric, for the fourth quarter of 2023 was $4.0 million, as compared to a $16.1 million adjusted operating loss for the fourth quarter of 2022. Adjusted operating loss excludes amortization of purchased intangibles and finance leases, stock-based compensation expense, other litigation, consulting and other employee costs, restructuring costs, impairment of goodwill, impairment of intangibles and other assets, gain on divestiture, leadership transition costs, contingent earn-out adjustments, IT transformation costs, acquisition and divestiture costs, interest (income) expense, and other (income) expense.

Adjusted EBITDA

Adjusted EBITDA, a non-GAAP financial measure, for the fourth quarter of 2023 was $3.7 million as compared to an adjusted EBITDA loss of $5.2 million for the fourth quarter of 2022. Adjusted EBITDA excludes amortization of purchased intangibles and finance leases, stock-based compensation expense, depreciation, other litigation, consulting and other employee costs, restructuring costs, impairment of goodwill, impairment of intangibles and other assets, leadership transition costs, IT transformation costs, gain on divestiture, contingent earn-out adjustments, provision for income taxes, acquisition and divestiture costs, interest (income) expense, and other (income) expense.

A reconciliation of non-GAAP financial measures to GAAP measures has been provided in the financial tables included in this press release. An explanation of the non-GAAP financial measures and how they are calculated is included below under the heading “Non-GAAP Financial Measures.”

Cash and Cash Equivalents

The Company’s cash balance was $210.8 million at December 31, 2023, as compared to $391.8 million at December 31, 2022.

Financial Expectations

The following forward-looking measures and the underlying assumptions involve significant known and unknown risks and uncertainties, and actual results may vary materially from these forward-looking measures. The Company does not present a quantitative reconciliation of the forward-looking non-GAAP financial measures, adjusted EBITDA and adjusted EBITDA margin to the most directly comparable GAAP financial measures (or otherwise present such forward-looking GAAP measures) because it is impractical to forecast certain items without unreasonable efforts due to the uncertainty and inherent difficulty of predicting, within a reasonable range, the occurrence and financial impact of and the periods in which such items may be recognized. In particular, these non-GAAP financial measures exclude certain items, including amortization of purchased intangibles and finance leases, stock-based compensation expense, depreciation, other litigation, consulting and other employee costs, restructuring costs, impairment of goodwill, impairment of intangibles and other assets, leadership transition costs, gain on divestiture, contingent earn-out adjustments, provision for income taxes, IT transformation costs, acquisition and divestiture costs, interest (income) expense, and other (income) expense, which depend on future events that the Company is unable to predict. Depending on the size of these items, they could have a significant impact on the Company’s GAAP financial results.

For the full year 2024, we expect total revenue to range from $300M - $315M or (24)% to (20)% year over year (excluding $7.2M of Kasamba revenue generated in Q1 2023). In addition, we expect B2B Core recurring revenue to represent 92% of total revenue. For the full year 2024, we expect adjusted EBITDA to range from $15M to $26M, or a margin of 5.0% to 8.3%.

For the first quarter, we expect total revenue to range from $79M - $83M or (21)% to (17)% year over year (excluding $7.2M of Kasamba revenue generated in Q1 2023). We expect B2B Core recurring revenue to represent 92% of total revenue. For the first quarter, we expect adjusted EBITDA to range from $(2) to $2M, or a margin of (2.5)% to 2.4%.

For the tables below, year-over-year growth rates are on a like-for-like basis (excluding $7.2M of Kasamba contribution from Q1 2023).

First Quarter 2024 | | | | | |

| Guidance |

| Revenue (in millions) | $79 - $83 |

| Revenue growth (year-over-year) | (21)% - (17)% |

| Adjusted EBITDA (in millions) | $(2) - $2 |

| Adjusted EBITDA margin (%) | (2.5)% - 2.4% |

Full Year 2024

| | | | | |

| Guidance |

| Revenue (in millions) | $300 - $315 |

| Revenue growth (year-over-year) | (24)% - (20)% |

| Adjusted EBITDA (in millions) | $15 - $26 |

| Adjusted EBITDA margin (%) | 5.0% - 8.3% |

Disaggregated Revenue

Included in the accompanying financial results are revenues disaggregated by revenue source, as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| (In thousands) |

| Revenue: | | | | | | | |

Hosted services (1) | $ | 78,600 | | | $ | 94,085 | | | $ | 332,971 | | | $ | 412,467 | |

| Professional services | 16,868 | | | 28,392 | | | 69,012 | | | 102,333 |

| Total revenue | $ | 95,468 | | | $ | 122,477 | | | $ | 401,983 | | | $ | 514,800 |

(1)On March 20, 2023, the Company completed the sale of Kasamba and therefore ceased recognizing revenue related to Kasamba effective on the transaction close date. Further, this sale eliminated the entire Consumer segment, as a result of which revenue is presented within a single consolidated segment. Hosted services includes $7.1 million for the year ended December 31, 2023 and $9.4 million and $37.1 million for the three and twelve months ended December 31, 2022 respectively, relating to Kasamba.

Stock-Based Compensation

Included in the accompanying financial results are expenses related to stock-based compensation, as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| (In thousands) |

| Cost of revenue | $ | 577 | | | $ | 777 | | | $ | 1,456 | | | $ | 9,933 | |

| Sales and marketing | 2,925 | | | 963 | | | 10,354 | | | 19,575 | |

| General and administrative | 364 | | | 4,987 | | | (5,706) | | | 40,690 | |

| Product development | 3,508 | | | 2,588 | | | 5,750 | | | 39,440 | |

| Total | $ | 7,374 | | | $ | 9,315 | | | $ | 11,854 | | | $ | 109,638 | |

Amortization of Purchased Intangibles and Finance Leases

Included in the accompanying financial results are expenses related to the amortization of purchased intangibles and finance leases, as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| (In thousands) |

| Cost of revenue | $ | 4,966 | | | $ | 4,646 | | | $ | 18,691 | | | $ | 18,434 | |

| Amortization of purchased intangibles | 861 | | | 936 | | | 3,505 | | | 3,678 | |

| Total | $ | 5,827 | | | $ | 5,582 | | | $ | 22,196 | | | $ | 22,112 | |

Supplemental Fourth Quarter 2023 Presentation

LivePerson will post a presentation providing supplemental information for the fourth quarter 2023 on the investor relations section of the Company’s web site at www.ir.liveperson.com.

Earnings Teleconference Information

The Company will discuss its fourth quarter of 2023 financial results during a teleconference today, February 28, 2024, at 5:00 PM ET. To participate via telephone, callers should dial in five to ten minutes prior to the 5:00 p.m. Eastern start time; domestic callers (U.S. and Canada) should dial 1-877-407-0784, while international callers should dial 1-201-689-8560, and both should reference the conference ID “13743243.”

The conference call will also be simulcast live on the Internet and can be accessed by logging onto the investor relations section of the Company’s web site at www.ir.liveperson.com.

If you are unable to participate in the live call, the teleconference will be available for replay approximately two hours after the call. To access the replay, please call 1-844-512-2921 (U.S. and Canada) or 1-412-317-6671 (international). Please reference the conference ID “13743243.” A replay will also be available on the investor relations section of the Company’s web site at www.ir.liveperson.com.

About LivePerson, Inc.

LivePerson (NASDAQ: LPSN) is the enterprise leader in digital customer conversations. The world’s leading brands — including HSBC, Chipotle, and Virgin Media — use our award-winning Conversational Cloud platform to connect with millions of consumers. We power nearly a billion conversational interactions every month, providing a uniquely rich data set and AI-powered solutions to accelerate contact center transformation, supercharge agent productivity, and deliver more personalized customer experiences. Fast Company named us the #1 Most Innovative AI Company in the world. To talk with us or our AI, please visit liveperson.com.

Non-GAAP Financial Measures

Investors are cautioned that the following financial measures used in this press release and on our earnings call are “non-GAAP financial measures”: (i) adjusted EBITDA, or loss before provision for income taxes, interest (income) expense, other (income) expense, depreciation, amortization of purchased intangibles and finance leases, stock-based compensation expense, contingent earn-out adjustments, restructuring costs, impairment of goodwill, impairment of intangibles and other assets, leadership transition costs, IT transformation costs, gain on divestiture, acquisition and divestiture costs and other litigation, consulting and other employee costs; (ii) adjusted EBITDA margin, or loss before provision for income taxes, interest (income) expense, other (income) expense, depreciation, amortization of purchased intangibles and finance leases, stock-based compensation expense, contingent earn-out adjustments, restructuring costs, impairment of goodwill, impairment of intangibles and other assets, leadership transition costs, IT transformation costs, gain on divestiture, acquisition and divestiture costs and other litigation, consulting and other employee costs divided by revenue; (iii) adjusted operating loss, or operating loss excluding interest (income) expense, other (income) expense, amortization of purchased intangibles and finance leases, stock-based compensation expense, contingent earn-out adjustments, restructuring costs, impairment of goodwill, impairment of intangibles and other assets, leadership transition costs, IT transformation costs, gain on divestiture, acquisition and divestiture costs, and other litigation, consulting and other employee costs and (iv) free cash flow, or net cash provided by operating activities less purchases of property and equipment, including capitalized software.

Non-GAAP financial information should not be construed as an alternative to any other measures of performance determined in accordance with GAAP, or as an indicator of our operating performance, liquidity or cash flows generated by operating, investing and financing activities as there may be significant factors or trends that it fails to address. We present non-GAAP financial information because we believe that it is helpful to some investors as one measure of our operations.

Forward-Looking Statements

Statements in this press release and on our earnings call regarding LivePerson that are not historical facts are forward-looking statements and are subject to risks and uncertainties that could cause actual future events or results to differ materially from such statements. Any such forward-looking statements, including but not limited to financial guidance, are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. It is routine for our internal projections and expectations to change as the quarter and year progress, and therefore it should be clearly understood that the internal projections and beliefs upon which we base our expectations may change. Although these expectations may change, we are under no obligation to inform you if they do. Some of the factors that could cause actual results to differ materially from the forward-looking statements contained herein include, without limitation: strain on our personnel resources and infrastructure from supporting our customer base; our ability to retain existing customers and cause them to purchase additional services and to attract new customers; our ability to retain key personnel, attract new personnel and to manage staff attrition; our ability to successfully integrate past or potential future acquisitions; our ability to refinance our substantial indebtedness before it becomes due or to secure necessary additional financing on commercially reasonable terms, or at all; lengthy sales cycles; delays in our implementation cycles; payment-related risks; potential fluctuations in our quarterly revenue and operating results; limitations on the effectiveness of our controls; non-payment or late payment of amounts due to us from a significant number of customers; volatility in the capital markets; recognition of revenue from subscriptions; customer retention and engagement; our ability to develop and maintain successful relationships with partners, service partners, social media and other third-party consumer messaging platforms and endpoints; our ability to effectively operate on mobile devices; the highly competitive markets in which we operate;

general economic conditions; failures or security breaches in our services, those of our third party service providers, or in the websites of our customers; regulation or possible misappropriation of personal information belonging to our customers’ Internet users; US and international laws and regulations regarding privacy data protection and AI and increased public scrutiny of privacy, security and AI issues that could result in increased government regulation and other legal obligations; ongoing litigation and legal matters; new regulatory or other legal requirements that could materially impact our business; governmental export controls and economic sanctions; industry-specific regulation and unfavorable industry-specific laws, regulations or interpretive positions; future regulation of the Internet or mobile devices; technology-related defects that could disrupt the LivePerson services; our ability to protect our intellectual property rights or potential infringement of the intellectual property rights of third parties; the use of AI in our product offerings or by our vendors; the presence of, and difficulty in correcting, errors, failures or “bugs” in our products; our ability to license necessary third party software for use in our products and services, and our ability to successfully integrate third party software; potential adverse impact due to foreign currency and cryptocurrency exchange rate fluctuations; additional regulatory requirements, tax liabilities, currency exchange rate fluctuations and other risks if and as we expand; risks related to our operations in Israel; potential failure to meeting service level commitments to certain customers; legal liability and/or negative publicity for the services provided to consumers via our technology platforms; technological or other defects that could disrupt or negatively impact our services; our ability to maintain our reputation; changes in accounting principles generally accepted in the United States; natural catastrophic events and interruption to our business by man-made problems; potential limitations on our ability to use net operating losses to offset future taxable income; and risks related to our common stock being traded on more than one securities exchange. This list is intended to identify only certain of the principal factors that could cause actual results to differ from those discussed in the forward-looking statements. Readers are referred to the Company’s reports and documents filed from time to time by us with the Securities and Exchange Commission for a discussion of these and other important factors that could cause actual results to differ from those discussed in forward-looking statements.

LivePerson, Inc.

Consolidated Statements of Operations

(In Thousands, Except Share and Per Share Data)

Unaudited

| | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, | |

| 2023 | | 2022 | | 2023 | | 2022 | |

| Revenue | $ | 95,468 | | | $ | 122,477 | | | $ | 401,983 | | | $ | 514,800 | | |

| | | | | | | | |

| Costs, expenses and other: | | | | | | | | |

| Cost of revenue | 39,818 | | | 46,402 | | | 142,823 | | | 184,699 | | |

| Sales and marketing | 32,365 | | | 46,464 | | | 125,677 | | | 214,027 | | |

| General and administrative | 21,554 | | | 28,473 | | | 91,619 | | | 120,625 | | |

| Product development | 29,859 | | | 37,120 | | | 124,792 | | | 193,688 | | |

| Impairment of goodwill | — | | | — | | | 11,895 | | | — | | |

| Impairment of intangibles and other assets | 5,015 | | | — | | | 7,974 | | | — | | |

| Restructuring costs | 6,665 | | | 2,018 | | | 22,664 | | | 19,967 | | |

| Gain on divestiture | — | | | — | | | (17,591) | | | — | | |

| Amortization of purchased intangible assets | 861 | | | 936 | | | 3,505 | | | 3,678 | | |

| Total costs, expenses and other | 136,137 | | | 161,413 | | | 513,358 | | | 736,684 | | |

| | | | | | | | |

| Loss from operations | (40,669) | | | (38,936) | | | (111,375) | | | (221,884) | | |

| | | | | | | | |

| Other income (expense), net: | | | | | | | | |

| Interest income (expense), net | 1,664 | | | 1,361 | | | 4,669 | | | (352) | | |

| Other income (expense), net | 1,043 | | | (3,692) | | | 10,434 | | | (1,784) | | |

| Total other income (expense), net | 2,707 | | | (2,331) | | | 15,103 | | | (2,136) | | |

| | | | | | | | |

| Loss before provision for income taxes | (37,962) | | | (41,267) | | | (96,272) | | | (224,020) | | |

| | | | | | | | |

| Provision for income taxes | 2,563 | | | 457 | | | 4,163 | | 1,727 | | |

| | | | | | | | |

| Net loss | $ | (40,525) | | | $ | (41,724) | | | $ | (100,435) | | | $ | (225,747) | | |

| | | | | | | | |

| Net loss per share of common stock: | | | | | | | | |

| Basic | $ | (0.48) | | | $ | (0.55) | | | $ | (1.28) | | | $ | (3.03) | | |

| Diluted | $ | (0.48) | | | $ | (0.55) | | | $ | (1.28) | | | $ | (3.03) | | |

| | | | | | | | |

| Weighted-average shares used to compute net loss per share: | | | | | | | | |

| Basic | 83,610,995 | | | 75,538,133 | | | 78,593,274 | | | 74,509,404 | | |

| Diluted | 83,610,995 | | | 75,538,133 | | | 78,593,274 | | | 74,509,404 | | |

LivePerson, Inc.

Consolidated Statements of Cash Flows

(In Thousands)

Unaudited

| | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| OPERATING ACTIVITIES: | | | |

| Net loss | $ | (100,435) | | | $ | (225,747) | |

| Adjustments to reconcile net loss to net cash (used in) provided by operating activities: | | | |

| Stock-based compensation expense | 11,854 | | | 109,638 | |

| Depreciation | 32,557 | | | 32,284 | |

| Amortization of purchased intangible assets and finance leases | 22,196 | | | 22,112 | |

| Amortization of debt issuance costs | 4,043 | | | 3,778 | |

| Accretion of debt discount on convertible senior notes | — | | | — | |

| Impairment of goodwill | 11,895 | | | — | |

| Impairment of intangible and other assets | 7,974 | | | — | |

| Change in fair value of contingent consideration | 4,629 | | | (8,516) | |

| Gain on repurchase of convertible notes | (7,200) | | | — | |

| Allowance for credit losses | 3,319 | | | 5,644 | |

| Gain on divestiture | (17,591) | | | — | |

| Gain on settlement of leases | — | | | (242) | |

| Deferred income taxes | 1,046 | | | (1,161) | |

| Equity loss in joint venture | 2,264 | | | — | |

| Changes in operating assets and liabilities, net of acquisitions: | | | |

| Accounts receivable | 1,457 | | | (38) | |

| Prepaid expenses and other current assets | (3,411) | | | (5,979) | |

| Contract acquisition costs | 4,992 | | | (6,370) | |

| Other assets | 1,361 | | | (153) | |

| Accounts payable | (13,570) | | | 12,050 | |

| Accrued expenses and other current liabilities | 24,343 | | | 7,485 | |

| Deferred revenue | (3,169) | | | (12,341) | |

| Operating lease liabilities | (523) | | | (2,638) | |

| Other liabilities | (7,796) | | | 8,093 | |

| Net cash used in operating activities | (19,765) | | | (62,101) | |

| INVESTING ACTIVITIES: | | | |

| Purchases of property and equipment, including capitalized software | (28,657) | | | (48,486) | |

| Proceeds from divestiture | 13,819 | | | — | |

| Payments for acquisitions, net of cash acquired | — | | | (3,430) | |

| Purchases of intangible assets | (4,004) | | | (2,680) | |

| | | |

| Investment in joint venture | — | | | (2,264) | |

| Net cash used in investing activities | (18,842) | | | (56,860) | |

| FINANCING ACTIVITIES: | | | |

| Principal payments for financing leases | (3,330) | | | (3,734) | |

| Repurchase of common stock | — | | | (221) | |

| Proceeds from issuance of common stock in connection with the exercise of options and ESPP | 1,890 | | | 5,573 | |

| Payment for repurchase of convertible senior notes | (149,702) | | | — | |

| Net cash (used in) provided by financing activities | (151,142) | | | 1,618 | |

| Effect of foreign exchange rate changes on cash and cash equivalents | 465 | | | (3,980) | |

| Net decrease in cash, cash equivalents, and restricted cash | (189,284) | | | (121,323) | |

| Cash classified within current assets held for sale | 10,011 | | | (10,011) | |

| Cash, cash equivalents, and restricted cash - beginning of year | 392,198 | | | 523,532 | |

| Cash, cash equivalents, and restricted cash - end of year | $ | 212,925 | | | $ | 392,198 | |

LivePerson, Inc.

Reconciliation of Non-GAAP Financial Information to GAAP

(In Thousands)

Unaudited

| | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, | |

| 2023 | | 2022 | | 2023 | | 2022 | |

| Reconciliation of Adjusted EBITDA (Loss): | | | | | | | | |

| GAAP net loss | $ | (40,525) | | | $ | (41,724) | | | $ | (100,435) | | | $ | (225,747) | | |

| Add/(less): | | | | | | | | |

| Depreciation | 7,705 | | | 10,870 | | | 32,557 | | | 32,284 | | |

Other litigation, consulting and other employee costs (1) | 5,553 | | | 4,569 | | | 32,266 | | | 17,212 | | |

Restructuring costs (2) | 6,665 | | | 2,018 | | | 22,664 | | | 19,967 | | |

| Amortization of purchased intangibles and finance leases | 5,827 | | | 5,582 | | | 22,196 | | | 22,112 | | |

| Impairment of goodwill | — | | | — | | | 11,895 | | | — | | |

Stock-based compensation expense (3) | 8,525 | | | 9,315 | | | 10,187 | | | 109,638 | | |

| Leadership transition costs | 1,418 | | | — | | | 8,384 | | | — | | |

| Impairment of intangibles and other assets | 5,015 | | | — | | | 7,974 | | | — | | |

| Contingent earn-out adjustments | (812) | | | 52 | | | 4,629 | | | (8,516) | | |

| Provision for income taxes | 2,563 | | | 457 | | | 4,163 | | | 1,727 | | |

IT transformation costs (4) | 3,576 | | | — | | | 3,576 | | | — | | |

| Acquisition and divestiture costs | 96 | | | 1,368 | | | 3,131 | | | 4,492 | | |

| Interest (income) expense, net | (1,664) | | | (1,361) | | | (4,669) | | | 352 | | |

| Gain on divestiture | — | | | — | | | (17,591) | | | — | | |

Other (income) expense, net (5) | (231) | | | 3,640 | | | (15,063) | | | 10,300 | | |

| Adjusted EBITDA (loss) | $ | 3,711 | | | $ | (5,214) | | | $ | 25,864 | | | $ | (16,179) | | |

| | | | | | | | |

| Reconciliation of Adjusted Operating Loss | | | | | | | | |

| Loss before provision for income taxes | (37,962) | | | (41,267) | | | (96,272) | | | (224,020) | | |

| Add/(less): | | | | | | | | |

Other litigation, consulting and other employee costs (1) | 5,553 | | | 4,569 | | | 32,266 | | | 17,212 | | |

Restructuring costs (2) | 6,665 | | | 2,018 | | | 22,664 | | | 19,967 | | |

| Amortization of purchased intangibles and finance leases | 5,827 | | | 5,582 | | | 22,196 | | | 22,112 | | |

| Impairment of goodwill | — | | | — | | | 11,895 | | | — | | |

Stock-based compensation expense (3) | 8,525 | | | 9,315 | | | 10,187 | | | 109,638 | | |

| Leadership transition costs | 1,418 | | | — | | | 8,384 | | | — | | |

| Impairment of intangibles and other assets | 5,015 | | | — | | | 7,974 | | | — | | |

| Contingent earn-out adjustments | (812) | | | 52 | | | 4,629 | | | (8,516) | | |

IT transformation costs (4) | 3,576 | | | — | | | 3,576 | | | — | | |

| Acquisition and divestiture costs | 96 | | | 1,368 | | | 3,131 | | | 4,492 | | |

| Interest (income) expense, net | (1,664) | | | (1,361) | | | (4,669) | | | 352 | | |

| Gain on divestiture | — | | | — | | | (17,591) | | | — | | |

Other (income) expense, net (5) | (231) | | | 3,640 | | | (15,063) | | | 10,300 | | |

| Adjusted operating loss | $ | (3,994) | | | $ | (16,084) | | | $ | (6,693) | | | $ | (48,463) | | |

LivePerson, Inc.

Reconciliation of Non-GAAP Financial Information to GAAP

(In Thousands)

Unaudited

——————————————

(1)Includes litigation costs of $4.4 million and consulting fees and related costs of $1.2 million for the three months ended December 31, 2023. Includes litigation costs of $3.6 million, employee benefit costs of $0.5 million and consulting costs of $0.5 million for the three months ended December 31, 2022. Includes litigation costs of $28.0 million, consulting fees and related costs of $4.4 million, offset by sales tax liability reversals of $0.1 million for the year ended December 31, 2023. Includes litigation costs of $11.0 million, employee benefit costs of $1.6 million, consulting fees and related costs of $2.2 million, employee-related costs of $2.1 million and reserve for sales and use tax liability of $0.3 million for the year ended December 31, 2022.

(2)Includes IT contract termination cost of $5.7 million and severance costs and other compensation related costs of $0.9 million for the three months ended December 31, 2023. Includes severance costs and other compensation related costs of $1.9 million and lease restructuring costs of $0.1 million for the three months ended December 31, 2022. Includes severance costs and other compensation related costs of $16.9 million and IT contract termination costs of $5.7 million for the year ended December 31, 2023. Includes severance costs and other compensation related costs of $19.5 million and lease restructuring costs of $0.4 million for the year ended December 31, 2022.

(3)Excludes $1.7 million of accelerated stock-based compensation for the three months ended and year ended December 31, 2023 in connection with the CEO departure, as these costs are presented in leadership transition costs.

(4)Includes IT infrastructure realignment costs related to consolidating and migrating data centers to the cloud. We expect these costs to continue in 2024.

(5)Includes $10.0 million of other income related to a litigation settlement, a $7.2 million gain related to convertible senior notes repurchases and losses related to the Company’s equity method investment during the year ended December 31, 2023. The remaining amount of other (income) expense, net fluctuation is attributable to currency rate fluctuations for the three months and year ended December 31, 2023. Includes $3.3 million of losses related to the Company's equity method investment for the three months ended December 31, 2022. Includes $0.2 million of other income related to the settlement of leases, offset by $7.7 million of losses related to the Company's equity method investment for the year ended December 31, 2022.

LivePerson, Inc.

Reconciliation of Non-GAAP Financial Information to GAAP

(In Thousands)

Unaudited

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Calculation of Free Cash Flow: | | | | | | | |

| Net cash used in operating activities | $ | 4,537 | | | $ | 17,370 | | | $ | (19,765) | | | $ | (62,101) | |

| Purchases of property and equipment, including capitalized software | (6,220) | | | (13,274) | | | (28,657) | | | (48,486) | |

| Total Free Cash Flow | $ | (1,683) | | | $ | 4,096 | | | $ | (48,422) | | | $ | (110,587) | |

LivePerson, Inc.

Consolidated Balance Sheets

(In Thousands)

Unaudited

| | | | | | | | | | | |

| December 31,

2023 | | December 31,

2022 |

| ASSETS | | | |

| CURRENT ASSETS: | | | |

| Cash and cash equivalents | $ | 210,782 | | | $ | 391,781 | |

| Restricted cash | 2,143 | | | 417 | |

| Accounts receivable, net | 81,802 | | | 86,537 | |

| Prepaid expenses and other current assets | 26,981 | | | 23,747 | |

| | | |

| Assets held for sale | — | | | 30,984 | |

| Total current assets | 321,708 | | | 533,466 | |

| | | |

| Operating lease right-of-use asset | 4,135 | | | 1,604 | |

| Property and equipment, net | 119,325 | | | 126,499 | |

| Contract acquisition costs | 37,354 | | | 43,804 | |

| Intangible assets, net | 61,625 | | | 78,103 | |

| Goodwill | 285,631 | | | 296,214 | |

| Deferred tax assets, net | 4,527 | | | 4,423 | |

| Investment in joint venture | — | | | 2,264 | |

| Other assets | 1,208 | | | 2,563 | |

| Total assets | $ | 835,513 | | | $ | 1,088,940 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| CURRENT LIABILITIES: | | | |

| Accounts payable | $ | 13,555 | | | $ | 25,303 | |

| Accrued expenses and other current liabilities | 97,024 | | | 129,244 | |

| Deferred revenue | 81,858 | | | 84,494 | |

| Convertible senior notes | 72,393 | | | — | |

| Operating lease liabilities | 2,719 | | | 2,160 | |

| Liabilities associated with assets held for sale | — | | | 10,357 | |

| Total current liabilities | 267,549 | | | 251,558 | |

| | | |

| | | |

| Convertible senior note, net of current portion | 511,565 | | | 737,423 | |

| Operating lease liabilities, net of current portion | 2,173 | | | 682 | |

| Deferred tax liabilities | 2,930 | | | 2,550 | |

| Other liabilities | 3,158 | | | 28,639 | |

| Total liabilities | 787,375 | | | 1,020,852 | |

| | | |

| | | |

| Total stockholders’ equity | 48,138 | | | 68,088 | |

| Total liabilities and stockholders’ equity | $ | 835,513 | | | $ | 1,088,940 | |

Investor Relations contact

ir-lp@liveperson.com

v3.24.0.1

Cover

|

Feb. 28, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 28, 2024

|

| Entity Registrant Name |

LivePerson, Inc.

|

| Entity Central Index Key |

0001102993

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

0-30141

|

| Entity Tax Identification Number |

13-3861628

|

| Entity Address, Address Line One |

530 7th Ave, Floor M1

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10018

|

| City Area Code |

212

|

| Local Phone Number |

609-4200

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock, par value $0.001 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

LPSN

|

| Security Exchange Name |

NASDAQ

|

| Rights to Purchase Series A Junior Participating Preferred Stock |

|

| Document Information [Line Items] |

|

| No Trading Symbol Flag |

true

|

| Title of 12(b) Security |

Rights to Purchase Series A Junior Participating Preferred Stock

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_RightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

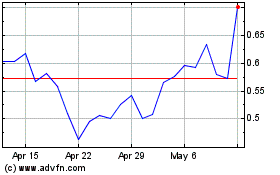

LivePerson (NASDAQ:LPSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

LivePerson (NASDAQ:LPSN)

Historical Stock Chart

From Apr 2023 to Apr 2024