Solana Price Trades Laterally, What Could Be The Next Level?

September 18 2022 - 6:00PM

NEWSBTC

Solana price has been volatile over the last week, with no

significant change in the last 24 hours. In the last week, SOL fell

by 6%. At the moment, the Solana price is neither swaying towards

the bullish zone nor the bearish territory. The technical outlook

for the altcoin has flashed mixed signals. Broader market weakness

could be attributed to the altcoin’s mundane price action. Bitcoin

slipped below the $20,000 mark and many other prominent altcoins

also travelled south. Buying strength on Solana’s daily chart

remains in the negative with chances of it dropping on its chart

further. The bulls are also trying hard to defend the $29 price

mark. A fall below the aforementioned level could push SOL into a

bearish pit. Solana prices had recently formed a rounding bottom,

making buyers enthusiastic about its next price movement. However,

the coin could not hold onto the bullish anticipation. The global

cryptocurrency market cap today is $1 trillion, with a 0.1%

negative change in the last 24 hours. Solana Price Analysis: One

Day Chart SOL was trading at $33 at the time of writing. The bulls

had surrendered to the $37 price level and caused the price to fall

to its next support line. At the moment, the bulls are trying to

defend the price of the altcoin at $29. The overhead resistance for

the coin stood at $37. If SOL moves past the $37 mark, the coin can

attempt to trade near the $40 price mark. On the flip side, one

push from the bears will make Solana land at $27. The amount of SOL

traded in the last session declined slightly, indicating that the

number of buyers had slightly declined. Technical Analysis SOL

flashed declining buying strength on the one-day chart. Over the

last 24 hours, Solana however noted a small uptick in buying

strength depicting that buying strength was returning to the

market. The Relative Strength Index was seen below the half-line

which meant that sellers were more in number as compared to buyers.

Solana price was below the 20-SMA which corresponded with decreased

buying strength and that sellers were driving the price momentum in

the market. Related Reading: Bitcoin Loses $20,000 Grip, Extends

Consolidation For 2nd Straight Day The technical indicators for the

Solana price pointed towards a mixed signal. Some indicators

indicated the onset of positive price action while the other ones

continued to remain negative. Moving Average Convergence Divergence

signals the market’s momentum and change in price action. The MACD

underwent a bearish crossover and pointed towards a sell signal for

the coin. Chaikin Money Flow is responsible for measuring capital

inflows and outflows at a given point in time. CMF was peeking

above the half-line, which showed that capital inflows were more

than outflows at the time of writing. Related Reading: Solana (SOL)

Heats Up 7% In Last 24 Hours As Helium Eyes Merge Featured image

from GOBankingRates, Chart: TradingView.com

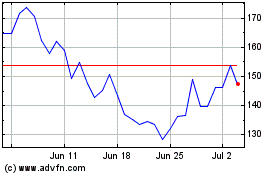

Solana (COIN:SOLUSD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Solana (COIN:SOLUSD)

Historical Stock Chart

From Sep 2023 to Sep 2024