Global Stocks Jump, Led by China Rebound

August 12 2019 - 5:10AM

Dow Jones News

By Avantika Chilkoti

-- Chinese stocks rise as yuan's slow devaluation continues

-- European markets climb, led by Germany

Stocks across the globe rallied Monday, with Chinese markets

advancing by the most in over a month, following a roller-coaster

week in which U.S.-China trade tensions shook asset prices across

the board.

The Shanghai Composite Index climbed 1.5% after the Chinese

central bank set the yuan at a stronger rate than traders had

expected -- 7.0211 to the dollar -- easing concerns of a quick

devaluation after President Trump last week accused China of

manipulating its currency.

The benchmark Stoxx Europe 600 index gained 0.9%, led by a 1%

advance in Germany's DAX.

The positive turn in markets comes despite fresh gloom around

U.S.-China trade talks, with Mr. Trump on Friday suggesting that

negotiations could break off.

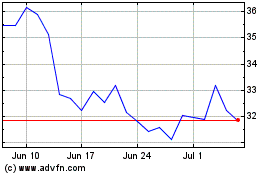

Among the biggest gainers in Europe was Tullow Oil, whose shares

rose 17% after the company said it had found more oil off the coast

of Guyana. Shares in ams AG, a 3-D sensor maker that supplies to

Apple, dropped 9% on reports that the Austrian company has put in a

bid to take over German lighting company Osram Licht, creating a

bidding war with private-equity buyers. Shares in Osram were up 10%

early Monday.

In Asia, amid a day of light trading with a number of regional

exchanges closed, Cathay Pacific fell 4.5%, putting the Hong Kong

airline on course to close at its lowest level in more than a

decade. China's aviation authority on Friday ordered the carrier to

remove all employees involved in the protests in Hong Kong from

flights to mainland China. The most closely watched class of shares

in Swire Pacific, the Hong Kong conglomerate that is Cathay's

largest shareholder, fell nearly 6%.

This week, investors will be watching for new consumer price

inflation estimates from the U.S. on Tuesday after the U.S. Federal

Reserve cited subdued inflation as one reason for cutting rates

last week. Consumer prices increased 0.1% between May and June.

"Given the low unemployment and strong consumer confidence in

the U.S., it's unlikely we get a recession any time soon," said

Patrick Spencer, managing director at U.S. investment firm Baird.

"It's a muddle-along economy then with markets continuing to trade

higher."

--William Horner, Steven Russolillo and Frances Yoon contributed

to this article.

Write to Avantika Chilkoti at Avantika.Chilkoti@wsj.com

(END) Dow Jones Newswires

August 12, 2019 04:55 ET (08:55 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

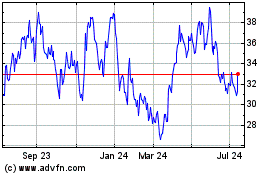

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Aug 2024 to Sep 2024

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Sep 2023 to Sep 2024