TIDMLLOY

RNS Number : 7929C

Lloyds Banking Group PLC

21 October 2020

FOR DISTRIBUTION ONLY OUTSIDE THE UNITED STATES, ITS TERRITORIES

AND POSSESSIONS TO PERSONS OTHER THAN "U.S. PERSONS" (AS DEFINED IN

REGULATION S OF THE UNITED STATES SECURITIES ACT OF 1933, AS

AMENDED (THE "SECURITIES ACT")). NOT FOR RELEASE, PUBLICATION OR

DISTRIBUTION IN OR INTO, OR TO ANY PERSON LOCATED OR RESIDENT IN,

ANY OTHER JURISDICTION WHERE IT IS UNLAWFUL TO RELEASE, PUBLISH OR

DISTRIBUTE THIS DOCUMENT.

21 October 2020

LLOYDS BANKING GROUP PLC

(i ncorporated w i th limited liability in Scotland registered

number 95000 )

(the "Issuer")

NOTICE OF RESULTS OF MEETINGS

t o t he ho lde rs o f the:

GBP1,494,392,000 7.625 per cent. Fixed Rate Reset Additional

Tier 1 Perpetual Subordinated Contingent Convertible Securities

Callable 2023 (ISIN: XS1043552188)

(the "PNC9 Securities")

GBP750,009,000 7.875 per cent. Fixed Rate Reset Additional Tier

1 Perpetual Subordinated Contingent Convertible Securities Callable

2029 (ISIN: XS1043552261)

(the "PNC15 Securities") (each a "Series" and together the

"Securities", and the holders thereof, the "Securityholders") of

the Issuer presently outstanding.

On 29 September 2020, the Issuer announced an invitation to

Eligible Securityholders of each Series described in the table

below to consent to the approval, by Extraordinary Resolution at

the relevant Meeting, of the modification of the Conditions

relating to the relevant Series as described in paragraph 1 of the

relevant Extraordinary Resolution as set out in the Consent

Solicitation Memorandum (as defined below) (the "Consent

Solicitations"). Meetings of th e Securityholders of the PNC9

Securities and the Securityholders of the PNC15 Securities (the

"PNC9 Meeting" and the "PNC15 Meeting" respectively, together th e

"Meetin gs") were held earlier today in connection with the Conse n

t Sol i c itations, and the Issuer now announces the results of

each Meeting.

The f ull ter ms and conditions o f the Consent Solicitations

were contained in the consent solicitation memorandum dated 29

September 2020 (the " Consent Solicitation Memorandum") prepared by

the Issuer. Capit a lised t e r ms used in this announcement but no

t defined have the meanings given to them in t he Consent Soli c it

a tion Memorandum.

ISIN/Common Code Outstanding Principal Outcome of Meeting

Amount

PNC9 Securities XS1043552188 / 104355218 GBP 1,494,392,000 Adjourned Meeting

PNC15 Securities XS1043552261 / 104355226 GBP 750,009,000 Adjourned Meeting

Respective Meetings of the PNC9 Securityholders and PNC15

Securityholders

The Meetings were held separately earlier today, and NOTICE IS

HEREBY GIVEN to the PNC9 Securityholders and the PNC15

Securityholders respectively th at, the quorum requir ed f o r the

respective Meetings were not obtained, a nd according l y each

Meeting has been ad j ourned as appropriate.

The ad journed Me e ting in respect of the:

(i) PNC9 Securities will commence on 5 November 2020 at 10 a.m.

(London time) (11 a.m. CET); and

(ii) PNC15 Securities will commence on 5 November 2020 at 10.15

a.m. (London time) (11.15 a.m. CET) or after the completion of the

PNC9 Securities Meeting (whichever is later)

I n the event tha t the Consent Conditi ons a r e satisfi ed at

each adjourned Meeting and the Extraordinary Resolution in respect

of each Series is passed, each Extraordinary Resolution constitutes

(amongst others) a direction by the Securityholders of each Series

to the Trustee to consent to and to concur in the amendments to the

Conditions of the relevant Series and any consequential or related

amendments to the transaction documents for the relevant Series in

order to change the Reset Reference Rate such that (i) the Reset

Reference Rate ceases to be a LIBOR linked mid-swap rate

(specifically being the mid-rate for a 5 year Sterling

fixed-for-floating interest rate swap (where the floating leg pays

6 month GBP LIBOR semi-annually)) and becomes a SONIA linked

mid-swap rate (specifically being the mid-rate for a 5 year

Sterling fixed-for-floating interest rate swap (where the floating

leg pays daily compounded SONIA annually)); (ii) the Reset

Reference Rate Adjustment is made to reflect the economic

difference between the LIBOR linked mid-swap rate and SONIA linked

mid-swap rate; (iii) the Margin applicable to each Series of

Securities remains unaltered by these changes; (iv) the fallbacks

relating to the Reset Reference Rate are amended; and (v) new

fallbacks are included in case a Benchmark Event occurs with

respect to the Reset Rate of Interest, as more fully set out in the

relevant Supplemental Trust Deed and as may be necessary to give

effect thereto .

Conse n t Instr uctions submitt ed p ri o r t o t he ti me and

dat e of this announcement shall remain effective. Notwithstand ing

the t e r ms of the Conse n t So li citations, the Issuer agrees

that any Securityholder may elect t o revoke any Conse n t Instruc

tion p rev ious l y submitted in respect of the relevant Consent

Solicitation prov ided such revocati on is validly made and

received by the Tabulation Agent on or prior to t he Expi r a ti on

Dea d li ne, occurring at 10 a.m. (London time) (11 a.m. (CET)) on

3 November 2020 in res pect of the ad j ourned Meetings.

No consent fee will be payable in connection with the Consent

Solicitations.

Capitalised terms used but not defined herein shall have the

meanings set out in the Consent Solicitation Memorandum.

Further information relating to the Consent Solicitations can be

obtained directly from the Solicitation Agent and the Tabulation

Agent:

Lloyds Bank Corporate Markets plc Lucid Issuer Services Limited

10 Gresham Street Tankerton Works

London EC2V 7AE 12 Argyle Walk

United Kingdom London WC1H 8HA

Telephone: +44 20 7158 1719/1726 United Kingdom

Attention: Liability Management Team Telephone: +44 20 7704 0880

Email: liability.management@lloydsbanking.com Attention: Arlind Bytyqi

Email:lloydsbank@lucid-is.com

DISCLAIMER This announcement must be read in conjunction with

the Consent Solicitation Me morandum. The Consent So licit a tion

Memorandu m contains important information which should be read

carefully before any decision is made with respect to the Consent

Solicitations. If any Securityholder is in any doubt as to the

action it should take or is unsure of the impact of the

implementation of the relevant Extraordinary Resolution, it is

recommended to seek its own financial and legal advice, including

in respect of any tax consequences, immediately from its broker,

bank manager, solicit o r, accountant, independent financial, tax

or legal adviser. Any individual or company whose Securities are

held on its behalf by a broker, dealer, bank, custodian, trust

company or other nominee must contact such entity if it wishes to

participate in the Consent Solicitation or otherwise participate in

the relevant adjourned Meeting.

The distribution of this announcement and the Consent

Solicitation Memorandum in certain jurisdictions may be restricted

by law. Persons into whose possession the Consent Solicitation

Memorandum comes are required to inform themselves about, and to

observe, any such restrictions.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROMPPGMAUUPUUBG

(END) Dow Jones Newswires

October 21, 2020 06:00 ET (10:00 GMT)

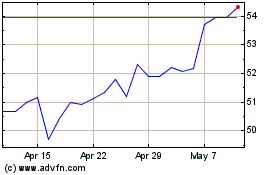

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Aug 2024 to Sep 2024

Lloyds Banking (LSE:LLOY)

Historical Stock Chart

From Sep 2023 to Sep 2024