Kier Group PLC AGM Trading Update (5500H)

November 16 2018 - 2:00AM

UK Regulatory

TIDMKIE

RNS Number : 5500H

Kier Group PLC

16 November 2018

KIER GROUP PLC

AGM TRADING UPDATE

Kier Group plc, a leading infrastructure services, buildings and

developments & housing group, announces its trading update

covering the period since 20 September 2018, prior to its Annual

General Meeting at 12 noon today.

Introduction

The Board is confident that the Group will meet its FY19

expectations, with the full-year results being weighted towards the

second half of the financial year.

Future Proofing Kier (FPK) programme

Since its launch, the FPK programme has made good progress with

respect to streamlining the business and improving cash

generation.

As anticipated, the costs of implementing the FPK programme in

the first half of the financial year are forecast to exceed the

realised savings by approximately GBP10m. The full-year FY19

position is still expected to be earnings and cashflow neutral.

Disposal

On 15 November 2018, Kier agreed the terms of the disposal of

its interest in KHSA Limited to Downer Group, the joint venture

partner, for a total cash consideration of up to AUS$43.7m

(c.GBP24m). The proceeds will service the reduction of the Group's

net debt.

Financial position

The Group continues to focus on operational cash generation and

net debt reduction, anticipating average monthly net debt of

approximately GBP390m for the first half of FY19, compared with

approximately GBP410m for the second half of FY18. The level of net

debt is increasingly a key focus for stakeholders in the industry

and the Board recognises the importance of a strong balance sheet

to take advantage of opportunities to underpin its future

performance.

Outlook

The FPK programme positions the Group well for an improvement in

profitability and cash generation, and its order books and

development pipelines remain strong.

- ENDS -

For further information, please contact:

Richard Mountain/Nick Hasell, FTI Consulting +44 (0)203 727 1340

Cautionary statement

This announcement does not constitute an offer of securities by

Kier Group plc (the "Company"). Nothing in this announcement is

intended to be, or intended to be construed as, a profit forecast

or a guide as to the performance, financial or otherwise, of the

Company or any of its subsidiaries (together, the "Group") whether

in the current or any future financial year. This announcement may

include statements that are, or may be deemed to be,

"forward-looking statements". By their nature, forward-looking

statements involve risks and uncertainties because they relate to

events and depend on circumstances that may or may not occur in the

future and may be beyond the Company's or the Group's ability to

control or predict. Forward-looking statements are not guarantees

of future performance. You are advised to read the section headed

"Principal risks and uncertainties" in the Company's Annual Report

and Accounts for the year ended 30 June 2018 for a further

discussion of the factors that could affect the Company's or the

Group's future performance and the industry in which it operates.

Other than in accordance with its legal or regulatory obligations,

the Company does not accept any obligation to update or revise

publicly any forward-looking statement, whether as a result of new

information, future events or otherwise.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTFKPDPCBDDADD

(END) Dow Jones Newswires

November 16, 2018 02:00 ET (07:00 GMT)

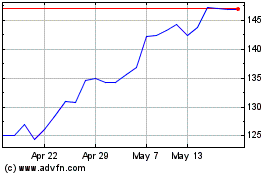

Kier (LSE:KIE)

Historical Stock Chart

From Mar 2024 to Apr 2024

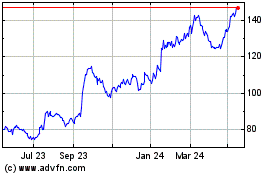

Kier (LSE:KIE)

Historical Stock Chart

From Apr 2023 to Apr 2024