Higher Prices Lift Glencore -- WSJ

August 11 2017 - 3:02AM

Dow Jones News

By Scott Patterson

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (August 11, 2017).

Swiss mining and trading giant Glencore PLC reported strong

first-half results on Thursday, benefiting from rising commodity

prices as it continues to recover from a downturn that sparked

widespread worries about its financial health and caused an

investor revolt.

Glencore, one of the world's largest coal, copper and zinc

producers, reported a $2.5 billion net gain for the first six

months through June, compared with a $369 million net loss in the

same period a year earlier. It posted a net gain of $1.4 billion

for all of 2016.

"Rising commodity prices have naturally had a very strong

favorable effect on our performance," Chief Executive Ivan

Glasenberg said Thursday.

Glencore shares fell 2% in early trading in London.

The earnings update closely follows other strong reports from

global diversified miners. Rio Tinto PLC reported a net profit of

$3.3 billion in the first half, up from $1.7 billion a year

earlier, fueled by a 25% gain in revenues. Anglo American PLC

reported first-half net income of $1.4 billion, compared with a net

loss of $813 million last year.

Glencore expects commodity markets to remain strong in the

second half of the year, saying it anticipates that its trading

division will report earnings before interest and taxes for 2017 in

the range of $2.4 billion to $2.7 billion, a $100 million increase

from its previous guidance.

"The second half has started well," said Chief Financial Officer

Steven Kalmin.

Mr. Glasenberg highlighted the rise of electric vehicles as a

growing trend that is driving demand for several of the firm's most

important commodities. "The potential large-scale roll out of

electric vehicles and energy storage systems looks set to unlock

material new sources of demand for enabling commodities, including

copper, cobalt, zinc and nickel," he said.

The company is the world's biggest producer of cobalt, a key

commodity in the lithium-ion batteries that power electric vehicles

and mobile phones. Cobalt prices were up 109% in the first half

from the same period last year, it said.

Glencore's first-half revenue rose 44% to $100 billion compared

with the same period a year ago, helped by rising and resilient

copper, coal and zinc prices. The firm's trading division posted

earnings before interest and taxes of $1.4 billion in the first

half of the year, a 13% gain from a year ago.

Net debt was $13.9 billion, down from $15.5 billion at the end

of 2016.

Corrections & Amplifications Steven Kalmin is Glencore's

chief financial officer. An earlier version of this article

incorrectly spelt Mr. Kalmin's name. (Aug. 10, 2017)

Write to Scott Patterson at scott.patterson@wsj.com

(END) Dow Jones Newswires

August 11, 2017 02:47 ET (06:47 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

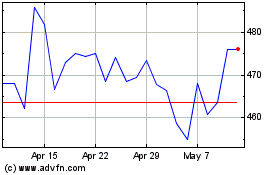

Glencore (LSE:GLEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

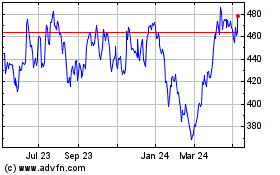

Glencore (LSE:GLEN)

Historical Stock Chart

From Apr 2023 to Apr 2024