Broadcom's Earnings Miss Estimate - Analyst Blog

April 24 2013 - 8:07AM

Zacks

Leading semiconductor manufacturer Broadcom

Corp. (BRCM) reported a GAAP net income of $191 million or

33 cents per share in first quarter 2013 versus $88 million or 15

cents in the year-ago quarter. The year-over-year increase in

earnings was primarily driven by a better-than-expected performance

by wireless baseband and connectivity chips. Despite more than a

two-fold rise, the reported earnings missed the Zacks Consensus

Estimate by a couple of cents.

Non-GAAP net income stood at $400 million or 65 cents per share in

the reported quarter compared to $387 million or 65 cents in the

year-earlier quarter.

Revenue

Total revenues for first quarter 2013 were $2.0 billion, up

11.1% year over year and ahead of the Zacks Consensus Estimate of

$1.9 billion. In terms of revenue composition, product revenues

came in at $1.9 billion in the reported quarter, while income from

the QUALCOMM Incorporated (QCOM) agreement came in

at $43 million and license revenues stood at $8 million.

In terms of end markets, Broadband Communications revenues were

$537 million, up 9% year over year, driven by growth in set-top

boxes. Mobile & Wireless segment revenues decreased 2%

sequentially to $996 million. Revenues from Infrastructure &

Networking segment climbed 6% year over year, driven by a growth in

large-scale cloud data center build-outs and optical transport

networking market.

Margins

Non-GAAP product gross margin remained relatively flat at 52.0% in

the reported quarter, while GAAP product margin came in at 49.4%,

up from 48.1% in the year-ago quarter.

GAAP research and development and selling, general and

administrative expenses were $794 million in first quarter 2013

compared to $725 million in the prior-year quarter.

Balance Sheet/Cash Flow

Broadcom generated $388 million in cash from operations in first

quarter 2013. The company ended the quarter with cash and cash

equivalents of $1.7 billion, marginally up from $1.6 billion at

year-end 2012. Long-term debt was fairly stable at $1.4

billion.

Guidance

Concurrent with the earnings release, management provided its

guidance for second quarter 2013. Total revenue is expected to be

around $2.1 billion. Product gross margin on a GAAP basis as well

as on a non-GAAP basis are expected to be down 50 basis points

sequentially in the second quarter of 2013. Research &

development and selling, general, and administrative expenses (both

GAAP and non-GAAP) are expected to be flat to up to $20 million

sequentially.

Broadcom presently has a Zacks Rank #4 (Sell). Other notable

companies in the sector that are worth mentioning include

Nitto Denko Corporation (NDEKY), carrying a Zacks

Rank #1 (Strong Buy), and Texas Instruments Inc.

(TXN), carrying a Zacks Rank #2 (Buy).

BROADCOM CORP-A (BRCM): Free Stock Analysis Report

NITTO DENKO CP (NDEKY): Get Free Report

QUALCOMM INC (QCOM): Free Stock Analysis Report

TEXAS INSTRS (TXN): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

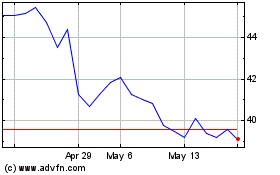

Nitto Denko (PK) (USOTC:NDEKY)

Historical Stock Chart

From Mar 2024 to Apr 2024

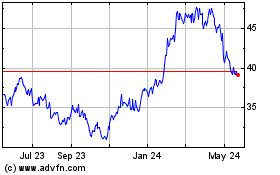

Nitto Denko (PK) (USOTC:NDEKY)

Historical Stock Chart

From Apr 2023 to Apr 2024