Transcontinental Realty Investors, Inc. (NYSE: TCI), a

Dallas-based real estate investment company, reported results of

operations for the second quarter ended June 30, 2016. TCI

announced today that the Company reported net income applicable to

common shares of approximately $4.4 million, or $0.51 per diluted

earnings per share, for the three months ended June 30, 2016, as

compared to a net loss applicable to common shares of $86 thousand,

or $0.01 per diluted earnings per share for the same period ended

2015.

“The Company’s strategic posture of maintaining a strong focus

on our multi-family portfolio has created valuable results. We are

committed to solidifying the portfolio and paying very close

attention to all operational details, while at the same time

maintaining our commitment to creating value. We believe our second

quarter 2016 operating results, combined with our recent

acquisitions, demonstrates yet another quarter of stabilized

performance for the Company. We believe the portfolio is well

positioned to deliver solid financial returns for the remainder of

2016,” said Danny Moos, the Company’s Chief Executive Officer and

President. “We are pleased that we are seeing continued

improvements in our operations from these endeavors and will

continue to adapt to market challenges with an eye on both

near-term economic challenges and long-term prospects as the real

estate market improves.”

Rental and other property revenues were $30.5 million for the

three months ended June 30, 2016. This represents an increase of

$6.7 million compared to the prior period revenues of $23.8

million. The change by segment is an increase in the apartment

portfolio of approximately $4.7 million and an increase in the

commercial portfolio of $2.0 million. During the three months ended

June 30, 2016, we recorded $2.5 million rental revenue for six

apartment communities purchased since June 30, 2015 and had a

decrease in rental revenue of $0.6 million for two apartment

communities sold since June 30, 2015, for a net increase of $1.9

million. In addition, we purchased seven apartment communities in

the second quarter of 2015, which produced rental revenue of $3.1

million and $1.3 million during the three months ended June 30,

2016 and 2015, respectively, for a net increase of $1.8 million.

The $2.0 million increase in revenues for the commercial portfolio

was primarily due to the acquisition of a commercial building in

Houston, Texas late in the second quarter of 2015.

Property operating expenses were $14.9 million for the three

months ended June 30, 2016. This represents an increase of $4.0

million compared to the prior period operating expenses of $10.9

million. The change by segment is an increase in the apartment

portfolio of $2.5 million and an increase in the commercial

portfolio of $1.5 million. The primary reason for the increase in

property operating expenses for the Company’s apartment portfolio

was the purchase of six communities with a total of 1,144 units,

net of two communities sold with a total of 360 units since June

30, 2015, for a net increase of 784 units. In addition, we

purchased seven apartment communities during the second quarter of

2015 which have a total of 1,261 units. Property operating expenses

for our commercial portfolio increased $1.5 million due to the

acquisition of an office building in Houston, Texas late in the

second quarter of 2015.

Mortgage and loan interest expense was $12.1 million for the

three months ended June 30, 2016. This represents an increase of

$3.9 million compared to the prior period expense of $8.2 million.

The change by segment was an increase of $2.8 million in the

apartment portfolio due to acquisitions, an increase of $1.8

million in the other portfolio primarily due to securing a new

mezzanine debt obligation in June 2015 and an increase in the

commercial portfolio of $0.1 million. These increases were

partially offset by a decrease in the land portfolio of $0.8

million due to the transfer of mortgage obligations related to land

sold.

Gain on sale of income-producing properties was $5.2 million for

the three months ended June 30, 2016. During 2016, the Company sold

one apartment community located in Irving, Texas to an independent

third party for a total sales price of $8.1 million which resulted

in a gain of $5.2 million. There were no sales of income-producing

properties during the three months ended June 30, 2015.

Gain on land sales was $1.7 million for the three months ended

June 30, 2016 compared to $1.2 million for the three months ended

June 30, 2015. In the current period we sold 12.2 acres of land for

a total sales price of $3.1 million and recorded a gain of $1.7

million. In 2015, we sold 9.7 acres of land for a total sales price

of $1.9 million and recorded a gain of $1.2 million.

About Transcontinental Realty Investors, Inc.

Transcontinental Realty Investors, Inc., a Dallas-based real

estate investment company, holds a diverse portfolio of equity real

estate located across the U.S., including office buildings,

apartments, shopping centers and developed and undeveloped land.

The Company invests in real estate through direct ownership, leases

and partnerships and invests in mortgage loans on real estate. For

more information, visit the Company’s website at

www.transconrealty-invest.com.

TRANSCONTINENTAL REALTY INVESTORS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS (unaudited)

Three Months Ended June 30,

Six Months Ended June 30, 2016

2015 2016 2015

Revenues: Rental and other property revenues (including $174

and $173 for the three months and $347 and $343 for the six months

ended 2016 and 2015, respectively, from related parties) $ 30,521 $

23,756 $ 59,424 $ 46,060

Expenses: Property operating

expenses (including $223 and $178 for the three months and $423 and

$331 for the six months ended 2016 and 2015, respectively, from

related parties) 14,919 10,929 29,882 21,793 Depreciation and

amortization 5,843 5,107 11,651 9,751 General and administrative

(including $753 and $727 for the three months and $1,502 and $1,547

for the six months ended 2016 and 2015, respectively, from related

parties) 1,604 1,278 3,213 3,045 Net income fee to related party 54

45 126 90 Advisory fee to related party 2,331

1,951 4,702 3,894 Total

operating expenses 24,751 19,310

49,574 38,573 Net operating income 5,770 4,446

9,850 7,487

Other income (expenses): Interest income

(including $3,274 and $2,748 for the three months and $6,008 and

$6,167 for the six months ended 2016 and 2015, respectively, from

related parties) 3,289 2,994 7,136 6,755 Other income 902 14 1,169

81 Mortgage and loan interest (including $165 and $190 for the

three months and $627 and $408 for the six months ended 2016 and

2015, respectively, from related parties) (12,092 ) (8,216 )

(25,258 ) (18,401 ) Earnings (losses) from unconsolidated joint

ventures and investees - 10 (2 ) 43 Litigation expense -

(45 ) - (118 ) Total other

expenses (7,901 ) (5,243 ) (16,955 )

(11,640 ) Loss before gain on sale of income-producing properties,

gain on land sales, non-controlling interest, and taxes (2,131 )

(797 ) (7,105 ) (4,153 ) Gain on sale of income-producing

properties 5,168 - 4,925 - Gain on land sales 1,719

1,250 3,370 4,126 Net

income (loss) from continuing operations before taxes 4,756 453

1,190 (27 ) Income tax benefit (expense) - (12

) 1 90 Net income from continuing

operations 4,756 441 1,191 63 Discontinued operations: Net income

(loss) from discontinued operations - (34 ) 3 258 Income tax

expense (benefit) from discontinued operations -

12 (1 ) (90 ) Net income (loss) from

discontinued operations - (22 ) 2

168 Net income 4,756 419 1,193 231 Net

(income) loss attributable to non-controlling interest (97 )

(281 ) (74 ) 12 Net income attributable

to Transcontinental Realty Investors, Inc. 4,659 138 1,119 243

Preferred dividend requirement (224 ) (224 )

(446 ) (446 ) Net income (loss) applicable to common shares

$ 4,435 $ (86 ) $ 673 $ (203 )

Earnings per

share - basic Net income (loss) from continuing operations $

0.51 $ (0.01 ) $ 0.08 $ (0.04 ) Net income from discontinued

operations - - -

0.02 Net income (loss) applicable to common shares $ 0.51

$ (0.01 ) $ 0.08 $ (0.02 )

Earnings per

share - diluted Net income (loss) from continuing operations $

0.51 $ (0.01 ) $ 0.08 $ (0.04 ) Net income from discontinued

operations - - -

0.02 Net income (loss) applicable to common shares $ 0.51

$ (0.01 ) $ 0.08 $ (0.02 ) Weighted average

common shares used in computing earnings per share 8,717,767

8,717,767 8,717,767 8,717,767 Weighted average common shares used

in computing diluted earnings per share 8,717,767 8,717,767

8,717,767 8,717,767

Amounts attributable to

Transcontinental Realty Investors, Inc. Net income from

continuing operations $ 4,659 $ 160 $ 1,117 $ 75 Net income (loss)

from discontinued operations - (22 ) 2

168 Net income $ 4,659 $ 138 $

1,119 $ 243

TRANSCONTINENTAL REALTY

INVESTORS, INC. CONSOLIDATED BALANCE SHEETS

June 30, December 31,

2016 2015 (unaudited) (dollars in

thousands, except share and par value amounts) Assets

Real estate, at cost $ 993,060 $ 935,635 Real estate subject to

sales contracts at cost, net of depreciation 47,192 47,192 Less

accumulated depreciation (148,718 ) (138,808 ) Total

real estate 891,534 844,019 Notes and interest receivable:

Performing (including $67,829 in 2016 and $64,181 in 2015 from

related parties) 76,002 71,376 Less allowance for doubtful accounts

(including $1,825 in 2016 and 2015 from related parties)

(1,825 ) (1,825 ) Total notes and interest receivable 74,177

69,551 Cash and cash equivalents 19,953 15,171 Restricted cash

29,880 44,060 Investments in unconsolidated joint ventures and

investees 2,460 5,243 Receivable from related party 75,615 90,515

Other assets 39,741 41,645 Total assets

$ 1,133,360 $ 1,110,204

Liabilities and

Shareholders’ Equity Liabilities: Notes and interest payable $

800,398 $ 772,636 Notes related to real estate held for sale 376

376 Notes related to real estate subject to sales contracts 6,072

6,422 Deferred revenue (including $50,669 in 2016 and $50,645 in

2015 to related parties) 71,045 71,021 Accounts payable and other

liabilities (including $6,060 in 2016 and $5,845 in 2015 to related

parties) 29,667 34,694 Total

liabilities 907,558 885,149 Shareholders’ equity: Preferred

stock, Series C: $0.01 par value, authorized 10,000,000 shares;

issued and outstanding zero shares in 2016 and 2015. Series D:

$0.01 par value, authorized, issued and outstanding 100,000 shares

in 2016 and 2015 (liquidation preference $100 per share) 1 1 Common

stock, $0.01 par value, authorized 10,000,000 shares; issued

8,717,967 shares in 2016 and 2015; outstanding 8,717,767 shares in

2016 and 2015 87 87 Treasury stock at cost, 200 shares in 2016 and

2015 (2 ) (2 ) Paid-in capital 270,303 270,749 Retained earnings

(62,968 ) (64,087 ) Total Transcontinental Realty

Investors, Inc. shareholders' equity 207,421 206,748

Non-controlling interest 18,381 18,307

Total shareholders' equity 225,802 225,055

Total liabilities and shareholders' equity $ 1,133,360

$ 1,110,204

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160815006140/en/

Transcontinental Realty Investors, Inc.Investor

RelationsGene Bertcher,

800-400-6407investor.relations@transconrealty-invest.com

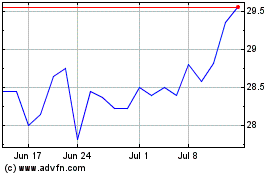

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

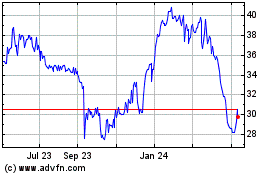

Transcontinental Realty ... (NYSE:TCI)

Historical Stock Chart

From Apr 2023 to Apr 2024