Charles Schwab Beats Revenue and Profit Expectations

January 16 2019 - 9:36AM

Dow Jones News

By Micah Maidenberg

Charles Schwab Corp. (SCHW) said net-interest revenue jumped in

the fourth quarter, more than offsetting a decline in some of the

fees the brokerage collects.

The company booked $2.67 billion in net revenue in the quarter,

up 19% from the year earlier and more than the $2.64 billion

analysts expected according to FactSet.

Net-interest revenue increased rose 42% to $1.63 billion, while

asset management and administrative fees fell 13% to $755 million.

Trading revenue rose to $206 million from $154 million.

Schwab said profit rose to $935 million, or 65 cents a share, in

the fourth quarter, from $597 million, or 41 a share, in the fourth

quarter of 2017. Analysts polled by FactSet predicted 64 cents a

share.

Pretax margin rose from to 45.3% from 42.5%.

Clients opened 380,000 new brokerage accounts in the quarter,

compared with 386,000 new accounts in the fourth quarter of

2017.

Stock markets were volatile at the end of last year, Schwab

said.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

January 16, 2019 09:21 ET (14:21 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

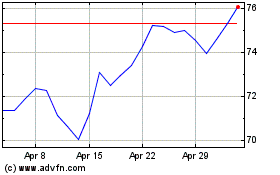

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Aug 2024 to Sep 2024

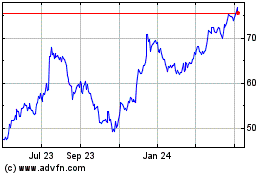

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Sep 2023 to Sep 2024