false000174033200017403322024-02-132024-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 13, 2024

RESIDEO TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38635 | | 82-5318796 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | |

16100 N. 71st Street, Suite 550 Scottsdale, Arizona | | 85254 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (480) 573-5340

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class: | | Trading Symbol: | | Name of each exchange on which registered: |

| Common Stock, par value $0.001 per share | | REZI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02.Results of Operations and Financial Condition.

On February 13, 2024, Resideo Technologies, Inc. (the “Company”) issued a press release announcing its fourth quarter and full year 2023 earnings, which is furnished herewith as Exhibit 99. The information furnished pursuant to this Item 2.02, including Exhibit 99, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities under that Section and shall not be deemed to be incorporated by reference into any filing of the Company under the Securities Act of 1933 or the Exchange Act.

Item 9.01Financial Statements and Exhibits.

(d)Exhibits

| | | | | |

| 99 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

Date: February 13, 2024 | | RESIDEO TECHNOLOGIES, INC. |

| | | |

| | By: | /s/ Jeannine J. Lane |

| | Name: | Jeannine J. Lane |

| | Title: | Executive Vice President, General Counsel and Corporate Secretary |

Exhibit 99

Resideo Announces Fourth Quarter and Full Year 2023 Financial Results

Products and Solutions fourth quarter gross margin of 39.5%, third consecutive quarter of year-over-year and sequential improvement

Operating cash flow of $440 million for 2023 and $263 million in fourth quarter

Repurchased 2.6 million shares during 2023 for $41 million as part of $150 million repurchase program

SCOTTSDALE, Ariz., February 13, 2024 – Resideo Technologies, Inc. (NYSE: REZI), a leading global manufacturer and developer of technology-driven products that provide critical home comfort, energy management, and safety and security solutions and a leading wholesale distributor of low-voltage security, life safety, audio visual, data com, and other product categories, today announced financial results for the fourth quarter and full year ended December 31, 2023.

Full Year 2023 Financial Highlights

•Net revenue of $6.24 billion, down 2% from $6.37 billion in 2022

•Income from operations of $547 million, including restructuring charges of $42 million, compared to $611 million in 2022, including $35 million of restructuring charges

•Fully diluted GAAP EPS of $1.42 and non-GAAP EPS of $1.58 compared to GAAP EPS of $1.90 and non-GAAP EPS of $1.99 in the prior year

•Cash provided by operating activities of $440 million, up from $152 million in the prior year

Fourth Quarter 2023 Financial Highlights

•Net revenue of $1.54 billion compared to $1.56 billion in the fourth quarter 2022

•Income from operations of $147 million compared to $98 million, including $35 million of restructuring charges in the fourth quarter 2022

•Fully diluted GAAP EPS of $0.56 and non-GAAP EPS of $0.48 compared to GAAP EPS of $0.26 and non-GAAP EPS of $0.25 in the fourth quarter 2022

•Cash provided by operating activities of $263 million, up from $139 million in the fourth quarter 2022

Management Remarks

“We finished 2023 on a strong note with results exceeding the midpoint of our fourth quarter outlook driven by continued improvement in order activity and gross margin in our Products and Solutions business,” commented Jay Geldmacher, Resideo’s President and CEO. “With a targeted focus on working capital, we significantly improved cash generation as the year progressed, ending 2023 with $440 million of operating cash flow. This performance, and the high level of free cash flow conversion over the past three years, highlights the strong cash generation capabilities of both of our businesses.”

“During 2023 we executed on a number of strategic initiatives including selling our Genesis Cable business, ramping new product introductions, significantly enhancing ADI’s digital capabilities, and reducing structural costs across the organization. Looking to 2024, we are focused on further expanding the margins and profitability of the business, both through ongoing portfolio optimization efforts and operational improvements.”

Products and Solutions 2023 Highlights

•Net revenue of $2.67 billion, down 4% compared to 2022

•Gross margin of 38.6%, down 10 basis points compared to 2022

•Operating profit of $495 million, including $27 million of restructuring charges, compared to $527 million operating profit and $29 million of restructuring charges in 2022

•Completed sale of Genesis Cable business for $86 million

Products and Solutions delivered net revenue of $2.67 billion in 2023, down 4% compared to 2022. Volume declined across product categories impacted by slower residential repair and remodel activity and inventory rebalancing in the HVAC channel. These headwinds were partially offset by strong price realization and a full year of First Alert revenue. The business continued to grow content per home within the new construction market, driven by expansion of First Alert products and deeper relationships with a growing number of home builders.

Gross margin for the year was 38.6%, compared to 38.7% in 2022. Gross margin reflects improving material costs, reduced freight, and lower direct labor spending, offset by factory deleveraging related to lower volumes. Gross margin improved sequentially in each quarter of 2023, reflecting input cost improvements and restructuring benefits. Operating profit for the year was $495 million or 18.5% of revenue, down from $527 million in 2022. Selling, general and administrative and research and development expenses were down $9 million and $2 million, respectively, compared to 2022 as cost savings were partially offset by inflation and targeted investment. Included in the year was $27 million in restructuring costs compared to $29 million in 2022.

On October 16, 2023, the Genesis Cable business was sold in a cash transaction for $86 million, subject to working capital and other closing adjustments. Genesis contributed $105 million to Products and Solutions revenue in 2023 prior to the sale and a pre-tax gain of $18 million was recognized in other expenses in the fourth quarter.

ADI Global Distribution Full Year 2023 Highlights

•Net revenue of $3.57 billion, flat when compared to 2022

•Gross margin of 18.7%, down 70 basis points compared to 2022

•Operating profit of $270 million, including $12 million of restructuring charges, compared to $313 million operating profit and $2 million of restructuring charges in 2022

ADI full year 2023 net revenue of $3.57 billion was down $17 million compared to 2022. ADI saw growth in the access control and audio-visual categories but continued slower demand within residential security category. ADI’s e-commerce channel grew 8% in 2023 compared to the prior year period, representing 20% of total ADI revenue, as the business continues to invest in the expansion of digital capabilities. Overall touchless revenue, which includes e-commerce, email order entry and EDI, was 38% of ADI’s total revenue for 2023.

Gross margin for the year was 18.7%, down 70 basis points compared to 2022. The reduction was driven by reduced inflationary pricing benefits that drove higher margin in 2022 and lower product line margin. Selling, general and administrative expenses were $375 million in 2023, up $2 million compared to prior period. Operating profit of $270 million for 2023 was down 14% from $313 million in 2022.

Full Year 2023 Financial Performance

Consolidated net revenue was $6.24 billion in 2023 compared with the prior year revenue of $6.37 billion. Gross profit margin was 27.2%, down 50 basis points compared to 27.7% in the prior year. Operating profit of $547 million in 2023 compared to the prior year’s operating profit of $611 million was down 10%. Total Corporate costs were $218 million, down $11 million from the prior year. Net income for 2023 was $210 million, or $1.42 per diluted common share, compared with $283 million, or $1.90 per diluted common share, in 2022. Non-GAAP EPS was $1.58 compared with $1.99 in the prior year.

Fourth Quarter 2023 Financial Performance

Consolidated net revenue was $1.54 billion in fourth quarter 2023 compared with the prior year fourth quarter revenue of $1.56 billion. Gross profit margin was 27.5%, down 10 basis points compared to 27.6% in the prior year fourth quarter. Operating profit of $147 million in fourth quarter 2023 compared to the prior year quarter’s operating profit of $98 million.

Total Corporate costs were $55 million, down $12 million from the prior year quarter. Net income for fourth quarter 2023 was $82 million, or $0.56 per diluted common share, compared with $39 million, or $0.26 per diluted common share, in the fourth quarter 2022. Non-GAAP EPS was $0.48 compared with $0.25 in the fourth quarter last year.

Cash Flow and Liquidity

Net cash provided by operating activities of $440 million in 2023 compared to $152 million in the prior year. The increase was driven by working capital improvements compared to the prior year period. At December 31, 2023, Resideo had cash and cash equivalents of $636 million and total outstanding debt of $1.41 billion.

As part of the $150 million share repurchase program authorized in early August 2023, Resideo repurchased 2.6 million shares during 2023 at a total cost of $41 million.

Outlook

The following table summarizes the Company’s current first quarter 2024 and updated full year 2024 outlook.

| | | | | | | | |

| ($ in millions, except per share data) | Q1 2024 | 2024 |

| Net revenue | $1,460 - $1,510 | $6,080 - $6,280 |

| | |

| | |

| | |

| Non-GAAP Adjusted EBITDA | $120 - $140 | $560 - $640 |

| Non-GAAP Earnings per share | $0.28 - $0.38 | $1.48 - $1.88 |

| Full Year Cash Provided by Operating Activities | At least $320 |

Conference Call and Webcast Details

Resideo will hold a conference call with investors on February 13, 2024, at 5:00 p.m. ET. An audio webcast of the call will be accessible at https://investor.resideo.com, where related materials will be posted before the call. A replay of the webcast will be available following the presentation. To join the conference call, please dial 888-660-6357 (U.S. toll-free) or 1-929-201-6127 (international), with the conference title “Resideo Fourth Quarter 2023 Earnings” or the conference ID: 7301399.

About Resideo

Resideo is a leading global manufacturer and developer of technology-driven products and components that provide critical comfort, energy management, and safety and security solutions to over 150 million homes globally. Through our ADI Global Distribution business, we are also a leading wholesale distributor of low-voltage security and life safety products for commercial and residential markets and serve a variety of adjacent product categories including audio visual, data com, wire and cable, and smart home solutions. For more information about Resideo, please visit www.resideo.com.

| | | | | | | | |

| Contacts: | | |

| | |

| Investors: | | Media: |

| Jason Willey | | Garrett Terry |

| Vice President, Investor Relations | | Corporate Communications Manager |

| investorrelations@resideo.com | | garrett.terry@resideo.com |

Forward-Looking Statements

This release contains “forward-looking statements.” All statements, other than statements of fact, that address activities, events or developments that we or our management intend, expect, project, believe or anticipate will or may occur in the future are forward-looking statements. Although we believe forward-looking statements are based upon reasonable assumptions, such statements involve known and unknown risks and uncertainties, which may cause the actual results or performance of the Company to differ materially from such forward-looking statements. Such risks and uncertainties include, but are not limited to, (1) our ability to achieve our outlook regarding the first quarter 2024 and full year 2024, (2) our ability to recognize the expected savings from, and the timing and impact of, our existing and anticipated cost reduction actions, and our ability to optimize our portfolio and operational footprint (3), the amount of our obligations and nature of our contractual restrictions pursuant to, and disputes that have or may hereafter arise under the agreements we entered into with Honeywell in connection with our spin-off, (4) risks related to our recently completed acquisitions including our ability to achieve the targeted amount of annual cost synergies and successfully integrate the acquired operations (including successfully driving category growth in connected offerings), (5) the Company’s share repurchase program, the timing, purchase price and number of additional shares purchased under such program, if at all, the sources of funds under the repurchase program and the impacts of the repurchase program, and (6) the other risks described under the headings “Risk Factors” and “Cautionary Statement Concerning Forward-Looking Statements” in our Annual Report on Form 10-K for the year ended December 31, 2023 and other periodic filings we make from time to time with the Securities and Exchange Commission. Forward-looking statements are not guarantees of future performance, and actual results, developments, and business decisions may differ from those envisaged by our forward-looking statements. Except as required by law, we undertake no obligation to update such statements to reflect events or circumstances arising after the date of this press release and we caution investors not to place undue reliance on any such forward looking statements.

Use of Non-GAAP Measures

This press release and accompanying earnings material includes certain “non-GAAP financial measures” as defined under the Securities Exchange Act of 1934 and in accordance with Regulation G. Management believes the use of such non- GAAP financial measures assists investors in understanding the ongoing operating performance of the Company by presenting the financial results between periods on a more comparable basis. Such non-GAAP financial measures should not be construed as an alternative to reported results determined in accordance with U.S. GAAP.

The Company discloses a tabular comparison of Non-GAAP Adjusted Net Income, Non-GAAP Adjusted Net Income per diluted common share, Non-GAAP Adjusted EBITDA, and Non-GAAP Adjusted Income from Operations, each of which is a non-GAAP measure, because management believes that they are instrumental in comparing the results from period to period. Non-GAAP Adjusted Net Income, Non-GAAP Adjusted Net Income per diluted common share, Non-GAAP Adjusted EBITDA, and Non-GAAP Adjusted Income from Operations should not be considered in isolation or as a substitute for Net Income, Net Income per diluted common share or Income from operations, as applicable, as reported on the face of our consolidated statements of operations. We define Non-GAAP Adjusted Net Income and Non-GAAP Adjusted Net Income per diluted common share as Net Income and Net income per diluted common share, respectively, as set forth on the face of our consolidated statements of operations, adjusted for the following items: pension settlement loss, restructuring and impairment expenses; acquisition/divestiture related costs, divestiture loss, litigation settlement, net of insurance proceeds, Tax Matters Agreement gain, foreign exchange transaction loss (income), and tax effect of applicable non-GAAP adjustments. We define Non-GAAP Adjusted EBITDA as Net Income as set forth on the face of our consolidated statements of operations, adjusted for the following items: provision for income taxes; depreciation and amortization; interest expense, net; stock-based compensation expense, pension settlement loss, restructuring and impairment expenses; acquisition/divestiture related costs, divestiture loss, litigation settlement, net of insurance proceeds, and Tax Matters Agreement gain, and foreign exchange transaction loss (income). We define Non-GAAP Adjusted Income from Operations as Income from operations as set forth on the face of our consolidated statements of operations, adjusted for the following items: stock-based compensation expense, restructuring and impairment charges, and acquisition/divestiture related costs. The Company provides outlook on a non-GAAP basis as we cannot predict certain elements which are included in reported GAAP results, including the impact of foreign exchange translation and pension settlement. A reconciliation of non-GAAP Adjusted EBITDA outlook to the corresponding GAAP financial measure (without the unavailable reconciling items) is included at the end of this release; however, please note that the unavailable reconciling items could materially impact the Company’s results. A reconciliation of non-GAAP earnings per share to the corresponding GAAP measure is not included because certain reconciling items are not available.

Table 1: SUMMARY OF FINANCIAL RESULTS (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q4 2023 | | YTD 2023 | | |

| (in millions) | Products and Solutions | | ADI Global Distribution | | Corporate | | Total Company | | Products and Solutions | | ADI Global Distribution | | Corporate | | Total Company | | | | | | | | |

| Net revenue | $ | 683 | | | $ | 854 | | | $ | — | | | $ | 1,537 | | | $ | 2,672 | | | $ | 3,570 | | | $ | — | | | $ | 6,242 | | | | | | | | | |

| Cost of goods sold | 413 | | | 700 | | | 1 | | | 1,114 | | | 1,640 | | | 2,902 | | | 4 | | | 4,546 | | | | | | | | | |

| Gross profit (loss) | 270 | | | 154 | | | (1) | | | 423 | | | 1,032 | | | 668 | | | (4) | | | 1,696 | | | | | | | | | |

| Research and development expenses | 26 | | | — | | | (1) | | | 25 | | | 108 | | | — | | | 1 | | | 109 | | | | | | | | | |

| Selling, general and administrative expenses | 95 | | | 92 | | | 54 | | | 241 | | | 379 | | | 375 | | | 206 | | | 960 | | | | | | | | | |

| Intangible asset amortization | 6 | | | 3 | | | 1 | | | 10 | | | 23 | | | 11 | | | 4 | | | 38 | | | | | | | | | |

| Restructuring and impairment expenses | — | | | — | | | — | | | — | | | 27 | | | 12 | | | 3 | | | 42 | | | | | | | | | |

| Income (loss) from operations | $ | 143 | | | $ | 59 | | | $ | (55) | | | $ | 147 | | | $ | 495 | | | $ | 270 | | | $ | (218) | | | $ | 547 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q4 2022 | | YTD 2022 | |

| (in millions) | Products and Solutions | | ADI Global Distribution | | Corporate | | Total Company | | Products and Solutions | | ADI Global Distribution | | Corporate | | Total Company | | | | | | | | |

| Net revenue | $ | 693 | | | $ | 867 | | | $ | — | | | $ | 1,560 | | | $ | 2,783 | | | $ | 3,587 | | | $ | — | | | $ | 6,370 | | | | | | | | | |

| Cost of goods sold | 427 | | | 701 | | | 1 | | | 1,129 | | | 1,707 | | | 2,891 | | | 6 | | | 4,604 | | | | | | | | | |

| Gross profit (loss) | 266 | | | 166 | | | (1) | | | 431 | | | 1,076 | | | 696 | | | (6) | | | 1,766 | | | | | | | | | |

| Research and development expenses | 30 | | | — | | | — | | | 30 | | | 110 | | | — | | | 1 | | | 111 | | | | | | | | | |

| Selling, general and administrative expenses | 105 | | | 92 | | | 61 | | | 258 | | | 388 | | | 373 | | | 213 | | | 974 | | | | | | | | | |

| Intangible asset amortization | 6 | | | 3 | | | 1 | | | 10 | | | 22 | | | 8 | | | 5 | | | 35 | | | | | | | | | |

| Restructuring and impairment expenses | 29 | | | 2 | | | 4 | | | 35 | | | 29 | | | 2 | | | 4 | | | 35 | | | | | | | | | |

| Income (loss) from operations | $ | 96 | | | $ | 69 | | | $ | (67) | | | $ | 98 | | | $ | 527 | | | $ | 313 | | | $ | (229) | | | $ | 611 | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Q4 2023 % change compared with prior period | | YTD 2023 % change compared with prior period |

| | Products and Solutions | | ADI Global Distribution | | Corporate | | Total Company | | Products and Solutions | | ADI Global Distribution | | Corporate | | Total Company |

| Net revenue | (1) | % | | (1) | % | | N/A | | (1) | % | | (4) | % | | — | % | | N/A | | (2) | % |

| Cost of goods sold | (3) | % | | — | % | | — | % | | (1) | % | | (4) | % | | — | % | | (33) | % | | (1) | % |

| Gross profit (loss) | 2 | % | | (7) | % | | — | % | | (2) | % | | (4) | % | | (4) | % | | (33) | % | | (4) | % |

| Research and development expenses | (13) | % | | N/A | | N/A | | (17) | % | | (2) | % | | N/A | | — | % | | (2) | % |

| Selling, general and administrative expenses | (10) | % | | 0 | % | | (11) | % | | (7) | % | | (2) | % | | 1 | % | | (3) | % | | (1) | % |

| Intangible asset amortization | — | % | | — | % | | — | % | | — | % | | 5 | % | | 38 | % | | (20) | % | | 9 | % |

| Restructuring and impairment expenses | N/A | | N/A | | N/A | | N/A | | (7) | % | | 500 | % | | (25) | % | | 20 | % |

| Income (loss) from operations | 49 | % | | (14) | % | | (18) | % | | 50 | % | | (6) | % | | (14) | % | | (5) | % | | (10) | % |

| | | | | | | | | | | | | | | |

|

|

Table 2: CONSOLIDATED STATEMENTS OF OPERATIONS (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| (in millions, except per share data) | December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Net revenue | $ | 1,537 | | | $ | 1,560 | | | $ | 6,242 | | | $ | 6,370 | |

| Cost of goods sold | 1,114 | | | 1,129 | | | 4,546 | | | 4,604 | |

| Gross profit | 423 | | | 431 | | | 1,696 | | | 1,766 | |

| Operating expenses: | | | | | | | |

| Research and development expenses | 25 | | | 30 | | | 109 | | | 111 | |

| Selling, general and administrative expenses | 241 | | | 258 | | | 960 | | | 974 | |

| Intangible asset amortization | 10 | | | 10 | | | 38 | | | 35 | |

| Restructuring and impairment expenses | — | | | 35 | | | 42 | | | 35 | |

| Total operating expenses | 276 | | | 333 | | | 1,149 | | | 1,155 | |

| Income from operations | 147 | | | 98 | | | 547 | | | 611 | |

Reimbursement Agreement expense (1) | 50 | | | 41 | | | 178 | | | 157 | |

| Other expenses, net | (19) | | | $ | (28) | | | (9) | | | (18) | |

| Interest expense, net | 15 | | | 15 | | | 65 | | | 54 | |

| Income before taxes | 101 | | | 70 | | | 313 | | | 418 | |

| Provision for income taxes | 19 | | | 31 | | | 103 | | | 135 | |

| Net income | $ | 82 | | | $ | 39 | | | $ | 210 | | | $ | 283 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Basic | $ | 0.56 | | | $ | 0.26 | | | $ | 1.43 | | | $ | 1.94 | |

| Diluted | $ | 0.56 | | | $ | 0.26 | | | $ | 1.42 | | | $ | 1.90 | |

| | | | | | | |

| Weighted average number of shares outstanding: | | | | | | | |

| Basic | 146 | | 146 | | 147 | | 146 |

| Diluted | 147 | | 149 | | 148 | | 149 |

(1) Represents the expense incurred pursuant to the Reimbursement Agreement, which has an annual cash payment cap of $140 million. The following table summarizes information concerning the Reimbursement Agreement:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| (in millions) | December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Accrual for Reimbursement Agreement liabilities deemed probable and reasonably estimable | $ | 50 | | | $ | 41 | | | $ | 178 | | | $ | 157 | |

| Cash payments made to Honeywell | (35) | | | (35) | | | (140) | | | (140) | |

| Accrual increase, non-cash component in period | $ | 15 | | | $ | 6 | | | $ | 38 | | | $ | 17 | |

Refer to Note 15 Commitments and Contingencies in our Form 10K for the period ended December 31, 2023 for further discussion.

Table 3: CONSOLIDATED BALANCE SHEETS (UNAUDITED)

| | | | | | | | | | | |

| (in millions, except par value) | December 31, 2023 | | December 31, 2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 636 | | | $ | 326 | |

| Accounts receivable, net | 973 | | | 1,002 | |

| Inventories, net | 941 | | | 975 | |

| Other current assets | 193 | | | 199 | |

| | | |

| Total current assets | 2,743 | | | 2,502 | |

| | | |

| Property, plant and equipment, net | 390 | | | 366 | |

| Goodwill | 2,705 | | | 2,724 | |

| Intangible assets, net | 461 | | | 475 | |

| Other assets | 346 | | | 320 | |

| | | |

| Total assets | $ | 6,645 | | | $ | 6,387 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 905 | | | $ | 894 | |

| Current portion of long-term debt | 12 | | | 12 | |

| Accrued liabilities | 608 | | | 640 | |

| | | |

| Total current liabilities | 1,525 | | | 1,546 | |

| | | |

| Long-term debt | 1,396 | | | 1,404 | |

| Obligations payable under Indemnification Agreements | 609 | | | 580 | |

| Other liabilities | 366 | | | 328 | |

| | | |

| Total liabilities | 3,896 | | | 3,858 | |

| | | |

| Stockholders’ equity | | | |

| Common stock, $0.001 par value: 700 shares authorized, 151 and 145 shares issued and outstanding at December 31, 2023, respectively, and 148 and 146 shares issued and outstanding at December 31, 2022, respectively | — | | | — | |

| Additional paid-in capital | 2,226 | | | 2,176 | |

| Retained earnings | 810 | | | 600 | |

| Accumulated other comprehensive loss, net | (194) | | | (212) | |

| Treasury stock at cost | (93) | | | (35) | |

| Total stockholders’ equity | 2,749 | | | 2,529 | |

| Total liabilities and stockholders’ equity | $ | 6,645 | | | $ | 6,387 | |

Table 4: CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| (in millions) | December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Cash Flows From Operating Activities: | | | | | | | |

| Net income | $ | 82 | | | $ | 39 | | | $ | 210 | | | $ | 283 | |

| Adjustments to reconcile net income to net cash in operating activities: | | | | | | | |

| | | | | | | |

| Depreciation and amortization | 27 | | | 25 | | | 98 | | | 94 | |

| Restructuring and impairment expenses | — | | | 35 | | | 42 | | | 35 | |

| Stock-based compensation expense | 8 | | | 14 | | | 44 | | | 50 | |

| Deferred income taxes | (28) | | | — | | | (28) | | | (3) | |

| | | | | | | |

| Other, net | (16) | | | (5) | | | (14) | | | 6 | |

| Changes in assets and liabilities, net of acquired companies: | | | | | | | |

| Accounts receivable, net | 28 | | | 70 | | | 19 | | | (72) | |

| Inventories, net | 36 | | | 7 | | | 32 | | | (122) | |

| Other current assets | 11 | | | 12 | | | 6 | | | (26) | |

| | | | | | | |

| Accounts payable | 32 | | | (48) | | | 18 | | | (43) | |

| Accrued liabilities | 80 | | | 4 | | | (34) | | | (21) | |

| Other, net | 3 | | | (14) | | | 47 | | | (29) | |

| | | | | | | |

| | | | | | | |

| Net cash provided by operating activities | 263 | | | 139 | | | 440 | | | 152 | |

| Cash Flows From Investing Activities: | | | | | | | |

| Capital expenditures | (31) | | | (51) | | | (105) | | | (85) | |

| Proceeds from sale of business | 86 | | | — | | | 86 | | | — | |

| Acquisitions, net of cash acquired | — | | | (5) | | | (16) | | | (665) | |

| Other investing activities, net | (9) | | | (1) | | | (9) | | | (14) | |

| | | | | | | |

| | | | | | | |

| Net cash provided by (used in) investing activities | 46 | | | (57) | | | (44) | | | (764) | |

| Cash Flows From Financing Activities: | | | | | | | |

| Common stock repurchases | (13) | | | — | | | (41) | | | — | |

| Proceeds from issuance of A&R Term B Facility | — | | | — | | | — | | | 200 | |

| Repayments of long-term debt | (3) | | | (3) | | | (12) | | | (12) | |

| | | | | | | |

| Other financing activities, net | (1) | | | (9) | | | (11) | | | (18) | |

| | | | | | | |

| | | | | | | |

| Net cash (used in) provided by financing activities | (17) | | | (12) | | | (64) | | | 170 | |

| Effect of foreign exchange rate changes on cash, cash equivalents and restricted cash | (25) | | | 4 | | | (24) | | | (8) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 267 | | | 74 | | | 308 | | | (450) | |

| Cash, cash equivalents and restricted cash at beginning of period | 370 | | | 255 | | | 329 | | | 779 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 637 | | | $ | 329 | | | $ | 637 | | | $ | 329 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

NON-GAAP FINANCIAL MEASURES AND RECONCILIATIONS

ADJUSTED NET INCOME PER DILUTED COMMON SHARE AND

NET INCOME COMPARISON

(Unaudited)

RESIDEO TECHNOLOGIES, INC.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

(in millions, except per share data) | December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| GAAP Net income applicable to common shares | $ | 82 | | | $ | 39 | | | $ | 210 | | | $ | 283 | |

| Restructuring and impairment expenses | — | | | 35 | | | 42 | | | 35 | |

| | | | | | | |

| Divestiture (gain) loss, net | (19) | | | 1 | | | (18) | | | 6 | |

| | | | | | | |

| Net periodic benefit (income) cost, excluding service costs | 3 | | | (39) | | | 9 | | | (39) | |

| | | | | | | |

| | | | | | | |

Other (1) | 1 | | | 1 | | | (1) | | | 16 | |

Tax effect of applicable non-GAAP adjustments (2) | 4 | | | — | | | (8) | | | (5) | |

| Non-GAAP Adjusted net income applicable to common shares | $ | 71 | | | $ | 37 | | | $ | 234 | | | $ | 297 | |

| | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| GAAP Net income per diluted common share | $ | 0.56 | | | $ | 0.26 | | | $ | 1.42 | | | $ | 1.90 | |

| Restructuring and impairment expenses | — | | | 0.23 | | | 0.28 | | | 0.24 | |

| | | | | | | |

| Divestiture (gain) loss, net | (0.13) | | | 0.01 | | | (0.12) | | | 0.04 | |

| | | | | | | |

| Net periodic benefit (income) cost, excluding service costs | 0.02 | | | (0.26) | | | 0.06 | | | (0.26) | |

| | | | | | | |

| | | | | | | |

Other (1) | 0.01 | | | 0.01 | | | (0.01) | | | 0.10 | |

Tax effect of applicable non-GAAP adjustments (2) | 0.03 | | | — | | | (0.05) | | | (0.03) | |

| Non-GAAP Adjusted net income per diluted common share | $ | 0.48 | | | $ | 0.25 | | | $ | 1.58 | | | $ | 1.99 | |

| | | | | | | |

(1)Other includes acquisition related costs, Tax Matters Agreement gain, foreign exchange transaction loss (income) and litigation settlement, net of insurance proceeds.

(2)We calculated the tax effect of non-GAAP adjustments by applying a flat statutory tax rate of 25% for the three and twelve months ended December 31, 2023 and December 31, 2022.

NON-GAAP FINANCIAL MEASURES AND RECONCILIATIONS

(Unaudited)

RESIDEO TECHNOLOGIES, INC.

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| (in millions) | December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Net revenue | $ | 1,537 | | | $ | 1,560 | | | $ | 6,242 | | | $ | 6,370 | |

| | | | | | | |

| GAAP Net income applicable to common shares | $ | 82 | | | $ | 39 | | | $ | 210 | | | $ | 283 | |

| Provision for income taxes | 19 | | | 31 | | | 103 | | | 135 | |

| GAAP Income before taxes | 101 | | | 70 | | | 313 | | | 418 | |

| Depreciation and amortization | 27 | | | 25 | | | 98 | | | 94 | |

| Interest expense, net | 15 | | | 15 | | | 65 | | | 54 | |

| Stock-based compensation expense | 8 | | | 14 | | | 44 | | | 50 | |

| Net periodic benefit (income) cost, excluding service costs | 3 | | | (39) | | | 9 | | | (39) | |

| Restructuring and impairment expenses | — | | | 35 | | | 42 | | | 35 | |

| | | | | | | |

| Divestiture (gain) loss, net | (19) | | | 1 | | | (18) | | | 6 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Other (1) | 1 | | | 1 | | | (1) | | | 16 | |

| Non-GAAP Adjusted EBITDA | $ | 136 | | | $ | 122 | | | $ | 552 | | | $ | 634 | |

| Non-GAAP Adjusted EBITDA as a % of net revenue | 8.8 | % | | 7.8 | % | | 8.8 | % | | 10.0 | % |

(1)Other includes acquisition related costs, Tax Matters Agreement gain, foreign exchange transaction loss (income) and litigation settlement, net of insurance proceeds.

NON-GAAP FINANCIAL MEASURES AND RECONCILIATIONS

(Unaudited)

PRODUCTS AND SOLUTIONS SEGMENT

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| (in millions) | December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Net revenue | $ | 683 | | | $ | 693 | | | $ | 2,672 | | | $ | 2,783 | |

| | | | | | | |

| GAAP Income from operations | $ | 143 | | | $ | 96 | | | $ | 495 | | | $ | 527 | |

| Stock-based compensation expense | 5 | | | 5 | | | 18 | | | 18 | |

| | | | | | | |

| Restructuring and impairment expenses | — | | | 29 | | | 27 | | | 29 | |

| Acquisition related costs | 4 | | | — | | | 5 | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Non-GAAP Adjusted Income from Operations | $ | 152 | | | $ | 130 | | | $ | 545 | | | $ | 574 | |

| | | | | | | |

| Depreciation and amortization | 20 | | | 19 | | | 71 | | | 69 | |

| | | | | | | |

| | | | | | | |

| Non-GAAP Adjusted EBITDA | $ | 172 | | | $ | 149 | | | $ | 616 | | | $ | 643 | |

| Non-GAAP Adjusted EBITDA as a % of net revenue | 25.2 | % | | 21.5 | % | | 23.1 | % | | 23.1 | % |

ADI GLOBAL DISTRIBUTION SEGMENT

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Twelve Months Ended |

| (in millions) | December 31, 2023 | | December 31, 2022 | | December 31, 2023 | | December 31, 2022 |

| Net revenue | $ | 854 | | | $ | 867 | | | $ | 3,570 | | | $ | 3,587 | |

| | | | | | | |

| GAAP Income from operations | $ | 59 | | | $ | 69 | | | $ | 270 | | | $ | 313 | |

| Stock-based compensation expense | 3 | | | 2 | | | 7 | | | 8 | |

| | | | | | | |

| Restructuring and impairment expenses | — | | | 2 | | | 12 | | | 2 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Non-GAAP Adjusted Income from Operations | $ | 62 | | | $ | 73 | | | $ | 289 | | | $ | 323 | |

| | | | | | | |

| Depreciation and amortization | 5 | | | 4 | | | 18 | | | 14 | |

| | | | | | | |

| | | | | | | |

| Non-GAAP Adjusted EBITDA | $ | 67 | | | $ | 77 | | | $ | 307 | | | $ | 337 | |

| Non-GAAP Adjusted EBITDA as a % of net revenue | 7.8 | % | | 8.9 | % | | 8.6 | % | | 9.4 | % |

NON-GAAP FINANCIAL MEASURES AND RECONCILIATIONS

(Unaudited)

RESIDEO TECHNOLOGIES, INC.

| | | | | | | | | | | | | | | | | | | | | | | |

| Q1 2024 | | Fiscal Year 2024 |

| (in millions) | Low | | High | | Low | | High |

| Net revenue | $ | 1,460 | | | $ | 1,510 | | | $ | 6,080 | | | $ | 6,280 | |

| | | | | | | |

| GAAP Net income applicable to common shares | $ | 37 | | | $ | 57 | | | $ | 210 | | | $ | 270 | |

| Provision for income taxes | 26 | | | 26 | | | 125 | | | 145 | |

| GAAP Income before taxes | 63 | | | 83 | | | 335 | | | 415 | |

| Depreciation and amortization | 25 | | | 25 | | | 100 | | | 100 | |

| Interest expense, net | 17 | | | 17 | | | 65 | | | 65 | |

| Stock-based compensation expense | 15 | | | 15 | | | 60 | | | 60 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Non-GAAP Adjusted EBITDA | $ | 120 | | | $ | 140 | | | $ | 560 | | | $ | 640 | |

| Non-GAAP Adjusted EBITDA as a % of net revenue | 8.2 | % | | 9.3 | % | | 9.2 | % | | 10.2 | % |

v3.24.0.1

Cover

|

Feb. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Entity Registrant Name |

RESIDEO TECHNOLOGIES, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38635

|

| Entity Tax Identification Number |

82-5318796

|

| Entity Address, Address Line One |

16100 N. 71st Street

|

| Entity Address, Address Line Two |

Suite 550

|

| Entity Address, City or Town |

Scottsdale

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85254

|

| City Area Code |

480

|

| Local Phone Number |

573-5340

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

REZI

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001740332

|

| Document Period End Date |

Feb. 13, 2024

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

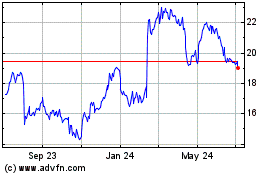

Resideo Technologies (NYSE:REZI)

Historical Stock Chart

From Mar 2024 to Apr 2024

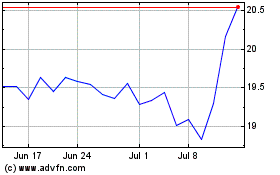

Resideo Technologies (NYSE:REZI)

Historical Stock Chart

From Apr 2023 to Apr 2024