Current Report Filing (8-k)

December 17 2019 - 6:05AM

Edgar (US Regulatory)

false0000075488000100498000010049802019-12-162019-12-160001004980pcg:PACIFICGASANDELECTRICCOMPANYMember2019-12-162019-12-160001004980pcg:FirstPreferredStockCumulativeParValue25PerShare550NonredeemableMemberpcg:NYSEAmericanLLCMember2019-12-162019-12-160001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare5SeriesARedeemableMember2019-12-162019-12-160001004980pcg:FirstPreferredStockCumulativeParValue25PerShare6NonredeemableMemberpcg:NYSEAmericanLLCMember2019-12-162019-12-160001004980pcg:FirstPreferredStockCumulativeParValue25PerShare5NonredeemableMemberpcg:NYSEAmericanLLCMember2019-12-162019-12-160001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare480RedeemableMember2019-12-162019-12-160001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare450RedeemableMember2019-12-162019-12-160001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare5RedeemableMember2019-12-162019-12-160001004980pcg:TheNewYorkStockExchangeMemberpcg:CommonStockNoParValueMember2019-12-162019-12-160001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare436SeriesARedeemableMember2019-12-162019-12-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: December 16, 2019

(Date of earliest event reported)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

Securities registered pursuant to Section 12(b) of the Act:

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this

chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

As previously disclosed, PG&E Corporation and Pacific Gas and Electric Company (the “Utility” and, together with

PG&E Corporation, the “Debtors”) entered into a Restructuring Support Agreement (the “RSA”) with the Official Committee of Tort Claimants (the “TCC”), the attorneys and other advisors and agents for holders of Fire Victim Claims (as defined in

the RSA) that are signatories to the RSA (each a “Consenting Fire Claimant Professional”), and certain funds and accounts managed or advised by Abrams Capital Management, LP and certain funds and accounts managed or advised by Knighthead Capital

Management, LLC (each a “Shareholder Proponent”). On December 12, 2019, the Debtors and Shareholder Proponents filed the Debtors’ and Shareholder Proponents’ Joint Chapter 11 Plan of Reorganization dated December 12, 2019 with the Bankruptcy Court

(the “Proposed Plan”).

On December 16, 2019, the Debtors entered into an amendment to the RSA (the “Amendment”) with the Requisite

Consenting Fire Claimant Professionals (as defined in the RSA, which includes the TCC) and the Shareholder Proponents. Previously, the RSA provided that it would automatically terminate if, on or before December 13, 2019, the Governor of the State

of California (the “Governor”) advised the Debtors that in his sole judgment the Proposed Plan and the restructuring transactions provided therein do not comply with Assembly Bill 1054, provided that such termination could not occur if the Debtors

had modified the Proposed Plan in a manner acceptable to the Governor in his sole discretion by the earlier of (i) the commencement of the Bankruptcy Court hearing to approve the RSA and (ii) December 17, 2019. The Amendment eliminates this automatic

termination provision. The Amendment also makes certain changes to the definition of “Aggregate Fire Victim Consideration.”

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by

reference to the Amendment, a copy of which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On December 16, 2019, PG&E Corporation issued a news release announcing the Amendment. A copy of this news

release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information set forth in this Item 7.01 of this Current Report on Form 8-K and in Exhibit 99.1 is being furnished

hereby and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into

any of the Debtors’ filings under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof and regardless of any general incorporation language in such filings, except to the extent expressly set forth

by specific reference in such filings. The filing of this Current Report on Form 8-K (including the exhibit hereto or any information included herein or therein) shall not be deemed an admission as to the materiality of any information herein that is

required to be disclosed solely by reason of Regulation FD.

Public Dissemination of Certain Information

PG&E Corporation and the Utility routinely provide links to the Utility’s principal regulatory proceedings with

the California Public Utilities Commission and the Federal Energy Regulatory Commission at http://investor.pgecorp.com, under the “Regulatory Filings” tab, so that such filings are available to investors upon filing with the relevant agency. PG&E

Corporation and the Utility also routinely post, or provide direct links to, presentations, documents, and other information that may be of interest to investors at http://investor.pgecorp.com, under the “Chapter 11,” “Wildfire Updates” and “News

& Events: Events & Presentations” tabs, respectively, in order to publicly disseminate such information. It is possible that any of these filings or information included therein could be deemed to be material information. The information

contained on such website is not part of this or any other report that PG&E Corporation or the Utility files with, or furnishes to, the Securities and Exchange Commission.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the

undersigned thereunto duly authorized.

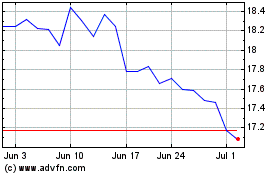

PG&E (NYSE:PCG)

Historical Stock Chart

From Aug 2024 to Sep 2024

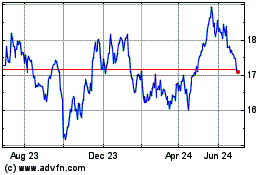

PG&E (NYSE:PCG)

Historical Stock Chart

From Sep 2023 to Sep 2024