Current Report Filing (8-k)

June 11 2019 - 5:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 7, 2019

___________

CARMAX, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

Virginia

(State or other jurisdiction

of incorporation)

|

1-31420

(Commission File Number)

|

54-1821055

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

12800 Tuckahoe Creek Parkway

Richmond, Virginia

(Address of principal executive offices)

|

23238

(Zip Code)

|

Registrant’s telephone number, including area code:

(804) 747-0422

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

KMX

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

|

|

|

|

|

|

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

|

The information described below under Item 2.03 is hereby incorporated by reference into this Item 1.01.

|

|

|

|

|

Item 1.02.

|

Termination of a Material Definitive Agreement.

|

|

On June 7, 2019, in connection with entering into a new unsecured revolving credit facility (as more fully described in Item 2.03 below), CarMax, Inc. (the “Company”) terminated its previous unsecured revolving credit facility and the related Credit Agreement dated August 24, 2015 (as amended from time to time), among the Company, CarMax Auto Superstores, Inc. (“CASI”), certain other subsidiaries of the Company, Bank of America, N.A., and the other lending institutions named therein (the “Previous Credit Agreement”). On entering the credit facility described below, the liability of the Company and its subsidiaries with respect to their obligations under the Previous Credit Agreement was discharged. The Previous Credit Agreement had been scheduled to terminate on August 24, 2020. No early termination penalties were incurred as a result of the termination.

|

|

|

|

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

|

On June 7, 2019, the Company, CASI, and certain other subsidiaries of the Company, entered into a Credit Agreement (the “2019 Credit Agreement” or “Agreement”) for an unsecured revolving credit facility with Bank of America, N.A., as a lender and as administrative agent, and the other lending institutions named therein. The revolving credit facility under the 2019 Credit Agreement replaced the revolving credit facility under the Previous Credit Agreement.

The Agreement provides for aggregate revolving borrowings of up to $1.45 billion, with an option to increase the aggregate commitment by up to $550 million by requesting an increase in commitments from the existing lenders or by adding additional lenders. Borrowings under the Agreement are available for working capital and general corporate purposes and all outstanding principal amounts borrowed under the Agreement will be due and payable on June 7, 2024, unless the Company exercises its option under the Agreement to extend the maturity date for up to two one-year periods and such extensions are approved by the required lenders. The borrowings and other obligations under the Agreement are guaranteed by the Company and certain of its subsidiaries.

The Company may elect interest rates on its revolving borrowings calculated either by reference to LIBOR or to a Base Rate, as defined in the Agreement, in each case plus a margin based on the Company’s consolidated leverage ratio. Interest will generally be payable on the first business day of each calendar month. A commitment fee, based on the Company’s consolidated leverage ratio, will accrue on the unused portion of the commitments under the facility.

The Agreement contains customary representations and warranties, conditions, and affirmative and negative covenants, including requirements to maintain a minimum coverage ratio and to avoid exceeding a maximum leverage ratio. The Agreement also provides for customary events of default, including non-payment of principal, interest or fees, violation of covenants, bankruptcy, change of control and cross-defaults to material indebtedness.

In addition to participation in the Agreement, certain of the lenders, and their respective affiliates, provide other services to the Company, CASI and certain other subsidiaries of the Company, from time to time, including cash management and treasury services, asset-backed securitization services, retail installment financing to the Company’s customers, derivative transactional services, and other corporate finance services, for which they receive customary fees and expenses.

The Agreement is attached hereto as Exhibit 10.1 and is hereby incorporated by reference into this Item 2.03. The foregoing description of the Agreement is qualified in its entirety by reference to the attached Exhibit.

|

|

|

|

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

(d) Exhibits

|

|

|

|

Credit Agreement, dated as of June 7, 2019, among CarMax Auto Superstores, Inc., CarMax, Inc., certain subsidiaries of CarMax named therein, Bank of America, N.A., as a lender and as administrative agent, and the other lending institutions named therein.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

CARMAX, INC.

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

Dated: June 11, 2019

|

|

By:

/s/ Eric M. Margolin

|

|

|

|

Eric M. Margolin

|

|

|

|

Executive Vice President,

|

|

|

|

General Counsel and Corporate Secretary

|

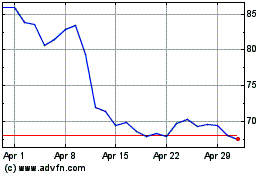

CarMax (NYSE:KMX)

Historical Stock Chart

From Aug 2024 to Sep 2024

CarMax (NYSE:KMX)

Historical Stock Chart

From Sep 2023 to Sep 2024