Express Cuts Guidance as Sales Growth Slumps

May 25 2016 - 8:20AM

Dow Jones News

Express Inc. slashed its guidance for the year and gave a bleak

outlook for the current quarter as the apparel chain reported

disappointing sales growth in the most recent quarter amid a tough

retail environment.

Shares tumbled 15% to $13.60 in light premarket trading.

The company said same-store sales, a measure that excludes

recently closed or opened stores, fell 3%. It had forecast a

low-single-digit rise.

Mall-based chains have been pressured in recent months, with

several retailers reporting dour results in the past few weeks amid

dwindling foot traffic and margin-eating promotions.

Still, Express has scaled back on promotional activity and

managed inventory levels. Chief Executive David Kornberg pointed to

increased merchandise margin and gross margin in the quarter.

Merchandise margin rose 20 basis points, on the company's

"disciplined approach to inventories and prudent use of

promotions," while gross margin improved 30 basis points.

"We believe that our product is on trend and we are providing

customers with engaging experiences," said Mr. Kornberg, who was

elevated to CEO last year amid a management team shake-up. "That

being said, our second-quarter and full-year guidance reflect the

challenges presented by the current retail environment."

For the full year, the company now expects adjusted earnings of

$1.41 to $1.54 a share, down from previous guidance for $1.56 to

$1.71. For the current quarter, the company said it anticipates

earnings of 15 cents to 19 cents a share, sharply below analysts'

projections for 29 cents. Same-store sales are expected to fall in

the mid-single digits.

For the quarter ended April 30, Express posted a first-quarter

profit of $12.9 million, or 16 cents a share, compared with $13.1

million, or 15 cents a share, a year earlier. The quarter was

dented by a $11.4 million expense related to the amendment to the

Times Square flagship store lease.

Excluding that charge, adjusted earnings rose to 25 cents from

22 cents, the low end of the company's projection for a range of 25

cents to 28 cents.

Revenue edged up 0.1% to $502.9 million. Analysts surveyed by

Thomson Reuters had anticipated $521 million.

E-commerce sales fell 1% to $77 million during the quarter.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

May 25, 2016 08:05 ET (12:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

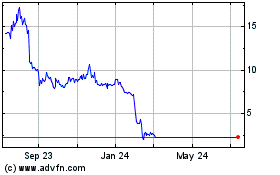

Express (NYSE:EXPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Express (NYSE:EXPR)

Historical Stock Chart

From Apr 2023 to Apr 2024