Caterpillar Sees Further Revenue Weakness--Update

January 28 2016 - 11:12AM

Dow Jones News

By Bob Tita

Caterpillar Inc. widened its anticipated sales decline for 2016

as the company swung to a fourth-quarter loss, hurt by expenses to

restructure operations as it deals with falling demand.

The maker of mining and construction equipment said depressed

prices for mined commodities, such as iron ore, lower oil prices

and weak economic conditions in developing countries are weighing

on sales of its bulldozers, excavators, giant dump trucks and

engines.

The Peoria, Ill.-based company now expects 2016 revenue to fall

by about 10% from 2015 to about $42 billion, which would be the

lowest level since 2010 and more than one-third below the company's

peak of $65.9 billion in 2012. The company in October predicted a

5% drop in revenue this year, but demand for equipment has

continued to deteriorate in recent months.

Fourth-quarter revenue came in lower than expected and was 23%

below the same period a year earlier, as equipment and engine sales

declined in all of the company's geographic markets. Caterpillar,

which is already planning to cut 10,000 jobs in the coming years,

said it would book $400 million in charges for restructuring

operations in 2016 to lower expenses after spending $908 million on

restructuring in 2015.

Restructuring expenses wiped out the company's fourth-quarter

profit. But excluding the restructuring costs, earnings per share

topped expectations.

"Cost management, restructuring action and operational execution

are helping the company while sales and revenue remain under

pressure," Chairman and Chief Executive Doug Oberhelman said.

Conditions in the global mining industry remain Caterpillar's

biggest obstacle. After spending $8.8 billion in 2011 to acquire

mining equipment company Bucyrus International Inc. to take

advantage of booming demand for commodities, Caterpillar has been

struggling with lower commodity prices for the past three

years.

Caterpillar said it expects sales of mining equipment this year

to fall 15% to 20% from 2015. Fourth-quarter sales from resource

industry equipment dropped 23% from a year earlier to $1.8 billion.

The business recorded a $105 million loss during the quarter after

earning $25 million a year earlier.

The company predicts that construction equipment sales will

decline 5% to 10% this year, following an 18% decline in fourth

quarter to $3.6 billion. Profit from the unit dropped 39% to $220

million.

Caterpillar forecast earnings of $4 a share for 2016, excluding

the restructuring costs. Analysts were expecting $3.48 a share in

adjusted earnings. Lower pension and post-employment benefit costs,

due to an accounting change, are expected to boost profit.

For the fourth quarter ended Dec. 31, Caterpillar swung to a

loss of $87 million, or 15 cents a share, compared with a

prior-year profit of $757 million, or $1.23 a share.

Excluding restructuring costs, which totaled about 89 cents a

share, the company reported earnings of 74 cents a share, topping

analysts' forecast of 69 cents a share. Total revenue, which

includes Caterpillar's finance unit, tumbled 23% to $11.03 billion.

Analysts had forecast $11.4 billion in revenue.

Caterpillar stock was recently up 2.5% at $59.85.

Chelsey Dulaney contributed to this article

Write to Bob Tita at robert.tita@wsj.com

(END) Dow Jones Newswires

January 28, 2016 10:57 ET (15:57 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

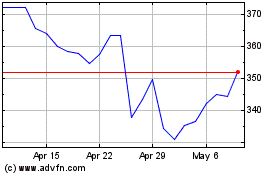

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

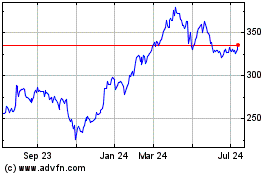

Caterpillar (NYSE:CAT)

Historical Stock Chart

From Apr 2023 to Apr 2024