Argan, Inc. (NYSE: AGX) (“Argan” or the “Company”)

today announced financial results for its third quarter ended

October 31, 2017. For additional information, please read the

Company’s Quarterly Report on Form 10-Q, which the Company intends

to file today with the U.S. Securities and Exchange Commission (the

“SEC”). The Quarterly Report can be retrieved from the SEC’s

website at www.sec.gov or from the Company’s website at

www.arganinc.com.

Summary Information (dollars in thousands, except per

share data (unaudited)):

October

31,

2017

2016

Change

%

Change

For the Quarter Ended: Revenues $ 232,945 $ 175,444 $ 57,501

33 % Gross profit 37,718 36,578 1,140 3 Gross profit margins 16.2 %

20.8 % (4.6 ) (22 ) Net income attributable to the stockholders of

the Company $ 17,229 $ 18,073 $ (844 ) (5 ) Diluted per share 1.09

1.16 (0.07 ) (6 ) EBITDA attributable to the stockholders of the

Company 30,275 27,024 3,251 12 Diluted per share 1.92 1.73 0.19 11

For the Nine Months Ended: Revenues $ 723,237 $

468,287 $ 254,950 54 % Gross profit 129,221 108,892 20,329 19 Gross

profit margins 17.9 % 23.3 % (5.4 ) (23 ) Net income attributable

to the stockholders of the Company $ 64,993 $ 49,977 $ 15,016 30

Diluted per share 4.11 3.23 0.88 27 EBITDA attributable to the

stockholders of the Company 105,443 79,295 26,148 33 Diluted per

share 6.68 5.12 1.56 30

As of:

October

31,2017

January

31,2017

Change

%

Change

Cash, cash equivalents and short-term investments $ 483,681 $

522,994

$

(39,313

)

(8

)%

Billings in excess of costs and estimated earnings 146,863 209,241

(62,378 ) (30 ) Backlog 509,000 1,011,000 (502,000 ) (50 )

Third Quarter Results:

Revenues increased to $233 million, up 33% compared to the prior

year quarter, primarily due to Gemma Power Systems (GPS) having

reached peak and post-peak construction activities on four large,

natural gas-fired power plants. The power industry services segment

continues to drive our financial results and represents 91% of

consolidated revenues for the quarter ended October 31, 2017. Gross

profit increased 3% to $38 million, primarily due to the increased

revenues, while gross margin percentage decreased from 20.8% to

16.2% compared to the prior year quarter, which primarily reflected

the achievement of final completion of two natural gas-fired power

plant projects in the prior year period, as well as the effects of

increased labor and subcontractor cost estimates in the current

period for certain projects.

Selling, general and administrative expenses increased $0.3

million to $10.1 million, primarily reflecting the cost of a larger

organization necessary to support increased operations and to

expand into new markets. However, these expenses decreased as a

percentage of revenues to 4.3% from 5.6% in the prior year quarter.

Other income increased $1.0 million quarter over quarter, due to

increased yields and short-term investment balances. There was no

net income attributable to non-controlling interests for the

current quarter compared to $1.2 million in the prior year quarter,

as activities on two large power plant projects were completed last

year by the joint ventures. The income tax expense and effective

rate were higher in the current quarter as compared to the prior

year quarter due to certain favorable adjustments in the prior year

quarter compared to unfavorable adjustments in the current quarter.

Exclusive of adjustments, the estimated annual effective income tax

is 36.7% for the current year compared to 35.2% at this time last

year, an increase primarily due to the decrease in non-controlling

interests. These factors resulted in net income attributable to our

stockholders decreasing 5% to $17.2 million, or $1.09 per diluted

share, compared to $18.1 million, or $1.16 per diluted share, for

the prior year quarter. EBITDA attributable to the stockholders for

the quarter ended October 31, 2017 increased 12% to $30.3 million,

or $1.92 per diluted share, from $27.0 million, or $1.73 per

diluted share, for the prior year quarter.

Nine Month Results:

For the nine months ended October 31, 2017, consolidated

revenues increased 54% to a record $723 million over the prior year

period, primarily due to the ramped-up, peak and post-peak

construction activities of GPS on four large, natural gas-fired

power plants. The power industry services segment represented 92%

of consolidated revenues for the nine months ended October 31,

2017. Gross profit increased 19% to $129 million, primarily due to

the increased revenues, while gross margin percentage decreased

from 23.3% to 17.9% compared to the prior year period, reflecting

the reason discussed above, the changes in the mix and progress of

various power plant projects and the differences in their

respective gross margins.

For the reasons discussed above, for the nine months ended

October 31, 2017, selling, general and administrative expenses

increased $6.0 million to $30.4 million, other income increased

$2.9 million and net income attributable to non-controlling

interests decreased 96%, or $6.4 million over the prior year

period. In addition, as described above, income tax expense

increased $10.6 million due to higher pre-tax income, an increased

estimated annual effective income tax and other adjustments. These

factors resulted in net income attributable to our stockholders for

the nine months ended October 31, 2017 increasing 30% to $65.0

million, or $4.11 per diluted share, compared to $50.0 million, or

$3.23 per diluted share, for the prior year period. EBITDA

attributable to the stockholders for the nine months ended October

31, 2017 increased 33% to $105.4 million, or $6.68 per diluted

share, from $79.3 million, or $5.12 per diluted share, for the

prior year period.

The Company’s balance sheet continues to strengthen. As of

October 31, 2017, cash, cash equivalents and short-term investments

totaled $484 million and net liquidity was $292 million. The

Company has no bank debt. The work performed in the quarter reduced

the contract backlog to $0.5 billion as of October 31, 2017,

including Atlantic Projects Company’s (APC) contract to perform

certain EPC services for the expansion of an existing gas-fired

power station in Spalding, England that was added to backlog during

the quarter.

Commenting on Argan’s results, Rainer Bosselmann, Chairman and

Chief Executive Officer, stated, “On a trailing twelve-month basis,

we have reached $930 million in revenues, $85 million in net income

and $137 million in EBITDA. Our fiscal year results just two years

ago were less than half of each of these amounts. This growth is a

direct result of our execution on major EPC projects in this

increasingly challenging market over the past two years. We are

proud of this growth and these results, and we are pleased to have

added some great projects in the United Kingdom to our backlog, but

we know we need to add many more. We remain hard at work in those

efforts as we endeavor to continue increasing long term shareholder

value.”

About Argan, Inc.

Argan’s primary business is providing a full range of services

to the power industry including the engineering, procurement and

construction of natural gas-fired power plants, along with related

commissioning, operations management, maintenance, project

development and consulting services, through its Gemma Power

Systems and Atlantic Projects Company operations. Argan also owns

SMC Infrastructure Solutions, which provides telecommunications

infrastructure services, and The Roberts Company, which is a fully

integrated fabrication, construction and industrial plant services

company.

Certain matters discussed in this press release may constitute

forward-looking statements within the meaning of the federal

securities laws and are subject to risks and uncertainties

including, but not limited to: (1) the continued strong

performance of our power industry services business; (2) the

Company’s ability to successfully and profitably integrate

acquisitions; and (3) the Company’s ability to achieve its

business strategy while effectively managing costs and expenses.

Actual results and the timing of certain events could differ

materially from those projected in or contemplated by the

forward-looking statements due to a number of factors detailed from

time to time in Argan’s filings with the SEC. In addition,

reference is hereby made to cautionary statements with respect to

risk factors set forth in the Company’s most recent reports on Form

10-K and 10-Q, and other SEC filings.

ARGAN, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF

EARNINGS

(In thousands, except per share data) (Unaudited)

Three Months EndedOctober

31,

Nine Months EndedOctober

31,

2017 2016 2017

2016 REVENUES $ 232,945 $ 175,444 $

723,237 $ 468,287 Cost of revenues 195,227 138,866

594,016 359,395

GROSS PROFIT

37,718 36,578 129,221 108,892 Selling, general and administrative

expenses 10,119 9,848 30,408 24,429 Impairment loss —

— — 1,979

INCOME FROM OPERATIONS

27,599 26,730 98,813 82,484 Other income, net 1,692

690 4,221 1,283

INCOME BEFORE INCOME

TAXES 29,291 27,420 103,034 83,767 Income tax expense

12,062 8,194 37,738 27,122

NET INCOME 17,229 19,226 65,296 56,645 Net income

attributable to non-controlling interests — 1,153

303 6,668

NET INCOME ATTRIBUTABLE TO THE

STOCKHOLDERS OF ARGAN, INC.

17,229 18,073 64,993

49,977

EARNINGS PER SHARE ATTRIBUTABLE TO THE

STOCKHOLDERS OF ARGAN, INC.

Basic $ 1.11 $ 1.19 $ 4.19 $ 3.34 Diluted $ 1.09 $

1.16 $ 4.11 $ 3.23

WEIGHTED AVERAGE NUMBER OF SHARES

OUTSTANDING

Basic 15,545 15,137 15,509

14,974 Diluted 15,793 15,601 15,796

15,490

CASH DIVIDENDS PER SHARE $ 1.00 $ 1.00

$ 1.00 $ 1.00

ARGAN, INC. AND

SUBSIDIARIES Reconciliations to EBITDA (In

thousands)(Unaudited) Three Months Ended October

31, 2017 2016 Net income $ 17,229 $ 19,226

Less EBITDA attributable to noncontrolling interests — (1,153 )

Income tax expense 12,062 8,194 Depreciation 726 525 Amortization

of purchased intangible assets 258 232

EBITDA attributable to the stockholders of the Company $ 30,275

$ 27,024

Nine Months Ended October 31,

2017 2016 Net income $ 65,296 $ 56,645 Less EBITDA

attributable to noncontrolling interests (303 ) (6,668 ) Income tax

expense 37,738 27,122 Depreciation 1,936 1,444 Amortization of

purchased intangible assets 776 752

EBITDA attributable to the stockholders of the Company $ 105,443

$ 79,295

Management uses EBITDA, a non-GAAP financial

measure, for planning purposes, including the preparation of

operating budgets and the determination of appropriate levels of

operating and capital investments. Management believes that EBITDA

provides additional insight for analysts and investors in

evaluating the Company's financial and operational performance and

in assisting investors in comparing the Company’s financial

performance to those of other companies in the Company’s industry.

However, EBITDA is not intended to be an alternative to financial

measures prepared in accordance with GAAP and should not be

considered in isolation from the Company’s GAAP results of

operations. Consistent with the requirements of SEC Regulation G,

reconciliations of the Company’s non-GAAP financial results from

net income are included in the presentations above and investors

are advised to carefully review and consider this information as

well as the GAAP financial results that are presented in the

Company’s SEC filings.

ARGAN, INC. AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (In thousands, except share and

per share data)

October 31,2017

January 31,2017

ASSETS

(Unaudited)

CURRENT ASSETS

Cash and cash equivalents $ 149,708 $ 167,198 Short-term

investments 333,973 355,796 Accounts receivable 83,681 54,836 Costs

and estimated earnings in excess of billings 10,197 3,192 Prepaid

expenses and other current assets 6,236 6,927

TOTAL CURRENT ASSETS 583,795 587,949 Property, plant

and equipment, net 15,257 13,112 Goodwill 34,913 34,913 Other

intangible assets, net 7,405 8,181 Deferred taxes 383 241 Other

assets 548 92

TOTAL ASSETS $

642,301 $ 644,488

LIABILITIES AND

EQUITY CURRENT LIABILITIES Accounts payable $

114,448 $ 101,944 Accrued expenses 31,005 39,539 Billings in excess

of costs and estimated earnings 146,863

209,241

TOTAL CURRENT LIABILITIES 292,316 350,724

Deferred taxes 1,788 1,195

TOTAL

LIABILITIES 294,104 351,919

COMMITMENTS AND CONTINGENCIES STOCKHOLDERS’

EQUITY

Preferred stock, par value $0.10 per share

– 500,000 shares authorized; no shares issued and outstanding

—

—

Common stock, par value $0.15 per share –

30,000,000 shares authorized; 15,551,952 and 15,461,452 shares

issued at October 31 and January 31, 2017, respectively; 15,548,719

and 15,458,219 shares outstanding at October 31 and January 31,

2017, respectively

2,333

2,319

Additional paid-in capital 141,766 135,426 Retained earnings

204,095 154,649 Accumulated other comprehensive losses (8 )

(762 )

TOTAL STOCKHOLDERS’ EQUITY 348,186 291,632

Noncontrolling interests 11 937

TOTAL EQUITY 348,197 292,569

TOTAL LIABILITIES AND EQUITY $ 642,301 $ 644,488

View source

version on businesswire.com: http://www.businesswire.com/news/home/20171206006165/en/

Argan, Inc.Company Contact:Rainer Bosselmann,

301-315-0027orInvestor Relations Contact:David Watson,

301-315-0027

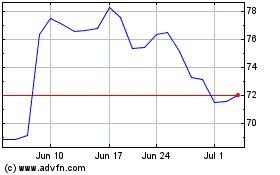

Argan (NYSE:AGX)

Historical Stock Chart

From Mar 2024 to Apr 2024

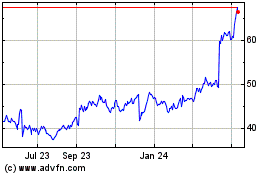

Argan (NYSE:AGX)

Historical Stock Chart

From Apr 2023 to Apr 2024