PROSPECTUS SUPPLEMENT NO. 2 Filed Pursuant to Rule 424(b)(3)

(to Prospectus dated November 21, 2023) Registration No. 333-268062

VINTAGE WINE ESTATES, INC.

27,633,275 Shares of Common Stock

__________________________________________

This prospectus supplement is being filed to update and supplement the information contained in the prospectus dated November 21, 2023 (as supplemented or amended from time to time, the “Prospectus”) with the information contained in our Current Report on Form 8-K, which was filed with the Securities and Exchange Commission on January 17, 2024. Accordingly, we have attached the Report to this prospectus supplement.

The Prospectus and this prospectus supplement relate to the resale from time to time by the selling securityholders named in the Prospectus or their permitted transferees of up to 27,633,275 shares of our common stock, no par value per share (“common stock”).

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Our common stock is listed on the Nasdaq Global Market (“Nasdaq”) under the symbol “VWE”. On January 16, 2024, the closing price of our common stock on Nasdaq was $0.50 per share.

Investing in our common stock involves risks that are described in the “Risk Factors” section beginning on page 3 of the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is January 17, 2024.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 16, 2024 |

Vintage Wine Estates, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Nevada |

001-40016 |

87-1005902 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

937 Tahoe Boulevard Suite 210 |

|

Incline Village, Nevada |

|

89451 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (877) 289-9463 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, no par value per share |

|

VWE |

|

The Nasdaq Stock Market LLC |

Warrants to purchase common stock |

|

VWEWW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05 Costs Associated with Exit or Disposal Activities.

On January 16, 2024, the Company's Board of Directors approved an organizational restructuring plan (the "Plan") to monetize assets and reduce non-core lower margin product and service offerings. As part of the Plan, there is a reduction in force affecting approximately 15% of the workforce, which is expected to result in annualized cost savings of $7.1 million. The Company expects the reduction in force to be substantially complete by the end of the third quarter of fiscal 2024.

Cash expenditures for the reduction in force are estimated to be $1.5 million, substantially all of which are related to employee severance and benefits costs. The expense will be accrued in the third quarter of fiscal 2024.

Item 2.05 of this report ("Item 2.05") contains "forward-looking statements" within the meaning established by the Private Securities Litigation Reform Act of 1995, which are identified by words such as "will," "expects," "estimated," and other similar words, expressions, and formulations. Item 2.05 contains forward-looking statements regarding the timing and scope of the reduction in force, the effect of the reduction in force on the Company's strategic initiatives and the amount and timing of the related charges. Many factors could affect the actual results of the reduction in force, and variances from the Company's current expectations regarding such factors could cause actual results of the reduction in force to differ materially from those expressed in these forward-looking statements. The Company presently considers the following to be a non-exclusive list of important factors that could cause actual results to differ materially from its expectations: estimates of employee headcount reductions; cash expenditures that may be made by the Company in connection with the reduction in force; and the number of outstanding unvested equity awards that will be canceled as a result of the reduction in force. A detailed discussion of these and other risks and uncertainties that could cause the Company's actual results to differ materially from these forward-looking statements is included in the documents that the Company files with the Securities and Exchange Commission on Forms 10-K, 10-Q and 8-K. These forward-looking statements speak only as of the date of this Report, and the Company does not undertake any obligation to revise or update such statements, whether as a result of new information, future events, or otherwise.

Item 8.01 Other Events.

On January 17, 2024, the Company issued a press release regarding the organizational restructuring plan. A copy of the press release is attached hereto as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

|

|

Exhibit Number |

Description |

99.1 |

Press Release of Vintage Wine Estates, Inc. dated January 17, 2024 |

104 |

Cover Page Interactive Data File (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Vintage Wine Estates, Inc. |

|

|

|

(Registrant) |

Date: |

January 17, 2024 |

By: |

/s/ Kristina Johnston |

|

|

|

Kristina Johnston

Chief Financial Officer |

News Release

News Release

937 Tahoe Boulevard, Suite 210 | Incline Village, NV 89451

For Immediate Release

Vintage Wine Estates Restructures Organization, Initiates Cost Cuts and

Simplifies Business Model

•Simplifies business with restructuring and reduction of non-core, lower margin product and service offerings

•To reduce workforce by approximately 15% for annualized savings of an estimated $7.1 million

•Retained Oppenheimer & Co. to accelerate monetization of non-core assets

•VWE to significantly narrow focus to a smaller, sustainable core business model with less complexity and stronger underlying economics

•Increasing focus on a core set of Super Premium+ priority brands while building a data-driven, consumer-centric culture and implementing a disciplined commercial planning process

INCLINE VILLAGE, NV, January 17, 2024– Vintage Wine Estates, Inc. (Nasdaq: VWE and VWEWW) (“VWE” or the “Company”), one of the top wine producers in the U.S., today announced that it is restructuring the business by seeking to monetize certain assets and exit certain non-core, lower margin product and service offerings. As a result, the Company will be reducing its workforce by approximately 15% for expected annualized savings of $7.1 million. Restructuring charges for the actions are expected to be approximately $1.5 million, which will be reflected in the third quarter of fiscal 2024 which ends March 31, 2024.

Seth Kaufman, President and Chief Executive Officer, commented “The complexity of our business has resulted in a disproportionately high-cost base. To drive margin improvement and generate cash we need to simplify beyond our product offerings and fundamentally reconstruct our business model. Getting from here to there starts by recognizing where our strengths lie and identifying the areas of the business in which we shouldn’t operate. The processes and requirements for estate wineries and wine making, production services and other custom crush offerings and several of our independent DTC operations are very dissimilar and require different capabilities. The actions we are taking now are the initial steps to streamlining our business model and operations as we develop a long-term strategy for building a select portfolio of nationally recognized brands.

“We need the resources to execute our plan and have engaged Oppenheimer & Co. to help accelerate our efforts to monetize certain assets that we do not see as part of the reimagined VWE. These include select luxury estates, some premium price-point and below wine brands as well as certain production services and some DTC platforms such as digitally-native brands and telemarketing. These efforts will help us pay down debt and we expect will enable investments to drive a step-change in consumer-centricity and commercial discipline.”

Restructuring to Simplify the Business

The Company plans to simplify its DTC operations to concentrate resources on certain Super Premium+ estate wineries. VWE also plans to monetize its Clos Pegase winery and tasting room in Napa and its Viansa property in Sonoma. It also will

Vintage Wine Estates Restructures Organization, Initiates Cost Cuts and Simplifies Business Model

January 17, 2024

Page 2 of 3

look to wind down certain custom crush and B2B services while evaluating its array of production services businesses and the contributions of each.

Its priority brands will include a number of Super Premium+ estate brands and the select lifestyle brands of Layer Cake, Bar Dog, Cherry Pie and ACE Cider. The Super Premium+ estate priority brands will include Girard, Kunde, BR Cohn, Laetitia and Firesteed, among others. Mr. Kaufman noted, “We expect this intense focus of our resources will enable us to create stronger brand desirability that can be leveraged to drive greater wholesale throughput across on-premise and retail, creating a marketing discipline which provides enhanced opportunities for our distribution partners.”

Mr. Kaufman concluded by saying, “As we reimagine VWE to become an omnichannel wine and cider company that offers the highest quality, Super Premium+ products in the U.S., we expect this transformation to result in a smaller company, but one that can grow sustainably while generating top-quartile industry margins. We are taking immediate actions now to move toward this vision and, as we advance our strategy, we will continue to communicate our efforts and progress.”

About Vintage Wine Estates, Inc.

Vintage Wine Estates (Nasdaq: VWE and VWEWW) is reimagining itself to become a leading wine and cider company that makes the highest quality, Super Premium+ wines and ciders that are accessible and approachable for consumers. Its vision is to be a growing, highly profitable omnichannel business with a consumer-centric culture. VWE has a family of estate wineries in Napa, Sonoma, California’s Central Coast, Oregon, and Washington State with valuable heritage and offerings. Through its Five-Point Plan and its strategy to reimagine the future of VWE, the Company is simplifying its offering to ACE Cider, three leading lifestyle brands (Bar Dog, Cherry Pie and Layer Cake) and key estate wines including B.R. Cohn, Firesteed, Girard, Kunde and Laetitia as well as several other heritage estate brands. Its primary focus is on the Super Premium+ segment of the U.S. wine industry defined as $15+ per bottle. The Company regularly posts updates and additional information at ir.vintagewineestates.com.

Forward-Looking Statements

Some of the statements contained in this press release are forward-looking statements within the meaning of applicable securities laws (collectively, “forward-looking statements”). Forward-looking statements are all statements other than those of historical fact, and generally may be identified by the use of words such as “seeking,” “expect,” “develop,” “will,” “should,” “plan,” or other similar expressions that indicate future events or trends. These forward-looking statements include, but are not limited to, statements regarding VWE’s business strategies; the ability of the restructuring efforts to drive margin improvement, generate cash, and generate top-quartile industry margins; the ability of Oppenheimer & Co. to accelerate the Company’s monetization efforts including select luxury estates, some premium price-point and below wine brands as well as certain production services and some DTC platforms such as digitally-native brands and telemarketing; the monetization of Clos Pegase winery and tasting room and Viansa property; winding down of certain custom crush and B2B services; the Company’s priority and lifestyle brands; the focus on resources to create stronger brand desirability; the ability to leverage stronger brand desirability to drive greater wholesale throughput across on premise and retail; the ability of simplifying the DTC operation to concentrate resources on Super Premium+ estate wineries; reductions in workforce and related annualized savings; the ability of monetization efforts to pay down debt and enable investments to drive a step-change in consumer-centricity and commercial discipline; the ability of the Company to create enhanced marketing discipline and opportunities for its distribution partners; and the size of the company and its ability to obtain sustainable growth. These statements are based on various assumptions, whether or not identified in this news release, and on the current expectations of VWE’s management. These forward-looking statements are not intended to serve as, and should not be relied on by any investor as, a guarantee of actual performance or an assurance or definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and may differ materially from those contained in or implied by such forward-looking statements. These forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the control of VWE. Factors that could cause actual results to differ materially from the results expressed or implied by such forward-looking statements include, among others: the Company’s ability to recognize benefits from any organizational restructuring and other cost savings actions, including expected results from the implementation of the Company’s Five-Point Plan, positive cash generation and asset monetization; the Company’s ability to regain compliance with the Nasdaq Listing Standards and maintain the listing of its securities on Nasdaq; risks related to ongoing legal proceedings;

Vintage Wine Estates Restructures Organization, Initiates Cost Cuts and Simplifies Business Model

January 17, 2024

Page 3 of 3

the Company’s limited experience operating as a public company and its ability to remediate its material weaknesses in internal control over financial reporting and to maintain effective internal control over financial reporting; the ability of the Company to retain key personnel; the effect of economic conditions on the industries and markets in which VWE operates, including financial market conditions, rising inflation, fluctuations in prices, interest rates and market demand; the effects of competition on VWE’s future business; the potential adverse effects of health pandemics, epidemics or contagious diseases on VWE’s business and the U.S. and world economy; declines or unanticipated changes in consumer demand for VWE’s products; disruption of supply or shortage of energy; VWE’s ability to adequately source grapes and other raw materials and any increase in the cost of such materials; the impact of environmental catastrophe, natural disasters, disease, pests, weather conditions and inadequate water supply on VWE’s business; VWE’s level of insurance against catastrophic events and losses; impacts from climate change and related government regulations; VWE’s significant reliance on its distribution channels, including independent distributors, particularly in its wholesale operations; a loss or significant decline of sales to important distributors, marketing companies, or retailers; risks associated with new lines of business or products; potential reputational harm to VWE’s brands from internal and external sources; decline in consumer sentiment to purchase wine through VWE’s direct-to-consumer channels; possible decreases in VWE’s wine quality ratings; integration risks associated with recent or future acquisitions; possible litigation relating to misuse or abuse of alcohol; changes in applicable laws and regulations and the significant expense to VWE of operating in a highly regulated industry; VWE’s ability to maintain necessary licenses; VWE’s ability to protect its trademarks and other intellectual property rights; risks associated with the Company’s information technology and ability to maintain and protect personal information; VWE’s ability to make payments on its indebtedness; risks that the Company is unable to meet the additional restrictions and obligations imposed by its amended credit agreement; and those factors discussed in the Company’s most recent Annual Report on Form 10-K and in subsequent Quarterly Reports on Form 10-Q or other reports filed with the Securities and Exchange Commission. There may be additional risks including other adjustments that VWE does not presently know or that VWE currently believes are immaterial that could also cause actual results to differ from those expressed in or implied by these forward-looking statements. In addition, forward-looking statements reflect VWE’s expectations, plans or forecasts of future events and views as of the date and time of this news release. VWE undertakes no obligation to update or revise any forward-looking statements contained herein, except as may be required by law. Accordingly, undue reliance should not be placed upon these forward-looking statements.

###

Contacts:

|

Deborah K. Pawlowski

Kei Advisors LLC

dpawlowski@keiadvisors.com

Phone: 716.843.3908 |

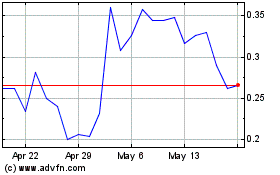

Vintage Wine Estates (NASDAQ:VWE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Vintage Wine Estates (NASDAQ:VWE)

Historical Stock Chart

From Apr 2023 to Apr 2024