0001597313FALSE00015973132023-07-172023-07-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_________________________________________________

FORM 8-K

_________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 17, 2023

_________________________________________________

ViewRay, Inc.

(Exact name of Registrant as Specified in Its Charter)

_________________________________________________

| | | | | | | | |

| Delaware | 001-37725 | 42-1777485 |

(State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

1099 18th Street, Suite 3000, Denver, Colorado 80202

(Address of Principal Executive Offices, Zip Code)

Registrant’s Telephone Number, Including Area Code: (440) 703-3210

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

_________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.01 | | VRAY | | The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On July 17, 2023, ViewRay, Inc. (the “Company”) was notified by The Nasdaq Stock Market (“Nasdaq”) that the Company’s common stock will be delisted from the Nasdaq Global Select Market as a result of (i) its filing for protection under Chapter 11 of the U.S. Bankruptcy Code, and (ii) concerns regarding the Company’s ability to sustain compliance with the $1.00 per share minimum bid price requirement for continued inclusion on Nasdaq based on Listing Rule 5450(a)(1).

Trading of the Company’s common stock will be suspended as of the open business on July 26, 2023, and Nasdaq will apply to the Securities and Exchange Commission to delist the common stock upon completion of all applicable procedures.

The Company anticipates that effective July 26, 2023, the common stock of the Company will commence trading on the over-the-counter (“OTC”) market. On the OTC market, shares of the Company’s common stock, which previously traded on the Nasdaq under the symbol “VRAY”, are expected to trade under the symbol “VRAYQ”. Quotes and related Company information are expected to be available at www.otcmarkets.com.

The Company will remain subject to all SEC rules and regulations applicable to reporting companies under the Securities Exchange Act of 1934.

Item 7.01. Regulation FD Disclosure.

Press Release

On July 21, 2023, the Company issued a press release with respect to the Nasdaq’s suspension of trading and commencement of delisting procedures. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Cooperation Agreement with Hudson Executive Capital

On July 19, 2023, Mr. Sai Nanduri, a Senior Investment Analyst employed by Hudson Executive Capital LP, informed the Board of Directors (the “Board”) of the Company that Mr. Nanduri was resigning from his position as an observer to the Board, effective immediately.

****

Cautionary Information Regarding Trading in the Company’s Securities

The Company cautions that trading in the Company’s securities during the pendency of the Company’s Chapter 11 proceedings is highly speculative and poses substantial risks. Trading prices for the Company’s common stock may bear little or no relationship to the actual recovery, if any, by holders of the Company’s common stock in such proceedings. Accordingly, the Company urges extreme caution with respect to existing and future investments in its common stock.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| VIEWRAY, INC. |

| | |

| Date: July 21, 2023 | By: | /s/ Sanket Shah |

| | Sanket Shah |

| | General Counsel and Corporate Secretary |

ViewRay® Announces Commencement of Nasdaq Delisting Proceedings: Common Stock Expected to Begin Trading on the OTC Markets

DENVER, CO, July 21, 2023— ViewRay, Inc. (the “Company”) (Nasdaq: VRAY) announced today that on July 17, it received a letter from the Listing Qualifications Department of the Nasdaq Stock Market LLC (“Nasdaq”). Nasdaq has determined that due to the Company’s voluntary petition for relief under Chapter 11 of the U.S. Bankruptcy Code, and concerns about the Company’s ability to sustain compliance with the $1.00 per share minimum bid price requirement for continued inclusion on Nasdaq based on Listing Rule 5450(a)(1), the Company’s securities will be delisted from the Nasdaq Stock Market. The Company does not intend to appeal Nasdaq’s determination.

Trading of the Company’s common stock will be suspended at the opening of business on July 26, 2023, and a Form 25-NSE will be filed with the Securities and Exchange Commission (“SEC”), which will remove the Company’s securities from listing and registration on The Nasdaq Stock Market. Once the delisting from Nasdaq takes effect, the Company’s common stock is expected to begin trading on the over-the counter (“OTC”) markets. On the OTC market, shares of the Company’s common stock, which previously traded on Nasdaq under the symbol “VRAY”, are expected to trade under the symbol “VRAYQ”.

The transition to the OTC markets will not affect the Company’s intention to continue to operate in the normal course while in chapter 11. The Company will remain subject to the public reporting requirements of the SEC following the transfer.

About ViewRay ViewRay, Inc. (Nasdaq: VRAY) designs, manufactures, and markets the MRIdian® MRI-Guided Radiation Therapy System. MRIdian is built upon a proprietary high-definition MR imaging system designed from the ground up to address the unique challenges and clinical workflow for advanced radiation oncology. Unlike MR systems used in diagnostic radiology, MRIdian's high-definition MR was purpose-built to address specific challenges, including beam distortion, skin toxicity, and other concerns that potentially may arise when high magnetic fields interact with radiation beams. ViewRay and MRIdian are registered trademarks of ViewRay, Inc.

Forward-Looking Statements This press release contains forward-looking statements within the meaning of Section 27A of the Private Securities Litigation Reform Act. Statements in this press release that are not purely historical are forward-looking statements. Such forward-looking statements include, among other things, ViewRay's financial guidance for the full year 2023, anticipated future orders, anticipated future operating and financial performance, treatment results, therapy adoption, innovation, and the performance of the MRIdian systems. Actual results could differ from those projected in any forward-looking statements due to numerous factors. Such factors include, among others, the ability to commercialize the MRIdian Linac System, demand for ViewRay's products, the ability to convert backlog into revenue, the timing of delivery of ViewRay's products, the timing, length, and severity of the COVID-19 pandemic, including its impacts across our businesses on demand, our operations and global supply chains, the results and other uncertainties associated with clinical trials, the ability to raise the additional funding needed to continue to pursue ViewRay's business and product development plans, the inherent uncertainties associated with developing new products or technologies, competition in the industry in which ViewRay operates, overall market conditions, risks attendant to the bankruptcy process, the impact of the expected delisting of the Company’s common stock from Nasdaq and the expected trading of the Company’s common stock on the OTC markets, employee attrition and the Company’s ability to retain senior management and other key personnel due to the distractions and uncertainties, the Company’s ability to maintain relationships with suppliers, customers, employees and other third parties and regulatory authorities as a result of the Chapter 11 proceedings; and the impact and timing of any cost-savings measures and related local law

requirements in various jurisdictions. For a further description of the risks and uncertainties that could cause actual results to differ from those expressed in these forward-looking statements, as well as risks relating to ViewRay's business in general, see ViewRay's current and future reports filed with the Securities and Exchange Commission, including its Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and its Quarterly Reports on Form 10-Q, as updated periodically with the Company's other filings with the SEC. These forward-looking statements are made as of the date of this press release, and ViewRay assumes no obligation to update the forward-looking statements, or to update the reasons why actual results could differ from those projected in the forward-looking statements, except as required by law.

Inquiries:

Investor Relations:

ViewRay, Inc.

1-844-MRIdian (674-3426)

Email: investors@viewray.com

v3.23.2

Cover

|

Jul. 21, 2023 |

| Cover [Abstract] |

|

| Entity Central Index Key |

0001597313

|

| Amendment Flag |

false

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 17, 2023

|

| Entity Registrant Name |

ViewRay, Inc.

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37725

|

| Entity Tax Identification Number |

42-1777485

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

1099 18th Street, Suite 3000

|

| Entity Address, City or Town |

Denver

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80202

|

| Local Phone Number |

703-3210

|

| Written Communications |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01

|

| Trading Symbol |

VRAY

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| City Area Code |

440

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

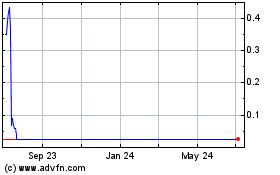

ViewRay (NASDAQ:VRAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

ViewRay (NASDAQ:VRAY)

Historical Stock Chart

From Apr 2023 to Apr 2024