Current Report Filing (8-k)

February 17 2022 - 10:27AM

Edgar (US Regulatory)

0001402328

false

0001402328

2022-02-15

2022-02-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form

8-K

Current Report Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

February 15, 2022

SUNSHINE

BIOPHARMA, INC.

(Exact name of small business issuer as specified

in its charter)

| Colorado |

000-52898 |

20-5566275 |

|

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer ID No.) |

6500 Trans-Canada Highway

4th Floor

Pointe-Claire, Quebec, Canada H9R0A5

(Address of principal executive offices)

(514) 426-6161

(Issuer’s Telephone Number)

Securities

registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Trading Symbol |

Name of Each Exchange on Which Registered |

| N/A |

N/A |

N/A |

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 1.01. |

Entry into a Material Definitive Agreement. |

On February 15, 2022, Sunshine Biopharma, Inc.

(the “Company”) entered into an underwriting agreement (the “Underwriting Agreement”) with Aegis Capital Corp.,

who acted as the sole underwriter (the “Underwriter”), in a firm commitment underwritten public offering (the “Offering”)

pursuant to which the Company agreed to sell to the Underwriter an aggregate of 1,882,353 units (each a “Unit”) for aggregate

gross proceeds of $8 million, prior to deducting underwriting discounts, commissions and other estimated offering expenses. The price

to the public in the Offering is $4.25 per Unit, before underwriting discounts and commissions. Each Unit consists of (i) one share of

the Company’s common stock (the “Common Stock”); and (ii) two warrants to purchase one share each of Common Stock at

an exercise price of $4.25 per whole share (the “Warrants”). The Common Stock and the Warrants comprising the Units will be

immediately separable upon issuance and will be issued separately. The Warrants are exercisable immediately, have an exercise price of

$4.25 per share and expire five years from the date of issuance. The Common Stock and Warrants were approved to list on the Nasdaq Capital

Market under the symbols "SBFM" and “SBFMW” and began trading there on February 15, 2022.

The offering closed on February 17, 2022.

The Units were offered and sold to the public

pursuant to the Company’s registration statement on Form S-1 (File No. 333-259394), initially filed by the Company with the Securities

and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”) on

September 9, 2021 and declared effective by the SEC on February 14, 2022.

The Underwriting Agreement contains customary

representations, warranties and agreements by the Company, customary conditions to closing, indemnification obligations of the Company

and the Representative, including for liabilities under the Securities Act of 1933, as amended, other obligations of the parties

and termination provisions. In addition, pursuant to the terms of the Underwriting Agreement and related “lock-up” agreements,

the Company, each director and executive officer of the Company, and certain stockholders have agreed not to offer for sale, issue, sell,

contract to sell, pledge or otherwise dispose of any of our Common Stock or securities convertible into Common Stock for a period of 180

days after February 15, 2022, the date of the final prospectus.

On February 17, 2022, the Company entered into

a warrant agency agreement (the “Warrant Agency Agreement”) with Equiniti Trust Company (“Equiniti”), to serve

as the Company’s warrant agent for the Warrants. Upon the closing the Warrants will be issued by Equiniti.

The foregoing description of the Underwriting

Agreement, the Warrants and the Warrant Agency Agreement are not complete and are qualified in their entirety by reference to the full

text of the Underwriting Agreement, the Warrant and the Warrant Agency Agreement, which are filed as exhibits to this Current Report on

Form 8-K and are incorporated by reference herein.

On February 15, 2022, the Company issued a press

release announcing the pricing of the Offering. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated herein

by reference.

On February 17, 2022, the Company issued a press

release announcing the closing of the Offering. A copy of the press release is attached as Exhibit 99.2 hereto and is incorporated herein

by reference.

| Item 9.01 |

Financial Statements and Exhibits |

(b) Exhibits. The following exhibits are included

in this report:

| No. |

Description |

| 1.1 |

Underwriting Agreement between Sunshine Biopharma, Inc. and Aegis Capital Corp., dated February 15, 2022 |

| 4.1 |

Form of Warrant |

| 10.1 |

Warrant Agency Agreement between Sunshine Biopharma, Inc. and Equiniti Trust Company, dated February 17, 2022 |

| 99.1 |

Press Release, dated February 15, 2022 |

| 99.2 |

Press Release, dated February 17, 2022 |

| 104 |

Cover Page Interactive Data File (formatted in iXBRL) |

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Dated: February 17, 2022 |

SUNSHINE BIOPHARMA, INC. |

| |

(Registrant) |

| |

|

| |

By: /s/ Dr. Steve N. Slilaty |

| |

Dr. Steve N. Slilaty, Chief Executive Officer |

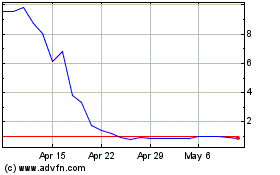

Sunshine Biopharma (NASDAQ:SBFM)

Historical Stock Chart

From Aug 2024 to Sep 2024

Sunshine Biopharma (NASDAQ:SBFM)

Historical Stock Chart

From Sep 2023 to Sep 2024