false000183003300018300332023-11-272023-11-270001830033us-gaap:CommonStockMember2023-11-272023-11-270001830033us-gaap:WarrantMember2023-11-272023-11-270001830033us-gaap:MemberUnitsMember2023-11-272023-11-27

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 27, 2023

| | | | | | | | |

| PureCycle Technologies, Inc. | |

| (Exact Name of Registrant as Specified in its Charter) | |

| | | | | | | | | | | | | | | | | | | | |

| Delaware | | 001-40234 | | 86-2293091 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | |

| | |

| | |

| | | | | | |

| | | | | | | | | | | | | | | | | |

| 5950 Hazeltine National Drive, | Suite 300, | Orlando | | 32822 |

| Florida | |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (877) 648-3565

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| | | | |

| Common Stock, par value $0.001 per share | | PCT | | The Nasdaq Stock Market LLC |

| Warrants, each exercisable for one share of common stock, $0.001 par value per share, at an exercise price of $11.50 per share | | PCTTW | | The Nasdaq Stock Market LLC |

| Units, each consisting of one share of common stock, $0.001 par value per share, and three quarters of one warrant | | PCTTU | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (Sec.230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Sec.240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.05 Costs Associated with Exit or Disposal Activities.

On December 1, 2023, PureCycle Technologies, Inc. (the “Company”) announced a reduction-in-force (“Separation”) of 22 employees, the majority of whom are not associated with the Company’s Ironton, Ohio facility. Following the Separation, which is expected to be completed on December 1, 2023, the Company will maintain approximately 160 employees. The reduction-in-force followed a zero based budgeting process at each function within the organization and was targeted toward optimizing the performance of the organization in the near-term. Consequently, the Company expects to be able maintain its historical strategic direction.

The Company currently expects severance costs, principally in the form of payroll expenses, to total approximately $1.0 million.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 27, 2023, the Company reached agreement with Jeff Fieler, 54, an independent member of the Board of Directors (“Board”), to serve as the Company’s interim Chief Financial Officer (“CFO”) while the Company conducts a search for a permanent CFO. Mr. Fieler’s appointment is effective as of December 1, 2023.

Mr. Fieler has served as an independent member of the Board since March 2021. Mr. Fieler is a Senior Advisor of Sylebra Capital Management since March 2023. Mr. Fieler also serves as the Chief Investment Officer, from June 2021, of Veztemida Capital Management, an asset manager. From June 2010 to March 2018, Mr. Fieler served as a Founder and Portfolio Manager of Sylebra Capital Management, a global investment manager, where he managed an active portfolio in the global technology, media, and telecommunications sectors with assets under management in excess of $1.5 billion. From May 2003 until June 2010 Mr. Fieler was at Coatue Management, a global investment manager, where he managed investment research and portfolio positions related to the Internet, Media, and Telecom industries. He served as partner from May 2003 until January 2007 and as a Senior Partner from January 2007 until June 2010, From March 2000 until May 2003, Mr. Fieler was a Managing Director and Senior Internet Analyst at Bear Stearns, an investment bank. Mr. Fieler has a Masters in Business Administration from the New York University Stern School of Business and a B.A. from Brown University.

There are no family relationships, as defined in Item 401 of Regulation S-K, between Mr. Fieler and any of the Company’s executive officers or directors or persons nominated or chosen to become directors or executive officers. There is no arrangement or understanding between Mr. Fieler and any other person pursuant to which Mr. Fieler was selected as interim CFO.

Other than as described in the Company’s Proxy Statement, filed with the Securities and Exchange Commission on March 31, 2023, in the section entitled “Certain Relationships and Related Party Transactions,” Mr. Fieler has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Pursuant to his appointment, the Company and Mr. Fieler executed an Independent Contractor Agreement (“ICA”). Pursuant to the terms of the ICA, Mr. Fieler’s appointment shall be month-to-month, with the ability for either party to terminate the appointment on not less than thirty (30) days’ notice without cause. Mr. Fieler will not receive any cash compensation for his service as Interim CFO. For the duration of Mr. Fieler’s service as interim CFO, Mr. Fieler will receive monthly compensation in the form of shares of the Company’s common stock equal to $42,500, with the number of shares to be based on the weighted average closing price of the Company’s common stock for the twenty (20) trading days prior to and including the last trading day of each month. Additionally, Mr. Fieler will receive a minimum bonus at the conclusion of his service as interim CFO of $360,000, pro-rated based on the number of months (relative to a full year) in which Mr. Fieler serves as interim CFO. The bonus may be increased up to a total of $720,000 (subject to pro-ration as described above) based on Mr. Fieler’s performance as interim CFO in the discretion of the Compensation Committee of the Board. Payment of the bonus, when earned, will be paid in shares, with the number of shares based on the weighted average closing price of the Company’s common stock for the twenty (20) trading days prior to and including the last trading day of the month in which Mr. Fieler’s service as interim CFO ends. Mr. Fieler will not be eligible for an annual long-term-incentive grant as his tenure as interim CFO is not expected to exceed twelve months. Mr. Fieler will continue to receive his cash and equity compensation as a member of the Board. The foregoing description of the ICA is not complete and is qualified in its entirety by reference to the full text of such ICA, which is attached hereto as Exhibit 10.1.

Concurrently with his appointment, Mr. Fieler ceased to be deemed an independent director, and resigned from his positions as Chair of the Board’s Nominating and Corporate Governance (“N&G”) Committee and member of the Audit and Finance Committee. Effective December 1, 2023, the Board made the following appointments to the N&G and Audit and Finance Committees:

a.Appointed Allen Jacoby as Chairman of the N&G Committee;

b.Appointed Fernando Musa as a member of the N&G Committee; and

c.Appointed Steven Bouck as a member of the Audit and Finance Committee.

Mr. Fieler will replace Lawrence C. Somma, who resigned his position with the Company to pursue other opportunities, effective December 1, 2023. In connection with his resignation, Mr. Somma has executed a separation agreement (the “Separation Agreement”)

dated December 1, 2023. Mr. Somma served as the Company’s CFO since November 2021. Mr. Somma’s decision to resign was not the result of any disagreement with the Company or its management. Pursuant to the Separation Agreement, Mr. Somma will receive a cash payment of $300,000, pro-rated vesting of all outstanding awards under the PureCycle Technologies, Inc. 2021 Equity and Incentive Compensation Plan through December 1, 2023 (with regard to performance units, those awards will be subject to the achievement of performance goals as determined by the Board), and vesting and acceleration of the remaining 120,791 restricted stock units that were part of a restricted stock unit grant awarded to Mr. Somma upon joining the Company in November 2021. The foregoing description of the Separation Agreement is not complete and is qualified in its entirety by reference to the full text of such Separation Agreement, which is attached hereto as Exhibit 10.2.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit Number | Description of Exhibit |

| 10.1 | |

| 10.2 | |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

PURECYCLE TECHNOLOGIES, INC.

By: /s/ Brad S. Kalter____________________

Name: Brad S. Kalter

Title: General Counsel and Corporate Secretary

Date: December 1, 2023

Exhibit 10.1

Independent Contractor Agreement

This Contractor Agreement (“Agreement”) is effective as of December 1, 2023 (“Effective Date”) and entered into between PureCycle Technologies, Inc., a Delaware corporation, including its subsidiaries and affiliates, (“PureCycle”) and Jeffrey R. Fieler, an independent contractor (“Contractor”). The parties agree as follows:

1.Services. During the term of this Agreement, Contractor will serve as PureCycle’s Interim Chief Financial Officer, and perform the duties and functions required of a chief financial officer of a publicly listed company including, but not limited to, oversight of the PureCycle’s financial reporting and controls, financial planning and analysis, internal audit, investor/shareholder relations, tax, budgeting, and capital raising strategies (collectively, the “Services”). Contractor will:

A.perform the Services in a professional and workmanlike manner in accordance with generally accepted industry standards, exercising the degree of skill and judgment normally exercised by recognized firms or individuals of similar stature and reputation performing services of a similar nature; and

B.comply with all applicable foreign, federal, state, and local laws, rules, and regulations and with any applicable PureCycle policies in connection with this Agreement.

2.Payment.

A.For each month Contractor is providing the Services, Contractor will receive monthly compensation of $42,500.00 paid in PureCycle common stock. The number of shares will be based on the weighted average closing price of the PureCycle common stock for the twenty (20) trading days prior to and including the last trading day of the month.

B.At the conclusion of the Agreement Contractor shall receive a minimum target bonus of $360,000 and, in the sole discretion of the Compensation Committee, Contractor’s bonus can be increased for a total bonus of up to $720,000. The calculation of the bonus shall be pro-rated based on the number of months Contractor provides the Services divided by 12 months (For example only Services provided for 3 months shall entitle Contractor to 25% of the recommended bonus: 3/12 X $360,000 = $90,000). The bonus shall be paid in PureCycle common stock. The number of shares will be based on the average weighted closing price of the PureCycle common stock for the twenty (20) trading days prior to and including the last trading day of the month in which the Agreement is terminated.

3.Term and Termination. The term of this Agreement shall commence as of the Effective Date and will continue on a month-to-month basis until terminated as follows:

A.Either party may terminate this Agreement at any time with or without cause upon thirty (30) days’ prior written notice to the other party. In the event of termination, PureCycle's obligation to Contractor will be limited to (i) the fees described in Section 2, and (ii) for all reasonable and documented costs and expenses incurred by Contractor directly attributable to winding down activities resulting from the termination. In the event of termination, Contractor will deliver to PureCycle all deliverables and other materials owned by PureCycle in Contractor’s possession or control relating to the chief financial officer role.

B.Upon any termination, PureCycle will only be obligated to pay for Services rendered through the effective date of termination, to the extent not otherwise subject to a good faith dispute, and provided that Contractor has complied with the foregoing delivery obligations.

4.Representations and Warranties. Contractor represents and warrants that: (i) he is either (a) an individual person or sole proprietorship or (b) a legal entity that is duly organized and validly existing in good standing under the laws of the state of its organization; (ii) if it is a legal entity, it has full power and authority and is authorized to enter into this Agreement and to perform all of its obligations under this Agreement; (iii) the execution, delivery, and performance of this Agreement does not conflict with any agreement, instrument, or understanding that is binding on Contractor nor violate any law, regulation, or order that applies to Contractor; (iv) it has all rights and permissions necessary to perform the Services and to make any grant of rights to PureCycle that is contemplated by this Agreement; and

(iv) the Services do not violate or infringe any copyright, patent, trade secret, trademark, trade name, right of privacy or publicity, or any other third party rights.

5.Relationship Between the Parties. The parties agree that Contractor will be an independent contractor, and that Contractor will not be considered an employee of PureCycle. Contractor understands and agrees that he shall not be entitled to participate in any PureCycle employee benefit plans or receive any fringe benefits, which are available only to employees of PureCycle.

6.Ownership. The results and proceeds of Contractor’s Services (collectively, the “Work Product”), including all US and foreign copyright, patent, trademark, trade secret, and all other intellectual property or proprietary rights (the “Intellectual Property Rights”), will be (i) deemed to have been specifically ordered and commissioned by PureCycle; (ii) considered a work made for hire from the moment of creation; and (iii) the sole and exclusive property of PureCycle without any need for accounting therefor. All elements of the Work Product that are protectable by copyright will be considered “works made for hire” under the United States Copyright Act, 17 U.S.C. § 101 et seq. To the extent that any Work Product does not constitute a work made for hire, or to the extent that ownership of any rights do not otherwise automatically vest in PureCycle, Contractor hereby assigns to PureCycle all right, title, and interest that Contractor may have or acquire in all Work Product, including all Intellectual Property Rights, and any related registrations or applications. Contractor agrees not to file for or register any patents, trademarks, or copyrights in connection with the Work Product. Upon completion of the Work Product (or PureCycle earlier request) Contractor must deliver to PureCycle the Work Product together with all copies of the Work Product. Contractor must provide (and shall cause its employees, service providers, and agents to provide) PureCycle with such information and know-how as necessary to use and utilize the Work Product and improvements or derivatives related to the Work Product. Upon PureCycle’s request, Contractor will provide such cooperation as PureCycle may reasonably request to confirm, obtain, register, transfer, and preserve in the name of PureCycle or its designee the Work Product and to assist in any proceeding or litigation relating to the Work Product.

7.Confidentiality. Confidentiality obligations will run concurrently with the existing confidentiality obligations Contractor maintains as a member of PureCycle’s Board of Directors.

8.Notices. Any notices provided under this Agreement must be in writing (including via electronic mail) and sent via (i) a nationally recognized courier; (ii) U.S. mail, return receipt requested, and are effective upon actual receipt (each with a return receipt notice) or via overnight courier with a tracking number or (iii) electronic mail. Either party may change its address or email by notice to the other.

PureCycle:

Attn: General Counsel

PureCycle Technologies, Inc.

5950 Hazeltine National Drive, Suite 300

Orlando, Florida 32822

with an email copy to: legaldepartment@purecycle.com

Contractor:

Jeffrey R. Fieler

PureCycle Technologies, Inc.

5950 Hazeltine National Drive

Suite 300

Orlando, Florida 32822

with an email copy to: jfieler@purecycle.com

9.Remedies. Contractor acknowledges and agrees that a breach, or attempted or threatened breach, of any obligation under this Agreement may cause immediate and/or irreparable harm to PureCycle for which monetary damages would not be a sufficient remedy, and that PureCycle shall be entitled to injunctive relief as a remedy for any such breach or attempted or threatened breach. The foregoing remedy will not be deemed to be the exclusive remedy of PureCycle but shall be in addition to all other remedies available at law or in equity.

10.Governing Law and Jurisdiction. This Agreement and any all disputes between the parties are governed by and must be construed in accordance with the laws of the state of Florida, without reference to conflicts of law principles. The parties agree to the exclusive jurisdiction and venue of the state and federal courts located in Orange County, Florida for any legal proceeding involving the Agreement or any dispute, controversy, or claim between PureCycle and Contractor. By execution and delivery of this Agreement, the parties to this Agreement submit to the jurisdiction of those courts. Contractor waives objection to venue or jurisdiction. In any action or proceeding to enforce rights under this Agreement, the prevailing party will be entitled to recover costs and attorneys’ fees.

11.Severability. If any provision of this Agreement is held to be illegal, invalid, or unenforceable in any respect, both parties agree that such term or provision shall be deemed to be modified to the extent necessary to permit its enforcement to the maximum extent permitted by applicable law.

12.Survival. Any paragraph, term, or provision, which contemplates performance or observance subsequent to any termination or expiration of this Agreement, shall survive the termination or expiration of this Agreement and continue in full force and effect for the specified period or, if no period is specified, indefinitely.

13.Entire Agreement and Amendments. Except for certain confidentiality and other obligations imposed upon Contractor related to his service on PureCycle’s Board of Directors, this Agreement is the complete and exclusive statement of the mutual understanding of the parties related to the subject matter of this Agreement and supersedes and cancels all previous written and oral agreements, communications and other understandings relating to the subject matter of this Agreement. The terms of this Agreement shall not be amended or modified in any respect whatsoever except by a written instrument executed by PureCycle and Contractor.

14.Other Terms. Any amendment to this Agreement shall be handled in accordance with Section 13, “Entire Agreement and Amendments.”

15.Miscellaneous. This Agreement is not assignable, transferable or sublicensable by Contractor except with PureCycle's prior written consent. PureCycle may transfer and assign any of its rights and obligations under this Agreement without consent.

16.Counterpart Execution. This Agreement may be executed in two or more counterparts, including via electronic signature (which shall, for the avoidance of doubt, include via DocuSign or similar platform), each of which shall be deemed an original, but all of which together shall constitute but one and the same instrument.

IN WITNESS WHEREOF, each party understands this Agreement and has it to be executed and delivered by their duly authorized representative(s).

| | | | | |

PureCycle Technologies, Inc. | Jeffrey R. Fieler |

| |

_/s/ Dustin Olson___________________________ | _/s/ Jeffrey R. Fieler_________________________ |

Signature | Signature |

| |

_Dustin Olson______________________________ | _Jeffrey R. Fieler____________________________ |

Name | Name |

| |

_Chief Executive Officer______________________ | _December 1, 2023__________________________ |

Title | Date |

| |

_December 1, 2023__________________________ | |

Date | |

Exhibit 10.2

SEPARATION AGREEMENT

This Separation Agreement (this “Separation Agreement”) between PureCycle Technologies, Inc. (the “Company”) and Lawrence C. Somma (“you” and similar words) sets forth certain terms of your separation from the Company, in order for you to receive certain separation payments and benefits, as set forth in detail below.

By signing this Separation Agreement, you and the Company agree as follows:

1.Status of Employment

You understand that you are no longer Chief Financial Officer of the Company effective as of December 1, 2023 (the “Separation Date”). You further agree that your cessation of employment on the Separation Date shall be treated as set forth in Paragraph 3 of this Separation Agreement. You also agree that, as of the Separation Date, you will terminate from all other positions you hold (if any) as an officer, employee or director of the Company and the Company’s subsidiaries and affiliates, and that you will promptly execute any documents and take any actions as may be necessary or reasonably requested by the Company to effectuate or memorialize your termination from all positions with the Company and its subsidiaries and affiliates.

2.Severance Benefits

In consideration for your (a) accepting and signing this Separation Agreement within 21 (twenty-one) days of receiving it and not revoking your acceptance within 7 (seven) days thereafter, (b) accepting and signing a general waiver and release of claims, substantially in the form attached hereto as Exhibit A (the “Release”), within 21 (twenty-one) days and not revoking your acceptance within 7 (seven) thereafter, and (c) full, ongoing compliance with your commitments set forth in the Separation Agreement and the Release, you will receive the payments and benefits as specified on Exhibit B attached hereto, all subject to applicable tax withholding (the “Severance Benefits”). The Severance Benefits will be in full satisfaction of any amounts due between the Company and you, the PureCycle Technologies, Inc. 2021 Equity and Incentive Compensation Plan (the “Equity Plan”), and other compensation arrangements of the Company. You acknowledge and agree that neither your cessation of service as Chief Financial Officer on the Separation Date shall constitute a resignation for “Good Reason” or a termination of employment by the Company without “Cause” for purposes of the PureCycle Technologies, Inc. Executive Severance Plan by and between you and the Company, dated November 20, 2021, the Equity Plan, the 2023 Short Term Incentive Plan, or any other severance or benefits plan operated by the Company. You further acknowledge and agree that certain portions of the Severance Benefits do not constitute benefits to which you would otherwise be entitled as a result of your termination of employment with the Company, that such portions of the Severance Benefits would not be due unless you sign the Release, and that such portions of the Severance Benefits constitute fair and adequate consideration for your promises and covenants set forth in this Separation Agreement and the Release.

3.Restrictive Covenants

By signing this Separation Agreement, you reaffirm that you will continue to abide by the covenants set forth in the Restrictive Covenants Agreement, dated as of November 20, 2021, between the Company and you, as well as the restrictive covenants contained in each of your equity awards issued under the Equity Plan (the “Restrictive Covenants Agreements”), which expressly survive the termination of your employment.

Notwithstanding anything in this Separation Agreement to the contrary, nothing in this Separation Agreement prevents you from providing, without prior notice to the Company, information to governmental authorities regarding possible legal violations or otherwise testifying or participating in any investigation or proceeding by any governmental authorities regarding possible legal violations, and for purpose of clarity you are not prohibited from providing information voluntarily to the Securities and Exchange Commission pursuant to Section 21F of the Securities Exchange Act of 1934, as amended.

No Company policy or individual agreement between the Company and you shall prevent you from providing information to government authorities regarding possible legal violations, participating in investigations, testifying in proceedings regarding the Company’s past or future conduct, engaging in any future activities protected under the whistleblower statutes administered by any government agency (e.g., EEOC, NLRB, SEC, etc.) or receiving a monetary award from a government-administered whistleblower award program for providing information directly to a government agency. The Company nonetheless asserts and does not waive its attorney-client privilege over any information appropriately protected by privilege. By executing this Separation Agreement you represent that, as of the date you sign this Separation Agreement, no claims, lawsuits, or charges have been filed by you or on your behalf against the Company or any of its legal predecessors, successors, assigns, fiduciaries, parents, subsidiaries, divisions or other affiliates, or any of the foregoing’s respective past, present or future principals, partners, shareholders, directors, officers, employees, agents, consultants, attorneys, trustees, administrators, executors or representatives. You acknowledge and agree that you have in a timely manner received or waived all applicable notices (if any) required under the Employment Agreement or the Severance Plan in connection with the termination of your employment with the Company. The Company agrees that this Separation Agreement does not extend to, release or modify any rights to indemnification or advancement of expenses to which you are entitled from the Company or its insurers under the Company’s certificate of incorporation, by-laws, or other corporate governing law or instruments or your indemnification agreement with the Company.

4.Limitations

Nothing in this Separation Agreement shall be binding upon the parties to the extent it is void or unenforceable for any reason, including, without limitation, as a result of any law regulating competition or proscribing unlawful business practices; provided, however, that to the extent that any provision in this Separation Agreement could be modified to render it enforceable under applicable law, it shall be deemed so modified and then enforced to the fullest extent allowed by law.

5.No Re-Employment

You understand that your employment with the Company terminates on the Separation Date. You agree that you will not seek or accept employment with the Company, including assignment to or on behalf of the Company as an independent contractor or through any third party, and the Company has no obligation to consider you for any future employment or assignment.

6.Review of Separation Agreement

This Separation Agreement is important. You are advised to review it carefully and consult an attorney before signing it, as well as any other professional whose advice you value, such as an accountant or financial advisor. If you agree to the terms of this Separation Agreement, sign in the space below where your agreement is indicated. The payments and benefits specified in this Separation Agreement are contingent on your (a) timely signing this Separation Agreement and (b) within seven (7) days of signing either or both documents, signing the Release and not revoking the Release timely.

7.Return of Property

You affirm that you will have returned within a reasonable time after the Separation Date, to the Company in reasonable working order all Company Property, as described more fully below. “Company Property” includes company-owned or leased motor vehicles, equipment, computers, supplies and documents. Such documents may include but are not limited to customer lists, financial statements, business plans, cost data, price lists, invoices, forms, passwords, electronic files and media, mailing lists, contracts, reports, manuals, personnel files, correspondence, business cards, drawings, employee lists or directories, lists of vendors, photographs, maps, surveys, and the like, including copies, notes or compilations made there from, whether such documents are embodied on “hard copies” or contained on computer disk or any other medium. You further agree that you will not retain any copies or duplicates of any such Company Property.

8.Future Cooperation

You agree that you shall, without any additional compensation, respond to reasonable requests for information from the Company regarding matters that may arise in the Company’s business. You further agree to fully and completely cooperate with the Company, its advisors and its legal counsel with respect to any litigation that is pending against the Company and any claim or action that may be filed against the Company in the future. Such cooperation shall include making yourself available at reasonable times and places for interviews, reviewing documents, testifying in a deposition or a legal or administrative or arbitration proceeding, and providing advice to the Company in preparing defenses to any pending or potential future claims against the Company. The Company agrees to (or to cause one of its affiliates to) pay/reimburse you for any approved travel expenses reasonably incurred as a result of your cooperation with the Company, with any such payments/reimbursements to be made in accordance with the Company's expense reimbursement policy in effect at the time.

9.Non-Disparagement

You agree that you will not make or issue, or procure any person, firm, or entity to make or issue, any statement in any form, including written, oral and electronic communications of any kind, which conveys negative or adverse information concerning the Company, its affiliates, or any and all past, present, or future related persons or entities, including but not limited to the Company’s and its affiliates’ directors, managers, employees, shareholders, agents, attorneys, successors and assigns.

This Paragraph does not apply to truthful testimony or disclosure compelled or required by applicable law or legal process.

10.Tax Matters

By signing this Separation Agreement, you acknowledge that you will be solely responsible for any taxes which may be imposed on you as a result of the Severance Benefits/ All amounts payable to you under this Separation Agreement will be subject to applicable tax withholding by the Company, and the Company has made no representations or guarantees regarding the tax consequences for you with respect to any income recognized by you in connection with this Separation Agreement or the Severance Benefits.

11.Other Acknowledgements

You and the Company also acknowledge and agree that, except for any restricted stock unit award, non-qualified stock option award and performance restricted stock unit awards specifically included in Exhibit B, any outstanding awards under the Equity Plan as of the Separation Date will be forfeited.

Failure by either party to enforce any term or condition of this Separation Agreement at any time shall not preclude that party from enforcing that provision, or any other provision, at a later time.

12.Nature of Agreement

By signing this Separation Agreement, you acknowledge that you are doing so freely, knowingly and voluntarily. You acknowledge that in signing this Separation Agreement you have relied only on the promises written in this Separation Agreement and on no other promise made by the Company or its affiliates. This Separation Agreement is not, and will not be considered, an admission of liability or of a violation of any applicable contract, law, rule, regulation, or order of any kind. This Separation Agreement and the Release contain the entire agreement between the Company, its affiliates and you regarding your departure from the Company, except that all post-employment covenants contained in the Restrictive Covenants Agreements remain in full force and effect. The Severance Benefits are in full satisfaction of any benefits under the Employment Agreement, the Severance Plan, the Equity Plan, and any other compensation arrangements between you and the Company or its affiliates. This Separation Agreement may not be altered, modified, waived or amended except by a written document signed by a duly authorized representative of the Company and you. Except as otherwise explicitly provided, this Separation Agreement will be interpreted and enforced in accordance with the laws of the state of Florida, and the parties hereto, including their successors and assigns, consent to the

jurisdiction of the state and federal courts of Orange County, Florida. The headings in this document are for reference only, and shall not in any way affect the meaning or interpretation of this Separation Agreement.

[SIGNATURE PAGE FOLLOWS]

IN WITNESS WHEREOF, you and the Company have executed this Separation Agreement as of the dates set forth below.

LAWRENCE C. SOMMA

/s/ Lawrence C. Somma

Date: December 1, 2023

PURECYCLE TECHNOLOGIES, INC.

By: __/s/ Dustin Olson____________________

Name: Dustin Olson

Title: Chief Executive Officer

Date: December 1, 2023

Exhibit A

Release

This Release is between PureCycle Technologies, Inc. (the “Company”) and Lawrence C. Somma (“you” and similar words), in consideration of the benefits provided to you and to be received by you from the Company as described in the Separation Agreement between the Company and you dated as of the applicable date referenced therein (the “Separation Agreement”). Capitalized terms used herein without definition have the meanings ascribed to such terms in the Separation Agreement.

By signing this Release, you and the Company hereby agree as follows:

1.Waiver and Release

You, on behalf of yourself and anyone claiming through you, including each and all of your legal representatives, administrators, executors, heirs, successors and assigns (collectively, the “Releasors”), hereby fully, finally and forever release, absolve and discharge the Company and each and all of its legal predecessors, successors, assigns, fiduciaries, parents, subsidiaries, divisions and other affiliates, and each of the foregoing’s respective past, present and future principals, partners, shareholders, directors, officers, employees, agents, consultants, attorneys, trustees, administrators, executors and representatives (collectively, the “Company Released Parties”), of, from and for any and all claims, causes of action, lawsuits, controversies, liabilities, losses, damages, costs, expenses and demands of any nature whatsoever, at law or in equity, whether known or unknown, asserted or unasserted, foreseen or unforeseen, whether brought individually, as a member or representative of a class, or derivatively on behalf of the Company or shareholders of the Company, that the Releasors (or any of them) now have, have ever had, or may have against the Company Released Parties (or any of them) based upon, arising out of, concerning, relating to or resulting from any act, omission, matter, fact, occurrence, transaction, claim, contention, statement or event occurring or existing at any time in the past up to and including the date on which you sign this Release, including, without limitation: (a) all claims arising out of or in any way relating to your employment with or separation of employment from the Company or its affiliates; (b) all claims for compensation or benefits, including salary, commissions, bonuses, vacation pay, expense reimbursements, severance pay, fringe benefits, stock options, restricted stock units or any other ownership interests in the Company Released Parties; (c) all claims for breach of contract, wrongful termination and breach of the implied covenant of good faith and fair dealing; (d) all tort claims, including claims for fraud, defamation, invasion of privacy and emotional distress; (e) all other common law claims; and (f) all claims (including claims for discrimination, harassment, retaliation, attorneys’ fees, expenses or otherwise) that were or could have been asserted by you or on your behalf in any federal, state, or local court, commission, or agency, or under any federal, state, local, employment, services or other law, regulation, ordinance, constitutional provision, executive order or other source of law, including without limitation under any of the following laws, as amended from time to time: the Age Discrimination in Employment Act (the “ADEA”), as amended by the Older Workers’ Benefit Protection Act of 1990 (the “OWBPA”); Title VII of the Civil Rights Act of 1964; 42 U.S.C. §§ 1981 & 1981a; the Americans with Disabilities Act; the Equal Pay Act; the Employee Retirement Income Security Act; the Lilly Ledbetter Fair Pay Act of 2009; the Family and Medical Leave Act; Sarbanes-Oxley Act of 2002; the

National Labor Relations Act; the Rehabilitation Act of 1973; the Worker Adjustment Retraining and Notification Act; the Uniformed Services Employment and Reemployment Rights Act; Federal Executive Order 11246; the Genetic Information Nondiscrimination Act; Florida Civil Human Rights Act, Fla. Stat. Ann. §§ 760.01 et seq.; The Florida AIDS Act, Fla. Stat. Ann. §§ 760.50 et seq.; Florida Wage Discrimination Law, Fla. Stat. Ann. § 725.07; Florida Equal Pay Law, Fla. Stat. Ann. § 448.07; Florida Whistleblower Protection Law, Fla. Stat. Ann. § 448.102; Florida Wage Payment Laws, Fla. Stat. Ann. §§ 222.15, 532.01 et seq.; Military Leave Non-Discrimination Law, Fla. Stat. Ann. §§ 250.482, 250.82; Florida Minimum Wage Law, Fla. Stat. Ann. §§ 448.109 to 448.110; Florida Right to Work Law, Fla. Stat. Ann. §§ 447.01 et seq.; Florida Wage Payment Law, Fla. Stat. Ann. §§ 532.01 et seq.; Florida Workers Compensation retaliation provision, Fla. Stat. Ann. § 440.205; Florida Domestic Violence Leave law Fla. Stat. Ann. § 741.313; and Florida Law on Wages/Hours/Payroll, Fla. Stat. Ann. §§ 443.071, 443.171, F.A.C. § 60BB-2.032.

2.Scope of Release

Nothing in this Release (a) shall release the Company from any of its obligations set forth in the Separation Agreement or any claim that by law is non-waivable, (b) shall release the Company from any obligation to defend and/or indemnify you against any third party claims arising out of any action or inaction by you during the time of your employment and within the scope of your duties with the Company to the extent you have any such defense or indemnification right, and to the extent permitted by applicable law and to the extent the claims are covered by the Company’s director & officer liability insurance, (c) shall release your right to any benefits to which you are entitled under any retirement plan of the Company that is intended to be qualified under Section 401(a) of the Code, or (d) shall affect your right to file a claim for workers’ compensation or unemployment insurance benefits.

Nothing in this Release (or any other agreement incorporated by reference herein) shall be construed to prevent you from providing truthful testimony under oath in a judicial or administrative proceeding or to prohibit or interfere with your right to participate as a complainant or witness in any federal, state or local governmental agency investigation (including but not limited to any activities protected under the whistleblower provisions of any applicable laws or regulations), during which communications can be made without authorization by or notification to the Company. However, you are waiving and releasing, to the fullest extent legally permissible, all entitlement to any form of personal monetary recovery or relief (including but not limited to any costs, expenses, attorneys’ fees, or reinstatement of your employment) should any agency or commission pursue any claims on behalf of you or others. You understand that this waiver and release of monetary relief would not affect an enforcement agency’s ability to investigate a charge or to pursue relief on behalf of others. Notwithstanding the foregoing, you will not give up your right to any monetary recovery under the Dodd-Frank Wall Street Reform and Consumer Protection Act and The Sarbanes-Oxley Act of 2002, or any monetary award offered by the Securities and Exchange Commission pursuant to Section 21F of the Securities Exchange Act of 1934.

By executing this Release you represent that, as of the date you sign this Release, no claims, lawsuits, grievances, or charges have been filed by you or on your behalf against the Company Released Parties. You further represent that, as of the date of execution of this Release, you have no knowledge of any actions or

inactions by the Company or any of the Company Released Parties, or by you with respect to your employment or relationship with the Company or any of the Company Released Parties, that you believe could possibly constitute a basis for a claimed violation of any federal, state, or local law, any common law, or any rule or regulation promulgated by an administrative body.

3.Age Discrimination in Employment Act & Older Workers Benefit Protection Act Disclosures

In compliance with the requirements of the OWBPA, you acknowledge by your signature below that, with respect to the rights and claims under the ADEA that are waived and released by this Release, including claims relating to employment discrimination based upon age, your waiver of such rights and claims is knowing and voluntary. Further, you specifically acknowledge and agree as follows: (a) you have read and understand the terms of this Release; (b) you have been and are hereby advised, and have had the opportunity, to consult with an attorney before signing this Release (and that you are responsible for any costs or fees resulting from an attorney’s review of this Release); (c) the Release is written in a manner understood by you; (d) you are releasing the Company and the other Company Released Parties from, among other things, any claims that you may have against them pursuant to the ADEA; (e) the Release does not cover rights or claims that may arise after you sign this Release; (f) you will receive valuable consideration in exchange for the Release other than amounts you would otherwise be entitled to receive; (g) you have been given a period of at least 21 days in which to consider and execute this Release (although you may elect not to use the full consideration period at your option); (h) you may revoke the Release during the seven-day period following the date on which you sign this Release, and the Release will not become effective and enforceable until the seven-day revocation period has expired; and (i) any such revocation must be submitted in writing to the Company c/o Brad Kalter, General Counsel and Corporate Secretary, PureCycle Technologies, Inc., 5950 Hazeltine National Drive, Suite 650, Orlando, Florida 32822 prior to the expiration of such seven-day revocation period. If you revoke the Release within such seven-day revocation period, it shall be null and void. If you do not revoke this Release prior to the eighth (8) day after your signing, this Agreement shall become enforceable immediately at that time.

4.Adequate Consideration and Other Benefits

You understand and agree that payment of certain of the benefits described in the Separation Agreement are not required by law and are not required by the Company’s policies and procedures absent execution of this Release. You further understand and agree that the benefits described in the Separation Agreement provide good and sufficient consideration for every promise, duty, release, obligation, agreement and right contained in this Release. You further understand and agree that a portion of the consideration for this Release is your ongoing compliance with the terms of this Release and the confidentiality, non-disparagement, non-competition, and non-solicitation provisions in the Restrictive Covenants Agreements and the Separation Agreement, over time.

All other benefits of your employment with the Company not described in the Separation Agreement cease as of the Separation Date. You acknowledge and agree that, other than: (i) the payments and benefits expressly set forth in the Separation Agreement; and (ii) any benefits to which you are entitled under any retirement plan of the Company that is intended to be qualified under Section

401(a) of the Code, or other deferred compensation plans, you have received all compensation to which you are entitled from the Company, and you are not entitled to any other payments or benefits from the Company, including but not limited to, any and all rights that you may have arising out of any other Company plan, agreement, offer letter, or contract of any type, or any other expectation of remuneration or benefit on your part, including but not limited to any payments for wages or vacation.

5.Entire Agreement

This Release, the Separation Agreement, and the documents referenced therein contain the entire agreement between you and the Company, and take priority over any other written or oral understanding or agreement that may have existed in the past. You acknowledge that no other promises or agreements have been offered for this Release (other than those described above) and that no other promises or agreements will be binding unless they are in writing and signed by you and the Company. Should any provision of this Release be declared by a court of competent jurisdiction to be illegal, void, or unenforceable, the remaining provisions shall remain in full force and effect; provided, however, that upon a finding that the Release, in whole or part, is illegal, void, or unenforceable, you shall be required, at the option of the Company, either to return the severance benefits described in the Separation Agreement or to execute a release that is legal and enforceable.

6.Compliance with Post-Employment Obligations

You agree and acknowledge that the confidentiality, non-disparagement, non-competition, and non-solicitation provisions in the Restrictive Covenants Agreements, Restricted Stock Unit Award Agreements and the Separation Agreement contain obligations that survive your separation from the Company, and you hereby reaffirm that you will continue to abide by those provisions.

7.Headings

The headings contained in this Release are for reference only and shall not in any way affect its meaning or interpretation.

8.No Waiver

A waiver by the Company of any breach of this Release shall not operate or be understood to be a waiver of any other provision or a waiver of any subsequent breach of this Release.

9.Assignment

Except as set forth herein, no rights of any kind under this Release shall, without the prior written consent of the Company, be transferable to or assignable by you or any other person, or, except as provided by applicable law, be subject to alienation, encumbrance, garnishment, attachment, execution or levy of any kind, voluntary or involuntary. This Release shall be binding upon and shall inure to the benefit of the Company and its successors and assigns. The Company may assign its rights and obligations under this Agreement at any time to any successor, subsidiary or assign.

10.Choice of Law

This Release shall be governed by, and construed in accordance with, the internal, substantive laws of the state of Florida. You agree that the state and federal courts located in Orange County, Florida shall have jurisdiction in any action, suit or proceeding based on or arising out of this Release and you hereby: (a) submit to the personal jurisdiction of such courts; (b) consent to service of process in connection with any action, suit or proceeding; and (c) waive any other requirement (whether imposed by statute, rule of court or otherwise) with respect to personal jurisdiction, venue or service of process.

[SIGNATURE PAGE FOLLOWS]

I agree to the terms and conditions set forth in this Release.

LAWRENCE C. SOMMA

_/s/ Lawrence C. Somma________

Date: _December 1, 2023_______

Exhibit B

Severance Benefits

Subject to and conditioned upon Lawrence C. Somma’s (“You” or “Your”) compliance with the terms and conditions of this Separation Agreement, including but not limited to Sections 3 (Restrictive Covenants), 8 (Future Cooperation) and 9 (Mutual Non-Disparagement), You will be entitled to:

1.The following under the PureCycle Technologies, Inc. 2021 Equity and Incentive Compensation Plan:

a.Pro-rata vesting of the following restricted stock units (“RSUs”) and non-qualified stock options (“NQSOs”) as of December 1, 2023, which will be released on December 29, 2023:

i.Pro-rated potion of 44,117 RSUs remaining from a grant date of March 2, 2022;

ii.Pro-rated portion of 107,456 RSUs granted on March 22, 2023;

iii.Pro-rated portion of 69,130 NQSOs granted on March 22, 2023; and

iv.All 120,791 RSUs remaining from a grant date of November 23, 2021.

b.Pro-rata vesting of Your performance-based restricted stock unit (“PRSUs”) awards as of December 1, 2023, with performance periods ending on or prior to December 31, 2025, based on the actual achievement of the applicable performance goals for the applicable performance period as determined by the Compensation Committee of the Board of Directors of the Company, which vested PRSUs (if any) will be settled on or as soon as practicable following the “Determination Date” set forth in the applicable PRSU agreement:

i.Pro-rated portion of 58,824 PRSUs for the performance period January 1, 2022 through December 31, 2024; and

ii.Pro-rated portion of 53,728 PRSUs for the performance period January 1, 2023 through December 31, 2025.

2.The Company will provide you with a lump sum payment of $300,000.00, less reductions or offsets due to any failure to return Company property. There is no accrued paid time off due and owing to You as of the Termination Date. Payment will be made to You on December 29, 2023.

3.If You timely and properly elect health continuation coverage under COBRA, the Company shall reimburse You for the difference between the monthly COBRA premium paid by You for You and Your dependents and the monthly premium amount paid by You for such coverage immediately prior to the date of termination. Such reimbursement shall be paid to You on the first of the month immediately following the month in which You timely remit the premium payment. You shall be eligible to receive such reimbursement until the earliest of (A) twelve (12) months following the Termination Date, (B) the time You are no longer eligible for such COBRA coverage, or (C) the date You become eligible for group health care insurance coverage from another source;

provided, that You shall promptly notify the Company of any such circumstances. For the avoidance of doubt, nothing in this Plan shall prohibit the Company from amending or terminating any group health plan. Notwithstanding anything in this Plan to the contrary, in the event that the payment of amounts payable under this clause (b) shall result in adverse tax consequences under Chapter 100 of the Code, Code Section 4980D or otherwise to the Company, the parties shall undertake commercially reasonable efforts to restructure such benefit in an economically equivalent manner to avoid the imposition of such taxes on the Company, provided, however, that should the Company’s auditors determine in good faith that no such alternative arrangement is achievable, You shall not be entitled to Your rights to payment under this clause (b). Further, neither the Company nor any of its employees, directors, managers, board members, Affiliates, parents, stakeholders, equityholders, agents, successors, predecessors or related parties guarantees the tax treatment of any benefit under this clause (b) and no such party shall have liability to You or Your beneficiaries with respect to the taxation of such benefits or amounts payable in respect thereof.

Exhibit 99.1

PureCycle Appoints Jeff Fieler as Interim CFO

Orlando, Florida – December 1, 2023 – PureCycle Technologies, Inc. (Nasdaq: PCT), today, announced Jeff Fieler will take over as the Company’s interim Chief Financial Officer, following the resignation of Larry Somma. A search for Somma’s permanent replacement is underway.

PureCycle CEO Dustin Olson said, “We’re fortunate to have longtime board member Jeff Fieler step in as interim CFO. Jeff has a deep understanding of both the industry and PureCycle’s business growth strategy. He’ll be a great fit as our company transitions to commercial operations.”

Fieler has served as an independent member of the PureCycle Board of Directors since March 2021. He is currently a Senior Advisor of Sylebra Capital Management and has more than 20 years of experience in the financial industry.

Olson added, “Larry Somma played a critical role in helping PureCycle get to where we are today, on the verge of commencing commercial operations. His contributions have been invaluable and we wish him success in his next endeavor.”

###

PureCycle Contact

Christian Bruey

cbruey@purecycle.com

+1 (352) 745-6120

About PureCycle Technologies

PureCycle Technologies LLC., a subsidiary of PureCycle Technologies, Inc., holds a global license for the only patented solvent-driven purification recycling technology, developed by The Procter & Gamble Company (P&G), that is designed to transform polypropylene plastic waste (designated as No. 5 plastic) into a continuously renewable resource. The unique purification process removes color, odor, and other impurities from No. 5 plastic waste resulting in an ultra-pure recycled (UPR) plastic that can be recycled and reused multiple times, changing our relationship with plastic.

Visit www.purecycle.com

Forward-Looking Statements

This press release contains forward-looking statements, including statements about the outcome of any legal proceedings to which PureCycle is, or may become a party, and the financial condition, results of operations, earnings outlook and prospects of

PureCycle. Forward-looking statements generally relate to future events or PureCycle’s future financial or operating performance and may refer to projections and forecasts. Forward-looking statements are often identified by future or conditional words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of the management of PureCycle and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of this press release. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” in each of PureCycle’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and PureCycle’s Quarterly Reports on Form 10-Q, those discussed and identified in other public filings made with the Securities and Exchange Commission by PureCycle and the following:

• PCT's ability to obtain funding for its operations and future growth and to continue as a going concern;

• PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s UPR resin (as defined below) in food grade applications (including in the United States, Europe, Asia and other future international locations);

• PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPR resin and PCT’s facilities (including in the United States, Europe, Asia and other future international locations);

• expectations and changes regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives;

• the ability of PCT’s first commercial-scale recycling facility in Lawrence County, Ohio (the “Ironton Facility”) to be appropriately certified by Leidos (as defined below), following certain performance and other tests, and commence full-scale commercial operations in a timely and cost-effective manner;

• PCT’s ability to meet, and to continue to meet, the requirements imposed upon it and its subsidiaries by the funding for its operations, including the funding for the Ironton Facility;

• PCT’s ability to complete the necessary funding with respect to, and complete the construction of, (i) its first U.S. multi-line facility, located in Augusta, Georgia (the “Augusta Facility”); (ii) its first commercial-scale European plant located in Antwerp, Belgium and (iii) its first commercial-scale Asian plant located in Ulsan, South Korea, in a timely and cost-effective manner;

• PCT’s ability to sort and process polypropylene plastic waste at its plastic waste prep (“Feed PreP”) facilities;

• PCT’s ability to maintain exclusivity under the Procter & Gamble Company (“P&G”) license (as described below);

• the implementation, market acceptance and success of PCT’s business model and growth strategy;

• the success or profitability of PCT’s offtake arrangements;

• the ability to source feedstock with a high polypropylene content at a reasonable cost;

• PCT’s future capital requirements and sources and uses of cash;

• developments and projections relating to PCT’s competitors and industry;

• the outcome of any legal or regulatory proceedings to which PCT is, or may become, a party including the securities class action case;

• geopolitical risk and changes in applicable laws or regulations;

• the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors, including rising interest rates, availability of capital, economic cycles, and other macro-economic impacts;

• turnover or increases in employees and employee-related costs;

• changes in the prices and availability of labor (including labor shortages), transportation and materials, including significant inflation, supply chain conditions and its related impact on energy and raw materials, and PCT’s ability to obtain them in a timely and cost-effective manner;

• any business disruptions due to political or economic instability, pandemics, armed hostilities (including the ongoing conflict between Russia and Ukraine and the current situation in Israel);

• the potential impact of climate change on PCT, including physical and transition risks, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms; and operational risk.

v3.23.3

Cover

|

Nov. 27, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 27, 2023

|

| Entity Registrant Name |

PureCycle Technologies, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40234

|

| Entity Tax Identification Number |

86-2293091

|

| Entity Address, Address Line One |

5950 Hazeltine National Drive,

|

| Entity Address, Address Line Two |

Suite 300,

|

| Entity Address, City or Town |

Orlando

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32822

|

| City Area Code |

877

|

| Local Phone Number |

648-3565

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001830033

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

PCT

|

| Security Exchange Name |

NASDAQ

|

| Warrants |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each exercisable for one share of common stock, $0.001 par value per share, at an exercise price of $11.50 per share

|

| Trading Symbol |

PCTTW

|

| Security Exchange Name |

NASDAQ

|

| Units |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Units, each consisting of one share of common stock, $0.001 par value per share, and three quarters of one warrant

|

| Trading Symbol |

PCTTU

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_MemberUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

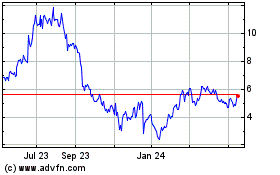

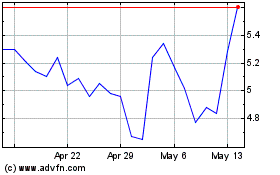

PureCycle Technologies (NASDAQ:PCT)

Historical Stock Chart

From Mar 2024 to Apr 2024

PureCycle Technologies (NASDAQ:PCT)

Historical Stock Chart

From Apr 2023 to Apr 2024