Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

February 15 2024 - 8:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE TO

(Amendment No. 2)

(RULE 14d-100)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

MakeMyTrip

Limited

(Name of Subject Company (Issuer))

MakeMyTrip Limited

(Name of Filing Person (Issuer))

0.00%

Convertible Senior Notes due 2028

(Title of Class of Securities)

56087F AB0

(CUSIP Number

of Class of Securities)

Mohit Kabra

Group Chief Financial Officer

19th Floor, Building No. 5

DLF Cyber City

Gurugram,

India, 122002

Telephone: (+91-124) 439-5000

with copy to:

Rajiv Gupta

Stacey Wong

Latham & Watkins LLP

9 Raffles Place

#42-02 Republic Plaza

Singapore 048619

+65 6536 1161

(Name,

address and telephone number of person authorized to receive notices and communications on behalf of the filing person)

Check the appropriate boxes

below to designate any transactions to which the statement relates:

| |

☐ |

third-party tender offer subject to Rule 14d-1. |

| |

☒ |

issuer tender offer subject to Rule 13e-4. |

| |

☐ |

going-private transaction subject to Rule 13e-3. |

| |

☐ |

amendment to Schedule 13D under Rule 13d-2. |

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☒

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| |

☐ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| |

☐ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

INTRODUCTORY STATEMENT

This Amendment No. 2 to Schedule TO (this “Amendment No. 2”) amends and supplements the Tender Offer Statement on Schedule

TO that was initially filed by MakeMyTrip Limited (the “Company”) on January 17, 2024 (the “Schedule TO”) relating to the Company’s 0.00% Convertible Senior Notes due 2028 (the “Notes”), as amended by

Amendment No. 1 filed with the Securities Exchange Commission (“SEC”) on January 31, 2024. This Amendment No. 2 relates to the final results of the Company’s repurchase of the Notes that have been validly surrendered

for repurchase and not withdrawn pursuant to the Company’s Notice to the holders of the Notes (the “Holders”) dated January 17, 2024 (the “Repurchase Right Notice”). The information contained in the Schedule TO,

including the Repurchase Right Notice, as supplemented and amended by the information contained in Item 11 below, is incorporated herein by reference. Except as specifically provided herein, this Amendment No. 2 does not modify any of the

information previously reported on the Schedule TO.

This Amendment No. 2 amends and supplements Schedule TO as set forth below and

constitutes the final amendment to the Schedule TO. This Amendment No. 2 is intended to satisfy the disclosure requirements of Rule 13e-4(c)(4) under the Securities Exchange Act of 1934, as amended.

ITEM 11. ADDITIONAL INFORMATION.

Item 11 of the Schedule TO is hereby amended and supplemented to include the following information:

The repurchase right offer expired at 11:59 p.m. Eastern Time, on Tuesday, February 13, 2024 (the “Expiration Date”). The

Company has been advised by The Bank of New York Mellon, as paying agent (the “Paying Agent”), that pursuant to the terms of the Repurchase Right Notice, none of the Notes were surrendered through the facilities of, and in accordance with

the procedures of, the Depository Trust Company’s (“DTC”) Automated Tender Offer Program (“ATOP”) for repurchase as of the Expiration Date. As of the Expiration Date, no Notes are held in the certificated non-global form. As none of the Notes were surrendered for repurchase as of the Expiration Date, the aggregate amount of the Repurchase Price is nil. As of February 15, 2024, US$ 230,000,000 aggregate

principal amount of the Notes remain outstanding and continue to be subject to the existing terms of the Indenture and the Notes.

ITEM 12. EXHIBITS.

|

|

|

| (a)(1)* |

|

Repurchase Right Notice to Holders of 0.00% Convertible Senior Notes due 2028 issued by the Company, dated as of January 17, 2024.

|

|

|

| (a)(1)(A)* |

|

Repurchase Right Notice to Holders of 0.00% Convertible Senior Notes due 2028 issued by the Company, dated as of January

17, 2024 (as amended by Amendment No. 1 to the Company’s Schedule TO-1 dated as of January 31, 2024). |

|

|

| (a)(5)(A)* |

|

Press Release issued by the Company, dated as of January 17, 2024. |

|

|

| (a)(5)(B)† |

|

Press Release issued by the Company, dated as of February 15, 2024. |

|

|

| (b) |

|

Not applicable. |

|

|

| (d)* |

|

Indenture, dated as of February

9, 2021, between the Company and The Bank of New York Mellon, as trustee (incorporated by reference to Exhibit 99.1 to the Company’s Form 6-K (File No.

001-34837) filed with the Securities and Exchange Commission on February 9, 2021). |

|

|

| (g) |

|

Not applicable. |

|

|

| (h) |

|

Not applicable. |

|

|

| 107† |

|

Filing Fee Table. |

1

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

|

| MakeMyTrip Limited |

|

|

| By: |

|

/s/ Rajesh Magow |

| Name: |

|

Rajesh Magow |

| Title: |

|

Group Chief Executive Officer |

Dated: February 15, 2024

2

Exhibit (a)(5)(B)

MakeMyTrip Limited Announces Completion of the Repurchase Right Offer for Its 0.00% Convertible

Senior Notes due 2028

GURUGRAM, India,

February 15, 2024— MakeMyTrip Limited (“MakeMyTrip” or the “Company”) (NASDAQ: MMYT), a leading travel service provider in India, today announced that it has completed its previously announced repurchase right offer

relating to its 0.00% Convertible Senior Notes due 2028 (CUSIP No. 56087F AB0) (the “Notes”). The repurchase right offer expired at 11:59 p.m. Eastern Time, on Tuesday, February 13, 2024. None of the noteholders exercised their

repurchase right, and no Notes were surrendered for repurchase.

Materials filed with the SEC will be available electronically without charge at the

SEC’s website, http://www.sec.gov. Documents filed with the SEC may also be obtained without charge at the Company’s website, https://investors.makemytrip.com/investors/financials.

About MakeMyTrip Limited

MakeMyTrip Limited is

India’s leading travel group operating well-recognized travel brands including MakeMyTrip, Goibibo and redBus. Through our primary websites www.makemytrip.com, www.goibibo.com, www.redbus.in, and mobile platforms, travellers can research, plan

and book a wide range of travel services and products in India as well as overseas. Our services and products include air ticketing, hotel and alternative accommodations bookings, holiday planning and packaging, rail ticketing, bus ticketing, car

hire and ancillary travel requirements such as facilitating access to third-party travel insurance, visa processing and foreign exchange.

We provide our

customers with access to all major domestic full-service and low-cost airlines operating in India and all major airlines operating to and from India, a comprehensive set of domestic accommodation properties in

India and a wide selection of properties outside of India, Indian Railways and all major Indian bus operators. For more information, visit https://www.makemytrip.com/about-us/company_profile.php.

For investor and media inquiries, please contact:

MakeMyTrip Limited

Investor Relations

Tel: 1-800-962-4284 (Toll Free US); 781-575-3120 (Outside of US)

Email:

vipul.garg@go-mmt.com

Source: MakeMyTrip

Exhibit 107(b)

Calculation of Filing Fee Tables

Schedule TO

(Amendment No. 2)

(Form Type)

MakeMyTrip

Limited

(Name of Issuer)

Table 1 – Transaction Valuation

|

|

|

|

|

|

|

| |

|

|

|

| |

|

Transaction

Valuation |

|

Fee

Rate |

|

Amount of

Filing Fee |

| |

|

|

|

| Fees to Be

Paid |

|

$ — |

|

|

|

— |

| |

|

|

|

| Fees Previously

Paid |

|

230,000,000.00(1) |

|

0.01476%(2) |

|

33,948.00(2) |

| |

|

|

|

|

Total Transaction Valuation |

|

$ 230,000,000.00 |

|

|

|

|

| |

|

|

|

|

Total Fees Due for Filing |

|

|

|

|

|

$ 33,948.00(2) |

| |

|

|

|

|

Total Fees Previously Paid |

|

|

|

|

|

33,948.00(2) |

| |

|

|

|

| Total Fee

Offsets |

|

|

|

|

|

— |

| |

|

|

|

|

Net Fee Due |

|

|

|

|

|

$ — |

| (1) |

Calculated solely for purposes of determining the filing fee. The purchase price of the 0.00% Convertible

Senior Notes due 2028 (the “Notes”), as described herein, is US$1,000 per US$1,000 principal amount outstanding. As of February 15, 2024 there was US$230,000,000.00 aggregate principal amount of Notes outstanding, resulting in an

aggregate maximum purchase price of US$230,000,000.00 (excluding any accrued and unpaid special interest, if and to the extent such special interest is payable pursuant to the terms of the Indenture). |

| (2) |

The filing fee of $33,948.00 was previously paid in connection with the filing of the Tender Offer Statement on

Schedule TO on January 17, 2024 by MakeMyTrip Limited (File No. 005-85619). The amount of the filing fee was calculated in accordance with Rule 0-11 of the

Securities Exchange Act of 1934, as amended, and equals US$147.60 for each US$1,000,000 of the value of the transaction. |

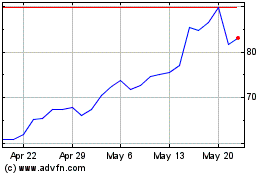

MakeMyTrip (NASDAQ:MMYT)

Historical Stock Chart

From Apr 2024 to May 2024

MakeMyTrip (NASDAQ:MMYT)

Historical Stock Chart

From May 2023 to May 2024