Trxade Group, Inc. (NASDAQ: MEDS), a health services IT

company focused on digitalizing the retail pharmacy experience by

optimizing drug procurement, the prescription journey and patient

engagement in the U.S., today announced its financial results for

the first quarter ended March 31, 2021.

Selected Financial Highlights

|

$ in millions |

|

Q12021 |

|

Q12020 |

|

% Increase (Decrease) |

|

Revenues |

|

$3.1 |

|

$2.2 |

|

39% |

| Gross

Profit |

|

$1.4 |

|

$1.6 |

|

(16%) |

| Gross Profit

Percentage |

|

45% |

|

74% |

|

(39%) |

| Net Income

(Loss) |

|

($0.7) |

|

$0.2 |

|

(446%) |

| Adjusted

EBITDA1 |

|

($0.5) |

|

$0.3 |

|

(244%) |

1 Adjusted EBITDA is a non-GAAP financial measure and is

described in relation to its most directly comparable GAAP measure

under “Use of Non-GAAP Financial Information” below.

First Quarter

2021 and Subsequent Operational

Highlights

-

Trxade continued to expand the Trxade drug procurement marketplace

nationwide, adding 223 new registered members in Q1 2021, bringing

the total registered members to approximately 12,100+.

-

Signed enterprise retail partnerships to onboard new customers to

our telehealth platform, with approximately 500+ stores offering

our signature Bonum Health product to thousands of customers

spanning all 50 states.

-

Appointed technology entrepreneur and industry thought leader James

Ram to lead the Company's newly launched MedCheks subsidiary in its

efforts to bring a Digital Health Passport to market, allowing the

holder to display vaccination and COVID-19 testing status.

Management Commentary

“We are pleased to have started 2021 achieving

record first quarter growth, while concurrently making impressive

operational progress spanning all business units,” said Suren

Ajjarapu, Chairman and Chief Executive Officer, who further stated,

“Our exciting suite of affiliated services – from our comprehensive

telehealth solution, to digital health passports enabling a safe

reopening with an attractive pay-per-scan business model – continue

to broaden our reach as a company, empowering independent

pharmacies with technology to make them indispensable local health

hubs.”

“We have been anything but idle in 2021 and have

been pounding the pavement to broaden the reach of our Bonum Health

Telehealth partnerships, signing strategic partnerships with

brand-name stores nationwide, such as Kinney Drugs, ProAct,

Brookshire Grocery Company, SpartanNash and most recently, Big Y

Foods, as well as others which we’ve been unable to announce per

the terms of our agreements, to build a truly national platform.

Approximately 500+ stores offer Bonum Health services to thousands

of users in all 50 states and we anticipate continued growth in the

quarters to come as we ramp up our strategic partnerships and see

an increasing number of employers turning to our turnkey telehealth

solution.

“Bonum Health is focused on bolstering its value

proposition and building its brand identity as part of its mission

to become a leading force in the telehealth marketplace. We

continue to integrate exciting new solutions into the Bonum Health

offering, including a direct-to-patient prescription drug coupon

platform through our partnership with SingleCare, the capability to

stream patient lab results directly into the Bonum Health virtual

electronic medical records, and remote patient monitoring. These

product enhancements, paired with our digital marketing strategy,

which we are ramping up, provide us with accelerated access into

new key markets alongside our enterprise retail partners.”

“We believe we are incredibly well positioned as

we stand today, poised to monetize several emerging revenue streams

in addition to the steady progress made by our high-margin Trxade

Exchange core platform. I look forward to aggressive operational

execution in the months ahead as we seek to create sustainable,

long-term value for our shareholders,” concluded Ajjarapu.

First Quarter

2021 Financial Summary

-

Revenues for the first quarter of 2021 increased 39% to $3.1

million, as compared to revenue of $2.2 million in the same quarter

last year. The increase in revenue was primarily due to higher

sales by our Integra Pharma Solutions subsidiary.

-

Gross profit in the first quarter of 2021 totaled $1.4 million, or

45% of revenues, compared to gross profit of $1.6 million, or 74%

of revenues, in the same quarter last year. The decrease in gross

profit was primarily attributable to the cost of Personal

Protective Equipment (PPE) related purchased products in the

current period, while revenues from the Trxade Platform (which made

up the majority of revenues last year) carry no cost of sales.

-

Operating expenses in the first quarter of 2021 were $2.0 million,

compared to $1.5 million in the same quarter last year. This change

is primarily due to IT development, legal expenses and marketing

expenses related to the recently launched Bonum Health and MedCheks

platforms.

-

Net loss in the first quarter of 2021 was $0.7 million, or $0.08

per basic and diluted share outstanding, compared to net income of

$0.2 million, or $0.03 per basic share outstanding, in the same

quarter last year.

-

Adjusted EBITDA, a non-GAAP financial measure, decreased 243% to

negative $0.5 million, compared to positive $0.4 million in the

same quarter last year.

- Cash and cash equivalents were $5.2

million as of March 31, 2021, compared with $5.9 million as of

December 31, 2020.

Conference Call and Webcast

Management will host a conference call on

Monday, April 26, 2021 at 5:00 p.m. Eastern time to discuss Trxade

Group’s first quarter 2021 financial results. The call will

conclude with a Q&A from participants. To participate, please

use the following information:

Q1 2021 Conference

Call and WebcastDate: Monday, April 26, 2021Time: 5:00

p.m. Eastern timeU.S. Dial-in: 1-877-425-9470International Dial-in:

1-201-0878Conference ID: 13718446Webcast:

http://public.viavid.com/index.php?id=144243

Please dial in at least 10 minutes before the

start of the call to ensure timely participation.

A playback of the call will be available through

May 26, 2021. To listen, call 1-844-512-2921 within the United

States or 1-412-317-6671 when calling internationally and enter

replay pin number 13718446. A webcast will also be available for 30

days on the IR section of the Trxade Group website or by clicking

the webcast link above.

About Trxade Group,

Inc.Trxade Group (NASDAQ: MEDS) is a health services IT

company focused on digitalizing the retail pharmacy experience by

optimizing drug procurement, the prescription journey and patient

engagement in the U.S. The Company operates the TRxADE drug

procurement marketplace serving a total of 12,100+ members

nationwide, fostering price transparency and under the Bonum Health

brand, offering patient centric telehealth services. For more

information on Trxade Group, please visit the Company’s IR website

at investors.trxadegroup.com.

Use of Non-GAAP Financial

InformationThis earnings release discusses EBITDA and

Adjusted EBITDA. These measurements are not recognized in

accordance with generally accepted accounting principles (GAAP) and

should not be viewed as an alternative to GAAP measures of

performance. EBITDA represents net income before interest, taxes,

depreciation and amortization. Adjusted EBITDA is defined as EBITDA

before stock-based compensation expense and gain (loss) in equity

investment. EBITDA and Adjusted EBITDA are presented because we

believe they provide additional useful information to investors due

to the various noncash items during the period. EBITDA and Adjusted

EBITDA have limitations as analytical tools, and you should not

consider them in isolation, or as a substitute for analysis of our

operating results as reported under GAAP. Some of these limitations

are: EBITDA and Adjusted EBITDA do not reflect cash expenditures,

future requirements for capital expenditures, or contractual

commitments; EBITDA and Adjusted EBITDA do not reflect changes in,

or cash requirements for, working capital needs; and EBITDA and

Adjusted EBITDA do not reflect the significant interest expense, or

the cash requirements necessary to service interest or principal

payments, on debt or cash income tax payments. Although

depreciation and amortization are noncash charges, the assets being

depreciated and amortized will often have to be replaced in the

future, and EBITDA and Adjusted EBITDA do not reflect any cash

requirements for such replacements. Additionally, other companies

in our industry may calculate EBITDA and Adjusted EBITDA

differently than Trxade Group, Inc. does, limiting its usefulness

as a comparative measure. See also “Reconciliation of Net Income

attributable to Trxade Group, Inc., to Earnings before Interest,

Taxes, Depreciation and Amortization (EBITDA) and Adjusted EBITDA”,

below.

Forward-Looking StatementsThis

press release may contain forward-looking statements, including

information about management’s view of Trxade’s future

expectations, plans and prospects, within the safe harbor

provisions under The Private Securities Litigation Reform Act of

1995 (the “Act”). In particular, when used in the preceding

discussion, the words “may,” “could,” “expect,” “intend,” “plan,”

“seek,” “anticipate,” “believe,” “estimate,” “predict,”

“potential,” “continue,” “likely,” “will,” “would” and variations

of these terms and similar expressions, or the negative of these

terms or similar expressions are intended to identify

forward-looking statements within the meaning of the Act, and are

subject to the safe harbor created by the Act. Any statements made

in this news release other than those of historical fact, about an

action, event or development, are forward-looking statements. These

statements involve known and unknown risks, uncertainties and other

factors, which may cause the results of Trxade, its divisions and

concepts to be materially different than those expressed or implied

in such statements. These risks include risks of our operations not

being profitable; claims relating to alleged violations of

intellectual property rights of others; technical problems with our

websites; risks relating to implementing our acquisition

strategies; our ability to manage our growth; negative effects on

our operations associated with the opioid pain medication health

crisis; regulatory and licensing requirement risks; risks related

to changes in the U.S. healthcare environment; the status of our

information systems, facilities and distribution networks; risks

associated with the operations of our more established competitors;

regulatory changes; healthcare fraud; COVID-19, governmental

responses thereto, economic downturns and possible recessions

caused thereby; changes in laws or regulations relating to our

operations; privacy laws; system errors; dependence on current

management; our growth strategy; and others that are included from

time to time in filings made by Trxade with the Securities and

Exchange Commission, including, but not limited to, in the “Risk

Factors” sections in its Form 10-Ks and Form 10-Qs and in its Form

8-Ks, which it has filed, and files from time to time, with the

U.S. Securities and Exchange Commission. These reports are

available at www.sec.gov. Other unknown or unpredictable factors

also could have material adverse effects on Trxade’s future results

and/or could cause our actual results and financial condition to

differ materially from those indicated in the forward-looking

statements. The forward-looking statements included in this press

release are made only as of the date hereof. Trxade cannot

guarantee future results, levels of activity, performance or

achievements. Accordingly, you should not place undue reliance on

these forward-looking statements. We undertake no obligation to

update publicly any of these forward-looking statements to reflect

actual results, new information or future events, changes in

assumptions or changes in other factors affecting forward-looking

statements, except to the extent required by applicable laws. If we

update one or more forward-looking statements, no inference should

be drawn that we will make additional updates with respect to those

or other forward-looking statements.

Investor Relations:Lucas

ZimmermanSenior Vice PresidentMZ Group - MZ North America(949)

259-4987MEDS@mzgroup.us www.mzgroup.us

Trxade Group,

Inc.Consolidated Balance

SheetsMarch 31, 2021 and December 31,

2020(unaudited)

| |

|

March 31, 2021 |

|

|

December 31, 2020 |

|

|

Assets |

|

|

|

|

|

|

|

|

| Current

Assets |

|

|

|

|

|

|

|

|

|

Cash |

|

$ |

5,209,280 |

|

|

$ |

5,919,578 |

|

|

Accounts Receivable, net |

|

|

1,936,850 |

|

|

|

805,043 |

|

|

Inventory |

|

|

470,122 |

|

|

|

1,257,754 |

|

|

Prepaid Assets |

|

|

457,738 |

|

|

|

151,248 |

|

|

Other Receivables |

|

|

1,081,250 |

|

|

|

1,087,675 |

|

|

Total Current Assets |

|

|

9,155,240 |

|

|

|

9,221,298 |

|

| |

|

|

|

|

|

|

|

|

| Property Plant and

Equipment, Net |

|

|

160,647 |

|

|

|

162,397 |

|

| |

|

|

|

|

|

|

|

|

| Other

Assets |

|

|

|

|

|

|

|

|

|

Deposits |

|

|

21,636 |

|

|

|

21,636 |

|

|

Right of use leased assets |

|

|

355,693 |

|

|

|

387,371 |

|

| |

|

|

|

|

|

|

|

|

| Total

Assets |

|

$ |

9,693,216 |

|

|

$ |

9,792,702 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Current

Liabilities |

|

|

|

|

|

|

|

|

|

Accounts Payable |

|

$ |

366,471 |

|

|

$ |

256,829 |

|

|

Accrued Liabilities |

|

|

519,179 |

|

|

|

219,256 |

|

|

Current Portion Lease Liabilities |

|

|

117,030 |

|

|

|

131,153 |

|

|

Customer Deposits |

|

|

10,000 |

|

|

|

10,000 |

|

|

Notes Payables – Related Party |

|

|

225,000 |

|

|

|

225,000 |

|

|

Total Current Liabilities |

|

|

1,237,680 |

|

|

|

842,238 |

|

| |

|

|

|

|

|

|

|

|

| Long Term

Liabilities |

|

|

|

|

|

|

|

|

|

Other Long-Term Liabilities — Leases |

|

|

253,912 |

|

|

|

271,306 |

|

|

Total Liabilities |

|

|

1,491,592 |

|

|

|

1,113,544 |

|

| |

|

|

|

|

|

|

|

|

| Stockholders’

Equity |

|

|

|

|

|

|

|

|

| Series A Preferred Stock,

$0.00001 par value; 10,000,000 shares authorized; none issued and

outstanding as of March 31, 2021 and December 31, 2020,

respectively |

|

|

- |

|

|

|

- |

|

|

Common Stock, $0.00001 par value; 100,000,000 shares authorized;

8,093,199 shares issued and outstanding as of March 31, 2021 and

December 31, 2020 |

|

|

81 |

|

|

|

81 |

|

|

Additional Paid-in Capital |

|

|

19,784,616 |

|

|

|

19,610,631 |

|

|

Accumulated Deficit |

|

|

(11,583,073 |

) |

|

|

(10,931,554 |

) |

|

Total Stockholders’ Equity |

|

|

8,201,624 |

|

|

|

8,679,158 |

|

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and

Stockholders’ Equity |

|

$ |

9,693,216 |

|

|

$ |

9,792,702 |

|

Trxade Group,

Inc.Consolidated Statements of

OperationsFor the Three Months Ended March 31,

2021 and 2020(unaudited)

| |

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

| Revenues |

|

$ |

3,053,235 |

|

|

$ |

2,203,320 |

|

| |

|

|

|

|

|

|

|

|

| Cost of

Sales |

|

|

1,669,924 |

|

|

|

563,184 |

|

| Gross

Profit |

|

|

1,383,311 |

|

|

|

1,640,136 |

|

|

|

|

|

|

|

|

|

|

|

| Operating

Expenses |

|

|

|

|

|

|

|

|

|

General and Administrative |

|

|

2,027,566 |

|

|

|

1,451,909 |

|

| |

|

|

|

|

|

|

|

|

| Operating Income

(Loss) |

|

|

(644,255 |

) |

|

|

188,227 |

|

| |

|

|

|

|

|

|

|

|

|

Interest net |

|

|

(7,264 |

) |

|

|

(7,924 |

) |

| Net Income

(Loss) |

|

$ |

(651,519 |

) |

|

$ |

180,303 |

|

| |

|

|

|

|

|

|

|

|

|

Net Income (loss) per Common Share – Basic: |

|

$ |

(0.08 |

) |

|

$ |

0.03 |

|

| |

|

|

|

|

|

|

|

|

|

Net Income (loss) per Common Share – Diluted: |

|

$ |

(0.08 |

) |

|

$ |

0.02 |

|

| |

|

|

|

|

|

|

|

|

| Weighted average Common Shares

Outstanding Basic |

|

|

8,093,199 |

|

|

|

6,971,427 |

|

| |

|

|

|

|

|

|

|

|

| Weighted average Common Shares

Outstanding Diluted |

|

|

8,093,199 |

|

|

|

7,423,669 |

|

Trxade Group,

Inc.Consolidated Statements of Cash

FlowsFor the Three months ended March 31, 2021 and

2020(unaudited)

|

|

|

2021 |

|

|

2020 |

|

| |

|

|

|

|

|

|

| Operating

Activities: |

|

|

|

|

|

|

|

|

|

Net Income (Loss) |

|

$ |

(651,519 |

) |

|

$ |

180,303 |

|

|

Adjustments to reconcile net income (loss) to net cash used in

operating activities: |

|

|

|

|

|

|

|

|

|

Depreciation Expense |

|

|

1,750 |

|

|

|

1,250 |

|

|

Options expense |

|

|

75,738 |

|

|

|

61,997 |

|

|

Warrant Expense |

|

|

- |

|

|

|

79,089 |

|

|

Common Stock Issued for Services |

|

|

98,247 |

|

|

|

- |

|

|

Bad Debt Expense |

|

|

- |

|

|

|

9,000 |

|

|

Amortization of right of use asset |

|

|

31,678 |

|

|

|

23,635 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts Receivable |

|

|

(1,131,807 |

) |

|

|

(94,047 |

) |

|

Prepaid Assets and other Current Assets |

|

|

(306,490 |

) |

|

|

(184,923 |

) |

|

Inventory |

|

|

787,632 |

|

|

|

(311,640 |

) |

|

Deposits for Inventory Purchases |

|

|

- |

|

|

|

(580,800 |

) |

|

Other Receivables |

|

|

6,425 |

|

|

|

- |

|

|

Lease Liability |

|

|

(31,517 |

) |

|

|

(20,974 |

) |

|

Accounts Payable |

|

|

109,642 |

|

|

|

(14,376 |

) |

|

Customer Deposits |

|

|

- |

|

|

|

305,972 |

|

|

Accrued Liabilities and Other Liabilities |

|

|

299,923 |

|

|

|

134,708 |

|

| Net Cash used in

operating activities |

|

|

(710,298 |

) |

|

|

(410,806 |

) |

| |

|

|

|

|

|

|

|

|

| Investing

Activities: |

|

|

|

|

|

|

|

|

|

Purchase of Fixed Assets |

|

|

- |

|

|

|

(23,505 |

) |

|

Net Cash used in Investing activities |

|

|

- |

|

|

|

(23,505 |

) |

| |

|

|

|

|

|

|

|

|

| Financing

Activities: |

|

|

|

|

|

|

|

|

| Stock Issuance Costs |

|

|

- |

|

|

|

(732,355 |

) |

|

Proceeds from exercise of Warrants |

|

|

- |

|

|

|

1,352 |

|

|

Proceeds from exercise of Stock Options |

|

|

- |

|

|

|

501 |

|

|

Proceeds from Issuance of Common Stock |

|

|

- |

|

|

|

5,994,424 |

|

|

Net Cash provided by financing activities |

|

|

- |

|

|

|

5,263,922 |

|

| |

|

|

|

|

|

|

|

|

| Net increase (decrease) in

Cash |

|

|

(710,298 |

) |

|

|

4,829,611 |

|

| Cash at Beginning of the

Period |

|

|

5,919,578 |

|

|

|

2,871,694 |

|

| Cash at End of the Period |

|

$ |

5,209,280 |

|

|

$ |

7,701,305 |

|

| |

|

|

|

|

|

|

|

|

| Supplemental Cash Flow

Information |

|

|

|

|

|

|

|

|

| Cash Paid for Interest |

|

$ |

1,639 |

|

|

$ |

2,348 |

|

| Cash Paid for Income

Taxes |

|

$ |

- |

|

|

$ |

- |

|

| |

|

|

|

|

|

|

|

|

|

Reconciliation of Net Income (Loss) attributable to Trxade

Group, Inc., to Earnings before Interest, Taxes, Depreciation and

Amortization (EBITDA) and Adjusted EBITDA* |

| |

|

|

|

|

|

|

| |

|

For the three months ended March

31, |

|

|

|

|

| |

|

|

2021 |

|

|

|

|

2020 |

|

|

|

|

|

|

|

|

|

| Net Income (Loss) attributable

to Trxade Group, Inc. |

|

$ |

(651,519 |

) |

|

|

$ |

180,303 |

|

|

|

|

|

|

|

|

|

| Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest, net |

|

|

7,264 |

|

|

|

|

7,973 |

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

|

1,750 |

|

|

|

|

1,250 |

|

|

|

|

|

|

|

|

|

| EBITDA |

|

|

(642,505 |

) |

|

|

|

189,526 |

|

|

|

|

|

|

|

|

|

| Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

|

173,985 |

|

|

|

|

141,086 |

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA

* |

|

$ |

(468,520 |

) |

|

|

$ |

330,612 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * EBITDA and

Adjusted EBITDA are non-GAAP financial measures. These measurements

are not recognized in accordance with GAAP and should not be viewed

as an alternative to GAAP measures of performance. See also “Use of

Non-GAAP Financial Information”, above. |

|

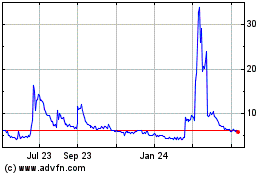

TRxADE Health (NASDAQ:MEDS)

Historical Stock Chart

From Aug 2024 to Sep 2024

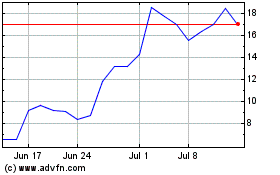

TRxADE Health (NASDAQ:MEDS)

Historical Stock Chart

From Sep 2023 to Sep 2024