false0001640384--12-3100016403842024-03-072024-03-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 07, 2024 |

LM FUNDING AMERICA, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37605 |

47-3844457 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1200 West Platt Street Suite 100 |

|

Tampa, Florida |

|

33606 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 813 222-8996 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock par value $0.001 per share |

|

LMFA |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modification to Rights of Security Holders.

To the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

As previously disclosed, on November 9, 2023, LM Funding America, Inc. (the “Company”) held a meeting of stockholders (the “Annual Meeting”). At the Annual Meeting, the stockholders approved the proposal to amend the Company’s Certificate of Incorporation (the “Certificate of Incorporation”), to effect a reverse stock split of its issued and outstanding common stock at a ratio within the range of one-for-two (1:2) to one-for-ten (1:10), as determined by the Board of Directors of the Company (the “Board”).

On February 23, 2024, the Board approved a one-for-six reverse stock split of the Company’s issued and outstanding common stock (the “Reverse Stock Split”). On March 7, 2024, the Company filed with the Secretary of State of the State of Delaware a Certificate of Amendment to its Certificate of Incorporation (the “Certificate of Amendment”) to effect the Reverse Stock Split. The Reverse Stock Split will become effective as of 12:01 a.m. Eastern Time on March 12, 2024 (the “Effective Time”), and the Company’s common stock will begin trading on a split-adjusted basis when the market opens on March 12, 2024.

When the Reverse Stock Split becomes effective, every six (6) shares of the Company’s issued and outstanding common stock (and such shares held in treasury, if any) will automatically be converted into one share of common stock, without any change in the par value per share. In addition, a proportionate adjustment will be made to the per share exercise price and the number of shares issuable upon the exercise of all outstanding stock options and warrants to purchase shares of common stock and to the number of shares reserved for issuance pursuant to the Company’s equity incentive compensation plans. Any fraction of a share of common stock that would be created as a result of the Reverse Stock Split will be rounded up to the next whole share.

The Company’s common stock will continue to trade on The Nasdaq Stock Market LLC (“Nasdaq”) under the symbol “LMFA.” The new CUSIP number for the common stock following the Reverse Stock Split will be 502074503. A copy of the Certificate of Amendment is attached as Exhibit 3.1 hereto and incorporated herein by reference.

Item 7.01 Regulation FD.

On March 8, 2024, the Company issued a press release announcing the Reverse Stock Split. The press release is furnished as Exhibit 99.1 and incorporated herein by reference.

The information in this Item 7.01, including Exhibit 99.1 attached hereto, is being furnished, shall not be deemed “filed” for any purpose, and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

The information provided in Item 5.03 is hereby incorporated by reference.

The Company has a registration statement on Form S-3 (File No. 333-258326) and a registration statement on Form S-8 (File No. 333-262316) on file with the Securities and Exchange Commission (the “SEC”). SEC regulations permit the Company to incorporate by reference future filings made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the termination of the offerings covered by registration statements filed on Form S-3 or Form S-8. The information incorporated by reference is considered to be part of the prospectus included within each of those registration statements. Information in this Item 8.01 of this Current Report on Form 8-K is therefore intended to be automatically incorporated by reference into each of the active registration statements listed above, thereby amending them. Pursuant to Rule 416(b) under the Securities Act, the amount of undistributed shares of Common Stock deemed to be covered by the effective registration statements of the Company described above are proportionately reduced as of the Effective Time to give effect to the Reverse Stock Split.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Forward-Looking Statements

This Current Report on Form 8-K may contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainty. Words such as “anticipate,” “estimate,” “expect,” “intend,” “plan,” and “project” and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guarantees of future results and conditions but rather are subject to various risks and uncertainties. Such statements are based on the Company’s current expectations and are subject to a number of risks and uncertainties that could cause actual results to differ materially from those described in the forward-looking statements. Investors are cautioned that there can be no assurance actual results or business conditions will not differ materially from those projected or suggested in such forward-looking statements as a result of various risks and uncertainties. Investors should refer to the risks detailed from time to time in the reports the Company files with the SEC, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, as well as other filings on Form 10-Q and periodic filings on Form 8-K, for additional factors that could cause actual results to differ materially from those stated or implied by such forward-looking statements. The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise, unless required by law.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

LM Funding America, Inc. |

|

|

|

|

Date: |

March 8, 2024 |

By: |

/s/ Richard Russell |

|

|

|

Richard Russell, Chief Financial Officer |

Exhibit 3.1

CERTIFICATE OF AMENDMENT TO THE

CERTIFICATE OF INCORPORATION

OF

LM FUNDING AMERICA, INC.

Adopted in accordance with the provisions

of Section 242 of the General Corporation

Law of the State of Delaware

LM Funding America, Inc., (the “Corporation”), a corporation organized and existing under the laws of the State of Delaware, by its duly authorized officer, does hereby certify:

FIRST: This Certificate of Amendment (the “Certificate of Amendment”) amends the provisions of the Corporation’s original Certificate of Incorporation filed with the Secretary of State of the State of Delaware on April 20, 2015, as amended on August 7, 2015, September 5, 2018, October 15, 2018, May 5, 2021, and December 27, 2021 (the “Certificate of Incorporation”).

SECOND: The Certificate of Incorporation is hereby amended by adding the following paragraph to the end of Article IV thereof as a new Article IV, Section 5:

“SECTION 5. Reverse Stock Split. Without regard to any other provision of this Certificate of Incorporation, effective at 12:01, eastern time, on March 12, 2024 (the “Effective Time”), the shares of Common Stock issued and outstanding immediately prior to the Effective Time and the shares of Common Stock issued and held in treasury of the Corporation immediately prior to the Effective Time are reclassified into a smaller number of shares such that each six (6) shares of issued Common Stock immediately prior to the Effective Time is reclassified into one (1) share of Common Stock. Notwithstanding the immediately preceding sentence, no fractional shares shall be issued and, in lieu thereof, upon surrender after the Effective Time of a certificate which formerly represented shares of Common Stock that were issued and outstanding immediately prior to the Effective Time, any person who would otherwise be entitled to a fractional share of Common Stock as a result of the reclassification, following the Effective Time, shall be entitled to receive one (1) share of Common Stock. Each certificate that immediately prior to the Effective Time represented shares of Common Stock (“Old Certificates”) shall thereafter represent that number of shares of Common Stock into which the shares of Common Stock represented by the Old Certificate shall have been combined, subject to the treatment of fractional shares as described above.”

THIRD: This Certificate of Amendment to the Certificate of Incorporation was duly authorized and adopted by the Corporation’s Board of Directors and stockholders in accordance with Section 242 of the General Corporation Law of the State of Delaware.

FOURTH: Except as specifically set forth herein, the remainder of the Certificate of Incorporation will not be amended, modified or otherwise altered.

* * *

IN WITNESS WHEREOF, the Corporation has caused this Certificate of Amendment to the Certificate of Incorporation to be executed by Bruce M. Rodgers, its Chief Executive Officer, this 7th day of March, 2024.

|

|

LM FUNDING AMERICA, INC. |

|

|

|

|

|

|

By: |

|

|

Bruce M. Rodgers |

|

Chief Executive Officer |

Exhibit 99.1

LM Funding Announces 1-for-6 Reverse Stock Split to Ensure Compliance with Nasdaq Continued Listing Requirements and to Attract a Broader Audience of Investors

TAMPA, FL / ACCESSWIRE / March 8, 2024 / LM Funding America, Inc. (NASDAQ:LMFA) ("LM Funding" or "LMFA"), a cryptocurrency mining and technology-based specialty finance company, today announced a 1-for-6 reverse stock split of its outstanding common stock, effective at 12:01 a.m. Eastern time on March 12, 2024. Beginning March 12, 2024, LM Funding’s common stock will trade on a split-adjusted basis.

Bruce M. Rodgers, Chairman and CEO of LM Funding, stated, "We believe that our business fundamentals are currently strong and that we continue to make good progress, as evidenced by our 1700% year-over-year revenue growth in the third quarter of 2023. Notably, as previously reported, the stockholders’ equity of LM Funding was $35.9 million, or $2.45 per share (or $14.70 per share after giving effect to the reverse split announced today), as of September 30, 2023, and yet our current share price remains below the Nasdaq minimum bid price requirement of $1.00. We believe this share consolidation will not only ensure we meet the continued listing requirements, but also help us to attract a broader universe of investors, including institutional investors and retail brokers that encounter share price restrictions. Importantly, the pro-rata ownership of each shareholder will remain unchanged as a result of the reverse split, and we believe this share consolidation will tighten our public float and enhance our capital structure as we continue to execute on our business model.”

At LM Funding’s Annual Meeting of Shareholders (the “Annual Meeting”) held on November 9, 2023, the Company’s shareholders approved a proposal to amend the Company’s Certificate of Incorporation to effect a reverse stock split of its common stock at a ratio within the range of one-for-two (1:2) to one-for-ten (1:10), as determined by the Company’s Board of Directors. On February 23, 2024, the Board of Directors adopted a resolution approving and authorizing a 1-for-6 reverse split, and on March 7, 2024, LM Funding filed a Certificate of Amendment to its Certificate of Incorporation to effect the reverse stock split effective as of March 12, 2024. There will be no change to the total number of authorized shares of LM Funding Common Stock as set forth in the Certificate of Incorporation of the Company, as amended.

LM Funding’s shares of common stock will continue to trade on the NASDAQ under the symbol “LMFA.” The new CUSIP number for the Company’s common stock post reverse stock split is 502074503.

Upon the effectiveness of the reverse stock split, every 6 shares of LM Funding’s issued and outstanding common stock will automatically be converted into one share of common stock. No fractional shares will be issued. Any fraction of a share of common stock that would be created as a result of the reverse stock split be rounded up to the next whole share.

About LM Funding America:

DOCPROPERTY "CUS_DocIDChunk0"

LM Funding America, Inc. (Nasdaq: LMFA), together with its subsidiaries, is a cryptocurrency mining business that commenced Bitcoin mining operations in September 2022. The Company also operates a technology-based specialty finance company that provides funding to nonprofit community associations (Associations) primarily located in the state of Florida, as well as in the states of Washington, Colorado, and Illinois, by funding a certain portion of the Associations' rights to delinquent accounts that are selected by the Associations arising from unpaid Association assessments.

Forward-Looking Statements:

This press release may contain forward-looking statements made pursuant to the Private Securities Litigation Reform Act of 1995. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan,” and “project” and other similar words and expressions are intended to signify forward-looking statements. Forward-looking statements are not guaranties of future results and conditions but rather are subject to various risks and uncertainties. Some of these risks and uncertainties are identified in the Company's most recent Annual Report on Form 10-K and its other filings with the SEC, which are available at www.sec.gov. These risks and uncertainties include, without limitation, uncertainty created by the risks of entering into and operating in the cryptocurrency mining business, uncertainty in the cryptocurrency mining business in general, problems with hosting vendors in the mining business, the capacity of our Bitcoin mining machines and our related ability to purchase power at reasonable prices, the ability to finance and grow our cryptocurrency mining operations, our ability to acquire new accounts in our specialty finance business at appropriate prices, the potential need for additional capital in the future, changes in governmental regulations that affect our ability to collected sufficient amounts on defaulted consumer receivables, changes in the credit or capital markets, changes in interest rates, and negative press regarding the debt collection industry. The occurrence of any of these risks and uncertainties could have a material adverse effect on our business, financial condition, and results of operations.

|

Company Contact: Crescendo Communications, LLC Tel: (212) 671-1021 Email: LMFA@crescendo-ir.com |

DOCPROPERTY "CUS_DocIDChunk0"

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

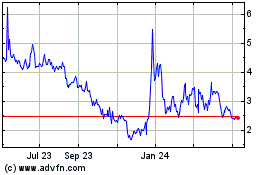

LM Funding America (NASDAQ:LMFA)

Historical Stock Chart

From Mar 2024 to Apr 2024

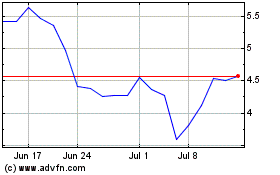

LM Funding America (NASDAQ:LMFA)

Historical Stock Chart

From Apr 2023 to Apr 2024