false

0001888886

True

0001888886

2024-03-08

2024-03-08

0001888886

gpcr:AmericanDepositarySharesAdssEachRepresentingThreeOrdinarySharesParValue0.0001PerOrdinaryShareMember

2024-03-08

2024-03-08

0001888886

gpcr:OrdinarySharesParValue0.0001PerShareMember

2024-03-08

2024-03-08

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 8, 2024

Structure Therapeutics Inc.

(Exact name of registrant as specified in its

charter)

| Cayman Islands |

|

001-41608 |

|

98-1480821 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

601 Gateway Blvd., Suite 900

South San Francisco, California |

|

94080 |

| (Address of principal executive offices) |

|

(Zip Code) |

(Registrant’s telephone number, including area code): (650) 457-1978

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| |

|

Name Of Each Exchange |

|

|

| Title of Each Class |

|

Trading Symbol(s) |

|

On Which Registered |

| American Depositary Shares (ADSs), each representing three ordinary shares, par value $0.0001 per ordinary share |

|

GPCR |

|

Nasdaq Global Market |

| |

|

|

|

|

| Ordinary shares, par value $0.0001 per share* |

|

True |

|

Nasdaq Global Market* |

* Not for trading, but only in connection with the registration of

the American Depositary Shares

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.02 Results of Operations and Financial Condition.

On March 8, 2024, Structure Therapeutics Inc. (the “Company”)

issued a press release providing a corporate update and announcing its financial results for the fourth quarter and year ended December 31,

2023. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated

herein by reference.

The information in this Current Report on Form 8-K (including

Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as

amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed to be incorporated

by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set

forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Structure Therapeutics Inc. |

| |

|

|

| Date: March 8, 2024 |

By: |

/s/ Raymond Stevens |

| |

|

Raymond Stevens, Ph.D. |

| |

|

Chief Executive Officer |

Exhibit 99.1

Structure Therapeutics Reports Fourth Quarter

and Full Year 2023 Financial Results and Recent Highlights

Topline GSBR-1290 Phase 2a 12-week obesity data,

as well as data from formulation bridging

and titration optimization study, on track for latter half of the second quarter 2024

Phase 2b study in obesity expected to begin

as planned in the fourth quarter 2024

Year-end cash balance of $467.3 million expected

to fund operations and

key clinical milestones through 2026

SAN FRANCISCO

– March 8, 2024 – Structure Therapeutics Inc. (NASDAQ: GPCR), a clinical-stage global biopharmaceutical company

developing novel oral small molecule therapeutics for metabolic and cardiopulmonary diseases, today reported financial results for the

fourth quarter and full year ended December 31, 2023, and highlighted recent corporate achievements.

“In 2023 we demonstrated clear proof-of-concept with our lead

GLP-1 receptor agonist, GSBR-1290, for obesity and type 2 diabetes. As a differentiated oral small molecule we have the scalability and

manufacturing advantages to potentially meet the significant unmet need currently observed in the GLP-1 space,” said Raymond Stevens,

Ph.D., Founder and CEO of Structure Therapeutics. “With a year-end cash balance of $467.3 million providing runway through the end

of 2026, we are well-positioned to initiate and complete our Phase 2b trials for GSBR-1290 and accelerate development of our oral small

molecule programs targeting amylin, GIP, and apelin receptors.”

Recent Highlights and Upcoming Milestones

GSBR-1290 for Type 2 Diabetes Mellitus (T2DM) and Obesity

| · | In December 2023, the Company reported clinically meaningful data from the Phase 2a study in T2DM demonstrating significant reductions

in hemoglobin A1c (HbA1c) and weight at 12 weeks. Interim Phase 2a data from the obesity cohort demonstrated significant reduction in

weight at 8 weeks. Across both cohorts, GSBR-1290 was generally well-tolerated with no treatment-related serious adverse events over 12

weeks and low study discontinuation rates due to adverse events related to study drug (2.8% in T2DM and 0% in obesity). |

| · | Topline data from the obesity cohort of the Phase 2a study, including full 12-week efficacy data for 40 participants and safety and

tolerability for all 64 participants. This study is fully enrolled and data are expected in the latter half of the second quarter of 2024. |

| · | In preparation for later stage clinical trials, a formulation bridging and titration optimization study to evaluate capsule versus

tablet pharmacokinetics (PK) and explore different titration regimens of GSBR-1290 is ongoing. This study is fully enrolled and data are

expected in the latter half of the second quarter of 2024. |

| · | The Company plans to initiate a global Phase 2b obesity study of GSBR-1290 in the fourth quarter of 2024. |

| · | The Company plans to initiate a Phase 2 study in T2DM in the second half of 2024. |

GLP-1R Combination Programs: Amylin, GIPR, Apelin (APJR)

| · | Oral Small Molecule Amylin Program: The Company is developing amylin agonists for use either alone or in combination with GLP-1R agonists

to treat obesity and associated diseases, and expects to select a development candidate in the second half of 2024. |

| · | Oral Small Molecule GIPR Program: The Company is developing a GIPR selective agonist and GLP-1R/GIPR

combinations to treat obesity and associated diseases, and expects to select a development candidate in the first half of 2025. |

| · | Oral Small Molecule Apelin Receptor (APJR) Program: The Company is evaluating its Phase 2 ready ANPA-0073, a biased agonist targeting

APJR used in combination with weight loss medicines, for selective or muscle-sparing weight loss. ANPA-0073 is also being evaluated for

idiopathic pulmonary fibrosis (IPF). The Company has completed a Phase 1 single-ascending and multiple-ascending dose study, in which

ANPA-0073 was generally well-tolerated with no serious adverse event reported. |

LPA1R Program for Idiopathic Pulmonary Fibrosis (IPF)

| · | The Company is developing LTSE-2578, an oral small molecule antagonist that targets lysophosphatidic

acid 1 receptor (LPA1R). Preclinical studies have demonstrated substantial anti-fibrotic activity in mouse models of fibrotic lung

disease, and the Company expects to initiate a first-in-human study of LTSE-2578 in the second quarter of 2024. |

Corporate

| · | In 2023, the Company raised approximately $485.0 million of equity capital: $185.0 million in gross proceeds from the initial public

offering in February, and $300.0 million in gross proceeds from the private placement equity financing in October. |

Fourth Quarter and Full Year 2023 Financial Highlights

Cash Position:

Cash, cash equivalents and short-term investments totaled $467.3 million at December 31, 2023. The Company expects its current cash,

cash equivalents and short-term investments to fund operations and expected key clinical milestones through at least 2026.

R&D

Expenses: Research and development (R&D) expenses for the fourth quarter of 2023 were $20.0 million, as compared to $8.4

million for the same period in 2022. For the year ended December 31, 2023, R&D expenses were $70.1 million, as compared to $36.2

million for the full year 2022. The increase was primarily due to the advancement of the Company’s GLP-1R franchise and other research

programs, clinical study activities and increases related to employee expenses, primarily due to an increase in personnel.

G&A

Expenses: General and administrative (G&A) expenses for the fourth quarter of 2023 were $11.0 million, as compared to $4.6

million for the same period in 2022. For the year ended December 31, 2023, G&A expenses were $32.7 million, as compared to $16.4

million for the full year 2022. The increase was primarily due to increases in professional services and employee related expenses as

the Company expanded its infrastructure to drive and support the growth in its operations as a publicly-traded company.

Net Loss:

Net loss for the fourth quarter of 2023 totaled $24.5, with non-cash stock-based compensation expense of $2.1 million, compared to $11.9

million for the fourth quarter of 2022 with non-cash stock-based compensation expense of $0.6 million. For the year ended December 31,

2023, net loss totaled $89.6 million, with non-cash stock-based compensation expense of $8.2 million, compared to $51.3 million for the

full year 2022 with non-cash stock-based compensation expense of $2.5 million.

About Structure Therapeutics

Structure

Therapeutics is a leading clinical-stage biopharmaceutical company focused on discovering and developing innovative oral treatments for

chronic metabolic and cardiopulmonary conditions with significant unmet medical needs. Utilizing its next generation structure-based

drug discovery platform, the Company has established a scientifically-driven, GPCR-targeted pipeline, featuring two wholly-owned proprietary

clinical-stage small molecule compounds designed to surpass the limitations of traditional biologic and peptide therapies and be accessible

to more patients around the world. For additional information, please visit www.structuretx.com.

Forward Looking Statements

This press

release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are statements that could be deemed

forward-looking statements, including, without limitation, statements concerning the Company’s future plans and prospects, the Company’s

anticipated cash runway, the clinical update from Structure’s Phase 2a study of GSBR-1290 in patients with T2DM and obesity, any

expectations regarding the safety, efficacy or tolerability of GSBR-1290 and other candidates under development, the ability of GSBR-1290

to treat T2DM, obesity or related indications, the planned initiation and study design of Structure’s Phase 2b studies for GSBR-1290

in patients with T2DM and obesity and the timing thereof, and first-in-human study of LTSE-2578 and the timing thereof, respectively,

the selection of a development candidate for the Company’s amylin receptor agonist program and GLP-1R/GIPR program, the planned

timing of the Company’s data results and continued development of GSBR-1290, amylin and next generation GLP-1R/GIPR combination

candidates and expectations regarding an oral development candidate targeting GLP-1R. In addition, when or if used in this press release,

the words “may,” “could,” “should,” “anticipate,” “believe,” “estimate,”

“expect,” “intend,” “plan,” “predict” and similar expressions and their variants, as they

relate to the Company may identify forward-looking statements. Forward-looking statements are neither historical facts nor assurances

of future performance. Although the Company believes the expectations reflected in such forward-looking statements are reasonable, the

Company can give no assurance that such expectations will prove to be correct. Readers are cautioned that actual results, levels of activity,

safety, performance or events and circumstances could differ materially from those expressed or implied in the Company’s forward-looking

statements due to a variety of risks and uncertainties, which include, without limitation, risks and uncertainties related to the preliminary

nature of the results due to length of the study and sample size, the risks that unblinded data is not consistent with blinded data, the

Company’s ability to advance GSBR-1290, LTSE-2578, ANPA-0073 and its other therapeutic candidates, obtain regulatory approval of

and ultimately commercialize the Company’s therapeutic candidates, the timing and results of preclinical and clinical trials, the

impact of any data collection omissions at any of our clinical sites, the Company’s ability to fund development activities and achieve

development goals, the impact of any global pandemics, inflation, supply chain issues, rising interest rates and future bank failures

on the Company’s business, its ability to protect its intellectual property and other risks and uncertainties described in the Company’s

filings with the Securities and Exchange Commission (SEC), including the Company’s Quarterly Report on Form 10-Q for

the quarter ended September 30, 2023, as filed with the SEC on November 17, 2023, and future reports the Company may file with

the SEC from time to time. All forward-looking statements contained in this press release speak only as of the date on which they were

made and are based on management’s assumptions and estimates as of such date. The Company undertakes no obligation to update such

statements to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

STRUCTURE THERAPEUTICS INC.

Condensed Consolidated Statements of Operations

(unaudited)

(In thousands)

| | |

THREE MONTHS ENDED | | |

YEAR ENDED | |

| | |

DECEMBER 31, | | |

DECEMBER 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Operating expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

$ | 20,042 | | |

$ | 8,360 | | |

$ | 70,103 | | |

$ | 36,193 | |

| General and administrative | |

| 10,952 | | |

| 4,596 | | |

| 32,672 | | |

| 16,368 | |

| Total operating expenses | |

| 30,994 | | |

| 12,956 | | |

| 102,775 | | |

| 52,561 | |

| Loss from operations | |

| (30,994 | ) | |

| (12,956 | ) | |

| (102,775 | ) | |

| (52,561 | ) |

| Interest and other income (expense), net | |

| 6,179 | | |

| 901 | | |

| 13,391 | | |

| 1,257 | |

| Loss before provision for income taxes | |

| (24,815 | ) | |

| (12,055 | ) | |

| (89,384 | ) | |

| (51,304 | ) |

| Provision for income taxes | |

| (312 | ) | |

| (180 | ) | |

| 236 | | |

| 17 | |

| Net loss | |

$ | (24,503 | ) | |

$ | (11,875 | ) | |

$ | (89,620 | ) | |

$ | (51,321 | ) |

STRUCTURE THERAPEUTICS INC.

Condensed Consolidated Balance Sheet Data

(unaudited)

(In thousands)

| | |

DECEMBER 31, | |

| | |

2023 | | |

2022 | |

| Assets | |

| | |

| |

| Current assets: | |

| | | |

| | |

| Cash, cash equivalents and short-term investments | |

$ | 467,323 | | |

$ | 90,841 | |

| Prepaid expenses and other current assets | |

| 6,285 | | |

| 2,248 | |

| Total current assets | |

| 473,608 | | |

| 93,089 | |

| Property and equipment, net | |

| 3,228 | | |

| 1,031 | |

| Operating right-of-use assets | |

| 5,136 | | |

| 262 | |

| Other non-current assets | |

| 45 | | |

| 3,463 | |

| Total assets | |

$ | 482,017 | | |

$ | 97,845 | |

| Liabilities, redeemable convertible preferred shares and shareholders’ equity (deficit) | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 4,742 | | |

$ | 6,009 | |

| Accrued expenses and other current liabilities | |

| 18,558 | | |

| 6,741 | |

| Operating lease liabilities, current portion | |

| 1,440 | | |

| 260 | |

| Total current liabilities | |

| 24,740 | | |

| 13,010 | |

| Operating lease liabilities, net of current portion | |

| 4,013 | | |

| — | |

| Other non-current liabilities | |

| 298 | | |

| — | |

| Total liabilities | |

| 29,051 | | |

| 13,010 | |

| Redeemable convertible preferred shares issuable in series | |

| — | | |

| 199,975 | |

| Total shareholders’ equity (deficit) | |

| 452,966 | | |

| (115,140 | ) |

| Total liabilities, redeemable convertible preferred shares and shareholders’ equity (deficit) | |

$ | 482,017 | | |

$ | 97,845 | |

Investors:

Danielle Keatley

Structure Therapeutics Inc.

ir@structuretx.com

Media:

Dan Budwick

1AB

Dan@1abmedia.com

v3.24.0.1

Cover

|

Mar. 08, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 08, 2024

|

| Entity File Number |

001-41608

|

| Entity Registrant Name |

Structure Therapeutics Inc.

|

| Entity Central Index Key |

0001888886

|

| Entity Tax Identification Number |

98-1480821

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

601 Gateway Blvd.

|

| Entity Address, Address Line Two |

Suite 900

|

| Entity Address, City or Town |

South San Francisco

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94080

|

| City Area Code |

650

|

| Local Phone Number |

457-1978

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| American Depositary Shares (ADSs), each representing three ordinary shares, par value $0.0001 per ordinary share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

American Depositary Shares (ADSs), each representing three ordinary shares, par value $0.0001 per ordinary share

|

| Trading Symbol |

GPCR

|

| Security Exchange Name |

NASDAQ

|

| Ordinary shares, par value $0.0001 per share* |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Ordinary shares, par value $0.0001 per share*

|

| No Trading Symbol Flag |

true

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=gpcr_AmericanDepositarySharesAdssEachRepresentingThreeOrdinarySharesParValue0.0001PerOrdinaryShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=gpcr_OrdinarySharesParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

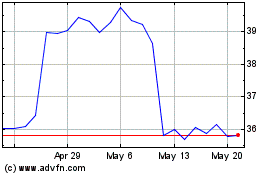

Structure Therapeutics (NASDAQ:GPCR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Structure Therapeutics (NASDAQ:GPCR)

Historical Stock Chart

From Apr 2023 to Apr 2024