0000029332False00000293322023-08-042023-08-04

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 4, 2023

THE DIXIE GROUP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Tennessee | | 0-2585 | | 62-0183370 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | |

| 475 Reed Road | Dalton | Georgia | 30720 |

| (Address of principal executive offices) | (Zip Code) |

| | | | | |

| (706) | 876-5800 |

| (Registrant's telephone number, including area code) |

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $3 Par Value | | DXYN | | NASDAQ Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition.

On August 04, 2023, The Dixie Group, Inc. issued a press release reporting results for the second quarter ended July 01, 2023.

Item 9.01. Financial Statements and Exhibits.

(c) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Date: August 4, 2023 | | THE DIXIE GROUP, INC. |

| | |

| | By: /s/ Allen L. Danzey |

| | Allen L. Danzey |

| | Chief Financial Officer |

CONTACT: Allen Danzey

Chief Financial Officer

706-876-5865

allen.danzey@dixiegroup.com

THE DIXIE GROUP REPORTS OPERATING INCOME FOR SECOND QUARTER OF 2023

Highlights from the Second Quarter 2023:

•Gross profit margin for three months of the second quarter of 2023 was 26.7% of net sales compared to 19.2% in the second quarter of 2022.

•Operating income for the three months of the second quarter of 2023 was $253 thousand compared to an operating loss of $2.9 million in the second quarter of 2022. The operating income in the current quarter included $719 thousand in expenses related to facility consolidations.

•Order entry for the month of July 2023 is slightly ahead of the comparable period in the prior year.

DALTON, GEORGIA (August 4, 2023) -- The Dixie Group, Inc. (NASDAQ: DXYN) today reported financial results for the quarter ended July 1, 2023. For the three months of the second quarter of 2023, the Company had net sales of $74,009,000 as compared to $83,698,000 in the same quarter of 2022. Operating income was $253,000 compared to a loss of $2,935,000 in the second quarter of 2022. The operating income in 2023 included expenses totaling $719,000 related to facility consolidations. The net loss from continuing operations for the three months of the second quarter of 2023 was $1,620,000 or $0.11 per diluted share. In 2022, the net loss from continuing operations for the second quarter was $4,019,000 or $0.26 per diluted share.

For the six months ended July 1, 2023, net sales from continuing operations were $141,093,000, a 12.5% decrease from sales in the first six months of 2022 at $161,273,000. Operating income for the six months ended July 1, 2023 was $560,000 compared to an operating loss of $5,182,000 in the six month period ended June 25, 2022. The net loss from continuing operations for the six months ended July 1, 2023 was $3,171,000, or $0.22 per diluted share, compared to a net loss of $7,361,000, or $0.48 per diluted share, in the first six months of the prior year.

Commenting on the results, Daniel K. Frierson, Chairman and Chief Executive Officer, said, “Our second quarter results continued to show the positive impact of the plant consolidation and cost reductions we began in 2022. Our gross margins were strong as our manufacturing plants continue to operate at levels of high efficiency despite the lower year over year sales volume. A significant factor in the year over year sales decline was a loss of volume in the mass merchant channel, with our primary customer’s strategy shifting toward lower price points. Excluding our mass merchant sales, net sales were down 9.1% over the prior year quarter. This decline in sales was primarily the continued result of high inflation and increased interest rates impacting consumer confidence and demand in the second quarter of 2023. For the first half of 2023, we have experienced higher selling expenses driven by samples and marketing investment for new product offerings, particularly in our new decorative line and the growing hard surface flooring market. The majority of the benefit of this current year expense will be reflected in sales in future periods.

In the second quarter we launched eleven new products in our synthetic soft surface lines. This included four new styles in our DH Floors collection made with DuraSilk™ solution dyed polyester, three new nylon products in our .

The Dixie Group Reports First Quarter 2023 Results

Page 2

May 4, 2023

Masland Energy main street commercial group and four new EnVision nylon styles in our high-end residential Masland and Fabrica brands

In our higher-end decorative brands, we have continued executing our growth strategy through 23 new introductions. This includes eight new styles in Décor by Fabrica, six in 1866 by Masland, and nine in our new 1866 All Seasons Collection. The 1866 All Seasons Collection is new for 2023 and includes 15 beautiful patterns for indoor or outdoor applications. Made with UV-treated fiber, which will not degrade from sunlight or weather, and available with a special exterior backing, these styles are especially well suited for the growing trend of outdoor living spaces.

In our hard surface lines, we introduced two new collections in TRUCOR Bravo and TRUCOR TYMBR Select. Bravo is a 5.5mm, 7”x60” SPC featuring great visuals, on-trend colors, and painted beveled edges. TYMBR Select is our second collection in the laminate segment and provides beautiful visuals and colors with an AC4 durability rating.

We are also excited about the continued expansion of our digital capability through our partnership with Broadlume. This program provides an excellent consumer experience, including integration with retailer websites, personalized online product visualization and easy online sample ordering. There are over 800 retailers in this program now, and we are seeing increased online activity, lead generation, and sample ordering,” Frierson concluded.

The gross profit in the three months of the second quarter of 2023 was 26.7% of net sales compared to 19.2% of net sales in the same quarter of 2022. Our 2022 gross margin was negatively impacted by exorbitantly high pricing from our former primary raw material provider driven by their decision to exit the business. In 2023, we have diversified our raw material suppliers at lower comparative costs. Our cost of goods sold also reflected favorable operating results from our manufacturing operations primarily attributable to our east coast plant consolidations. Selling and administrative costs in the second quarter 2023 were higher as a percent of the lower net sales, 25.7% of net sales in 2023 compared to 22.5% in the second quarter of 2022.

The Company’s receivables increased $4.5 million from the balance at fiscal year end 2022 due to higher comparative sales volume in the last month of each respective period. The net inventory value at second quarter end 2023 decreased $4.5 million from the fiscal year end 2022 balance due to lower inventory volume and values. Our accounts payable and accrued expenses increased by $6.2 million from prior year end. This increase was primarily the result of higher accounts payable related to increased production volume for higher comparative production demand. Our capital expenditures for the second quarter were $238 thousand bringing our year to date July 1, 2023 capital expenditure amount to $597 thousand. Total capital expenditures for the year are planned at $3.0 million. Interest expense was $1.8 million in the second quarter of 2023 compared to $1.1 million in the second quarter of 2022. The higher interest expense in 2023 was the result of increased borrowing and higher interest rates. Our debt decreased by $3.1 million in the second quarter of 2023 driven by decreased inventory and timing of expense payments and purchases. Our availability under our line of credit with our senior lending facility was $19.8 million at the end of the quarter.

For the month of July 2023, order entry is slightly higher than the comparable period in the prior year. We anticipate stronger demand in the later third quarter due to normal seasonality and the impact of new product launches.

This press release contains forward-looking statements. Forward-looking statements are based on estimates, projections, beliefs and assumptions of management and the Company at the time of such statements and are not guarantees of performance. Forward-looking statements are subject to risk factors and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements. Such factors include the levels of demand for the products produced by the Company. Other factors that could affect the Company's results include, but are not limited to, availability of raw material and transportation costs related to petroleum prices, the cost and availability of capital, integration of acquisitions, ability to attract, develop and retain qualified personnel and general economic and competitive conditions related to the Company's business. Issues related to the availability and price of energy may adversely affect the Company's operations. Additional information regarding these and other risk factors and uncertainties may be found in the Company's filings with the Securities and Exchange Commission. The Company disclaims any obligation to update or revise any forward-looking statements based on the occurrence of future events, the receipt of new information, or otherwise.

The Dixie Group Reports Second Quarter 2023 Results

Page 3

August 4, 2023

THE DIXIE GROUP, INC.

Consolidated Condensed Statements of Operations

(unaudited; in thousands, except earnings (loss) per share)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Six Months Ended |

| | July 1,

2023 | | June 25,

2022 | | July 1,

2023 | | June 25,

2022 |

| | | | | | | |

| NET SALES | $ | 74,009 | | | $ | 83,698 | | | $ | 141,093 | | | $ | 161,273 | |

| Cost of sales | 54,229 | | | 67,642 | | | 103,480 | | | 130,041 | |

| GROSS PROFIT | 19,780 | | | 16,056 | | | 37,613 | | | 31,232 | |

| Selling and administrative expenses | 19,042 | | | 18,855 | | | 35,451 | | | 36,268 | |

| Other operating (income) expense, net | (234) | | | 136 | | | (166) | | | 146 | |

| Facility consolidation and severance expenses, net | 719 | | | — | | | 1,768 | | | — | |

| | | | | | | |

| OPERATING INCOME (LOSS) | 253 | | | (2,935) | | | 560 | | | (5,182) | |

| Interest expense | 1,849 | | | 1,081 | | | 3,707 | | | 2,196 | |

| Other (income) expense, net | 3 | | | — | | | (10) | | | (1) | |

| | | | | | | |

| | | | | | | |

| Loss from continuing operations before taxes | (1,599) | | | (4,016) | | | (3,137) | | | (7,377) | |

| Income tax provision (benefit) | 21 | | | 3 | | | 34 | | | (16) | |

| Loss from continuing operations | (1,620) | | | (4,019) | | | (3,171) | | | (7,361) | |

| Loss from discontinued operations, net of tax | (106) | | | (468) | | | (313) | | | (483) | |

| NET LOSS | $ | (1,726) | | | $ | (4,487) | | | $ | (3,484) | | | $ | (7,844) | |

| | | | | | | |

| BASIC EARNINGS (LOSS) PER SHARE: | | | | | | | |

| Continuing operations | $ | (0.11) | | | $ | (0.26) | | | $ | (0.22) | | | $ | (0.48) | |

| Discontinued operations | (0.01) | | | (0.03) | | | (0.02) | | | (0.03) | |

| Net loss | $ | (0.12) | | | $ | (0.29) | | | $ | (0.24) | | | $ | (0.51) | |

| | | | | | | |

| DILUTED EARNINGS (LOSS) PER SHARE: | | | | | | | |

| Continuing operations | $ | (0.11) | | | $ | (0.26) | | | $ | (0.22) | | | $ | (0.48) | |

| Discontinued operations | (0.01) | | | (0.03) | | | (0.02) | | | (0.03) | |

| Net loss | $ | (0.12) | | | $ | (0.29) | | | $ | (0.24) | | | $ | (0.51) | |

| | | | | | | |

| Weighted-average shares outstanding: | | | | | | | |

| Basic | 14,808 | | | 15,225 | | | 14,742 | | | 15,184 | |

| Diluted | 14,808 | | | 15,225 | | | 14,742 | | | 15,184 | |

| | | | | | | |

The Dixie Group Reports Second Quarter 2023 Results

Page 4

August 4, 2023

THE DIXIE GROUP, INC.

Consolidated Condensed Balance Sheets

(in thousands)

| | | | | | | | | | | |

| | July 1,

2023 | | December 31,

2022 |

| ASSETS | (Unaudited) | | |

| Current Assets | | | |

| Cash and cash equivalents | $ | 102 | | | $ | 363 | |

| Receivables, net | 29,497 | | | 25,009 | |

| Inventories, net | 79,182 | | | 83,699 | |

| Prepaid and other current assets | 13,424 | | | 10,167 | |

| Current assets of discontinued operations | 294 | | | 641 | |

| Total Current Assets | 122,499 | | | 119,879 | |

| | | |

| Property, Plant and Equipment, Net | 42,484 | | | 44,916 | |

| Operating Lease Right-Of-Use Assets | 19,273 | | | 20,617 | |

| | | |

| Other Assets | 15,533 | | | 15,982 | |

| Long-Term Assets of Discontinued Operations | 1,566 | | | 1,552 | |

| TOTAL ASSETS | $ | 201,355 | | | $ | 202,946 | |

| | | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Current Liabilities | | | |

| Accounts payable | $ | 19,514 | | | $ | 14,205 | |

| Accrued expenses | 18,525 | | | 17,667 | |

| Current portion of long-term debt | 4,245 | | | 4,573 | |

| Current portion of operating lease liabilities | 2,814 | | | 2,774 | |

| Current liabilities of discontinued operations | 1,514 | | | 2,447 | |

| Total Current Liabilities | 46,612 | | | 41,666 | |

| | | |

| Long-Term Debt, Net | 91,918 | | | 94,725 | |

| | | |

| Operating Lease Liabilities | 17,163 | | | 18,802 | |

| Other Long-Term Liabilities | 13,664 | | | 12,480 | |

| Long-Term Liabilities of Discontinued Operations | 3,853 | | | 3,759 | |

| Stockholders' Equity | 28,145 | | | 31,514 | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | $ | 201,355 | | | $ | 202,946 | |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

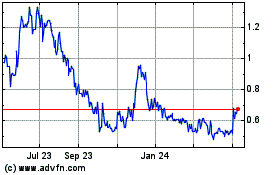

Dixie (NASDAQ:DXYN)

Historical Stock Chart

From Mar 2024 to Apr 2024

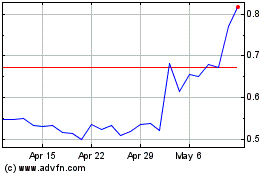

Dixie (NASDAQ:DXYN)

Historical Stock Chart

From Apr 2023 to Apr 2024