| |

|

|

|

|

| |

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING |

|

|

| |

|

|

|

|

| |

|

|

|

OMB APPROVAL

OMB Number: 3235-0058

Expires: April 30, 2025

Estimated average burden

hours per response ............ 2.50 |

| |

SEC File Number: |

001-26046 |

| |

CUSIP Number: |

G2110U117 |

| (Check one): |

|

o Form 10-K |

|

ý Form 20-F |

|

o Form 11-K |

|

o Form 10-Q |

|

o Form 10-D |

| |

|

o Form N-CEN |

|

o Form N-CSR |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

For Period Ended: |

December 31, 2022 |

| |

|

o Transition Report on Form 10-K |

|

|

|

|

| |

|

o Transition Report on Form 20-F |

|

|

|

|

| |

|

o Transition Report on Form 11-K |

|

|

|

|

| |

|

o Transition Report on Form 10-Q |

|

|

|

|

| |

|

For the Transition Period Ended: |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Read Instructions (on back page) Before Preparing

Form. Please Print or Type.

Nothing in this form shall be construed to imply

that the Commission has verified any information contained herein. |

If the notification relates to a portion of the filing checked above, identify

the Item(s) to which the notification relates:

PART I — REGISTRANT INFORMATION

| CHINA NATURAL RESOURCES, INC. |

| Full Name of Registrant |

| |

| N/A |

| Former Name if Applicable |

| |

| ROOM 2205, 22/F, WEST TOWER, SHUN TAK CENTRE, 168-200 CONNAUGHT ROAD CENTRAL |

| Address of Principal Executive Office (Street and Number) |

| |

| SHEUNG WAN, HONG KONG |

| City, State and Zip Code |

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or

expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

| |

(a) |

The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense |

| x |

(b) |

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

| |

(c) |

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III — NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q,

10-D, N-CEN, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

China Natural Resources, Inc. (the “Company”) has determined

that it is unable to file, without unreasonable effort or expense, its Annual Report on Form 20-F for the fiscal year ended December 31,

2022 (the “Form 20-F”) with the Securities and Exchange Commission (the “SEC”) on or prior to the prescribed due

date.

As disclosed on the Company’s Current Report on Form 6-K filed with

the SEC on February 28, 2023, the Company entered into a sale and purchase agreement (the “Sale and Purchase Agreement”) on

February 27, 2023, to acquire Williams Minerals (Pvt) Ltd (“Williams Minerals”). As a result, since February 2023, the Company’s

resources and management have been substantially committed to the negotiation of the Sale and Purchase Agreement and the due diligence

process required by it, which have had a direct impact on the Company’s ability to timely file its Form 20-F. Pursuant to the Sale

and Purchase Agreement, the Company had approximately one month to conduct its due diligence investigation into, among other things, the

business, legal, geological, operational, and financial aspects of Williams Minerals. Such due diligence exercise diverted significant

staff resources and time in March 2023 from the Company’s normal process of completing the Form 20-F.

The Company completed its due diligence exercise on April 14, 2023, as

disclosed on the Company’s Current Report on Form 6-K filed with the SEC on April 14, 2023, and is currently in the process of reviewing

and compiling certain financial and other information necessary to finalize the Form 20-F and the consolidated financial statements included

therein. The Company intends to file its Form 20-F with the SEC as promptly as practicable and is presently unaware of any circumstances

that would prevent it from filing its Form 20-F on or prior to the fifteenth calendar day following the prescribed due date in compliance

with Rule 12b-25.

PART IV — OTHER INFORMATION

| (1) |

|

Name and telephone number of person to contact in regard to this notification

|

| |

|

ZHU Youyi |

|

+86 |

|

755 82991472 |

| |

|

(Name) |

|

(Area Code) |

|

(Telephone Number) |

| |

|

|

| (2) |

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). |

| |

|

|

| |

|

|

|

|

|

ý Yes o No |

| |

|

|

|

|

|

|

| (3) |

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? |

| |

|

|

| |

|

|

|

|

|

ý Yes o No |

| |

|

|

|

|

|

|

| |

|

If so: attach an explanation of the anticipated change, both narratively

and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

The Company expects that its net loss for the fiscal year ended December

31, 2022 will be reduced by approximately 60% from its net loss of approximately CNY54.97 million for the fiscal year ended December 31,

2021. The decrease in net loss was mainly caused by fair value losses on financial instruments in 2021 which were not repeated in 2022.

The financial information set out above is preliminary and our final financial

information could have significant differences from this preliminary financial information. |

Discussion of Forward-Looking Statements about China Natural Resources,

Inc.

Statements in this notification on Form 12b-25 regarding China Natural

Resources, Inc. that are not historical facts are “forward-looking statements” that involve risks and uncertainties, which

could cause actual results to differ from those contained in the forward-looking statements. These include, without limitation, statements

regarding the intent, belief and current expectations of the Company, its directors or its officers with respect to our ability to file

the Form 20-F within the fifteen-day extension period permitted by Rule 12b-25; the thoroughness of our due diligence investigation into

Williams Minerals and our satisfaction with its results; the potential completion of the acquisition of Williams Minerals, and the timing

thereof; our ability to locate and execute on strategic opportunities; and the availability of internally generated funds for the payment

of operating expenses, capital expenditures and the Company’s growth strategy. Forward-looking statements are not a guarantee of

future performance and involve risks and uncertainties, and actual results may differ materially from those in the forward-looking statements

as a result of various factors. Among the risks and uncertainties that could cause the Company’s actual results to differ from its

forward-looking statements are: uncertainties regarding the governmental, economic and political circumstances in the PRC; the impact

on the Company’s financial position, growth potential and business from an investment in the natural resources sector generally

and in the Zimbabwean lithium mine owned by Williams Minerals specifically; uncertainties related to the Company’s ability to identify

potential partners or acquisition targets as it considers strategic alternatives; uncertainties related to the external consultants and

experts engaged by the Company in connection with the acquisition of Williams Minerals; uncertainties related to the Company’s ability

to settle in cash the consideration due in connection with the acquisition of Williams Minerals, as contemplated by the Sale and Purchase

Agreement; uncertainties related to the vesting of the ownership of the regions of the Zimbabwean mine owned by Williams Minerals, as

contemplated by the Sale and Purchase Agreement, and the timing thereof; uncertainties associated with metal price volatility; uncertainties

concerning the viability of mining and estimates of reserves at the Zimbabwean mine owned by Williams Minerals; uncertainties associated

with the issuance of and accuracy of the independent technical reports contemplated by the Sale and Purchase Agreement; uncertainties

related to geopolitical events and conflicts, such as the conflict between Russia and Ukraine; uncertainties regarding the impact of the

COVID-19 pandemic on domestic PRC and global economic conditions, demand for the mineral reserves that we may locate or extract, our workforce,

whether due to illness or restrictions on movement, and on the price of our common shares; uncertainties related to possible future increases

in operating expenses; the fluctuations of interest rates and foreign exchange rates; uncertainties related to the results of the next

assessment by the Staff of the Nasdaq Listing Qualifications department of the Company’s compliance with the Nasdaq Listing Rules;

uncertainties related to the political situation between the PRC and the United States; uncertainties regarding the ability of the Public

Company Accounting Oversight Board to continue to fully inspect auditors located in the PRC and Hong Kong, the implementation by the SEC

of more stringent disclosure and/or other requirements for companies located in the PRC or that have operations in the PRC that are listed

on exchanges in the United States, and increasing regulation by PRC government agencies of companies located in the PRC but listed elsewhere;

uncertainties related to the possibility that legislative or other regulatory action in the United States may result in listing standards

or other requirements that, if the Company cannot meet, may result in delisting and adversely affect the Company’s liquidity or

the trading price of the Company’s securities that are listed and traded in the United States; uncertainties related to PRC law

and government control of currency conversion that may restrict the ability to transfer funds into or out of the PRC; and other risks

detailed from time to time in the Company’s filings with the SEC, including, without limitation, the information set forth in the

Company’s Annual Reports on Form 20-F under the heading “Risk Factors.” When, in any forward-looking statement, the

Company, or its management, expresses an expectation or belief as to future results, that expectation or belief is expressed in good faith

and is believed to have a reasonable basis, but there can be no assurance that the stated expectation or belief will result or be achieved

or accomplished. Except as required by law, the Company undertakes no obligation to update any forward-looking statements.

CHINA NATURAL RESOURCES, INC.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf

by the undersigned hereunto duly authorized.

| Date |

May 1, 2023 |

|

By |

/s/ Wong Wah On Edward |

| |

|

|

|

Wong Wah On Edward |

| |

|

|

|

Chairman and Chief Executive Officer |

INSTRUCTION: The form may be signed by an executive officer of the registrant

or by any other duly authorized representative. The name and title of the person signing the form shall be typed or printed beneath the

signature. If the statement is signed on behalf of the registrant by an authorized representative (other than an executive officer), evidence

of the representative’s authority to sign on behalf of the registrant shall be filed with the form.

| |

ATTENTION |

|

| Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001). |

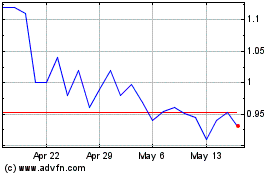

China Natural Resources (NASDAQ:CHNR)

Historical Stock Chart

From Apr 2024 to May 2024

China Natural Resources (NASDAQ:CHNR)

Historical Stock Chart

From May 2023 to May 2024