false

0000729580

0000729580

2024-02-21

2024-02-21

0000729580

belfb:ClassACommonStockCustomMember

2024-02-21

2024-02-21

0000729580

belfb:ClassBCommonStockCustomMember

2024-02-21

2024-02-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 21, 2024

BELFUSE INC /NJ

BEL FUSE INC.

(Exact Name of Registrant as Specified in its Charter)

|

New Jersey

|

|

0-11676

|

|

22-1463699

|

|

(State of incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

300 Executive Drive, Suite 300, West Orange, New Jersey

|

|

07052

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code: (201) 432-0463

|

Not Applicable

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol

|

|

Name of Exchange on Which Registered

|

|

Class A Common Stock ($0.10 par value)

|

|

BELFA

|

|

Nasdaq Global Select Market

|

|

Class B Common Stock ($0.10 par value)

|

|

BELFB

|

|

Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 21, 2024, Bel Fuse Inc. ("Bel" or the "Company") issued a press release regarding results for the three and twelve months ended December 31, 2023. A copy of this press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instruction B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01. Other Events.

On February 21, 2024, the Board of Directors of the Company approved a share repurchase program (the “Repurchase Program”), pursuant to which the Company is authorized to repurchase up to $25.0 million of shares of the Company’s outstanding Class A Common Stock, par value $0.10 per share (the “Class A Stock”) and Class B Common Stock, par value $0.10 per share (the “Class B Stock”, and collectively with the Class A Common Stock, the “Common Stock”). The aggregate $25.0 million available for repurchases under the Repurchase Program has been suballocated for purchases of Class A Shares and Class B shares in portions of $4.0 million and $21.0 million, respectively, prorated to take into account the number of outstanding shares of each respective class. Shares of Common Stock may be Repurchased pursuant to the Repurchase Program in open market, privately negotiated or block transactions or otherwise from time to time, depending upon market conditions and other factors, and in accordance with applicable law and regulations of the Securities and Exchange Commission, including Rule 10b-18 of the Securities Exchange Act of 1934, as amended.

All shares of Common Stock repurchased pursuant to the Repurchase Program will be cancelled and be available for use and reissuance as and when determined by the Board of Directors including, without limitation, pursuant to the Company’s 2020 Equity Compensation Plan or in connection with the administration of any other employee benefit plan maintained by the Company.

The Repurchase Program has no expiration date. The Repurchase Program does not obligate the Company to repurchase any dollar amount or number of shares, and the Repurchase Program may be suspended or terminated at any time. The timing and actual number of shares repurchased will depend on a variety of factors including price, market conditions, corporate and regulatory requirements and the consideration of other uses of cash including other investment opportunities. Information regarding share repurchases will be available in the Company’s periodic reports on Form 10-Q and 10-K filed with the Securities and Exchange Commission as required by the applicable rules promulgated under the Securities Exchange Act of 1934, as amended.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

As described in Item 2.02 of this Report, the following Exhibit 99.1 is furnished as part of this Current Report on Form 8-K:

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: February 21, 2024

|

BEL FUSE INC.

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

By:

|

/s/Daniel Bernstein

|

|

|

Daniel Bernstein

|

|

|

President and Chief Executive Officer

|

EXHIBIT INDEX

|

99.1

|

|

Press release issued by the Company, dated February 21, 2024 related to the financial results of the Company for the three and twelve months ended December 31, 2023.

|

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

|

|

Exhibit 99.1

|

|

FOR IMMEDIATE RELEASE

|

Bel Fuse Inc.

300 Executive Drive

Suite 300

West Orange, NJ 07052

www.belfuse.com

tel 201.432.0463

|

|

|

|

|

|

|

|

Bel Reports Fourth Quarter and Full Year 2023 Results

Announces New $25 Million Share Repurchase Program

WEST ORANGE, NJ, Wednesday, February 21, 2024 -- Bel Fuse Inc. (Nasdaq: BELFA and BELFB) today announced preliminary financial results for the fourth quarter and full year of 2023.

Fourth Quarter 2023 Highlights

|

•

|

Net sales of $140.0 million compared to $169.2 million in Q4-22. Non-GAAP adjusted net sales (which exclude expedite fee revenue) were $139.6 million in Q4-23 as compared to $158.7 million in Q4-22

|

|

•

|

Gross profit margin of 36.6%, up from 31.0% in Q4-22

|

| • |

Net earnings of $12.0 million versus $14.0 million in Q4-22 |

| • |

Adjusted EBITDA of $24.0 million (17.1% of sales) as compared to $25.0 million (14.8% of sales) in Q4-22 |

Full Year 2023 Highlights

|

|

Net sales of $639.8 million compared to $654.2 million in 2022. Non-GAAP adjusted net sales (which exclude expedite fee revenue) were $625.0 million in 2023, up from $621.7 million in 2022 |

|

|

Gross profit margin of 33.7%, up from 28.0% in 2022 |

|

|

Net earnings of $73.8 million versus $52.7 million in 2022

|

|

|

Adjusted EBITDA of $110.5 million (17.3% of sales), up from $83.0 million (12.7% of sales) in 2022

|

“In closing out 2023, we were very pleased with the financial turnaround that the team was able to achieve in a tough macro environment,” said Daniel Bernstein, President and CEO. “Our diversity in product segments and end markets served continues to be our strength, allowing us to focus on the future and growth. The Power and Connectivity segments were successful in mitigating the effects of a challenging Magnetics segment. Based on our strong 2023 cash flow generation, the Board has authorized a $25 million share repurchase program. This program is an output of our ongoing evaluation of the optimal use of capital and the various alternatives at present.

“In January 2024, Bel celebrated its 75th year in business. In reflecting on our history and progress made over the decades, we understand the short-term cycles that our industry and end markets will face from time to time. We have always been successful in persevering and coming out on the other side as a stronger company. The time and effort spent by our global team in 2023 to strengthen Bel’s foundation will serve us well in the years to come as growth returns and new end markets take hold,” concluded Mr. Bernstein.

Farouq Tuweiq, CFO, added “Our priority for 2023 was resetting Bel operationally and this was achieved through a number of initiatives - the largest one being the completion of our previously-announced Magnetics facility consolidations in China. In light of the current level of sales within our Magnetics group, the more efficient cost structure now in place for this segment was particularly well-timed. During the fourth quarter of 2023, we began another consolidation project at our Pennsylvania facility within the Connectivity segment.

“As our focus in streamlining the organization continues its momentum with material milestones achieved, the team will reemphasize and dedicate its focus on top line growth. It is expected that 2024 will be off to a slow start with various indicators forecasting a possible rebound in the second half of the year as inventory in the channel normalizes. Based on information available today, GAAP net sales in the first quarter of 2024 are expected to be in the range of $125 to $135 million, with gross margins holding at the full year 2023 level. We are ready and excited for another year of coordinated efforts across our versatile and resilient global team in building Bel for success in the years to come,” concluded Mr. Tuweiq.

Non-GAAP financial measures, such as Non-GAAP net earnings, Non-GAAP EPS, EBITDA and Adjusted EBITDA, exclude restructuring charges, gains on sales of business and properties, loss on liquidation of a foreign subsidiary and certain litigation costs. Non-GAAP adjusted net sales exclude expedite fee revenue. Please refer to the financial information included with this press release for reconciliations of GAAP financial measures to Non-GAAP financial measures and our explanation of why we present Non-GAAP financial measures.

Conference Call

Bel has scheduled a conference call for 8:30 a.m. ET on Thursday, February 22, 2024 to discuss these results. To participate in the conference call, investors should dial 877-407-0784, or 201-689-8560 if dialing internationally. The presentation will additionally be broadcast live over the Internet and will be available at https://ir.belfuse.com/events-and-presentations. The webcast will be available via replay for a period of at least 30 days at this same Internet address. For those unable to access the live call, a telephone replay will be available at 844-512-2921, or 412-317-6671 if dialing internationally, using access code 13743808 after 12:30 pm ET, also for 30 days.

About Bel

Bel (www.belfuse.com) designs, manufactures and markets a broad array of products that power, protect and connect electronic circuits. These products are primarily used in the networking, telecommunications, computing, general industrial, high-speed data transmission, military, commercial aerospace, transportation and eMobility industries. Bel's portfolio of products also finds application in the automotive, medical, broadcasting and consumer electronics markets. Bel's product groups include Magnetic Solutions (integrated connector modules, power transformers, power inductors and discrete components), Power Solutions and Protection (front-end, board-mount and industrial power products, module products and circuit protection), and Connectivity Solutions (expanded beam fiber optic, copper-based, RF and RJ connectors and cable assemblies). The Company operates facilities around the world.

Company Contact:

Farouq Tuweiq

Chief Financial Officer

ir@belf.com

Investor Contact:

Three Part Advisors

Jean Marie Young, Managing Director or Steven Hooser, Partner

631-418-4339

jyoung@threepa.com; shooser@threepa.com

Cautionary Language Concerning Forward-Looking Statements

This press release contains “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including but not limited to, our guidance for the first quarter of 2024, and our statements regarding our expectations for 2024 generally including anticipated financial performance and trends for the coming year, and our statements regarding future events, performance, plans, intentions, beliefs, expectations and estimates, including statements regarding matters such as trends and expectations as to our sales, gross margin, inventory, products and product segments, end markets, growth, costs and cost structures, consolidation projects and initiatives, focuses on streamlining and top line growth, and statements regarding the Company's positioning, its strategies, future progress, investments, plans, targets, goals, and other focuses and initiatives, and the expected timing and potential benefits thereof, and statements regarding our expectations and beliefs regarding trends in the Company's business and industry and the macroeconomic environment generally. These forward-looking statements are made as of the date of this release and are based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Words such as “expect,” “anticipate,” “should,” “believe,” “hope,” “target,” “project,” “forecast,” “outlook,” “goals,” “estimate,” “potential,” “predict,” “may,” “will,” “might,” “could,” “intend,” variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond Bel’s control. Bel’s actual results could differ materially from those stated or implied in our forward-looking statements (including without limitation any of Bel’s projections) due to a number of factors, including but not limited to, the market concerns facing our customers, and risks for the Company’s business in the event of the loss of certain substantial customers; the continuing viability of sectors that rely on our products; the effects of business and economic conditions; the impact of public health crises (such as the ongoing governmental, social and economic effects and ultimate impact of COVID-19); the effects of rising input costs, and cost changes generally; difficulties associated with integrating previously acquired companies; capacity and supply constraints or difficulties, including supply chain constraints or other challenges; difficulties associated with the availability of labor, and the risks of any labor unrest or labor shortages; risks associated with our international operations, including our substantial manufacturing operations in China; risks associated with restructuring programs or other strategic initiatives, including any difficulties in implementation or realization of the expected benefits or cost savings; product development, commercialization or technological difficulties; the regulatory and trade environment; risks associated with fluctuations in foreign currency exchange rates and interest rates; uncertainties associated with legal proceedings; the market's acceptance of the Company's new products and competitive responses to those new products; the impact of changes to U.S. legal and regulatory requirements, including tax laws, trade and tariff policies; and the risks detailed in Bel’s most recent Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and in subsequent reports filed by Bel with the Securities and Exchange Commission, as well as other documents that may be filed by Bel from time to time with the Securities and Exchange Commission. In light of the risks and uncertainties impacting our business, there can be no assurance that any forward-looking statement will in fact prove to be correct. Past performance is not necessarily indicative of future results. The forward-looking statements included in this press release represent Bel’s views as of the date of this press release. Bel anticipates that subsequent events and developments will cause its views to change. Bel undertakes no intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. These forward-looking statements should not be relied upon as representing Bel’s views as of any date subsequent to the date of this press release.

Non-GAAP Financial Measures

The Non-GAAP measures identified in this press release as well as in the supplementary information to this press release (Non-GAAP adjusted net sales, Non-GAAP net earnings, Non-GAAP EPS, EBITDA and Adjusted EBITDA) are not measures of performance under accounting principles generally accepted in the United States of America ("GAAP"). These measures should not be considered a substitute for, and the reader should also consider, income from operations, net earnings, earnings per share and other measures of performance as defined by GAAP as indicators of our performance or profitability. Our Non-GAAP measures may not be comparable to other similarly-titled captions of other companies due to differences in the method of calculation. We present results adjusted to exclude the effects of certain unusual or special items and their related tax impact that would otherwise be included under U.S. GAAP, to aid in comparisons with other periods. We may use Non-GAAP financial measures to determine performance-based compensation and management believes that this information may be useful to investors.

Website Information

We routinely post important information for investors on our website, www.belfuse.com, in the "Investor Relations" section. We use our website as a means of disclosing material, otherwise non-public information and for complying with our disclosure obligations under Regulation FD. Accordingly, investors should monitor the Investor Relations section of our website, in addition to following our press releases, SEC filings, public conference calls, presentations and webcasts. The information contained on, or that may be accessed through, our website is not incorporated by reference into, and is not a part of, this document.

[Financial tables follow]

|

Bel Fuse Inc.

|

|

Supplementary Information(1)

|

|

Condensed Consolidated Statements of Operations

|

|

(in thousands, except per share amounts)

|

|

(unaudited)

|

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$ |

140,010 |

|

|

$ |

169,203 |

|

|

$ |

639,813 |

|

|

$ |

654,233 |

|

|

Cost of sales

|

|

|

88,827 |

|

|

|

116,696 |

|

|

|

423,964 |

|

|

|

470,780 |

|

|

Gross profit

|

|

|

51,183 |

|

|

|

52,507 |

|

|

|

215,849 |

|

|

|

183,453 |

|

|

As a % of net sales

|

|

|

36.6 |

% |

|

|

31.0 |

% |

|

|

33.7 |

% |

|

|

28.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development costs

|

|

|

5,966 |

|

|

|

5,857 |

|

|

|

22,487 |

|

|

|

20,238 |

|

|

Selling, general and administrative expenses

|

|

|

24,942 |

|

|

|

25,126 |

|

|

|

99,091 |

|

|

|

92,342 |

|

|

As a % of net sales

|

|

|

17.8 |

% |

|

|

14.8 |

% |

|

|

15.5 |

% |

|

|

14.1 |

% |

|

Restructuring charges

|

|

|

3,808 |

|

|

|

3,322 |

|

|

|

10,114 |

|

|

|

7,322 |

|

|

Gains on sale of properties

|

|

|

- |

|

|

|

- |

|

|

|

(3,819 |

) |

|

|

(1,596 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from operations

|

|

|

16,467 |

|

|

|

18,202 |

|

|

|

87,976 |

|

|

|

65,147 |

|

|

As a % of net sales

|

|

|

11.8 |

% |

|

|

10.8 |

% |

|

|

13.8 |

% |

|

|

10.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gain on sale of Czech Republic business

|

|

|

- |

|

|

|

- |

|

|

|

980 |

|

|

|

- |

|

|

Interest expense

|

|

|

(448 |

) |

|

|

(968 |

) |

|

|

(2,850 |

) |

|

|

(3,379 |

) |

|

Other income/expense, net

|

|

|

(2,520 |

) |

|

|

218 |

|

|

|

(2,806 |

) |

|

|

(2,709 |

) |

|

Earnings before income taxes

|

|

|

13,499 |

|

|

|

17,452 |

|

|

|

83,300 |

|

|

|

59,059 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes

|

|

|

1,463 |

|

|

|

3,412 |

|

|

|

9,469 |

|

|

|

6,370 |

|

|

Effective tax rate

|

|

|

10.8 |

% |

|

|

19.6 |

% |

|

|

11.4 |

% |

|

|

10.8 |

% |

|

Net earnings

|

|

$ |

12,036 |

|

|

$ |

14,040 |

|

|

$ |

73,831 |

|

|

$ |

52,689 |

|

|

As a % of net sales

|

|

|

8.6 |

% |

|

|

8.3 |

% |

|

|

11.5 |

% |

|

|

8.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A common shares - basic and diluted

|

|

|

2,142 |

|

|

|

2,142 |

|

|

|

2,142 |

|

|

|

2,143 |

|

|

Class B common shares - basic and diluted

|

|

|

10,628 |

|

|

|

10,502 |

|

|

|

10,634 |

|

|

|

10,394 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net earnings per common share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Class A common shares - basic and diluted

|

|

$ |

0.90 |

|

|

$ |

1.06 |

|

|

$ |

5.52 |

|

|

$ |

4.01 |

|

|

Class B common shares - basic and diluted

|

|

$ |

0.95 |

|

|

$ |

1.12 |

|

|

$ |

5.83 |

|

|

$ |

4.24 |

|

|

(1) The supplementary information included in this press release for 2023 is preliminary and subject to change prior to the filing of our upcoming Annual Report on Form 10-K with the Securities and Exchange Commission.

|

|

| |

|

|

Bel Fuse Inc.

|

|

Supplementary Information(1)

|

|

Condensed Consolidated Balance Sheets

|

|

(in thousands, unaudited)

|

| |

|

December 31, 2023

|

|

|

December 31, 2022

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

89,371 |

|

|

$ |

67,740 |

|

|

Held to maturity U.S. Treasury securities

|

|

|

37,548 |

|

|

|

- |

|

|

Accounts receivable, net

|

|

|

84,129 |

|

|

|

107,274 |

|

|

Inventories

|

|

|

136,540 |

|

|

|

172,465 |

|

|

Other current assets

|

|

|

33,890 |

|

|

|

33,929 |

|

|

Total current assets

|

|

|

381,478 |

|

|

|

381,408 |

|

|

Property, plant and equipment, net

|

|

|

36,533 |

|

|

|

36,833 |

|

|

Right-of-use assets

|

|

|

20,481 |

|

|

|

21,551 |

|

|

Related-party note receivable

|

|

|

2,152 |

|

|

|

- |

|

|

Equity method investment

|

|

|

10,282 |

|

|

|

- |

|

|

Goodwill and other intangible assets, net

|

|

|

76,033 |

|

|

|

79,210 |

|

|

Other assets

|

|

|

44,672 |

|

|

|

41,464 |

|

|

Total assets

|

|

$ |

571,631 |

|

|

$ |

560,466 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

40,441 |

|

|

$ |

64,589 |

|

|

Operating lease liability, current

|

|

|

6,350 |

|

|

|

5,870 |

|

|

Other current liabilities

|

|

|

63,818 |

|

|

|

65,845 |

|

|

Total current liabilities

|

|

|

110,609 |

|

|

|

136,304 |

|

|

Long-term debt

|

|

|

60,000 |

|

|

|

95,000 |

|

|

Operating lease liability, long-term

|

|

|

14,212 |

|

|

|

15,742 |

|

|

Other liabilities

|

|

|

46,252 |

|

|

|

51,074 |

|

|

Total liabilities

|

|

|

231,073 |

|

|

|

298,120 |

|

|

Stockholders' equity

|

|

|

340,558 |

|

|

|

262,346 |

|

|

Total liabilities and stockholders' equity

|

|

$ |

571,631 |

|

|

$ |

560,466 |

|

|

(1) The supplementary information included in this press release for 2023 is preliminary and subject to change prior to the filing of our upcoming Annual Report on Form 10-K with the Securities and Exchange Commission.

|

|

|

Bel Fuse Inc.

|

|

Supplementary Information(1)

|

|

Condensed Consolidated Statements of Cash Flows

|

|

(in thousands, unaudited)

|

| |

|

Year Ended

|

|

| |

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net earnings

|

|

$ |

73,831 |

|

|

$ |

52,689 |

|

|

Adjustments to reconcile net earnings to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

13,312 |

|

|

|

14,863 |

|

|

Stock-based compensation

|

|

|

3,486 |

|

|

|

2,382 |

|

|

Amortization of deferred financing costs

|

|

|

33 |

|

|

|

34 |

|

|

Deferred income taxes

|

|

|

(3,872 |

) |

|

|

(4,594 |

) |

|

Net unrealized losses (gains) on foreign currency revaluation

|

|

|

1,356 |

|

|

|

(278 |

) |

|

Gains on sale/disposal of property, plant and equipment

|

|

|

(2,117 |

) |

|

|

(1,596 |

) |

|

Gain on sale of Czech Republic business

|

|

|

(980 |

) |

|

|

- |

|

|

Other, net

|

|

|

(1,037 |

) |

|

|

1,195 |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net

|

|

|

22,500 |

|

|

|

(20,702 |

) |

|

Unbilled receivables

|

|

|

5,451 |

|

|

|

10,031 |

|

|

Inventories

|

|

|

33,613 |

|

|

|

(36,592 |

) |

|

Accounts payable

|

|

|

(22,745 |

) |

|

|

1,522 |

|

|

Accrued expenses

|

|

|

5,356 |

|

|

|

10,933 |

|

|

Accrued restructuring costs

|

|

|

(1,228 |

) |

|

|

6,784 |

|

|

Income taxes payable

|

|

|

(4,976 |

) |

|

|

1,958 |

|

|

Other operating assets/liabilities, net

|

|

|

(13,634 |

) |

|

|

(898 |

) |

|

Net cash provided by operating activities

|

|

|

108,349 |

|

|

|

37,731 |

|

| |

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Purchases of property, plant and equipment

|

|

|

(12,126 |

) |

|

|

(8,832 |

) |

|

Purchases of held to maturity U.S. Treasury securities

|

|

|

(57,466 |

) |

|

|

- |

|

|

Proceeds from held to maturity securities

|

|

|

19,918 |

|

|

|

- |

|

|

Payment for noncontrolling investment

|

|

|

(10,282 |

) |

|

|

- |

|

|

Investment in related party notes receivable

|

|

|

(2,152 |

) |

|

|

- |

|

|

Proceeds from sale of property, plant and equipment

|

|

|

6,036 |

|

|

|

1,833 |

|

|

Proceeds from sale of business

|

|

|

5,063 |

|

|

|

- |

|

|

Net cash used in investing activities

|

|

|

(51,009 |

) |

|

|

(6,999 |

) |

| |

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Dividends paid to common stockholders

|

|

|

(3,492 |

) |

|

|

(3,413 |

) |

|

Repayments under revolving credit line

|

|

|

(40,000 |

) |

|

|

(17,500 |

) |

|

Borrowings under revolving credit line

|

|

|

5,000 |

|

|

|

- |

|

|

Purchase of treasury stock

|

|

|

(105 |

) |

|

|

(349 |

) |

|

Net cash used in financing activities

|

|

|

(38,597 |

) |

|

|

(21,262 |

) |

| |

|

|

|

|

|

|

|

|

|

Effect of exchange rate changes on cash and cash equivalents

|

|

|

2,888 |

|

|

|

(3,486 |

) |

| |

|

|

|

|

|

|

|

|

|

Net increase in cash and cash equivalents

|

|

|

21,631 |

|

|

|

5,984 |

|

|

Cash and cash equivalents - beginning of period

|

|

|

67,740 |

|

|

|

61,756 |

|

|

Cash and cash equivalents - end of period

|

|

$ |

89,371 |

|

|

$ |

67,740 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Supplementary information:

|

|

|

|

|

|

|

|

|

|

Cash paid during the period for:

|

|

|

|

|

|

|

|

|

|

Income taxes, net of refunds received

|

|

$ |

25,056 |

|

|

$ |

14,618 |

|

|

Interest payments

|

|

$ |

4,729 |

|

|

$ |

3,371 |

|

|

ROU assets obtained in exchange for lease obligations

|

|

$ |

5,999 |

|

|

$ |

8,052 |

|

(1) The supplementary information included in this press release for 2023 is preliminary and subject to change prior to the filing of our upcoming Annual Report on Form 10-K with the Securities and Exchange Commission.

|

Bel Fuse Inc.

|

|

Supplementary Information(1)

|

|

Product Group Highlights

|

|

(dollars in thousands, unaudited)

|

| |

|

Sales

|

|

|

Gross Margin

|

|

| |

|

Q4-23

|

|

|

Q4-22

|

|

|

% Change

|

|

|

Q4-23

|

|

|

Q4-22

|

|

|

Basis Point Change

|

|

|

Power Solutions and Protection

|

|

$ |

68,971 |

|

|

$ |

82,119 |

|

|

|

-16.0 |

% |

|

|

40.2 |

% |

|

|

33.0 |

% |

|

|

720 |

|

|

Connectivity Solutions

|

|

|

50,562 |

|

|

|

47,020 |

|

|

|

7.5 |

% |

|

|

29.3 |

% |

|

|

23.6 |

% |

|

|

570 |

|

|

Magnetic Solutions

|

|

|

20,477 |

|

|

|

40,064 |

|

|

|

-48.9 |

% |

|

|

17.1 |

% |

|

|

29.5 |

% |

|

|

(1,240 |

) |

|

Total

|

|

$ |

140,010 |

|

|

$ |

169,203 |

|

|

|

-17.3 |

% |

|

|

36.6 |

% |

|

|

31.0 |

% |

|

|

560 |

|

| |

Sales

|

|

|

Gross Margin

|

|

| |

FY 2023

|

|

|

FY 2022

|

|

|

% Change

|

|

|

FY 2023

|

|

|

FY 2022

|

|

|

Basis Point Change

|

|

|

Power Solutions and Protection

|

|

314,105 |

|

|

|

288,366 |

|

|

|

8.9 |

% |

|

|

38.1 |

% |

|

|

30.5 |

% |

|

|

760 |

|

|

Connectivity Solutions

|

|

210,572 |

|

|

|

187,085 |

|

|

|

12.6 |

% |

|

|

34.2 |

% |

|

|

25.9 |

% |

|

|

830 |

|

|

Magnetic Solutions

|

|

115,136 |

|

|

|

178,782 |

|

|

|

-35.6 |

% |

|

|

22.0 |

% |

|

|

27.6 |

% |

|

|

(560 |

) |

|

Total

|

$ |

639,813 |

|

|

$ |

654,233 |

|

|

|

-2.2 |

% |

|

|

33.7 |

% |

|

|

28.0 |

% |

|

|

570 |

|

|

(1) The supplementary information included in this press release for 2023 is preliminary and subject to change prior to the filing of our upcoming Annual Report on Form 10-K with the Securities and Exchange Commission.

|

|

|

Bel Fuse Inc.

|

|

Supplementary Information(1)

|

| Reconciliation of GAAP Net Sales to Non-GAAP Adjusted Net Sales(2) |

|

Reconciliation of GAAP Net Earnings to EBITDA and Adjusted EBITDA(2)

|

|

(in thousands, unaudited)

|

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31, |

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net sales

|

|

$ |

140,010 |

|

|

$ |

169,203 |

|

|

$ |

639,813 |

|

|

$ |

654,233 |

|

|

Expedite fee revenue

|

|

|

425 |

|

|

|

10,484 |

|

|

|

14,850 |

|

|

|

32,507 |

|

|

Non-GAAP adjusted net sales

|

|

$ |

139,585 |

|

|

$ |

158,719 |

|

|

$ |

624,963 |

|

|

$ |

621,726 |

|

| |

|

Three Months Ended

|

|

|

Year Ended

|

|

| |

|

December 31,

|

|

|

December 31,

|

|

| |

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Net earnings

|

|

$ |

12,036 |

|

|

$ |

14,040 |

|

|

$ |

73,831 |

|

|

$ |

52,689 |

|

|

Interest expense

|

|

|

448 |

|

|

|

968 |

|

|

|

2,850 |

|

|

|

3,379 |

|

|

Provision for income taxes

|

|

|

1,463 |

|

|

|

3,412 |

|

|

|

9,469 |

|

|

|

6,370 |

|

|

Depreciation and amortization

|

|

|

3,350 |

|

|

|

3,259 |

|

|

|

13,312 |

|

|

|

14,863 |

|

|

EBITDA

|

|

$ |

17,297 |

|

|

$ |

21,679 |

|

|

$ |

99,462 |

|

|

$ |

77,301 |

|

|

% of net sales

|

|

|

12.4 |

% |

|

|

12.8 |

% |

|

|

15.5 |

% |

|

|

11.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Unusual or special items:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restructuring charges

|

|

|

3,808 |

|

|

|

3,322 |

|

|

|

10,114 |

|

|

|

7,322 |

|

|

MPS litigation costs

|

|

|

128 |

|

|

|

- |

|

|

|

3,031 |

|

|

|

- |

|

|

Gain on sale of Czech Republic business

|

|

|

- |

|

|

|

- |

|

|

|

(980 |

) |

|

|

- |

|

|

Gain on sale of properties

|

|

|

- |

|

|

|

- |

|

|

|

(3,819 |

) |

|

|

(1,596 |

) |

|

Loss on liquidation of foreign subsidiary

|

|

|

2,724 |

|

|

|

- |

|

|

|

2,724 |

|

|

|

- |

|

|

Adjusted EBITDA

|

|

$ |

23,957 |

|

|

$ |

25,001 |

|

|

$ |

110,532 |

|

|

$ |

83,027 |

|

|

% of net sales

|

|

|

17.1 |

% |

|

|

14.8 |

% |

|

|

17.3 |

% |

|

|

12.7 |

% |

|

(1) The supplementary information included in this press release for 2023 is preliminary and subject to change prior to the filing of our upcoming Annual Report on Form 10-K with the Securities and Exchange Commission.

|

|

|

(2) In this press release and supplemental information, we have included Non-GAAP financial measures, including Non-GAAP adjusted net sales, Non-GAAP net earnings, Non-GAAP EPS, EBITDA and Adjusted EBITDA. We present results adjusted to exclude the effects of certain specified items and their related tax impact that would otherwise be included under GAAP, to aid in comparisons with other periods. We may use Non-GAAP financial measures to determine performance-based compensation and management believes that this information may be useful to investors.

|

|

|

Bel Fuse Inc.

|

|

Supplementary Information(1)

|

|

Reconciliation of GAAP Measures to Non-GAAP Measures(2)

|

|

(in thousands, except per share data)

(unaudited)

|

|

The following tables detail the impact that certain unusual or special items had on the Company's net earnings per common Class A and Class B basic and diluted shares ("EPS") and the line items in which these items were included on the consolidated statements of operations.

|

| |

|

Three Months Ended December 31, 2023

|

|

|

Three Months Ended December 31, 2022

|

|

|

Reconciling Items

|

|

Earnings before taxes

|

|

|

Provision for income taxes

|

|

|

Net earnings

|

|

|

Class A EPS(3)

|

|

|

Class B EPS(3)

|

|

|

Earnings before taxes

|

|

|

Provision for income taxes

|

|

|

Net earnings

|

|

|

Class A EPS(3)

|

|

|

Class B EPS(3)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP measures

|

|

$ |

13,499 |

|

|

$ |

1,463 |

|

|

$ |

12,036 |

|

|

$ |

0.90 |

|

|

$ |

0.95 |

|

|

$ |

17,452 |

|

|

$ |

3,412 |

|

|

$ |

14,040 |

|

|

$ |

1.06 |

|

|

$ |

1.12 |

|

|

Restructuring charges

|

|

|

3,808 |

|

|

|

675 |

|

|

|

3,133 |

|

|

|

0.24 |

|

|

|

0.25 |

|

|

|

3,322 |

|

|

|

505 |

|

|

|

2,817 |

|

|

|

0.21 |

|

|

|

0.22 |

|

|

MPS litigation costs

|

|

|

128 |

|

|

|

29 |

|

|

|

99 |

|

|

|

0.01 |

|

|

|

0.01 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Gain on sale of Czech Republic business

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Gain on sale of properties

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Loss on liquidation of foreign subsidiary

|

|

|

2,724 |

|

|

|

681 |

|

|

|

2,043 |

|

|

|

0.15 |

|

|

|

0.16 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Non-GAAP measures

|

|

$ |

20,159 |

|

|

$ |

2,848 |

|

|

$ |

17,311 |

|

|

$ |

1.29 |

|

|

$ |

1.37 |

|

|

$ |

20,774 |

|

|

$ |

3,917 |

|

|

$ |

16,857 |

|

|

$ |

1.27 |

|

|

$ |

1.35 |

|

| |

|

Year Ended December 31, 2023

|

|

|

Year Ended December 31, 2022

|

|

|

Reconciling Items

|

|

Earnings before taxes

|

|

|

Provision for income taxes

|

|

|

Net earnings

|

|

|

Class A EPS(3)

|

|

|

Class B EPS(3)

|

|

|

Earnings before taxes

|

|

|

Provision for income taxes

|

|

|

Net earnings

|

|

|

Class A EPS(3)

|

|

|

Class B EPS(3)

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP measures

|

|

$ |

83,300 |

|

|

$ |

9,469 |

|

|

$ |

73,831 |

|

|

$ |

5.52 |

|

|

$ |

5.83 |

|

|

$ |

59,059 |

|

|

$ |

6,370 |

|

|

$ |

52,689 |

|

|

$ |

4.01 |

|

|

$ |

4.24 |

|

|

Restructuring charges

|

|

|

10,114 |

|

|

|

1,682 |

|

|

|

8,432 |

|

|

|

0.63 |

|

|

|

0.67 |

|

|

|

7,322 |

|

|

|

1,495 |

|

|

|

5,827 |

|

|

|

0.45 |

|

|

|

0.47 |

|

|

MPS litigation costs

|

|

|

3,031 |

|

|

|

696 |

|

|

|

2,335 |

|

|

|

0.18 |

|

|

|

0.18 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Gain on sale of Czech Republic business

|

|

|

(980 |

) |

|

|

(49 |

) |

|

|

(931 |

) |

|

|

(0.07 |

) |

|

|

(0.07 |

) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Gain on sale of properties

|

|

|

(3,819 |

) |

|

|

(763 |

) |

|

|

(3,056 |

) |

|

|

(0.23 |

) |

|

|

(0.24 |

) |

|

|

(1,596 |

) |

|

|

(367 |

) |

|

|

(1,229 |

) |

|

|

(0.09 |

) |

|

|

(0.10 |

) |

|

Loss on liquidation of foreign subsidiary

|

|

|

2,724 |

|

|

|

681 |

|

|

|

2,043 |

|

|

|

0.15 |

|

|

|

0.16 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Non-GAAP measures

|

|

$ |

94,370 |

|

|

$ |

11,716 |

|

|

$ |

82,654 |

|

|

$ |

6.19 |

|

|

$ |

6.53 |

|

|

$ |

64,785 |

|

|

$ |

7,498 |

|

|

$ |

57,287 |

|

|

$ |

4.36 |

|

|

$ |

4.61 |

|

|

(1) The supplementary information included in this press release for 2023 is preliminary and subject to change prior to the filing of our upcoming Annual Report on Form 10-K with the Securities and Exchange Commission.

|

|

(2) In this press release and supplemental information, we have included Non-GAAP financial measures, including Non-GAAP adjusted net sales, Non-GAAP net earnings, Non-GAAP EPS, EBITDA and Adjusted EBITDA. We present results adjusted to exclude the effects of certain specified items and their related tax impact that would otherwise be included under GAAP, to aid in comparisons with other periods. We may use Non-GAAP financial measures to determine performance-based compensation and management believes that this information may be useful to investors.

|

|

(3) Individual amounts of earnings per share may not agree to the total due to rounding.

|

v3.24.0.1

Document And Entity Information

|

Feb. 21, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

BELFUSE INC /NJ

|

| Document, Type |

8-K

|

| Document, Period End Date |

Feb. 21, 2024

|

| Entity, Incorporation, State or Country Code |

NJ

|

| Entity, File Number |

0-11676

|

| Entity, Tax Identification Number |

22-1463699

|

| Entity, Address, Address Line One |

300 Executive Drive, Suite 300

|

| Entity, Address, City or Town |

West Orange

|

| Entity, Address, State or Province |

NJ

|

| Entity, Address, Postal Zip Code |

07052

|

| City Area Code |

201

|

| Local Phone Number |

432-0463

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000729580

|

| ClassACommonStock Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class A Common Stock

|

| Trading Symbol |

BELFA

|

| Security Exchange Name |

NASDAQ

|

| ClassBCommonStock Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class B Common Stock

|

| Trading Symbol |

BELFB

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=belfb_ClassACommonStockCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=belfb_ClassBCommonStockCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

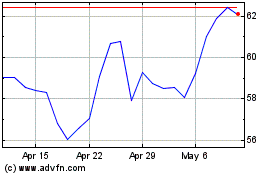

Bel Fuse (NASDAQ:BELFB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bel Fuse (NASDAQ:BELFB)

Historical Stock Chart

From Apr 2023 to Apr 2024