--12-31false00013624682023FY00013624682023-01-012023-12-3100013624682023-06-30iso4217:USD00013624682024-02-23xbrli:shares00013624682023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

(Mark One)

| | | | | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended | December 31, 2023 |

| | |

| Or |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____

Commission File Number 001-33166

Allegiant Travel Company

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Nevada | 20-4745737 |

| (State or Other Jurisdiction of Incorporation or Organization) | (IRS Employer Identification No.) |

| | |

| 1201 North Town Center Drive | |

| Las Vegas, | Nevada | 89144 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (702) 851-7300

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.001 Par Value | ALGT | Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be

submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a

smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated

filer,” “smaller reporting company,”and "emerging growth company" in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☐ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of

the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.

7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant's executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of common equity held by non-affiliates of the registrant was approximately $1.9 billion computed by reference to the closing sale price of the common stock on the Nasdaq Global Select Market on June 30, 2023, the last trading day of the registrant’s most recently completed second fiscal quarter.

The number of shares of the registrant’s common stock outstanding as of the close of business on February 23, 2024 was 18,286,324.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Auditor Firm ID: 185 Auditor Name: KPMG LLP Auditor Location: Dallas, TX

EXHIBIT INDEX IS LOCATED ON PAGE 4.

EXPLANATORY NOTE

This Amendment to Form 10-K (the “Amendment”) amends the Annual Report on Form 10-K of Allegiant Travel Company for the fiscal year ended December 31, 2023, originally filed with the Securities and Exchange Commission (“SEC”) on February 29, 2024 (the “Original Filing”). We are filing this Amendment to correct the inadvertent omission of a statement in Item 9B, paragraph (b) and the inadvertent omission of Exhibit 97.1 from Item 15 in the Original Filing. In connection with the filing of this Amendment and pursuant to the rules of the SEC, we are including with this Amendment certain new certifications by our principal executive officer and principal financial officer. Accordingly, Item 15 of Part IV has also been amended to reflect the filing of these new certifications.

Except as described above, no other changes have been made to the Original Filing. The Original Filing continues to speak as of the date of the Original Filing, and we have not updated the disclosures contained therein to reflect any events which occurred at a date subsequent to the filing of the Original Filing other than as expressly indicated in this Amendment. In this Amendment, unless the context indicates otherwise, the terms “Company,” “we,” “us,” and “our” refer to Allegiant Travel Company. Other defined terms used in this Amendment but not defined herein shall have the meaning specified for such terms in the Original Filing.

Table of Contents

| | | | | | | | |

| PART II | | |

| ITEM 9B. | | |

| | |

| PART IV | | |

| ITEM 15. | | |

| | |

PART II

Item 9B. Other Information

Securities Trading Plans of Directors and Executive Officers

During the quarter ended December 31, 2023, none of our directors or executive officers adopted or terminated any contract, instruction or written plan for the purchase or sale of the Company's securities that was intended to satisfy the affirmative defense conditions of Rule 10b5-1(c) or any “non-Rule 10b5-1 trading arrangement.”

PART IV

Item 15. Exhibits and Financial Statement Schedules

| | | | | |

| — | Financial Statements and Supplementary Data. The financial statements included in Item 8 - Financial Statements and Supplementary Data above are filed as part of this annual report. |

| — | Financial Statement Schedules. Schedules are not submitted because they are not required or are not applicable, or the required information is shown in the consolidated financial statements or notes thereto. |

| — | Exhibits. The Exhibits listed below are filed or incorporated by reference as part of this Form 10-K. Where so indicated, exhibits which were previously filed are incorporated by reference. |

| | | | | | | | | | | |

Exhibit

Number | | Description | |

| 3.1 | | | |

| 3.2 | | | | |

| 3.3 | | | | |

| 4.1 | | | | |

| 4.2 | | | | |

| 4.3 | | | | |

| 4.4 | | | | |

| 4.5 | | | | |

| 4.6 | | | | |

| 4.7* | | | |

| 10.1 | | | | |

| 10.2 | | | |

| 10.3 | | | |

| 10.4 | | | |

| 10.5 | | | |

| 10.6 | | | |

| 10.7 | | | |

| 10.8 | | Credit Agreement dated as of October 13, 2021 among Sunseeker Florida, Inc., Allegiant Travel Company, certain subsidiaries of Allegiant Travel Company, the Lenders party thereto, Wilmington Trust, National Association as Administrative Agent and Castlelake Lending Opportunities, LLC as Facility Manager (incorporated by reference to Exhibit 10.20 to Annual Report on Form 10-K for the year ended December 31, 2021 filed with the Commission on March 1, 2022). (2) | |

| 10.9 | | | |

| 10.10 | | | |

| | | | | | | | | | | |

| 10.11 | | | |

| 10.12 | | | |

| 10.13 | | | |

| 10.15 | | | |

| 10.16 | | | |

| 10.17 | | | |

| 10.18 | | | |

| 10.19 | | | |

| 10.20 | | | |

| 10.21 | | | |

| 10.22 | | | |

| 10.23 | | | |

| 10.24 | | | |

| 10.25 | | | |

| 10.26 | | | |

| 10.27 | | | |

| 10.28 | | | |

| 10.29 | | | |

| 10.30 | | | |

| 10.31 | | | |

| 10.32 | | | |

| | | | | | | | | | | |

| 10.33 | | | |

| 10.34 | | | |

| 10.35 | | | |

| 10.36 | | | |

| 10.37 | | | |

| 10.38 | | | |

| 10.39 | | | |

| 10.40 | | | |

| 10.41 | | | |

| 10.42 | | | |

| 10.43 | | | |

| 10.44 | | | |

| 10.45 | | | |

| 10.46 | | | |

| 10.47 | | | |

| 10.48 | | | |

| 10.49 | | | |

| 10.50 | | | |

| 10.51 | | | |

| 10.52 | | | |

| 10.53 | | | |

| 10.54 | | | |

| 10.55 | | | |

| | | | | | | | | | | |

| 10.56 | | | |

| 10.57 | | | |

| 10.58 | | | | |

| 10.59 | | | | |

| 10.60 | | | | |

| 10.61 | | | | |

| 10.62 | | | | |

| 10.63 | | | | |

| 10.64 | | | | |

| 10.65 | | | Revolving Credit and Guaranty Agreement, dated as of August 17, 2022, among the Company, as borrower, certain subsidiaries of the Company party thereto, as guarantors, the lenders party thereto and Barclays Bank PLC, as administrative agent and lead arranger (incorporated by reference to Exhibit 10.1 to the Current Report on Form 8-K, filed with the Commission on August 17, 2022). | |

| 10.66 | | | | |

| 10.67 | | | | |

| 10.68 | | | | |

| 10.69 | | | | |

| 10.70 | | | |

| 10.71 | | | |

| 10.72 | | | |

| 10.73 | | | |

| 10.74 | | | |

| 10.75 | | | |

| 10.76 | | | |

| | | | | | | | | | | |

| 10.77 | | Credit Agreement by and among Sunrise Asset Management, LLC, as Borrower, the Lenders party hereto, as Lenders, BNP Paribas, as Administrative Agent, Bank of Utah, as Security Trustee, BNP Paribas and JSA International U.S. Holdings ,LLC as Lead Arrangers, and BNP Paribas, as Sole Structuring Agent dated as of September 27, 2023 (2) (incorporated by reference to Exhibit 10.02 to the Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, filed with the Commission on November 8, 2023). | |

| 10.78 | | Mortgage and Security Agreement by and among Sunrise Asset Management, LLC, as Mortgagor, Bank of Utah, as Account Bank, and Bank of Utah, not in its individual capacity but solely as Security Trustee, as Mortgagee, dated as of September 27, 2023 (2) (incorporated by reference to Exhibit 10.03 to the Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, filed with the Commission on November 8, 2023). | |

| 10.79 | | Lessee Consent from Sunrise Asset Management, LLC as Lessor, and Bank of Utah, as Security Trustee, to Allegiant Air, LLC, as Lessee dated September 29, 2023(2) (incorporated by reference to Exhibit 10.04 to the Quarterly Report on Form 10-Q for the quarter ended September 30, 2023, filed with the Commission on November 8, 2023). | |

| 10.80 | | | |

| 10.81 | | | |

| 10.82 | | | |

| 10.83 | | | |

| 10.84 | | | |

| 10.85 | | | |

| 10.86 | | | |

| 10.87 | | | |

| 10.88 | | | |

| 10.89 | | | |

| 10.90 | | | |

| 10.91 | |

| |

| 10.92 | | | |

| 10.93 | | | |

| 10.94 | | | |

| 10.95 | | | |

| 10.96 | | | |

| 10.97 | | | |

| | | | | | | | | | | |

| 10.98 | | | |

| 10.99 | | | |

| 10.100* | | | |

| 10.101* | | | |

| 10.102* | | | |

| 21* | | | |

| 23.1* | | | |

| 31.1 | | | | |

| 31.2 | | | | |

| 32 | | | | |

| 97.1 | | | | |

| 101* | | The following financial information from the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC on February 29, 2024, formatted in XBRL includes (i) Consolidated Balance Sheets as of December 31, 2023 and December 31, 2022 (ii) Consolidated Statements of Income for the years ended December 31, 2023, 2022 and 2021 (iii) Consolidated Statements of Comprehensive Income for the years ended December 31, 2023, 2022 and 2021 (iv) Consolidated Statements of Shareholders’ Equity for the years ended December 31, 2023, 2022 and 2021 (v) Consolidated Cash Flow Statements for the years ended December 31, 2023, 2022 and 2021 (vi) the Notes to the Consolidated Financial Statements. (3) | |

(1)Management contract or compensation plan or agreement required to be filed as an Exhibit to this Report on Form 10-K pursuant to Item 15(b) of Form 10-K.

(2)Certain confidential information in this agreement has been omitted because it (i) is not material and (ii) would be competitively harmful if publicly disclosed.

(3)Pursuant to Rule 406 of Regulation S-T, the XBRL related information in Exhibit 101 to this annual report on Form 10-K shall be deemed to be not filed for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section, and shall not be deemed part of a registration statement, prospectus or other document filed under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

* Previously filed as a part of the Original Filing

Signatures

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this Amendment No. 1 to Form 10-K to be signed on its behalf by the undersigned, thereunto duly authorized in the City of Las Vegas, State of Nevada on March 8, 2024.

| | | | | | | | |

| | Allegiant Travel Company |

| | |

| | By: | /s/ Gregory Anderson |

| | | Gregory Anderson, as duly authorized officer of the Company (President) |

Pursuant to the requirements of the Securities Exchange Act of 1934, Amendment No. 1 to this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated. | | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| | | | | |

| /s/ Maurice J. Gallagher, Jr. | | Chief Executive Officer and Director | | March 8, 2024 |

| Maurice J. Gallagher, Jr. | | (Principal Executive Officer and Chairman of the Board) | | |

| | | | | |

| /s/ Robert Neal | | Chief Financial Officer | | March 8, 2024 |

| Robert Neal | | (Principal Financial Officer) | | |

| | | | |

| /s/ Rebecca Aretos | | Chief Accounting Officer | | March 8, 2024 |

| Rebecca Aretos | | (Principal Accounting Officer) | | |

| | | | | |

| | | | |

| | | | |

| | | | |

| * | | Director | | March 8, 2024 |

| Montie Brewer | | | | |

| | | | | |

| * | | Director | | March 8, 2024 |

| Gary Ellmer | | | | |

| | | | | |

| * | | Director | | March 8, 2024 |

| M. Ponder Harrison | | | | |

| | | | |

| * | | Director | | March 8, 2024 |

| Linda Marvin | | | | |

| | | | | |

| * | | Director | | March 8, 2024 |

| Sandra D. Morgan | | | | |

| | | | |

| * | | Director | | March 8, 2024 |

| Charles W. Pollard | | | | |

| | | | |

| | | | | | | | |

| * | By: | /s/ Gregory Anderson |

| | | Gregory Anderson, Attorney in Fact |

Exhibit 31.1

Certifications

I, Maurice J. Gallagher, Jr., certify that:

1.I have reviewed the annual report on Form 10-K of Allegiant Travel Company, as amended by Amendment No. 1;

2.Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3.Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4.The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

a.Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b.Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c.Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d.Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5.The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

a.All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b.Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| | | | | | | | |

| Date: | March 8, 2024 | /s/ Maurice J. Gallagher, Jr. |

| | | Title: Principal Executive Officer |

Exhibit 31.2

Certifications

I, Robert Neal, certify that:

1.I have reviewed the annual report on Form 10-K of Allegiant Travel Company, as amended by Amendment No. 1;

2.Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3.Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4.The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

a.Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

b.Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

c.Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

d.Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5.The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

a.All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

b.Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| | | | | | | | |

| Date: | March 8, 2024 | /s/ Robert J. Neal |

| | | Title: Principal Financial Officer |

Exhibit 32

Allegiant Travel Company Certification under Section 906 of the Sarbanes/Oxley Act - filed as an exhibit to Form 10-K/A (Amendment No. 1) for the Year Ended December 31, 2023

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with Amendment No. 1 to the annual report of Allegiant Travel Company (the “Company”) on Form 10-K/A for the period ended December 31, 2023 as filed with the Securities and Exchange Commission on the date hereof (the “Report”), the undersigned, Maurice J. Gallagher, Jr., Chief Executive Officer and Executive Chairman of the Company, and Robert Neal, Chief Financial Officer of the Company, certify, pursuant to 18 U.S.C. § 1350, as adopted pursuant to § 906 of the Sarbanes-Oxley Act of 2002, that to the best of our knowledge:

1.The Report fully complies with the requirements of section 13(a) or 15(d) of the Securities Exchange Act of 1934; and

2.The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

| | | | | | | | |

| /s/ Maurice J. Gallagher, Jr. | | /s/ Robert J. Neal |

| Maurice J. Gallagher, Jr. | | Robert J. Neal |

| Principal Executive Officer | | Principal Financial Officer |

| March 8, 2024 | | March 8, 2024 |

The foregoing Certification shall not be deemed incorporated by reference by any general statement incorporating by reference this report into any filing under the Securities Act of 1933 or under the Securities Exchange Act of 1934, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed filed under such Acts.

Allegiant Travel Company

Policy Relating to

Recovery of Erroneously Awarded Compensation

This Policy has been adopted by the Board of Directors of Allegiant Travel Company (the “Company”) effective as of December 1, 2023. With respect to compensation paid to executive officers after October 2, 2023, this Policy shall supersede the Company’s Executive Compensation Recoupment Policy adopted by the Board on April 26, 2016 (the “Prior Policy”). The Prior Policy shall remain in effect for compensation paid to executive officers prior to October 2, 2023.

(1) The Company will recover reasonably promptly the amount of “erroneously awarded incentive-based compensation” (as defined below) in the event that the Company is required to prepare an accounting restatement due to the material noncompliance of the Company with any financial reporting requirement under the securities laws, including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period.

(2) The Company’s recovery policy applies to all incentive-based compensation received by a person:

(A) After beginning service as an executive officer;

(B) Who served as an executive officer at any time during the performance period for that incentive-based compensation; and

(C) During the three completed fiscal years immediately preceding the date that the Company is required to prepare an accounting restatement as described in paragraph (1) of this Policy. The Company’s obligation to recover erroneously awarded compensation is not dependent on if or when the restated financial statements are filed.

(3) For purposes of determining the relevant recovery period, the date that the Company is required to prepare an accounting restatement as described in paragraph (1) of this Policy is the earlier to occur of:

(A) The date the Company’s Board of Directors, a committee of the Board of Directors, or the officer or officers of the Company authorized to take such action if Board action is not required, concludes, or reasonably should have concluded, that the Company is required to prepare an accounting restatement as described in paragraph (1) of this Policy; or

(B) The date a court, regulator, or other legally authorized body directs the Company to prepare an accounting restatement as described in paragraph (1) of this Policy.

(4) The amount of incentive-based compensation that is subject to the Company’s recovery policy (“erroneously awarded compensation”) is the amount of incentive-based compensation received that exceeds the amount of incentive-based compensation that otherwise would have been received had it been determined based on the restated amounts, and must be computed without regard to any taxes paid. For incentive-based compensation based on stock price or total shareholder return, where the amount of erroneously awarded compensation is not subject to mathematical recalculation directly from the information in an accounting restatement:

(A) The amount shall be based on a reasonable estimate of the effect of the accounting restatement on the stock price or total shareholder return upon which the incentive-based compensation was received; and

(B) The Company shall maintain documentation of the determination of that reasonable estimate and provide such documentation to the Nasdaq Stock Exchange (“Nasdaq”).

(5) The Company shall recover erroneously awarded compensation in compliance with this recovery policy except to the extent that the conditions of paragraphs (A), (B) or (C) below are met, and the Company’s Compensation Committee, or in the absence of such a committee, a majority of the independent directors serving on the Board, has made a determination that recovery would be impracticable.

(A) The direct expense paid to a third party to assist in enforcing the Policy would exceed the amount to be recovered. Before concluding that it would be impracticable to recover any amount of erroneously awarded compensation based on expense of enforcement, the Company

must make a reasonable attempt to recover such erroneously awarded compensation, document such reasonable attempt(s) to recover and provide that documentation to Nasdaq.

(B) Recovery would violate home country law where that law was adopted prior to November 28, 2022. Before concluding that it would be impracticable to recover any amount of erroneously awarded compensation based on violation of home country law, the Company must obtain an opinion of home country counsel, acceptable to Nasdaq, that recovery would result in such a violation, and must provide such opinion to Nasdaq.

(C) Recovery would likely cause an otherwise tax-qualified retirement plan, under which benefits are broadly available to employees of the Company, to fail to meet the requirements of 26 U.S.C. 401(a)(13) or 26 U.S.C. 411(a) and regulations thereunder.

(6) The Company shall be prohibited from indemnifying any executive officer or former executive officer against the loss of erroneously awarded compensation.

(7) Unless the context otherwise requires, the following definitions apply for purposes of this Policy:

Executive Officer. An executive officer is the Company’s chief executive officer, president, principal financial officer, principal accounting officer (or if there is no such accounting officer, the controller), any vice-president of the Company in charge of a principal business unit, division, or function (such as sales, administration, or finance), any other officer who performs a policy-making function, or any other person who performs similar policy-making functions for the Company. Policy-making function is not intended to include policy-making functions that are not significant. Identification of an executive officer for purposes of this Policy would include at a minimum executive officers identified in the Company’s proxy statement.

Financial Reporting Measures. Financial reporting measures are measures that are determined and presented in accordance with the accounting principles used in preparing the Company’s financial statements, and any measures that are derived wholly or in part from such measures. Stock price and total shareholder return are also financial reporting measures. A financial reporting measure need not be presented within the financial statements or included in a filing with the Commission.

Incentive-Based Compensation. Incentive-based compensation is any compensation that is granted, earned, or vested based wholly or in part upon the attainment of a financial reporting measure.

Received. Incentive-based compensation is deemed received in the Company’s fiscal period during which the financial reporting measure specified in the incentive-based compensation award is attained, even if the payment or grant of the incentive-based compensation occurs after the end of that period.

(8) This Policy is effective as of December 1, 2023. The Company shall comply with this Policy for all incentive-based compensation received (as such term is defined above) by executive officers on or after October 2, 2023. The Company shall provide the disclosures required by the applicable Nasdaq rules and in the applicable filings with the Securities and Exchange Commission on or after October 2, 2023. Notwithstanding the foregoing, the Company is only required to apply the recovery policy to incentive-based compensation received on or after October 2, 2023.

v3.24.0.1

Cover Page - USD ($)

$ in Billions |

12 Months Ended |

|

|

Dec. 31, 2023 |

Feb. 23, 2024 |

Jun. 30, 2023 |

| Cover [Abstract] |

|

|

|

| Document Type |

10-K/A

|

|

|

| Document Annual Report |

true

|

|

|

| Document Period End Date |

Dec. 31, 2023

|

|

|

| Document Transition Report |

false

|

|

|

| Entity File Number |

001-33166

|

|

|

| Entity Registrant Name |

Allegiant Travel Co

|

|

|

| Entity Incorporation, State or Country Code |

NV

|

|

|

| Entity Tax Identification Number |

20-4745737

|

|

|

| Entity Address, Address Line One |

1201 North Town Center Drive

|

|

|

| Entity Address, City or Town |

Las Vegas,

|

|

|

| Entity Address, State or Province |

NV

|

|

|

| Entity Address, Postal Zip Code |

89144

|

|

|

| City Area Code |

702

|

|

|

| Local Phone Number |

851-7300

|

|

|

| Title of 12(b) Security |

Common Stock, $0.001 Par Value

|

|

|

| Trading Symbol |

ALGT

|

|

|

| Security Exchange Name |

NASDAQ

|

|

|

| Entity Well Known Seasoned Issuer |

Yes

|

|

|

| Entity Voluntary Filers |

No

|

|

|

| Entity Current Reporting Status |

Yes

|

|

|

| Entity Interactive Data Current |

Yes

|

|

|

| Entity Filer Category |

Large Accelerated Filer

|

|

|

| Entity Emerging Growth Company |

false

|

|

|

| Entity Small Business |

false

|

|

|

| ICFR Auditor Attestation Flag |

true

|

|

|

| Document Financial Statement Error Correction [Flag] |

false

|

|

|

| Entity Shell Company |

false

|

|

|

| Entity Public Float |

|

|

$ 1.9

|

| Entity Common Stock, Shares Outstanding |

|

18,286,324

|

|

| Entity Central Index Key |

0001362468

|

|

|

| Current Fiscal Year End Date |

--12-31

|

|

|

| Document Fiscal Year Focus |

2023

|

|

|

| Document Fiscal Period Focus |

FY

|

|

|

| Amendment Flag |

false

|

|

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as an annual report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentAnnualReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates whether any of the financial statement period in the filing include a restatement due to error correction. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 402

-Subsection w

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 4: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_DocumentFinStmtErrorCorrectionFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a form used as a transition report. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Forms 10-K, 10-Q, 20-F

-Number 240

-Section 13

-Subsection a-1

| Name: |

dei_DocumentTransitionReport |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate number of shares or other units outstanding of each of registrant's classes of capital or common stock or other ownership interests, if and as stated on cover of related periodic report. Where multiple classes or units exist define each class/interest by adding class of stock items such as Common Class A [Member], Common Class B [Member] or Partnership Interest [Member] onto the Instrument [Domain] of the Entity Listings, Instrument.

| Name: |

dei_EntityCommonStockSharesOutstanding |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:sharesItemType |

| Balance Type: |

na |

| Period Type: |

instant |

|

| X |

- DefinitionIndicate 'Yes' or 'No' whether registrants (1) have filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that registrants were required to file such reports), and (2) have been subject to such filing requirements for the past 90 days. This information should be based on the registrant's current or most recent filing containing the related disclosure.

| Name: |

dei_EntityCurrentReportingStatus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate whether the registrant is one of the following: Large Accelerated Filer, Accelerated Filer, Non-accelerated Filer. Definitions of these categories are stated in Rule 12b-2 of the Exchange Act. This information should be based on the registrant's current or most recent filing containing the related disclosure. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityFilerCategory |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:filerCategoryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-T

-Number 232

-Section 405

| Name: |

dei_EntityInteractiveDataCurrent |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

| Name: |

dei_EntityPublicFloat |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

credit |

| Period Type: |

instant |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the registrant is a shell company as defined in Rule 12b-2 of the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityShellCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicates that the company is a Smaller Reporting Company (SRC). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntitySmallBusiness |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

| Name: |

dei_EntityVoluntaryFilers |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate 'Yes' or 'No' if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Is used on Form Type: 10-K, 10-Q, 8-K, 20-F, 6-K, 10-K/A, 10-Q/A, 20-F/A, 6-K/A, N-CSR, N-Q, N-1A. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 405

| Name: |

dei_EntityWellKnownSeasonedIssuer |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:yesNoItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_IcfrAuditorAttestationFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.0.1

| X |

- DefinitionPCAOB issued Audit Firm Identifier Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorFirmId |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:nonemptySequenceNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorLocation |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 10-K

-Number 249

-Section 310

Reference 2: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 20-F

-Number 249

-Section 220

-Subsection f

Reference 3: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Form 40-F

-Number 249

-Section 240

-Subsection f

| Name: |

dei_AuditorName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:internationalNameItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.0.1

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 408

-Subsection a

-Paragraph 1

| Name: |

ecd_NonRule10b51ArrAdoptedFlag |

| Namespace Prefix: |

ecd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 408

-Subsection a

-Paragraph 1

| Name: |

ecd_NonRule10b51ArrTrmntdFlag |

| Namespace Prefix: |

ecd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 408

-Subsection a

-Paragraph 1

| Name: |

ecd_Rule10b51ArrAdoptedFlag |

| Namespace Prefix: |

ecd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 408

-Subsection a

-Paragraph 1

| Name: |

ecd_Rule10b51ArrTrmntdFlag |

| Namespace Prefix: |

ecd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Regulation S-K

-Number 229

-Section 408

-Subsection a

-Paragraph 2

-Subparagraph A

| Name: |

ecd_TradingArrByIndTable |

| Namespace Prefix: |

ecd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

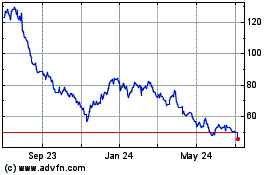

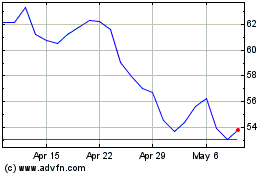

Allegiant Travel (NASDAQ:ALGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Allegiant Travel (NASDAQ:ALGT)

Historical Stock Chart

From Apr 2023 to Apr 2024