What’s Next For Monero As Bulls Fail To Clear This Level?

February 27 2023 - 4:00PM

NEWSBTC

The Monero price had risen considerably during the beginning of the

year, but XMR could not hold onto that price momentum. In recent

times, the XMR price has been correcting itself. Over the last

week, Monero dipped by 8%. On the daily chart, XMR lost 0.4% of its

value. Currently, the altcoin is consolidating under the immediate

resistance mark. The technical outlook of Monero also sided with

the bears as demand for the coin fell on its chart. Accumulation

also declined as buying strength fell. Related Reading: Aave Might

Retrace Further Due To This Formation On Its Chart The altcoin is

still hovering close to its immediate resistance level, but the

bulls tire out every time the altcoin tries to breach the immediate

price ceiling. For the broader market to gain strength, Bitcoin has

to start recovering on its chart. The bulls could be back, as

indicated by the golden cross on the daily chart. The market

capitalization of Monero fell, which indicated sellers were

starting to take over the price at the time of writing. Monero

Price Analysis: One-Day Chart XMR was trading at $146 at press

time. The altcoin has been struggling under the $150 resistance

level for some time now. The coin has to move above the $150 price

ceiling for the bulls to take over. Only after that can XMR begin

its bullish recovery. Monero’s local support level was $141, and a

drop below that level would give the bears control of the asset’s

price. The amount of XMR traded in the last session declined,

indicating a fall in buying strength at press time. Technical

Analysis The altcoin formed a golden cross on the daily chart. A

golden cross is associated with bullish price momentum in the

market. It happens when the longer moving average crosses above a

shorter moving average. In the case of Monero, the 50-Simple Moving

Average (SMA) crossed above the 20-Simple Moving Average line.

Currently, the Monero price is below the 20-SMA as sellers are

driving the price momentum in the market. The Relative Strength

Index dipped below the half-line, which indicated that buying

pressure had faded over the past couple of weeks. XMR depicted a

sell signal on the chart as bearish pressure remained on the

one-day chart. The Moving Average Convergence Divergence formed red

signal bars, indicating bearish momentum and a sell signal for

Monero. Related Reading: Ethereum Price Holds Strong at $1,600: A

Strengthening Case for Upside The Chaikin Money Flow was also

negative by other indicators. The indicator depicts capital inflows

and outflows; it was below the half-line, suggesting that capital

inflows fell at the time of writing. Featured Image From UnSplash,

Charts From TradingView.com.

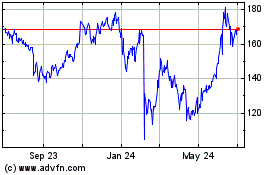

Monero (COIN:XMRUSD)

Historical Stock Chart

From Aug 2024 to Sep 2024

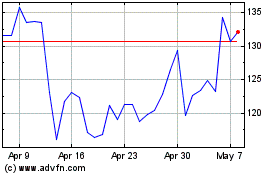

Monero (COIN:XMRUSD)

Historical Stock Chart

From Sep 2023 to Sep 2024