Ethereum Encounters Resistance At Critical Level, Vital Trading Levels to Monitor

May 24 2023 - 6:00PM

NEWSBTC

Ethereum started the week with a promising performance,

experiencing a gain of over 3%. However, the bullish momentum was

short-lived as the altcoin failed to sustain its position above a

key resistance level. Within the past 24 hours, ETH’s market value

has declined by nearly 3%. Throughout the week, the ETH price has

shown limited progress, with the bears dominating the price

movement. The altcoin’s technical outlook indicates a decline in

buying strength, accompanied by low demand and accumulation on the

daily chart. Related Reading: Ethereum Staking Hits Over $40

Billion After Shanghai Upgrade: What It Means For ETH To prevent

further strengthening of the bears, it is crucial for Ethereum to

surpass its immediate resistance in the upcoming trading sessions.

Failure to do so may lead to additional pressure from sellers,

potentially causing Ethereum to breach its immediate support level

and experience a significant loss in value during future trading

sessions. Additionally, the fall in the ETH market capitalization

suggests an increase in selling strength, as observed on the daily

chart. Ethereum Price Analysis: One-Day Chart At the time of

writing, the trading price of ETH was $1790. Despite attempting to

trade within the $1800 price range, the altcoin encountered selling

pressure, resulting in its depreciation. The current overhead

resistance for Ethereum is $1810. If the altcoin surpasses this

resistance level, it has the potential to trigger a rally in its

price. On the other hand, if the present price level experiences a

decline, Ethereum is likely to decline further to $1750 before

eventually reaching the $1700 price mark. The recent session saw a

decrease in the volume of Ethereum traded, indicated by the red

colour, indicating a weak buying strength. Technical Analysis

Throughout this month, Ethereum experienced a decline in demand,

resulting in reduced buying strength. The Relative Strength Index

(RSI) dropped below the midpoint line, suggesting a decrease in

demand and an increase in selling pressure on the chart.

Additionally, the price of Ethereum fell below the 20-Simple Moving

Average (SMA), indicating that sellers were dominating the market’s

price momentum. Given that Bitcoin’s price movement remains

uncertain, several altcoins, including Ethereum, have followed a

similar price trajectory. However, if Ethereum gains broader market

strength, there is a possibility that demand could return, causing

ETH to surpass the 20-SMA line and potentially climb higher. Due to

the absence of demand, ETH did not exhibit significant buy signals.

The Moving Average Convergence Divergence (MACD), a tool used to

indicate price momentum and potential trend reversals, showed small

green histograms that do not provide conclusive buy signals at this

point. The Bollinger Bands, which measure price volatility and

potential fluctuations, have maintained a parallel shape. However,

they displayed slight convergence, suggesting that ETH may trade

within a relatively stable range without substantial price

fluctuations. Related Reading: Bitfinex And Crypto Bank OrionX

Forged Partnership To Broaden Presence In Latin America To reclaim

the $1800 price level, it is crucial for buyers to re-enter the

market at the current price level. Their participation is essential

for Ethereum to regain strength and potentially push the price

higher. Featured Image From UnSplash, Charts From TradingView.com

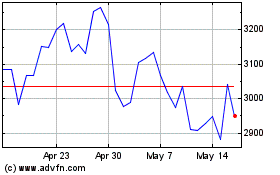

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Mar 2024 to Apr 2024

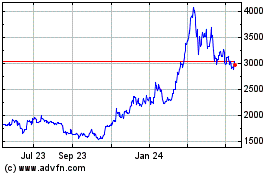

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Apr 2023 to Apr 2024