Shell Transport and Trading

11/23/2004

Shell Transport and Trading (SHEL) and Royal Dutch Petroleum (RD) recently announced plans to merge their dual United Kingdom and Netherlands structures into the single entity Royal Dutch Shell. We believe that the corporate restructure will encourage decisive decision-making by management instead of the consensus style which has prevailed to date. The dual board structure resulted in a lack of transparency and accountability in decision making, while creating unnecessarily bureaucracy, and in our opinion contributed to the reserve downgrades this year. In addition we expect substantial cost savings will be realised as the duplication of various functions (accounting, administration and reporting) is eliminated. Shell Transport and Trading (SHEL) and Royal Dutch Petroleum (RD) recently announced plans to merge their dual United Kingdom and Netherlands structures into the single entity Royal Dutch Shell. We believe that the corporate restructure will encourage decisive decision-making by management instead of the consensus style which has prevailed to date. The dual board structure resulted in a lack of transparency and accountability in decision making, while creating unnecessarily bureaucracy, and in our opinion contributed to the reserve downgrades this year. In addition we expect substantial cost savings will be realised as the duplication of various functions (accounting, administration and reporting) is eliminated.

In another development the market was advised that Shell intends to cut a further 900 million barrels of oil equivalent (boe) from reserves. The 6.3 percent reduction is the fifth cut in reserves this year with further downgrades possible. We are however pleased that Shell is progressing the review in an efficient and transparent manner, with 56 percent of the 14.35 billion boe in proven reserves now audited.

The company's profitability remains near record levels, with Shell reporting profits after tax of US$5.4 billion for the September quarter and US$14.1 billion for the 9 months year to date. Shell's return on average capital employed (ROACE) climbed significantly to 17.4 percent, compared with 15.5 percent last quarter.

The quarterly earnings result represented an impressive 120 percent improvement on the US$2.45 billion reported a year earlier and a solid 35 percent gain on the US$4 billion last quarter. We remain particularly encouraged by robust operating cashflow of US$6.24 billion for the quarter and a whopping US$18.85 billion for the nine months to September 30.

A stellar cashflow performance has allowed Shell to comfortably finance capital investment of US$9.8 billion, US$7.4 billion in dividends, US$1.1 billion in share buybacks, and reduce debt by US$3.2 billion. Gearing has been lowered from 22.1 percent a year ago to 16.3 percent, which compared to Shell's peers is conservative. In our opinion Shell now has ample room for a significant investment and further share buy-backs.

Going forward the company's key strategic initiatives are to funnel capital expenditure into upstream oil and gas production investment where returns on capital are higher. Capital expenditure is expected to be approximately US$15 billion in both 2005 and 2006, with around US$11.5 billion earmarked for exploration and production investments. Historically Shell has been guilty of under-investment, so we are highly encouraged that action is being taken now. Shell has boosted the 2005 exploration budget by 50 percent to US$1.5 billion, targeting discoveries in excess of 100 million boe.

We consider Shell's current valuation as attractive with the shares trading on a 2005 price earnings ratio of 13 times, while offering a respectable dividend yield of 4 percent. The company is priced at a 20 percent discount to integrated oil company peers, which we attribute largely to this year's reserve downgrades. We however believe that market confidence in the beleaguered oil major is being restored. Despite the reserves fiasco this year Shell still has proven reserves sufficient for 10 years of oil and gas production. In our opinion this leaves sufficient time for the company to prove up less certain resources and locate new discoveries.

Significantly, Royal Dutch Shell will command an 8 percent weighting in the FTSE100 against the 4 percent attributed to SHEL today. This increased weighting will result in greater demand for the scrip from local index managers. While the recent reserve downgrade is a negative, in our opinion it is already priced into the stock. Going forward we expect share price out-performance will be driven by robust growth in earnings and cash flows on the back of a stubbornly high oil price.

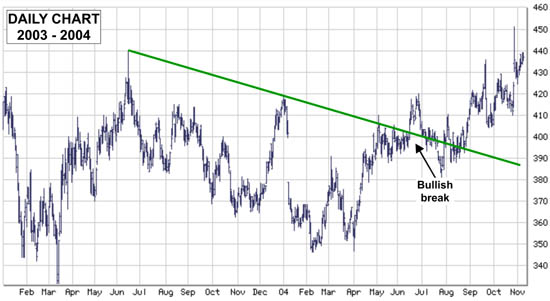

Shell Transport and Trading Stock Chart :

|