Dana Petroleum

10/18/2004

Dana Petroleum's recent interim result was characterised by increased North Sea oil production and improved cashflow. Dana has also confirmed a series of positive exploration and field development deals. We believe that recent announcements highlight Dana as a strong cash producer with attractive international exploration and development interests. Dana Petroleum's recent interim result was characterised by increased North Sea oil production and improved cashflow. Dana has also confirmed a series of positive exploration and field development deals. We believe that recent announcements highlight Dana as a strong cash producer with attractive international exploration and development interests.

A combination of increased production and a 33 percent jump in averaged realised oil and gas prices resulted in turnover rising 32 percent to £48.7 million. Operating profits rose 35 percent to £20.2 million, with a robust cash flow performance allowing Dana to eliminate debt.

Dana has agreed terms with Amerada Hess to exchange a 12 percent interest in the Pangkah Production Sharing Contract (PPS) for an additional 28 percent interest in the Hudson gas field. The transaction immediately boosts Dana's North Sea oil production by 3,500 barrels of oil per day, versus participation in Ujung Pangkah field development, where gas will not be flowing until 2007. Dana's strategy is to trade undeveloped oil and gas assets in non-core areas, for producing assets in core areas. We believe this is an excellent deal for shareholders and demonstrates a creative approach to deal making by management.

We are also positive about the multi-country exploration deal Dana announced with the large Australian integrated oil and gas company, Woodside Petroleum. The deal gives Dana geographically diversified exposure to three pending African exploration wells over the next 18 months.

Elsewhere, Dana has received government approval for development of the company's 50 percent interest in the Gadwall oil field. This North Sea field will produce 6,000 boepd, with first oil flowing as soon as February 2005. This interest bolsters Dana's production by over 15 percent and means the company will soon have 10 producing fields.

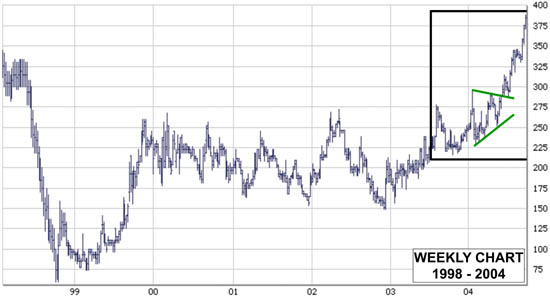

The rapid appreciation of oil prices, rising North Sea oil production and exciting exploration interests have all provided fuel for Dana's share price over recent months. Looking forward, we believe energy prices will remain persistently high, significantly boosting the earnings profiles of quality producers such as Dana.

Dana has clearly been highly fortunate to have three key valuation drivers simultaneously working in the company's favour. Not surprisingly the shares have been re-rated significantly in the last six months yet still trade on a price earnings multiple of around 16 times.

Dana Petroleum Stock Charts :

|