Swallowfield (SWL)

03/14/2005

Last month toiletries and cosmetics manufacturer Swallowfield (SWL) delivered a strong first half performance with profit before tax increasing 68 percent to ?620,000. We remain highly encouraged by the company's strategic shift in response to challenging market conditions. Management's decision to re-position the group as a supplier of contract outsourcing services has already reaped benefits, following the award of a significant contract. Last month toiletries and cosmetics manufacturer Swallowfield (SWL) delivered a strong first half performance with profit before tax increasing 68 percent to ?620,000. We remain highly encouraged by the company's strategic shift in response to challenging market conditions. Management's decision to re-position the group as a supplier of contract outsourcing services has already reaped benefits, following the award of a significant contract.

Turnover in the six months to 8 January 2005 increased 5 percent to ?24.7 million with both the cosmetics and aerosols divisions performing robustly.

Earnings have been under pressure from general weakness in consumer spending, and an inability to pass raw materials price increases on to customers. We are therefore heartened by the overall improvement in bottom line profitability following last year's restructuring initiatives. Savings from the new office in China are expected to be ?400,000 in 2005 and ?500,000 per annum thereafter. The company is also deriving efficiencies from the integration of technical and sales teams into a single customer-facing organisation.

In response to margin squeezes and the impact of an influx of cheaper Far Eastern source product, management conducted a major strategic review last year. As a result SWL has been repositioned as an international supplier of contract outsourcing services to the toiletry, household and cosmetic markets. This new focus is already bearing fruit. In the last six months, SWL won a major three-year aerosol manufacturing contract. We are heartened by management's comments that they believe several other similar opportunities currently exist.

We continue to be impressed by the ability of management to respond proactively to the challenges faced in key markets. SWL has achieved sales and earnings growth despite a lack of pricing power, and subdued demand. We therefore remain confident that management will deliver on their promise to raise return on shareholders equity from 10 percent now to of 12 percent by 30 June 2006, and 15 percent by 2009.

In our view Swallowfield's earnings growth profile will be underpinned by a commitment to flexibility and innovation. The company can offer customers either a standard manufacturing service or a comprehensive 'one-stop shop' that includes design, production and distribution.

We were reassured that Swallowfield's balance sheet strength has increased since the full year end. Net debt has been reduced to ?3.6 million, with gearing falling from 73 percent at year end to 42 percent. Relative financial flexibility means SWL is well positioned to bolster manufacturing capabilities and secure earnings growth in a maturing market through opportunistic acquisitions.

Despite undergoing a re-rating in past few months, Swallowfield's investment fundamentals remain attractive with a prospective price earnings ratio of 9 times and a 5 percent dividend yield. In addition, SWL has solid net tangible asset backing of 108p.

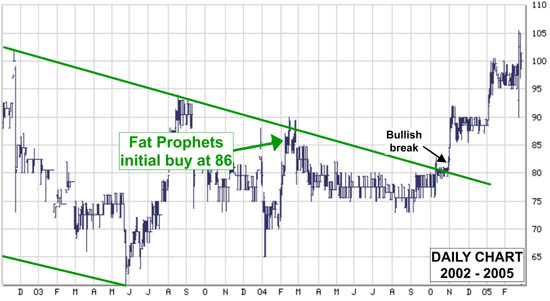

Swallowfield (SWL) Stock Charts

|