JKX Oil & Gas

11/01/2004

Recent interim results confirm that JKX Oil & Gas (JKX), like other energy companies, has been a major benefactor of higher oil and gas prices. The company has encouragingly been reinvesting much improved cash-flow into future production capacity, particularly in the Ukraine. Recent interim results confirm that JKX Oil & Gas (JKX), like other energy companies, has been a major benefactor of higher oil and gas prices. The company has encouragingly been reinvesting much improved cash-flow into future production capacity, particularly in the Ukraine.

Over the six months to 30 June JKX produced 8,022 barrels of oil equivalent per day (boepd), representing a healthy 8 percent improvement over 2003. Operating profits rose strongly from US$4.8 million to US$8.4 million mainly due to realised prices for oil and gas climbing 17 percent.

Over the half JKX's capital expenditure of US$8.6 million was largely funnelled into drilling and development works in the Ukraine. This spend had little effect on balance sheet strength being more than offset by US$9.7 million of positive operating cash-flows. As at June 30, JKX had no debt and net cash of US$20.5 million.

A strong balance sheet will allow JKX to internally finance an extensive exploration and production programme. The company has budgeted for sizeable capital expenditure of US$11.4 million for the second half of 2004, and a further US$20 million in 2005. The 2004 drilling programme included three wells, with a further three planned for 2005. The drilling is being undertaken in a highly prospective area and is part of a larger well development programme. .

JKX is currently re-entering abandoned wells, where it is utilising modern engineering techniques to restart and enhance energy production. The drilling and development programme is steadily boosting the company's understanding of the area and ultimately production potential. JKX is in active discussions with the Ukrainian government regarding additional exploration licenses for the surrounding areas.

JKX is currently producing at between 8,500 and 9,000 boepd, with the aim of having output at 10,000 barrels by year end. As it steps up drilling, management believes a production rate of between 12,000 and 15,000 boepd is achievable by the end of 2005. The company remains strongly reserved with 56.3 million barrels of oil equivalent. Even based on optimistic 2005 production levels, current reserves represent in excess of 10 years of production. We also expect the level of reserving to rapidly increase on the back of an extensive exploration and development programme.

Given our belief that energy prices will remain high, we are positive about JKX's overall earnings outlook. Near-term profitability will be driven by a 50 percent rise in production by the end of 2005. We expect longer term earnings growth will be secured by the company's commitment to intensive exploration and development over the next two years. The shares currently trade on a 2005 price earnings multiple of less than 13 times which we regard as conservative given longer term growth potential. In addition following a dividend increase JKX now offers a yield of 0.5 percent.

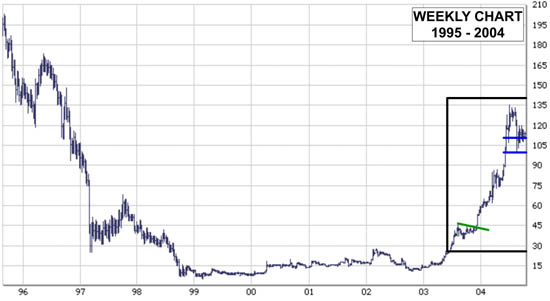

JFX Oil & Gas Charts

|