Scottish Power

11/08/2004

In the last six weeks the UK's fifth largest energy supplier, Scottish Power (SPW) has announced an expansion of generation interests on both sides of the Atlantic. In addition the UK regulator has signalled increased capital and operating expenditure allowances for energy suppliers. In our opinion, SPW has a quality portfolio of electricity generation, distribution and retail marketing businesses. We believe SPW's operating assets offer significant leverage to rising electricity prices and increased customer demand. We expect this to be further reinforced by the group's half-year results which are released this week. In the last six weeks the UK's fifth largest energy supplier, Scottish Power (SPW) has announced an expansion of generation interests on both sides of the Atlantic. In addition the UK regulator has signalled increased capital and operating expenditure allowances for energy suppliers. In our opinion, SPW has a quality portfolio of electricity generation, distribution and retail marketing businesses. We believe SPW's operating assets offer significant leverage to rising electricity prices and increased customer demand. We expect this to be further reinforced by the group's half-year results which are released this week.

SPW has confirmed that it is proceeding with the development of two US wind farms in the clean energy business 'PPM Energy'. The Oregon and Minnesota state wind farms are expected to be commissioned and earnings enhancing in 2005, and will generate an impressive one third of US wind power. PPM is now firmly on target to generate 2,000 MW's of wind power electricity by the year 2010.

While the initial capital cost of wind power is expensive relative to hydrocarbon or coal based electricity generation, the running costs are cheaper. In addition the economics of green power are supported by US government tax credits and higher allowable electricity prices. We believe the recent reinstatement of the Federal Government's production tax credits (1.8 cents per kilowatt hour) scheme reinforces this message and will significantly boost green power production in future years. In our opinion, PPM is strongly positioned to take advantage of renewable energy developments in the US.

In September Scottish Power assumed full ownership of electricity generator 'Brighton Power Station'. In our opinion the acquisition price was highly favourable, equating to 50 percent of replacement cost. The deal boosts Scottish Power's England and Wales generation capacity to 2,000 MW's. More importantly the transaction strengthens SPW's business vertically by matching generation capacity with a fast growing customer base.

In regulatory developments, The Office for Gas and Electricity (OFGEM) has remained unmoved on the allowable real returns on the regulated transmission and distribution assets. However, we are pleased OFGEM has signalled a healthy 46 percent increase in capital expenditure allowances and a more modest 8 percent increase in allowable operating expenses. The Regulator's interim findings are a net positive for SPW in our opinion.

We are also buoyed by the outlook at Scottish Power's US subsidiary, PacifiCorp, which provides electricity to more than 1.5 million retail customers. Following some operational difficulties in the first quarter PacifiCorp is now on track to earn US$1 billion in earnings before interest tax and amortisation (EBITA) in the 2004-2005 year.

We regard SPW's investment fundamentals as compelling with a 2005 price earnings ratio of 11 times, and a generous 5 percent yield. In our opinion the company's business model is strengthening as additional generation capacity is matched with a growing customer base. We also believe PPM Energy's leadership in US wind power may prove extremely lucrative in years to come.

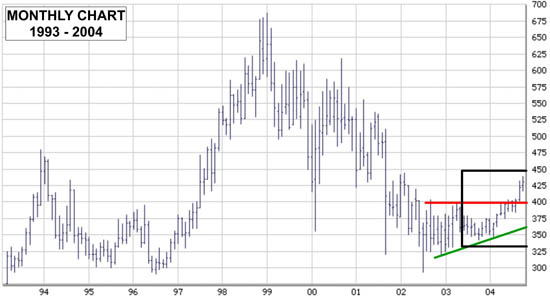

Scottish Power Stock Charts :

|