TIDMSVT

RNS Number : 1847Z

Severn Trent PLC

19 May 2021

THIS ANNOUNCEMENT IS RESTRICTED AND IS NOT FOR RELEASE,

PUBLICATION, DISTRIBUTION OR FORWARDING, IN WHOLE OR IN PART,

DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA,

CANADA, THE REPUBLIC OF SOUTH AFRICA, JAPAN OR ANY OTHER

JURISDICTION IN WHICH SUCH PUBLICATION, RELEASE OR DISTRIBUTION

WOULD BE UNLAWFUL

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

IS NOT AN OFFER OF SECURITIES IN ANY JURISDICTION

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

LEI: 213800RPBXRETY4A4C59

For immediate release

19 May 2021

Severn Trent Plc

("Severn Trent", the "Company" or the "Group")

Results of the Placing

Severn Trent announces the successful pricing of the

non-pre-emptive placing of new ordinary shares in the capital of

the Company announced earlier today (the "Placing").

A total of 10,126,366 new ordinary shares in the capital of the

Company (the "Placing Shares") have been placed by Merrill Lynch

International ("BofA Securities") and Morgan Stanley & Co.

International ("Morgan Stanley", and together with BofA Securities,

the "Joint Bookrunners" and "Joint Corporate Brokers") , at a price

of 2,400 pence per Placing Share (the "Placing Price").

Concurrently with the Placing , retail investors have subscribed

in the offer made by the Company via the PrimaryBid platform for a

total of 286,344 new ordinary shares in the capital of the Company

(the "Retail Offer Shares") at the Placing Price (the "Retail

Offer").

Additionally, certain members of the Board and Executive

Management Team have subscribed for new ordinary shares for a total

of 7,290 new ordinary shares in the capital of the Company (the

"Subscription Shares") at the Placing Price (the

"Subscription").

The Placing, Retail Offer, and Subscription in aggregate of

10,420,000 new ordinary shares will raise gross proceeds of

approximately GBP250 million. The Placing Price of 2,400 pence

represents a discount of approximately 4.0 per cent to the closing

share price of 2,500 pence on 18 May 2021 and a discount of

approximately 3.2 per cent to the middle market price at the time

at which the Company and the Joint Bookrunners agreed the Placing

Price. The Placing Shares, Retail Offer Shares, and Subscription

Shares being issued represent approximately 4.3 per cent of the

existing issued ordinary share capital of Severn Trent prior to the

Placing, Retail Offer, and Subscription.

Applications have been made to the Financial Conduct Authority

(the "FCA") and London Stock Exchange plc (the "LSE") respectively

for the admission of the Placing Shares, Retail Offer Shares, and

Subscription Shares to the premium listing segment of the Official

List of the FCA and to trading on the main market for listed

securities of the LSE (together, "Admission"). It is expected that

Admission will become effective on or before 8.00 a.m. on 21 May

2021. The Placing is conditional upon, amongst other things,

Admission becoming effective and upon the placing agreement between

the Joint Bookrunners and the Company not being terminated in

accordance with its terms.

The Placing Shares, Retail Offer Shares, and Subscription

Shares, when issued, will be fully paid and will rank pari passu in

all respects with each other and with the existing ordinary shares

of the Company, including, without limitation, the right to receive

all dividends and other distributions declared, made or paid after

the date of issue.

Following Admission, the total number of shares in issue in

Severn Trent will be 253,170,812. The Company holds 3,376,054

shares in treasury, and therefore the total number of voting rights

in Severn Trent will be 249,794,758 following Admission, and this

figure may be used by shareholders as the denominator for the

calculations by which they will determine if they are required to

notify their interest in, or a change to their interest in, Severn

Trent Plc under the FCA's Disclosure Guidance and Transparency

Rules .

This Announcement should be read in its entirety. In particular,

you should read and understand the information provided in the

"Important Notices" section of this Announcement.

For further information on the Announcement, please contact:

Severn Trent Plc:

Stuart Howell, Head of Investor Relations +44 (0) 77 0371

8361

Selina Soma, Investor Relations Manager +44 (0) 79 7693 8604

BofA Securities: +44 (0) 20 7628 1000

Peter Luck

Patrick De Loe

Oliver Elias

Sean Cox

Morgan Stanley: +44 (0) 20 7425 8000

Ben Grindley

Melissa Godoy

Francesco Puletti

Emma Whitehouse

Media enquiries:

Jonathan Sibun, Tulchan Communications +44 (0) 20 7353 4200

Press Office, Severn Trent Plc +44 (0) 24 7771 5640

IMPORTANT NOTICES

No action has been taken by the Company or Merrill Lynch

International ("BofA Securities") or Morgan Stanley & Co.

International plc ("Morgan Stanley", and together with BofA

Securities, the "Joint Bookrunners"), or any of their respective

affiliates, agents, directors, officers or employees that would, or

which is intended to, permit an offer of the securities referred to

herein or result in the possession or distribution of this

Announcement or any other offering or publicity material relating

to the securities referred to herein in any jurisdiction where

action for that purpose is required. Any failure to comply with

these restrictions may constitute a violation of the securities

laws of such jurisdictions. Persons into whose possession this

Announcement comes shall inform themselves about, and observe, such

restrictions.

No prospectus will be made available in connection with the

matters contained in this Announcement and no such prospectus is

required (in accordance with the Prospectus Regulation (EU)

2017/1129 as amended from time to time (the "Prospectus

Regulation") and the Prospectus Regulation as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018

(the "UK Prospectus Regulation") to be published. Persons needing

advice should consult an independent financial adviser.

This Announcement has been issued by and is the sole

responsibility of the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by the

Joint Bookrunners or by any of their respective affiliates or

agents (or any of their respective directors, officers, employees

or advisers) as to, or in relation to, the contents of the

information contained in this Announcement or any other written or

oral information made available to or publicly available to any

interested party or its advisers, or any other statement made or

purported to be made by or on behalf of either Joint Bookrunner or

any of their respective affiliates in connection with the Company,

the Placing Shares, Retail Offer Shares, the Placing or the Retail

Offer and any liability therefor is expressly disclaimed. The Joint

Bookrunners and each of their respective affiliates accordingly

disclaim all and any liability, whether arising in tort, contract

or otherwise (save as referred to above) in respect of any

statements or other information contained in this Announcement and

no representation or warranty, express or implied, is made by

either Joint Bookrunner or any of their respective affiliates as to

the accuracy, completeness or sufficiency of the information

contained in this Announcement.

Members of the public are not eligible to take part in the

Placing. This Announcement and the terms and conditions set out

herein are for information purposes only and are directed at and my

only be communicated to (a) in the European Economic Area ("EEA"),

persons who are "qualified investors" within the meaning of Article

2(e) of Prospectus Regulation (Regulation (EU) 2017/1129)

("Qualified Investors"); and (b) in the United Kingdom, at

Qualified Investors within the meaning of Article 2(e) of the UK

Prospectus Regulation who are also (i) persons having professional

experience in matters relating to investments who fall within the

definition of "investment professionals" in Article 19(5) of the

Financial Services and Markets Act 2000 (Financial Promotion) Order

2005 (the "Order"); (ii) high net worth bodies corporate,

unincorporated associations and partnerships and trustees of high

value trusts as described in Article 49(2) of the Order; or (iii)

persons to whom it may otherwise lawfully be communicated (all such

persons together being referred to as "Relevant Persons").

Any investment or investment activity to which this Announcement

relates is only available to, and will be engaged in only with,

Relevant Persons. Persons distributing this Announcement must

satisfy themselves that is lawful to do so. This Announcement is

for information purposes only and shall not constitute an offer to

sell or issue or the solicitation of an offer to buy, subscribe for

or otherwise acquire securities in any jurisdiction in which any

such offer or solicitation would be unlawful. Any failure to comply

with this restriction may constitute a violation of the securities

laws of such jurisdictions. Persons needing advice should consult

an independent financial adviser.

The distribution of this Announcement and the offering, placing

and/or issue of the Placing Shares in certain jurisdictions may be

restricted by law. No action has been taken by the Company or the

Joint Bookrunners or any of their respective affiliates that would

permit an offer of the Placing Shares or possession or distribution

of this Announcement or any other offering or publicity material

relating to such Placing Shares in any jurisdiction where action

for that purpose is required. Persons into whose possession this

announcement comes are required by the Company and the Joint

Bookrunners to inform themselves about and to observe any such

restrictions.

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN, IS

RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE OR DISTRIBUTION,

DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO THE UNITED

STATES OF AMERICA, ITS TERRITORIES AND POSSESSIONS, ANY STATE OF

THE UNITED STATES OR THE DISTRICT OF COLUMBIA (COLLECTIVELY, THE

"UNITED STATES"), AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA

OR JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH PUBLICATION,

RELEASE OR DISTRIBUTION WOULD BE UNLAWFUL. FURTHER, THIS

ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS NOT AN OFFER

OF SECURITIES IN ANY JURISDICTION. THIS ANNOUNCEMENT HAS NOT BEEN

APPROVED BY THE LONDON STOCK EXCHANGE, NOR IS IT INTED THAT IT WILL

BE SO APPROVED.

This communication is not a public offer of securities for sale

in the United States. The securities referred to herein have not

been and will not be registered under the US Securities Act 1933,

as amended (the "Securities Act") or under the securities laws of

any state or other jurisdiction of the United States, and may not

be offered or sold directly or indirectly in or into the United

States except pursuant to an exemption from, or in a transaction

not subject to, the registration requirements of the Securities Act

and in compliance with the securities laws of any state or any

other jurisdiction of the United States. The securities referred to

herein may not be offered and sold within the United States except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements of the Securities Act.

UK Product Governance Requirements

Solely for the purposes of the product governance requirements

of Chapter 3 of the FCA Handbook Product Intervention and Product

Governance Sourcebook (the "UK MiFIR Product Governance

Requirements"), and disclaiming all and any liability, whether

arising in tort, contract or otherwise, which any 'manufacturer'

(for the purposes of the UK MiFIR Product Governance Requirements)

may otherwise have with respect thereto, the Placing Shares have

been subject to a product approval process, which has determined

that the Placing Shares are: (i) compatible with an end target

market of retail investors and investors who meet the criteria of

professional clients and eligible counterparties, each as

respectively defined in paragraphs 3.5 and 3.6 of the FCA Handbook

Conduct of Business Sourcebook ; and (ii) eligible for distribution

through all permitted distribution channels (the "UK Target Market

Assessment"). Notwithstanding the UK Target Market Assessment,

distributors should note that: the price of the Placing Shares may

decline and investors could lose all or part of their investment;

the Placing Shares offer no guaranteed income and no capital

protection; and an investment in the Placing Shares is compatible

only with investors who do not need a guaranteed income or capital

protection, who (either alone or in conjunction with an appropriate

financial or other adviser) are capable of evaluating the merits

and risks of such an investment and who have sufficient resources

to be able to bear any losses that may result therefrom. The UK

Target Market Assessment is without prejudice to the requirements

of any contractual, legal or regulatory selling restrictions in

relation to the Placing. Furthermore, it is noted that,

notwithstanding the UK Target Market Assessment, BofA Securities

and Morgan Stanley will only procure investors who meet the

criteria of professional clients and eligible counterparties.

For the avoidance of doubt, the UK Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of Chapters 9A or 10A respectively of the FCA

Handbook Conduct of Business Sourcebook; or (b) a recommendation to

any investor or group of investors to invest in, or purchase or

take any other action whatsoever with respect to the Placing

Shares. Each distributor is responsible for undertaking its own

target market assessment in respect of the securities referred to

herein and determining appropriate distribution channels.

EU Product Governance Requirements

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended, ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the "MiFID

II Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the MiFID II Product

Governance Requirements) may otherwise have with respect thereto,

the Placing Shares have been subject to a product approval process,

which has determined that such Placing Shares are: (i) compatible

with an end target market of retail investors and investors who

meet the criteria of professional clients and eligible

counterparties, each as defined in MiFID II; and (ii) eligible for

distribution through all distribution channels as are permitted by

MiFID II (the "Target Market Assessment"). Notwithstanding the

Target Market Assessment, distributors should note that: the price

of the Placing Shares may decline and investors could lose all or

part of their investment; the Placing Shares offer no guaranteed

income and no capital protection; and an investment in the Placing

Shares is compatible only with investors who do not need a

guaranteed income or capital protection, who (either alone or in

conjunction with an appropriate financial or other adviser) are

capable of evaluating the merits and risks of such an investment

and who have sufficient resources to be able to bear any losses

that may result therefrom. The Target Market Assessment is without

prejudice to the requirements of any contractual, legal or

regulatory selling restrictions in relation to the Placing.

Furthermore, it is noted that, notwithstanding the Target Market

Assessment, BofA Securities and Morgan Stanley will only procure

investors who meet the criteria of professional clients and

eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability or appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

Forward looking information

This Announcement contains (or may contain) certain

forward-looking statements with respect to certain of the Company's

current expectations and projections about future performance,

anticipated events or trends and other matters that are not

historical facts. These forward-looking statements, which sometimes

use words such as "aim", "anticipate", "believe", "intend", "plan"

"estimate", "expect" and words of similar meaning, include all

matters that are not historical facts and reflect the directors'

beliefs and expectations and involve a number of risks,

uncertainties and assumptions that could cause actual results and

performance to differ materially from any expected future results

or performance expressed or implied by the forward-looking

statement. These statements are subject to unknown risks,

uncertainties and other factors that could cause actual results to

differ materially from those expressed or implied by such

forward-looking statements. Statements contained in this

Announcement regarding past trends or activities should not be

taken as a representation that such trends or activities will

continue in the future. The information contained in this

Announcement is subject to change without notice and, except as

required by applicable law, neither the Company nor the Joint

Bookrunners assume any responsibility or obligation and each

expressly disclaim any obligation or undertaking to update publicly

or review any of the forward-looking statements contained herein,

whether as a result of new information, future events or otherwise,

unless required to do so by applicable law or regulation. You

should not place undue reliance on forward-looking statements,

which speak only as of the date of this Announcement.

Any indication in this Announcement of the price at which

ordinary shares have been bought or sold in the past cannot be

relied upon as a guide to future performance. No statement in this

Announcement is intended as a profit forecast or estimate for any

period and no statement in this Announcement should be interpreted

to mean that earnings, earnings per share or income, cash flow from

operations or free cash flow for the Company, as appropriate, for

the current or future years would necessarily match or exceed the

historical published earnings, earnings per share or income, cash

flow from operations or free cash flow for the Company. Past

performance is no guide for future performance and persons reading

this Announcement should consult an independent financial

adviser.

This Announcement does not constitute a recommendation to

acquire any securities of the Company. This Announcement does not

identify or suggest, or purport to identify or suggest, the risks

(direct or indirect) that may be associated with an investment in

the Placing Shares. Any investment decision to buy Placing Shares

in the Placing must be made solely on the basis of publicly

available information, which has not been independently verified by

the Joint Bookrunners.

Persons (including, without limitation, nominees and trustees)

who have a contractual or other legal obligation to forward a copy

of this Announcement should seek appropriate advice before taking

any action.

In connection with the Placing, the Joint Bookrunners may

release communications to the market as to the extent to which the

book is "covered". A communication that a transaction is, or that

the books are, "covered" refers to the position of the order book

at that time. It is not an assurance that the books will remain

covered, that the transaction will take place on any terms

indicated or at all, or that if the transaction does take place,

the securities will be fully distributed by the Joint

Bookrunners.

BofA Securities and Morgan Stanley are each authorised by the

Prudential Regulatory Authority and regulated in the United Kingdom

by the Prudential Regulation Authority and the Financial Conduct

Authority. Each of BofA Securities and Morgan Stanley is acting

exclusively for the Company and no one else in connection with the

Placing, the content of this Announcement and other matters

described in this Announcement. BofA Securities and Morgan Stanley

will not regard any other person as their respective clients in

relation to the Placing, the content of this Announcement and other

matters described in this Announcement and will not be responsible

to anyone (including any placees) other than the Company for

providing the protections afforded to their respective clients or

for providing advice to any other person in relation to the

Placing, the content of this Announcement or any other matters

referred to in this Announcement.

In connection with the Placing, each of BofA Securities and

Morgan Stanley and any of their affiliates, acting as investors for

their own account, may take up a portion of the shares in the

Placing as a principal position and in that capacity may retain,

purchase, sell, offer to sell for their own accounts such shares

and other securities of the Company or related investments in

connection with the Placing or otherwise. Accordingly, references

to Placing Shares being offered, acquired, placed or otherwise

dealt in should be read as including any issue or offer to, or

acquisition, placing or dealing by, the Joint Bookrunners and any

of their affiliates acting in such capacity. In addition, the Joint

Bookrunners and any of their affiliates may enter into financing

arrangements (including swaps) with investors in connection with

which the Joint Bookrunners and any of their respective affiliates

may from time to time acquire, hold or dispose of shares. The Joint

Bookrunners do not intend to disclose the extent of any such

investment or transactions otherwise than in accordance with any

legal or regulatory obligations to do so. The Joint Bookrunners are

not acting for the Company with respect to the Retail Offer.

The most recent Annual Report of the Group and other information

about the Group are available on the Severn Trent website at

www.Severn Trent.com. Neither the contents of the Company's website

(or any other website) nor the content of any website accessible

from hyperlinks on the Company's website (or any other website) is

incorporated into or forms part of this Announcement. The Placing

Shares to be issued or sold pursuant to the Placing will not be

admitted to trading on any stock exchange other than the London

Stock Exchange.

Notice to investors in Canada

No prospectus has been filed with any securities commission or

similar regulatory authority in Canada in connection with the offer

and sale of the Placing Shares. No securities commission or similar

regulatory authority in Canada has reviewed or in any way passed

upon this document or the merits of the Placing Shares and any

representation to the contrary is an offence. In Canada, the

Placing Shares may only be offered and sold on a private placement

basis and are exempt from the requirement that the Company prepares

and files a prospectus under applicable Canadian securities laws.

Any resale of Placing Shares acquired by a Canadian investor in

this Placing must be made in accordance with applicable Canadian

securities laws, which resale restrictions may under circumstances

apply to resales of the Placing Shares outside of Canada.

As applicable, each Canadian investor who purchases the Placing

Shares will be deemed to have represented to the Company, the Joint

Bookrunners and to each dealer from whom a purchase confirmation is

received, as applicable that the investor (i) is purchasing as

principal, or is deemed to be purchasing as principal in accordance

with applicable Canadian securities laws, for investment only and

not with a view to resale or redistribution; (ii) is an "accredited

investor" as such term is defined in section 1.1 of National

Instrument 45-106 Prospectus Exemptions or, in Ontario, as such

term is defined in section 73.3(1) of the Securities Act (Ontario);

(iii) is a "permitted client" as such term is defined in section

1.1 of National Instrument 31-103 Registration Requirements,

Exemptions and Ongoing Registrant Obligations ("NI 31-103"), and

(iv) is purchasing the Placing Shares from a dealer permitted to

rely on the "international dealer exemption" contained in section

8.18 of NI 31-103, in which case, the investor also acknowledges

that the investor has been notified by such dealer: (A) that the

dealer is not registered in the local jurisdiction to make the

trade and that all or substantially all of the assets of the person

or company may be situated out of Canada; and (B) of the dealer's

jurisdiction of residence and the name and address of the agent for

service of process of the person or company in the local

jurisdiction and that there may be difficulty enforcing legal

rights against the person or company because of the foregoing.

If, in connection with a distribution of an eligible foreign

security as defined in Ontario Securities Commission Rule 45-501

Ontario Prospectus and Registration Exemptions and in Multilateral

Instrument 45-107 Listing Representation and Statutory Rights of

Action Disclosure Exemptions, we deliver to you an offering

document that constitutes an offering memorandum under applicable

securities laws in Canada, you may have, depending on the province

or territory of Canada in which the trade was made to you, remedies

for rescission or damages if the offering memorandum (including any

amendment thereto) contains a misrepresentation, provided that the

remedies for rescission or damages are exercised by you within the

time limit prescribed by the securities legislation of your

province or territory. You should refer to any applicable

provisions of the securities legislation of your province or

territory for the particulars of these rights or consult with a

legal advisor.

Pursuant to section 3A.3 of National Instrument 33-105

Underwriting Conflicts ("NI 33-105"), this Placing is conducted

pursuant to an exemption from the requirement that Canadian

investors be provided with certain underwriting conflicts of

interest disclosure that would otherwise be required pursuant to

subsection 2.1(1) of NI 33-105.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIKZGMKFLRGMZM

(END) Dow Jones Newswires

May 19, 2021 10:01 ET (14:01 GMT)

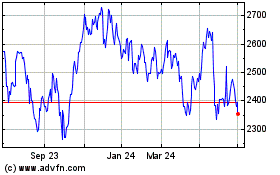

Severn Trent (LSE:SVT)

Historical Stock Chart

From Mar 2024 to Apr 2024

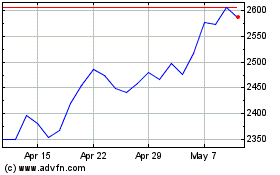

Severn Trent (LSE:SVT)

Historical Stock Chart

From Apr 2023 to Apr 2024