By Steven Russolillo

HONG KONG-- Since antigovernment protests erupted in June,

hotels in Hong Kong have become ghost towns. Restaurants, normally

heaving with tourists and locals, are struggling to attract diners.

Nearly a quarter of American businesses polled said they were

considering moving capital or assets out of the city.

And the city is now officially in a recession.

Hong Kong's economy shrank 3.2% in the July-to-September quarter

from the period just before, according to data released Thursday.

Compared with the year-earlier quarter, the city's gross domestic

product fell 2.9%, its first year-over-year contraction in a

decade.

If anything, the figures undersell the speed and severity of the

downturn for shopkeepers, restaurant owners and others with

consumer-facing businesses.

For some entrepreneurs in Hong Kong, business is as tough as

they can remember. And this is after nearly a quarter-century that

saw two financial crises, a transfer of sovereignty to China from

the U.K., the deadly SARS epidemic and an earlier wave of protests

in 2014.

The gloom risks becoming self-reinforcing: 46% of respondents to

a recent American Chamber of Commerce poll said they were

pessimistic about Hong Kong's long-term prospects. Nearly a quarter

were considering moving capital, assets or operations out of Hong

Kong, in many cases to Singapore.

"I haven't been this stressed ever in the restaurant business,"

said Que Vinh Dang, a chef who has spent 22 years in the industry.

Mr. Dang said sales at his nearly year-old Vietnamese restaurant,

Nhau, have almost halved since the protests started. The

43-year-old said conditions were more challenging than during SARS,

the global financial crisis or 2014's Umbrella Movement

protests.

Dozens of small-business owners have made appeals on social

media for people to visit their stores and buy their products and

services, but they have largely refrained from criticizing the

protest moment or blaming it for their predicaments. One risk is

businesses perceived to have taken sides against the protesters--

like the city's subway system and a local operator of restaurant

chains--have been vandalized. In addition, public opinion polls are

continuing to reflect high levels of public dissatisfaction with

the government and police.

Mr. Dang said he sympathized with the demonstrators but thought

some of their demands were implausible. "I'm trying to look at the

whole situation in a very open way," he said.

Tour company Hong Kong DolphinWatch has been in operation since

1995. It was forced to cancel most of its weekday trips to view the

city's pink dolphins this summer because of the protests. Bookings

on Sundays, its busiest day, have fallen substantially due to a

drop in tourists and as residents worried they wouldn't be able to

return home safely afterward.

"For the first time ever, I googled how to close a company,"

said Bennie To, a manager at the company. After undertaking a

social-media campaign to help generate sales, she said the business

recovered to break-even levels as of September. But she remains

concerned about what lies ahead. That's because while local

community support provided a temporary boost, she said it would

take a while for tourists to get comfortable enough to visit Hong

Kong again.

"We really hope that this social unrest would stop and let Hong

Kong and everyone in it recover and move forward," Ms. To said.

The second straight quarter of contraction means Hong Kong is

now in recession--hit not only by social unrest but also the

U.S.-China trade war and weaker global growth. In a recent blog

post, Hong Kong Financial Secretary Paul Chan said the economic

contraction could last a full year.

A steep drop in tourism, predominantly from mainland China, has

been accompanied by tumbling retail sales. Hotels have slashed

prices to woo bookings. Mr. Chan wrote in his post that hotel

occupancy had crashed to 66% in August from above 90%

previously.

London-listed InterContinental Hotels Group PLC operates the

Crowne Plaza, Holiday Inn and InterContinental hotels, among

others. It told investors recently that in Hong Kong, its revenue

per available room--a standard industry measure--fell by more than

50% in September. At the Hong Kong operations of rival Hilton

Worldwide Holdings Inc., revenue per room was down 40% in the third

quarter.

Hong Kong retail sales as measured by value fell 23% in August

from a year earlier, the worst monthly decline on record, according

to government statistics. Sales of jewelry, watches, clocks and

other valuable gifts fell by a record 47%, while sales at

department stores dropped 30%.

Many buyers of luxury items come from mainland China, which

accounts for the largest segment of inbound tourists to Hong Kong.

But many have stopped visiting as the unrest has intensified.

Tourist arrivals in Hong Kong dropped nearly 40% in August from

a year earlier. That marked the worst decline since May 2003, when

Hong Kong was grappling with SARS.

More recently, Hong Kong's leader, Carrie Lam, said arrivals in

early October's "Golden Week"--a popular time to travel especially

for mainland Chinese--had fallen by more than half from a year

earlier.

The protests were sparked by a legislative measure that would

have allowed the extradition of criminal suspects to mainland China

for trial. But they have since morphed into a broader movement in

opposition to the government, police conduct and China's increasing

encroachment on the semiautonomous city.

Since June, conferences and events have been canceled, lines

have dwindled outside restaurants popular with tourists and the

airport has shut down at times. Some shoppers have gotten caught up

in clashes and stores in busy shopping districts have often been

forced to close their doors.

JustGreen, a chain of organic convenience stores, closed for

good in September after 11 years selling organic groceries,

gluten-free pretzels and nondairy frozen pizza.

Protests were a factor in the decision, a spokesman said, and

sales were hardest hit in areas that had demonstrations or

transport disruptions. "There was just a lot less volume," he said.

"You just weren't seeing people show up."

Meanwhile, Anthony Rendall--a yacht broker--said a slowdown had

forced him to expand abroad to places like the Philippines and

Thailand. "My business has come to a grinding halt with no recovery

in sight," he said.

For 12 years Chan Fung has been selling flashlights, LED lights

and watch straps at an outdoor market stall in Jordan, a busy

neighborhood in the urban jungle of Kowloon that is usually

bustling with locals and tourists alike. He said sales have plunged

40% in the last couple of months and the decline occurred very

quickly, within a matter of weeks. The market is now often deserted

on weekends because people are worried about getting caught up in

the protests, the 42-year-old said.

Other sectors are suffering, too. In finance, the city's banks

aren't expected to be as profitable as they were in years past.

HSBC Holdings PLC and Standard Chartered PLC said Thursday they

would cut their savings rate for Hong Kong dollar deposits to

0.001%--or virtually zero--and cut slightly their prime lending

rates in the city to help businesses. And this week, pan-Asian life

insurer AIA Group Ltd. reported a steep decline in business from

mainland Chinese visitors. While in Hong Kong, Chinese visitors

have been known to buy investment-linked insurance policies that

are denominated in U.S. dollars.

There is some evidence of money moving to other locales.

Analysts at Goldman Sachs estimated as much as $3 billion to $4

billion had shifted to Singapore from the city's Hong Kong-dollar

denominated deposit accounts, as of August.

The Hong Kong Monetary Authority, the city's de facto central

bank, said local-currency deposits fell 1.6% in August from a month

earlier, the largest drop in more than a year. However, it called

this a normal fluctuation given a lack of fundraising--including

via initial public offerings--and said there was a slight increase

in deposits in the first three weeks of September.

Data from the Monetary Authority of Singapore, meanwhile, showed

that foreign currency deposits at banks there climbed to a record

high of 14.9 billion Singapore dollars ($10.9 billion) in

September, roughly double their level in May before the Hong Kong

protests began.

Imports and exports, another cornerstone of Hong Kong's economy,

have shrunk year-over-year every month so far in 2019.

The government has announced measures to support the economy.

This month, the monetary authority made it easier for banks to lend

to small businesses by cutting capital requirements.

Mrs. Lam, the city's leader, has also promised billions of

dollars in social-welfare initiatives, including pledging to build

more low-cost homes and giving easier access to mortgages for

first-time home buyers.

Some business owners are hoping the worst is over. Girish

Jhunjhnuwala, CEO of Ovolo Hotels Group, said occupancy rates at

the chain's four Hong Kong hotels dropped to as low as 40% in

August, forcing them to cut prices by a fifth.

More recently, Ovolo was able to raise rates as occupancy levels

have improved to between 65% and 75%, thanks to business travelers

returning to the city. But they are still a far cry from the

roughly 95% occupancy levels the hotels used to enjoy.

With the end of the protests nowhere in sight, "this is just

something that we are going to have to live with," said Mr.

Jhunjhnuwala.

Lucy Craymer contributed to this article.

Write to Steven Russolillo at steven.russolillo@wsj.com

(END) Dow Jones Newswires

October 31, 2019 05:31 ET (09:31 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

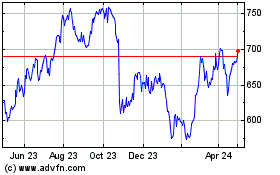

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

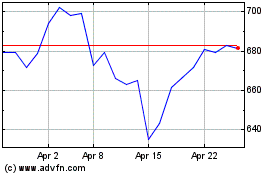

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024