TIDMOMG

RNS Number : 6492V

Oxford Metrics PLC

05 December 2023

5 December 2023

Oxford Metrics plc

("Oxford Metrics", the "Company" or the "Group")

Preliminary Results for the financial year ended 30 September

2023

- Record Revenue and Adjusted PBT performance, ahead of market

expectations

- Continued innovation unveiling our new markerless technology

at Siggraph 2023

- In FY23 Vicon manufactured more camera systems than ever

before

- Enter FY24 with strong order book and visibility on over half

of revenue expectations

Oxford Metrics plc (LSE: OMG), the smart sensing and software

company servicing life sciences, entertainment and engineering

markets , announces preliminary results for the financial year

ended 30 September 2023.

Continuing Operations FY23 % Change FY22

Revenue GBP44.2m +53.5% GBP28.8m

-------- -------- --------

Adjusted Profit Before Tax* GBP6.5m +151.9% GBP2.6m

-------- -------- --------

Adjusted* Basic Earnings per Share 4.57p +79.2% 2.55p

-------- -------- --------

Ordinary Dividend per Share 2.75p +10% 2.50p

-------- -------- --------

Statutory Profit after Tax GBP5.7m +66.5% GBP3.4m

-------- -------- --------

Statutory Basic Earnings per Share 4.35p +63.5% 2.66p

-------- -------- --------

Net Cash** GBP64.8m -4.3% GBP67.7m

-------- -------- --------

Orders-in-hand GBP11.5m -52.2% GBP24.0m

-------- -------- --------

* Profit Before Tax before Group recharges adjusted for

share-based payments, amortisation and impairment of intangibles

arising on acquisition and additional Contemplas consideration

deemed remuneration.

** Including Fixed Term Deposits and Bank overdraft.

Financial Highlights

-- Record headline revenue of GBP44.2m (FY22: GBP28.8m), (up 53.5%,

up 52.4% on a constant currency basis), driven by demand for

our new flagship system, Valkyrie

-- Gross Profit of 65.0% (FY22: 67.5%), reflecting the use of higher

cost components acquired during the supply chain challenge of

the last few years and changes in product mix

-- Adjusted Profit Before Tax* at GBP6.5m (FY22: GBP2.6m), up 151.9%

year on year, reflecting the strong revenue performance as well

as a planned increase in R&D to deliver the five-year plan and

the benefit of increased interest income

-- Strong balance sheet with net cash position of GBP64.8m (FY22:

GBP67.7m), well placed to pursue M&A aspect of the five-year

plan

-- Board proposes increased final dividend to 2.75p per share (FY22:

2.50p), up 10.0% year on year

Operational highlights

Strong execution of orders and continued buyout demand drives

revenue growth

-- Order book as of 30(th) September 2023 of GBP11.5m (FY22: GBP24.0m),

reflecting the more normalised buying cycles following the global

supply chain challenges now largely abated

-- Strong demand across all our market segments

-- Entertainment: Buoyant demand continued, with revenue up 82%,

accounting for 43% of orders in hand

o Contract wins for major Valkyrie Stages at Cover Japan,

Dimension Studio & PUBG Madison

-- Engineering: revenues up 56% year on year, accounting for 22%

of orders in hand

o Contract wins with ITESM, University of Arizona and University

of Manitoba

-- Life Sciences: revenues grew 40%, accounting for 29% of the

orders in hand

o Notable deals include Hospital Israelita Albert Einstein

(HIAE), University of Padova, Victoria University and University

of Rochester Medical Centre

-- Location-based Entertainment (LBE): reported a slight decline

year on year of 5% following exceptional growth, accounts for

6% of orders in hand

o Sandbox VR announced their 45(th) location and Immersive

Gamebox opened their 30(th) location in the year, all powered

by Vicon technology

-- Valkyrie, Vicon's flagship system, continued to drive revenues

and orders in the year

-- Markerless technology demonstrated at Siggraph 2023 was well-received

o Technology demonstration of markerless technology follows

over four years of R&D focussing on the integration of machine

learning and AI into markerless motion capture

o Established our Pioneer Programme, working closely with

both customers and prospects to help refine the product

as we start to commercialise markerless

-- Imogen Moorhouse appointed Group CEO 1 October 2023

Extending smart sensing capabilities via M&A - Industrial

Vision Systems (IVS)

-- Post period end on 1(st) November 2023, acquired Industrial Vision

Systems Ltd ("IVS") adding smart manufacturing to our market-leading

portfolio

o Brings specialised machine learning AI technology for automated

quality control, meeting companies' requirements for a "right

first time" solution

o IVS adds IP rich, hard-to-replicate vision software and

machine technology, bringing over 23 years of experience

in smart vision technology

o IVS' systems spot patterns and anomalies in real-time manufacturing

quality control, ensuring precise and repeatable solutions

that continuously learn based on image data

Outlook

-- With encouraging demand, Vicon enters the new financial year

with over GBP11.5m orders in hand and a strong and executable

pipeline

-- Trading in the first months of the financial year has been in

line with our expectations

-- Over half of revenue expectations for the full year is underpinned

by orders in hand and a strong sales pipeline.

-- FY2024 will see the beginning of the commercialisation of our

new markerless technology

-- Modest expectations for new markerless technology expected in

FY24 ahead of contributing more material revenues in FY25

-- Following the successful acquisition of IVS in November 2023

the Group will continue to pursue M&A opportunities in known

markets possessing hard-to-replicate, deep Intellectual Property

in integrated smart sensing with attractive financial metrics

Commenting on the results Imogen Moorhouse, Chief Executive

said:

"I am delighted to report my first set of results as CEO of

Oxford Metrics. Two years into our five-year strategy, we are

reporting record revenue and adjusted PBT performance for FY23.

This result builds on from our strongest-ever first half as Vicon

executed against orders and continued demand for our smart sensing

technology continued, driven by positive uptake of our new system,

Valkyrie.

Our team this year has continued to innovate, manufacturing more

advanced camera systems than ever before. At our industry

conference Siggraph 2023, we showed the world our new markerless

technology. This technological advancement represents a pivotal

moment and is expected to drive growth once commercialised in

FY24.

We continue to pursue M&A opportunities to unlock growth and

new market opportunities. Post period end, we successfully

delivered on our promise of acquisition activity adding smart

manufacturing to our market-leading portfolio with Industrial

Vision Systems.

Vicon enters the new financial year with well over half of

revenue expectations underpinned by orders in hand and a strong

sales pipeline. With an energised team, a clear roadmap and

continued market demand, the Board looks forward to the new

financial year which is set to see further underlying growth in our

existing markets whilst laying the foundations for future growth

including the commercialisation of markerless technology."

For further information please contact :

+44 (0) 1865

Oxford Metrics 261860

Imogen Moorhouse, CEO

David Deacon, CFO

+44 (0)20 7260

Deutsche Numis 1000

Simon Willis / Hugo Rubinstein / Tejas Padalkar

+44 (0)20 3727

FTI Consulting 1000

Matt Dixon / Emma Hall / Jamille Smith /

Jemima Gurney

About Oxford Metrics

Oxford Metrics is a smart sensing and software company that

enables the interface between the real world and its virtual twin.

Our smart sensing technology helps over 10,000 customers in more

than 70 countries, including all of the world's top 10 games

companies and all of the top 20 universities worldwide. Founded in

1984, we started our journey in healthcare, expanded into

entertainment, winning an OSCAR(R) and an Emmy(R), moved into

defence, engineering and smart manufacturing. We have a strong

track record of creating value by incubating, growing and then

augmenting through acquisition, unique technology businesses.

The Group trades through its market-leading division Vicon and,

recently acquired, Industrial Vision Systems. Vicon is a world

leader in motion measurement analysis to thousands of customers

worldwide, including Red Bull, Imperial College London, Dreamscape

Immersive, Industrial Light & Magic, and NASA. Industrial

Vision Systems is a specialist in machine vision software and

technology for high precision, automated quality control systems

trusted by blue-chip, smart manufacturing companies across the

globe including BD, DePuy, Jaguar Land Rover, Johnson &

Johnson, Zytronic and Alkegen.

The Group is headquartered in Oxford with offices in California,

Colorado, Auckland, and Kempten. Since 2001, Oxford Metrics (LSE:

OMG), has been a quoted company listed on AIM, a market operated by

the London Stock Exchange. For more information about Oxford

Metrics, visit www.oxfordmetrics.com

Chairman's Statement

I am delighted to report that Oxford Metrics has delivered a

strong financial performance during 2023 reporting both record

revenue and Adjusted PBT results. Valkyrie, the Group's most

advanced motion capture system to date, launched in July 2022, has

continued to drive revenues and has been positively received and

widely adopted by new and existing customers alike.

Since the launch of the Group's current five-year plan, we have

continued to invest in the future of the business. Over the Summer,

at Siggraph, the premier conference for computer graphics and

interactive techniques, hosted in Los Angeles, we were able to

reveal the fruits of our innovation efforts over the past four

years to unveil our new markerless technology. Following successful

public demonstrations, this development represents a pivotal moment

for the business and, once commercialised, is expected to help

drive growth over the coming years.

Given the record performance in FY23, the addition of Industrial

Vision Systems (IVS) acquired in November 2023 and the

commercialisation of markerless, we remain on track to achieve our

five-year plan which aims to grow revenues 2.5x to GBP70m whilst

delivering an Adjusted PBT* margin of 15% by the end of the

FY26.

The Group reported revenues of GBP44.2m (FY22: GBP28.8m),

adjusting for the deferment of GBP3.5m of orders we were unable to

ship in September 2022; the underlying growth was strong

nonetheless at 26%. An Adjusted PBT* of GBP6.5m (FY22: GBP2.6m) is

reported, equivalent to a return on sales of 14.8% (FY22: 9.0%).

The order book for the year ahead stands at GBP11.5m (FY22:

GBP24.0m) which represents a more reasonable lead time for our

customers, following the easing of supply chain constraints, which

we will seek to maintain in the future.

The Group reports a statutory Profit after tax for all

operations of GBP5.7m (FY22: GBP46.9m) which last year included the

disposal of the Yotta business at a highly attractive valuation and

on a continuing basis a statutory Profit after tax of GBP5.7m

(FY22: GBP3.4m) is reported. The net cash position including Fixed

Term Deposits was GBP64.8m (FY22: GBP67.7m). After the continued

investment in the business and the deployment of cash for working

capital purposes during the year, the net cash position remains

significant and available for the execution of our M&A

plans.

The Board proposes a 10% increase to our final dividend to 2.75p

per share (FY22 Final Dividend: 2.50p) this year. We remain

committed to our progressive dividend policy and aims to achieve

average dividend cover of approximately two-times Adjusted PBT* per

share over time.

The success of our business depends on having engaged and

dedicated employees. This is reflected in our very high retention

rate, 89% globally, of which we are very proud. We understand the

importance of environmental and social sustainability within our

own operations and our supply chain, and we are taking steps to

reduce our impact on the environment from redesigning our products

and transforming our operational processes. As an important part of

our investment in the future of the business, we have published our

Environmental, Social and Governance initiatives on our

sustainability webpage oxfordmetrics.com/sustainability , and we

have published our Streamlined Energy and Carbon Reporting ('SECR')

data in this year's Annual Report. The Board is committed to taking

a holistic view of the business and we will continue to update and

review our sustainability webpage throughout 2024.

I would like to take the opportunity on behalf of the Board and

our colleagues to thank our former CEO, Nick Bolton, who

contributed an enormous amount. Nick successfully led the Group

over the last 18 years leaving it well positioned to capitalise on

the opportunities ahead of us today. We wish him all the very best

in his new role. Following a thorough and orderly CEO transition

process, we are delighted to have appointed Imogen Moorhouse, to

step up into CEO of Oxford Metrics to lead us forward.

We are very fortunate to have a natural successor; Imogen knows

our business inside and out, having spent 22 years at Vicon, the

last 12 of which as Vicon CEO. Through this time Imogen has grown

the business organically and via M&A and has been integral to

the development and implementation of the Group's five-year growth

plan.

We were also pleased to announce the acquisition of Industrial

Vision Systems. The acquisition is immediately earnings enhancing,

adding smart manufacturing to our portfolio and increasing our

presence in the Engineering market. Along with our new IVS

colleagues and energised team, I look forward to continuing to work

with Imogen as we move ahead to achieve our aims of creating a

Group focussed on expanding market opportunities in smart

sensing.

Lastly, I would like to thank everyone involved in supporting

and building our business - our customers, our shareholders, our

partners, and, of course, our brilliant team across the world who

responded magnificently, not least the production team who, this

year, manufactured more camera systems than ever before.

Roger Parry

Chair

CEO STATEMENT

After 12 years as operational CEO for Vicon I am delighted to

have taken on the Oxford Metrics CEO role at such an exciting time

for the Group.

Delivering the five-year growth plan for Oxford Metrics is my

key focus, having worked very closely with my predecessor, Nick

Bolton, to formulate the Group's next chapter. In year two of the

plan, 2023 has certainly been a year of powering up, delivering a

record performance from our Vicon division and unveiling yet more

innovation, making our markerless technology a reality at Siggraph.

Post year end, we acquired Industrial Vision Systems in November

and are encouraged by our start to the new financial year.

We enter year three of the plan in a strong position. Over FY23

I have grown the senior leadership team at Vicon with a series of

new appointments.

With an energised team and clear roadmap, we are well-positioned

to deliver on the target of growing revenues 2.5x whilst delivering

an Adjusted PBT* margin of 15% by the end of the plan. At the core

of the plan is the three elements of smart sensing: sense, analyse

and apply:

1. Extend our sensing capabilities

Firstly, we seek growth by extending our sensing methods through

R&D, M&A and fostering key supplier partnerships, which

broadens the applicability of our solutions and expands our

addressable market.

At Siggraph, we unveiled our markerless technology, receiving a

very positive market reaction. At the same time, we launched a

Pioneer Programme allowing customers and prospects to work with us

on executing product delivery to ensure we capture both the

technical, user experience, operational and commercial aspects of

the delivery in the right way.

With our post year end acquisition of IVS, we have added machine

vision techniques used in the growing smart manufacturing market,

an adjacent industry to Vicon, and one where there are clear

opportunities to expand its geographic footprint and grow its

IP-rich static technology offering with prospects to benefit from

Vicon's dynamic sensing. We're excited about the opportunity ahead

to extend into yet more applications and industries as inspection

automation becomes more mainstream and smart manufacturing becomes

the standard.

2. Enhance the analysis we can perform

Secondly, we seek to augment the analysis our customers can

undertake with our software, thus broadening the range of

applications to which our systems can be applied.

Vicon's new life sciences reporting tool, Nexus Insight, is a

good example of this. Nexus Insight simplifies reporting, making it

easier for customers to visualise, interpret, share, analyse and

compare their data. This new tool takes motion capture data,

turning it into clear, easy to understand, accessible reports.

3. Apply our IP by embedding in other companies' solutions

Finally, we aim to grow by seeing our deep technology

incorporated into other business' products and services - which

aims to expand our addressable market as we drive the integration

of our sensing and analysis IP to specific application domains.

Currently, the best example of our embedding opportunity is in

the Location-based Entertainment (LBE) market and in FY23 we saw

encouraging next phase rollouts by our partners Sandbox VR and

Immersive Gamebox. Sandbox VR recently announced their 45(th)

location while Immersive Gamebox have opened their 30(th) location

in the year with exciting news announced of their multi-million

pound agreement with Merlin entertainments across the UK, Europe,

the USA, and Australia. The multi-territory partnership is intended

to create immersive experiences that will engage and connect

players of all ages, using the Gamebox suite of IP partnerships

that include Paw Patrol, Ghostbusters, Netflix, and the Angry Birds

game.

In addition, there are opportunities for IVS' proprietary vision

modules to be embedded by providers into their solutions in smart

manufacturing process to ensure "right first time" products.

New markerless technology

Markerless motion capture enables 3D motion capture without the

need to wear motion capture suits or attach reflective markers,

active markers or inertial sensors. The technology uses the latest

machine learning and AI techniques to process video imagery to

create 3D visualisations. In a similar way to how Large Language

Models are used to drive AI Chatbots, we are building our own

proprietary Large Video Models to develop and improve the

markerless technology. We showcased our new markerless technology

platform in the summer showing the technique seamlessly working in

a six-participant real-time immersive VR experience with our LBE

partner Dreamscape.

In its nascent state, markerless technology is not yet as

accurate as existing marker-based systems so will be a

complementary solution. The markerless solution will therefore be

suited to situations where it is not practical or desirable to add

markers to the subject or where commercial imperatives mean

efficiency is key. We expect the markerless technology to have

immediate applicability in the LBE and Entertainment segments and,

over time, will become relevant in Life Sciences in clinical

situations as the technique is validated against marker-based data.

Markerless is a complementary capture technique to marker-based and

will be of value to most of Vicon's existing 10,000 global

customers, as well as expanding our TAM by appealing to those who

cannot use markers to adopt the technology.

Ultimately, the markerless product solution will incorporate

elements of cloud infrastructure and delivery, exploring the

opportunity for subscription and annual recurring revenue (ARR)

models alongside the traditional capital goods model.

M&A

During the year, we continued to actively pursue M&A

opportunities to complement the five-year plan. Our recent

acquisition of IVS in November 2023 fits into our five-year plan

and is a good strategic fit, serving as an example of the types of

targets we are seeking to acquire. IVS has deep Intellectual

Property in integrated smart sensing; has a position of strength in

its niche market; is culturally a good fit; has an attractive

financial profile and will be immediately earnings enhancing.

Oxford Metrics has a disciplined approach to M&A - we are

absolutely determined to find the right acquisitions, at the right

price, for the right reasons.

Our M&A pipeline continues to develop and evolve and

includes greater focus on certain market opportunities, for example

smart manufacturing is emerging as a strong adjacent technology

market with global growth potential.

Quadrants of Growth

OPERATIONAL REVIEW

KPI Revenue PBT Adjusted PBT*

FY23 FY22 FY23 FY22 FY23 FY22

--------- --------- -------- -------- ---------- ----------

Vicon GBP44.2m GBP28.8m GBP4.6m GBP2.7m GBP8.2m GBP5.4m

--------- --------- -------- -------- ---------- ----------

Plc - - GBP1.6m - (GBP1.7m) (GBP2.8m)

--------- --------- -------- -------- ---------- ----------

Group GBP44.2m GBP28.8m GBP6.2m GBP2.7m GBP6.5m GBP2.6m

--------- --------- -------- -------- ---------- ----------

Record revenues are reported of GBP44.2m (FY22: GBP28.8m)

representing an increase of 53.5% (52.4% on a constant currency

basis). Order intake for the full year was GBP31.7m (FY22:

GBP46.9m) reflecting a normalisation of customer buying behaviour

compared to last year in which customers were placing orders in

advance following the disruption caused by the pandemic and

subsequent supply chain challenges. As of 30(th) September 2023,

the order book stood at GBP11.5m (FY22: GBP24.0m) representing a

normalisation of customer buying patterns. Given the operational

benefits of having an order book, the business will seek to

maintain an order book broadly equivalent to a quarter's revenue in

the future.

Continued buoyant performance in our Entertainment segment,

which saw year on year revenue growth of 82% and accounts for 43%

of orders in hand. Cover Japan purchased a large number of Valkyrie

cameras for four motion capture stages to allow V-tubers to capture

and purchase content for their channels. Double Negative's

partnership with Dimension Studio continued with the purchase of an

In-Camera Visual Effects stage which is being shipped globally for

projects coming to a theatre or streaming service very soon. While

in the USA, PUBG Madison installed the first Valkyrie stage in that

territory.

Life Sciences, traditionally our cornerstone market, saw year on

year revenue growth of 40% and accounts for 29% of the orders in

hand. The Hospital Israelita Albert Einstein (HIAE), the largest

gait lab in Brazil, upgraded their system and in Italy the

University of Padova's Industrial Engineering in Sports Department

are using the new Valkyrie 8 for high speed analysis with the

Italian Paralympic team. Elsewhere, in Australia, Victoria

University continue to provide gold standard testing for FIFA's

research using the Valkyrie 16 and 26 systems, and in the US, the

University of Rochester Medical Centre have installed multiple

Valkyrie laboratories for spine and other biomechanical

research.

Engineering reported year on year revenue growth of 56% and

accounts for 22% of orders in hand. ITESM, a private university in

Monterrey, Mexico installed a Valkyrie system for drone tracking

whilst the University of Arizona also purchased Valkyrie 26 cameras

to track tiny 'crazyfly' drones. While the University of Manitoba

acquired a large Valkyrie system for both Unmanned Aerial Vehicle

(UAV) and ground robot tracking in an indoor agriculture research

facility.

LBE reported a slight revenue decline year on year of 5% and

accounts for 6% of orders in hand. Despite this, LBE remains an

attractive market and presents a clear growth opportunity going

forward, but for the time being remains sensitive to customer roll

out plans and consumer acceptance of this exciting application. Our

partner Sandbox VR recently announced their 45(th) location and

Immersive Gamebox opened their 30(th) location in the year with

exciting news announced of their multi-million pound and

multi-territory agreement with Merlin Entertainments, a family

entertainment company.

Overall, Entertainment represented the largest segment of

revenues but given strong performances in Life Sciences and

Engineering in the second half, it is likely that we can expect a

more even balance of revenues in the year ahead.

Included in the Gross Profit, the Product gross margin was 68.0%

(FY22: 70.5%). This was largely driven by more expensive components

as a consequence of the challenging supply chain constraints over

the past two years together with product mix. The supply chain

constraints have, for the most part, returned to normal so

replenishment of Inventory will be at lower cost. The overall cost

base increased during the year reflecting the investment set out in

our five-year plan, the resources are now largely all in place.

Given the above, Vicon reported an improved Adjusted PBT* of

GBP8.2m (FY22: GBP5.4m).

In addition to our markerless development outlined earlier, FY23

also saw the development and release of numerous software updates

that serve our existing markets including Tracker 4.0 in

Engineering, Shogun 1.09 and Shogun 1.10 in Entertainment, Nexus

2.15 and Nexus Insight in Life Sciences and Evoke 1.6 in the LBE

market. All these releases kept our solutions relevant, and at the

cutting edge, ensuring the best customer experience.

CURRENT TRADING AND OUTLOOK

With ongoing market demand, Vicon starts the new financial year

with an Order Book of GBP11.5m which, together with a growing sales

pipeline, provides the business with visibility on over a half of

expected revenues for the year ahead. The year ahead will also see

the start of the commercialisation of our markerless technology. In

this regard, revenue expectations for the year ahead from that

product are modest ahead of a more expected material contribution

in FY25.

In FY23 we saw decline in product gross margins arising from

supply chain cost pressures; the supply chain situation has now

normalised, and we expect to see recovery closer to historic

performance in FY24.

The cost base increased in FY23, reflecting the planned

investment to deliver the five-year plan. We feel the key resources

to deliver the plan are in place and will open a new dedicated

markerless facility in Oxford in FY24. More generally the cost base

is not immune to the current inflationary environment, so some

underlying increase is to be expected.

The Group remains in good financial health which includes a net

cash position of GBP64.8m. With these resources the Group can move

forward with confidence and in a strong position both to pursue

further M&A in line with the five-year plan and enhance

earnings per share.

The Board looks forward to the new financial year which is set

to see further underlying growth in our existing markets whilst

laying the foundations for future growth including the rollout of

markerless in Vicon.

Imogen Moorhouse

CEO

* Profit Before Tax before Group recharges adjusted for

share-based payments, amortisation and impairment of intangibles

arising on acquisition and additional Contemplas consideration

deemed remuneration.

FINANCIAL REVIEW

Income Statement

The Group reported revenue from continuing operations of

GBP44.2m (FY22: GBP28.8m) representing a headline increase of

53.5%. The year on year FX effects were modest: on a constant FX

basis revenues increased by 52.4%. From a geographical perspective,

our Asia Pacific region had a strong year driven by Entertainment

reporting 74.8% year on year growth, whilst Vicon USA, our largest

market in the year reported year on year growth of 61.0%.

Gross Profit margin declined to 65.0% (FY22: 67.5%), which

reflected the usage of higher cost components acquired during the

supply chain challenge of the last few years and product mix within

year. In real terms Gross Profit improved year on year by GBP9.3m

to GBP28.7m.

Reviewing the cost base within the Income Statement:

-- Sales, Support and Marketing costs increased by GBP1.6m which

was largely due to increased revenue generation activity, additional

marketing resources and commission.

-- Research & Development expensed through the Income Statement

was GBP6.5m (FY22: GBP3.5m). The continual investment and innovation

in product and services is necessary to maintain the Group's

competitive position; this included a number of the new products

released during the financial year. In addition, the markerless

project, described in the CEO review was expensed during the

year as research into the technology progressed toward a marketable

and capitalisable product in the future.

-- Administration expenses. Excluding the presentational effect

of the Yotta disposal, the underlying increase was GBP1.7m

from continuing operations which was due to augmentation of

back office and operational management together with performance

related payments.

Adjusted PBT* of GBP6.5m (FY22: GBP2.6m) has been determined

after adding back to the Statutory PBT GBP6.3m (FY22: GBP2.7m)

non-cash items such as amortisation and impairment of acquired

intangibles, share option charge and non-recurring items. A full

reconciliation is available in note 6.

Compared to the first half, second half profitability did

benefit both from an increased gross margin as a result of higher

revenues and from additional Interest received, however the

Adjusted PBT performance in the second half of GBP2.4m compared

with a first half performance of GBP4.1m. The imbalance was largely

caused by costs incurred or accrued in the second half that in

practice relate to the full year, such as higher marketing and

performance related incentives finalised at the end of the year.

Taking this effect into account underlying profitability in the

second half was similar to the first half.

Statement of Financial Position

Goodwill and intangibles

The overall balance was largely unchanged at GBP10.2m (FY22:

GBP10.1m) reflecting the addition of GBP2.1m (FY22: GBP3.4m) of

capitalised development in the year less amortisation and

impairment of development costs GBP1.7m (FY22: GBP1.4m) and the

amortisation and impairment of acquired intangibles of GBP0.3m

(FY22: GBP0.3m).

Property, plant and equipment

The value of fixed assets increased to GBP2.5m (FY22: GBP1.6m).

The movement arising due to investment of GBP1.5m (FY22: GBP0.6m)

in the year which included Leasehold Improvements for the new

Denver office, a variety of IT related equipment and a Dreamscape

pod. Depreciation charge for the year of GBP 0. 6m (FY22:

GBP0.4m).

Right of use assets (IFRS16)

The value of Right of Use assets increased to GBP3.1m (FY22:

GBP1.4m) during the year which reflected the commencement of a new

lease for our US operations in Denver and a rent review of at our

Oxford facility.

Investments

The investment of GBP0.2m (FY22: GBP0.2m) relates to a minority

interest in Trensl Inc. which provides training VR solutions for

the military and healthcare (rehabilitation). The investment comes

back-to-back with an exclusive supply agreement to provide all

systems.

Inventories

The inventory position at the end of the financial year was

GBP7.2m (FY22: GBP4.5m). Given the supply chain situation over the

past few years, the Group decided to deploy cash during the year to

increase inventory in order to hedge against any further

disruption. The supply chain has for the most part normalised, so

inventory is expected to return to a lower level in the year

ahead.

Trade and other receivables

At the year-end Trade and other receivables were GBP9.9m (FY22:

GBP7.4m). The net overall increase is due to higher Vicon Trade

receivables GBP7.6m (FY22: GBP5.3m), which reflected the pattern of

trading in FY23 and Accrued interest GBP0.6m (FY22: GBP0.3m).

Current liabilities

At the year-end, Trade and other payables were GBP11.3m (FY22:

GBP11.3m). Whilst there was no change overall trade payables

decreased at the year-end to GBP 3.8m (FY22: GBP4.0m), accruals

were higher at GBP3. 5m (FY22: GBP1.9m) and Vicon support contract

liabilities were lower at GBP3. 7m (FY22: GBP5.1m) due in part to

exceptional level of customer deposits last year.

The bank overdraft of GBP1.2m (FY22: GBP0.0m) relates to a

subsidiary current account where there is technically no legal

right of set-off, we are therefore required to present this balance

separately.

The lease liabilities balance reported at GBP0.7m (FY22:

GBP0.4m) represents the value of lease payments due within one year

relating to right of use assets.

Non-current liabilities

The GBP0.2m decrease in other liabilities are due to Vicon

Support contract liabilities.

The lease liabilities balance reported of GBP2.5m (FY22:

GBP1.1m) represents the value of lease payments due greater than

one year relating to right of use assets which has increased due to

changes described in Right of Use assets.

Statement of cashflows

The Group finished the year with Net cash of GBP64.8m (FY22:

GBP67.7m) including Fixed Term deposits of GBP42.0m (FY22:

GBP55.0m). The amount on fixed term deposit was reduced at year-end

in readiness for the acquisition of IVS post yearend.

Cash generated by operating activities was GBP3.2m (FY22:

GBP3.5m).

The deployment of this cash included continued investment in

development giving rise to a purchase of intangibles of GBP2.1m

(FY22: GBP3.5m), payment of dividends of GBP3.2m (FY22: GBP2.5m)

and the aforementioned increase in Inventory.

Surplus cash not required for the day to day working capital

needs of the business is on a variety of 3-12 month bank deposits

with NatWest and Lloyds Bank. Interest received in cash for the

year was GBP1.2m (FY22: GBP0.0m).

Tax

The Group tax charge this year is GBP0.6m (FY22: Credit

GBP0.7m). The tax credit in the prior year arose due to various

deferred tax adjustments including but not exclusively Research

& Development tax credits which continues to have a beneficial

effect on the level of corporation tax payable in the UK.

The Group has a net deferred tax liability of GBP1.1m (FY22:

GBP0.9m).

David Deacon

CFO

* Profit Before Tax before Group recharges adjusted for

share-based payments, amortisation and impairment of intangibles

arising on acquisition and additional Contemplas consideration

deemed remuneration and exceptional costs.

consolidated INCOME statement

for the year ended 30 september 2023

All amounts relate to continuing operations 2023 2022

Note GBP'000 GBP'000

------------------------------------------------------- ---- -------- --------

Revenue 3 44,240 28,816

Cost of sales (15,497) (9,352)

------------------------------------------------------- ---- -------- --------

Gross profit 28,743 19,464

Sales, support and marketing costs (8,202) (6,608)

Research and development costs (6,543) (3,547)

Administrative expenses (9,146) (6,814)

Operating profit 4,852 2,495

Finance income 1,561 305

Finance expense (163) (67)

Profit before taxation 3,5 6,250 2,733

Taxation 7 (594) 665

------------------------------------------------------- ---- -------- --------

Profit from continuing operations 5,656 3,398

------------------------------------------------------- ---- -------- --------

Profit from discontinued operations net of tax - 43,519

------------------------------------------------------- ---- -------- --------

Profit attributable to owners of the parent during

the year 5,656 46,917

------------------------------------------------------- ---- -------- --------

Earnings per share for profit on continuing operations

attributable to owners of the parent during the

year

Basic earnings per ordinary share (pence) 8 4.35p 2.66p

Diluted earnings per ordinary share (pence) 8 4.32p 2.62p

Earnings per share for profit on total operations

attributable to owners of the parent during the

year

Basic earnings per ordinary share (pence) 8 4.35p 36.70p

Diluted earnings per ordinary share (pence) 8 4.32p 36.11p

COnsolidated statement of

comprehensive income FOR THE YEAR

ED 30 sEPTEMBER 2023

Group Group

2023 2022

GBP'000 GBP'000

----------------------------------------------------- ------- -------

Net profit for the year 5,656 46,917

------------------------------------------------------ ------- -------

Other comprehensive expense

Items that will or may be reclassified to profit

or loss

Exchange differences on retranslation of overseas

subsidiaries (110) 953

Total other comprehensive expense (110) 953

------------------------------------------------------ ------- -------

Total comprehensive income for the year attributable

to owners of the parent 5,546 47,870

------------------------------------------------------ ------- -------

consolidated statement of financial position AS AT 30 september

2023

Restated

COMPANY NUMBER: 03998880 Group Group

2023 2022

GBP'000 GBP'000

-------------------------------------- -------- --------

Non-current assets

Goodwill and intangible assets 10,203 10,081

Property, plant and equipment 2,480 1,638

Right of use assets 3,135 1,367

Financial asset - investments 236 236

Deferred tax asset - -

-------------------------------------- -------- --------

16,054 13,322

Current assets

Inventories 7,240 4,462

Trade and other receivables 9,907 7,397

Current tax receivable - 254

Fixed term deposits 42,000 55,000

Cash and cash equivalents 23,965 12,679

-------------------------------------- -------- --------

83,112 79,792

Current liabilities

Trade and other payables (11,304) (11,287)

Current tax payable (275) -

Bank overdraft (1,174) -

Lease liabilities (724) (440)

(13,477) (11,727)

Net current assets 69,635 68,065

-------------------------------------- -------- --------

Total assets less current liabilities 85,689 81,387

-------------------------------------- -------- --------

Non-current liabilities

Other liabilities (820) (965)

Lease liabilities (2,498) (1,064)

Provisions (48) (40)

Deferred tax liability (1,118) (932)

-------------------------------------- -------- --------

(4,484) (3,001)

-------------------------------------- -------- --------

Net assets 81,205 78,386

-------------------------------------- -------- --------

Capital and reserves attributable

to

owners of the parent

-------------------------------------- -------- --------

Share capital 326 324

Shares to be issued 65 65

Share premium account 19,487 19,094

Retained earnings 60,451 57,917

Foreign currency translation reserve 876 986

-------------------------------------- -------- --------

Total equity shareholders' funds 81,205 78,386

-------------------------------------- -------- --------

consolidated STATEMENT of CASHFLOWS

For the YEAR ended 30 september 2023

Group Group

2023 2022

GBP'000 GBP'000

----------------------------------------- -------- --------

Cash flows from operating activities

Profit for the year 5,656 46,917

Income tax expense/(credit) 594 (934)

Finance income (1,561) (305)

Finance expense 163 114

Dividends receivable - -

Depreciation and amortisation 2,898 2,555

Impairment of intangible assets 217 -

Profit on sale of property, plant

and equipment (8) -

Profit on disposal of discontinued

operation - (43,578)

Share-based payments 59 139

Increase in inventories (2,799) (1,919)

(Increase)/decrease in receivables (2,274) (3,664)

Increase/(decrease) in payables 205 4,187

Cash generated from operating activities 3,150 3,512

Tax received/(paid) 209 (248)

----------------------------------------- -------- --------

Net cash from operating activities 3,359 3,264

Cash flows from investing activities

Purchase of property, plant and

equipment (1,499) (588)

Purchase of intangible assets (2,127) (3,464)

Disposal of discontinued operation,

net of cash disposed of - 47,141

Proceeds on disposal of property,

plant and equipment 8 37

Cash placed on fixed term deposits (67,000) (65,000)

Fixed term deposits maturing 80,000 10,000

Interest received 1,219 28

-----------------------------------------

Net cash generated from/(used in)

investing activities 10,601 (11,846)

Cash flows from financing activities

Principal paid on lease liabilities (579) (460)

Interest paid (4) -

Interest paid on lease liabilities (159) (112)

Issue of ordinary shares 370 583

Equity dividends paid (3,246) (2,542)

----------------------------------------- -------- --------

Net cash used in financing activities (3,618) (2,531)

----------------------------------------- -------- --------

Net increase/(decrease) in cash

and cash equivalents 10,342 (11,113)

Cash and cash equivalents at beginning

of the period 12,679 22,957

Exchange (loss)/gain on cash and

cash equivalents (230) 835

Cash and cash equivalents at end

of the period 22,791 12,679

----------------------------------------- -------- --------

Cash and cash equivalents included

in current assets 23,965 12,679

Bank overdraft included in current

liabilities (1,174) -

----------------------------------------- -------- --------

22,791 12,679

----------------------------------------- -------- --------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE YEARED 30

SEPTEMBER 2023

Foreign

Share currency

Share Shares premium Retained translation

Group capital to be issued account earnings reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- -------- ------------- -------- --------- ------------ -------

Balance as at 30 September

2021 317 65 18,483 13,538 33 32,436

Net profit for the year - - - 46,917 - 46,917

Exchange differences on

retranslation of overseas

subsidiaries - - - - 953 953

Transactions with owners:

Tax recognised directly

in equity in relation to

employee share option schemes - - - (99) - (99)

Dividends - - - (2,542) - (2,542)

Issue of share capital 7 - 611 - - 618

Share based payment charge - - - 103 - 103

Balance as at 30 September

2022 324 65 19,094 57,917 986 78,386

Net profit for the year - - - 5,656 - 5,656

Exchange differences on

retranslation of overseas

subsidiaries - - - - (110) (110)

Transactions with owners:

Tax recognised directly

in equity in relation to

employee share option schemes - - - 90 - 90

Dividends - - - (3,246) - (3,246)

Issue of share capital 2 - 393 - - 395

Share based payment charge - - - 34 - 34

Balance as at 30 September

2023 326 65 19,487 60,451 876 81,205

------------------------------- -------- ------------- -------- --------- ------------ -------

1. B asis of preparation of the financial information

The financial information in this preliminary announcement has

been prepared in accordance with the recognition and measurement

criteria of IFRS. This announcement does not itself contain

sufficient information to comply with IFRS. The Company expects to

publish full financial statements that comply with IFRS on 5

December 2023.

The preparation of financial statements in conformity with IFRS

requires the use of certain critical accounting estimates. It also

requires management to exercise judgement in the process of

applying the Group's accounting policies which affect the reported

amount of assets and liabilities at the statement of financial

position date and the reported amounts of revenues and expenses

during the reported period. Although the estimates are based on

management's best knowledge of the amount, event or actions, actual

results may ultimately differ from those estimates.

The financial information set out in this preliminary

announcement does not constitute statutory accounts as defined in

Section 434 of the Companies Act 2006 for the years ended 30

September 2023 and 30 September 2022 but is derived from those

accounts. The statutory accounts for the year ended 30 September

2022 have been delivered to the Registrar of Companies and those

for the year ended 30 September 2023 will be delivered following

the Company's annual general meeting. The auditors have reported on

those accounts: their report was unqualified, did not contain

references to any matters to which the auditors drew attention by

way of emphasis and did not contain a statement under Section 498

of the Companies Act 2006 for the year ended 30 September 2023 or

30 September 2022.

2. Basis of consolidation

The consolidated financial information incorporates the results

of the Company and all of its subsidiary undertakings drawn up to

30 September 2023.

3. Revenue from contracts with customers

All revenue is from continuing operations.

2023 2022

Revenue GBP'000 GBP'000

---------------------- ------- -------

Continuing operations

Vicon UK 25,545 17,338

Vicon USA 18,695 11,478

---------------------- ------- -------

44,240 28,816

---------------------- ------- -------

Timing of the transfer

of goods Total

and services Vicon UK Vicon USA

2023 GBP'000 GBP'000 GBP'000

------------------------ ---------- ----------- -------

Point in time 23,714 16,032 39,746

Over time 1,831 2,663 4,494

------------------------ ---------- ----------- -------

Total 25,545 18,695 44,240

------------------------ ---------- ----------- -------

Contract Counterparties

------------------------ ---------- ----------- -------

Direct to consumers 5,341 17,673 23,014

Third party distributor 20,204 1,022 21,226

------------------------ ---------- ----------- -------

Total 25,545 18,695 44,240

------------------------ ---------- ----------- -------

By destination

------------------------ ---------- ----------- -------

UK 3,176 - 3,176

Germany 1,973 - 1,973

Italy 633 - 633

Netherlands 646 - 646

France 155 - 155

Poland 178 - 178

Spain 88 - 88

Ireland 565 - 565

Rest of Europe 1,087 - 1,087

------------------------ ---------- ----------- -------

Total Europe 5,325 - 5,325

------------------------ ---------- ----------- -------

Canada 9 1,878 1,887

USA 12 16,533 16,545

Total North America 21 18,411 18,432

------------------------ ---------- ----------- -------

Australia 939 13 952

Hong Kong 2,517 - 2,517

Japan 5,680 - 5,680

South Korea 2,835 - 2,835

China 3,957 - 3,957

India 574 - 574

Rest of Asia Pacific 397 - 397

------------------------ ---------- ----------- -------

Total Asia Pacific 16,899 13 16,912

------------------------ ---------- ----------- -------

Other 124 271 395

------------------------ ---------- ----------- -------

Total 25,545 18,695 44,240

------------------------ ---------- ----------- -------

Timing of the transfer

of goods Total

and services Vicon UK Vicon USA

2022 GBP'000 GBP'000 GBP'000

---------- ----------- -------

Point in time 15,494 9,175 24,669

Over time 1,844 2,303 4,147

------------------------ ---------- ----------- -------

Total 17,338 11,478 28,816

------------------------ ---------- ----------- -------

Contract Counterparties

------------------------ ---------- ----------- -------

Direct to consumers 4,256 10,529 14,785

Third party distributor 13,082 949 14,031

------------------------ ---------- ----------- -------

Total 17,338 11,478 28,816

------------------------ ---------- ----------- -------

By destination

------------------------ ---------- ----------- -------

UK 2,396 - 2,396

Germany 2,156 - 2,156

Italy 304 - 304

Netherlands 441 - 441

France 473 - 473

Poland 332 - 332

Spain 260 - 260

Rest of Europe 1,022 - 1,022

------------------------ ---------- ----------- -------

Total Europe 4,988 - 4,988

------------------------ ---------- ----------- -------

Canada 39 1,008 1,047

USA 24 10,197 10,221

Rest of North America - 177 177

------------------------ ---------- ----------- -------

Total North America 63 11,382 11,445

------------------------ ---------- ----------- -------

Australia 797 - 797

Hong Kong 2,539 - 2,539

Japan 2,334 - 2,334

South Korea 1,314 - 1,314

China 2,158 - 2,158

Rest of Asia Pacific 532 - 532

------------------------ ---------- ----------- -------

Total Asia Pacific 9,674 - 9,674

------------------------ ---------- ----------- -------

Other 217 96 313

------------------------ ---------- ----------- -------

Total 17,338 11,478 28,816

------------------------ ---------- ----------- -------

2023 2022

GBP'000 GBP'000

------------------------------------- --------- ---------

Vicon revenue by market - Continuing

operations

Engineering 8,708 5,581

Entertainment 18,193 10,023

Life sciences 14,841 10,589

Location based entertainment 2,498 2,623

Total 44,240 28,816

------------------------------------- --------- ---------

Group revenue by

type

Continuing operations

Sale of hardware 36,158 22,700

Sale of software 1,974 1,970

Rendering of services 5,209 3,009

SaaS - 193

Support 899 944

----------------------- ------ ------

Total 44,240 28,816

----------------------- ------ ------

Group revenue by origin

Continuing operations

UK 23,690 16,010

Europe 1,852 1,312

North America 18,695 11,478

Asia Pacific 3 16

------------------------ ------ ------

Total 44,240 28,816

------------------------ ------ ------

Contract balances

2023

Contract assets Contract liabilities

GBP'000 GBP'000

---------------------------------------------- --------------- --------------------

At 1 October 2022 - 6,043

Amounts included in contract liabilities

recognised as revenue during the period - (18,400)

Cash received in advance of performance

and not recognised as revenue during the

period - 17,138

Foreign exchange differences - (253)

At 30 September 2023 - 4,528

---------------------------------------------- --------------- --------------------

2022

Contract assets Contract liabilities

GBP'000 GBP'000

---------------------------------------------- --------------- --------------------

At 1 October 2021 261 7,474

Transfers from contract assets to trade

receivables (520) -

Amounts included in contract liabilities

recognised as revenue during the period - (23,176)

Excess of revenue recognised over cash during

the period 770 -

Cash received in advance of performance

and not recognised as revenue during the

period - 26,670

Disposal (511) (5,325)

Foreign exchange differences - 400

At 30 September 2022 - 6,043

---------------------------------------------- --------------- --------------------

Contract assets and contract liabilities are included within

trade and other assets and trade and other payables and other

liabilities respectively on the face of the statement of financial

position. They arise primarily from the Group's support contracts

which are delivered over time and where the cumulative payments

received from customers at each balance sheet date do not

necessarily equal the amount of revenue recognised on the

contract.

Remaining performance obligations

The majority of the Group's contracts are for the delivery of

goods and services within the next 12 months. However, some

software and support contracts are for a period greater than 12

months and the amount of revenue that will be recognised in future

periods on these contracts is as follows:

At 30 September 2029 and

2023 2024 2025 2026 2027 2028 beyond

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ ------- ------- ------- ------- ------- --------

Support contracts 3,707 493 199 86 39 4

------------------ ------- ------- ------- ------- ------- --------

At 30 September 2028 and

2022 2023 2024 2025 2026 2027 beyond

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------ ------- ------- ------- ------- ------- --------

Support contracts 3,143 595 239 75 44 11

------------------ ------- ------- ------- ------- ------- --------

4. Segmental analysis

Segment information is presented in the financial statements in

respect of the Group's business segments, which are reported to the

Chief Operating Decision Maker (CODM). The Group has identified the

Board of Directors of Oxford Metrics plc ("the Board") as the CODM.

The business segment reporting reflects the Group's management and

internal reporting structure.

The Group comprises the following business segments:

-- Vicon Group: This is the development, production and sale of

computer software and equipment for the engineering, entertainment

and life science markets; and

Other unallocated costs represent head office expenses not

recharged to subsidiary companies.

Inter segment transfers are priced along the same lines as sales

to external customers, with an appropriate discount being applied

to encourage use of Group resources. This policy was applied

consistently throughout the current and prior year. There were no

significant inter segment transfers during the current or prior

year.

Intra segment sales between Vicon UK and Vicon USA are

eliminated prior to management and internal reporting, and hence

are not shown separately in the analysis below. The total intra

segment sales between Vicon UK and Vicon USA in the year ended 30

September 2023 are GBP10,376,000 (2022: GBP5,718,000).

Segment assets consist primarily of property, plant and

equipment, intangible assets, inventories and trade and other

receivables. Unallocated assets comprise deferred taxation,

investments and cash and cash equivalents.

2023 2022

Adjusted Adjusted

profit/(loss) Profit/(loss) profit/(loss) Profit/(loss)

before Adjusting Group before before Adjusting Group before

tax items recharges tax tax items recharges tax

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------ ------------- --------- ---------- ------------- ------------- --------- ---------- -------------

Continuing

operations

Vicon UK 1,692 (287) 2,852 4,257 1,590 (434) 1,426 2,582

Vicon USA 6,542 - (6,162) 380 3,848 - (3,712) 136

------------ ------------- --------- ---------- ------------- ------------- --------- ---------- -------------

Vicon Group 8,234 (287) (3,310) 4,637 5,438 (434) (2,286) 2,718

------------ ------------- --------- ---------- ------------- ------------- --------- ---------- -------------

Unallocated (1,689) (8) 3,310 1,613 (2,840) (86) 2,941 15

Total

continuing

operations 6,545 (295) - 6,250 2,598 (520) 655 2,733

------------ ------------- --------- ---------- ------------- ------------- --------- ---------- -------------

Adjusted profit before tax is detailed in note 6.

Segment depreciation and amortisation

2023 2022

GBP'000 GBP'000

---------------------------- ------------------- ------------------

Continuing operations

Vicon UK 2,742 1,810

Vicon USA 328 203

---------------------------- -------------------

Vicon Group 3,070 2,013

---------------------------- -------------------

Unallocated 45 59

---------------------------- -------------------

Total continuing operations 3,115 2,072

---------------------------- -------------------

Discontinued operations

Yotta - 483

Oxford Metrics Group 3,115 2,555

---------------------------- ------------------- ------------------

Non-current Additions to Carrying amount Carrying amount

assets non-current assets of segment assets of segment liabilities

2023 2022 2023 2022 2023 2022 2023 2022

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------- -------- ---------- --------- --------- --------- ------------ -----------

Vicon UK 12,763 11,635 3,885 3,304 28,161 29,566 (10,717) (9,817)

Vicon USA 3,010 1,416 1,998 566 13,107 6,445 (6,116) (4,476)

---------------- -------- -------- ---------- --------- --------- --------- ------------ -----------

Vicon Group 15,773 13,051 5,883 3,870 41,268 36,011 (16,833) (14,293)

---------------- -------- -------- ---------- --------- --------- --------- ------------ -----------

Yotta Group - - - 661 - - - -

Unallocated 281 271 55 8 63,950 63,155 (1,128) (435)

OMG Life Group* - - - - (6,052) (6,052) - -

Oxford Metrics

Group 16,054 13,322 5,938 4,539 99,166 93,114 (17,961) (14,728)

---------------- -------- -------- ---------- --------- --------- --------- ------------ -----------

* The negative balance within segment assets represents a cash

overdraft which is part of the Group's cash offset facility.

5. Profit for the year

The profit for the year is stated after charging /

(crediting):

2023 2022

GBP'000 GBP'000

------------------------------------------------------ ------- -------

Amortisation of right of use assets 523 496

Depreciation of property, plant and equipment - owned 639 424

Amortisation of intellectual property 274 272

Amortisation of development costs 1,462 1,363

Impairment of development costs 217 -

Share based payments - equity settled 25 36

Share option charges 34 103

Foreign exchange (gain)/loss (108) 487

------------------------------------------------------ ------- -------

6. Reconciliation of adjusted profit before tax

The adjusted profit before tax is considered by the Board to

more accurately reflect the underlying operating performance of the

business on a go-forward basis and complements the statutory

measure as reported in the Consolidated Income Statement.

The reconciliation of profit before tax to adjusted profit

provided below includes items that are:

-- non-recurring in nature, such as redundancy costs incurred

from time to time, acquisition costs and results of the Group's

equity accounted associate, which are not core to operations

or future operating performance.

-- non-cash moving items which arise from the accounting treatment

of share based payments and the amortisation of acquired intangibles

which affect neither future operating performance nor cash generation.

The above definition has been consistently applied historically

and is the measure by which the market generally judges PBT

performance.

2023 2022

GBP'000 GBP'000

---------------------------------------------------- ------- -------

Profit before tax - continuing operations 6,250 2,733

Share option charges 34 103

Amortisation of intangibles arising on acquisition 261 261

Costs associated with the acquisition of Contemplas - 156

Reapportion Group overheads - (655)

Adjusted profit before tax - continuing operations 6,545 2,598

---------------------------------------------------- ------- -------

Adjusted earnings per share for

profit on continuing operations

attributable to owners of the parent

during the year

Basic earnings per share (pence) 4.57p 2.55p

Diluted earnings per share (pence) 4.54p 2.51p

The adjusted profit before tax for the Vicon business segment is

shown in detail below;

Vicon Group

2023 2022

Continuing operations GBP'000 GBP'000

---------------------------------------------------- ------- -------

Profit before tax 4,637 2,718

Share option charges 26 17

Amortisation of intangibles arising on acquisition 261 261

Costs associated with the acquisition of Contemplas - 156

Reapportion Group overheads 3,310 2,286

Adjusted profit before tax 8,234 5,438

---------------------------------------------------- ------- -------

The Group overheads in the tables above include head office

expenses recharged to subsidiaries.

7. Taxation

The tax is based on the profit for the year and represents:

2023 2022

GBP'000 GBP'000

------------------------------------------------------ ------- -------

United Kingdom corporation tax at 22.0% (2022: 19.0%) 218 462

Overseas taxation 143 69

Adjustments in respect of prior year 15 (79)

------------------------------------------------------ ------- -------

Current taxation 376 452

Deferred taxation 218 (1,386)

------------------------------------------------------ ------- -------

Total taxation expense/(credit) 594 (934)

------------------------------------------------------ ------- -------

UK corporation tax has been calculated at 19.0% up to 31 March

2023 and 25.0% from 1 April 2023. This gives rise to a blended tax

rate of 22.0% for the year.

Continuing and discontinued operations:

2023 2022

GBP'000 GBP'000

--------------------------------------------------------- ------- -------

Income tax expense/(credit) from continuing operations 594 (665)

Income tax credit from discontinued operations excluding

gain on sale (note 11) - (269)

Total tax (credit)/ expense 594 (934)

--------------------------------------------------------- ------- -------

At 30 September 2023, the Group had an undiscounted deferred tax

asset of GBP1,618,000 (2022: GBP1,588,000). The asset comprises

principally short term timing differences, future tax relief

available on the exercise of outstanding employee share options in

Oxford Metrics plc and unrelieved trading losses carried forward

for which recoverability is reasonably certain.

Deferred tax assets and liabilities have been measured at an

effective rate of 25% in both the UK and USA (2022: 25%).

The tax assessed for the year is lower than the blended rate of

corporation tax in the UK of 22.0% (2022: lower than the standard

rate of 19%).

The differences are explained as follows:

2023 2022

GBP'000 GBP'000

--------------------------------------------------- ------- -------

Profit for the year 5,656 46,917

Income tax expense/(credit) including discontinued

operations 594 (934)

--------------------------------------------------- ------- -------

Profit on ordinary activities before tax 6,250 45,983

--------------------------------------------------- ------- -------

Expected tax income based on the blended rate of

corporation tax in the UK of 22.0% (2022: 19.0%) 1,375 8,737

Effect of:

Expenses not deductible for tax purposes 82 68

Book gain on disposal in excess of tax gain - (8,280)

Unrelieved current year losses 170 (335)

Utilisation of losses brought forward (21) -

Adjustments to tax charge in respect of prior year

current tax 15 (79)

Adjustments to tax charge in respect of prior year

deferred tax (309) (383)

Higher rates on overseas taxation 44 29

Research and development tax credit (682) (467)

Effect of tax rate change (80) (224)

--------------------------------------------------- ------- -------

Total tax expense/(credit) 594 (934)

--------------------------------------------------- ------- -------

During the prior year the UK Government substantively enacted an

increase in the corporation tax rate to 25.0% effective from 1

April 2023. The deferred tax asset and liability as at 30 September

2023 has been calculated based on the rate of 25.0% unless the

asset/liability is expected to be realised or settled before the

rate increase in which case the rate of 19.0% has been used.

8. Earnings per share

2023 2022

Weighted Weighted

average average

number Per share number of Per share

Earnings of shares amount Earnings shares amount

GBP'000 '000 pence GBP'000 '000 pence

Continuing operations

Basic earnings per share

Earnings attributable to

ordinary shareholders 5,656 130,162 4.35 3,398 127,840 2.66

Dilutive effect of employee

share options - 904 (0.03) - 2,081 (0.04)

Diluted earnings per share 5,656 131,066 4.32 3,398 129,921 2.62

---------------------------- -------- ---------- --------- -------- ---------- ---------

Discontinued operations

Basic earnings per share

Earnings attributable to

ordinary shareholders - 130,162 - 43,519 127,840 34.04

Dilutive effect of employee

share options - 904 - - 2,081 (0.54)

Diluted earnings per share - 131,066 - 43,519 129,921 33.50

---------------------------- -------- ---------- --------- -------- ---------- ---------

Total operations

Basic earnings per share

Earnings attributable to

ordinary shareholders 5,656 130,162 4.35 46,917 127,840 36.70

Dilutive effect of employee

share options - 904 (0.03) - 2,081 (0.59)

---------------------------- -------- ---------- --------- -------- ---------- ---------

Diluted earnings per share 5,656 131,066 4.32 46,917 129,921 36.11

---------------------------- -------- ---------- --------- -------- ---------- ---------

Basic earnings per share is calculated by dividing the profit

attributable to equity holders of the Company by the weighted

average number of ordinary shares in issue during the year.

Diluted earnings per share is calculated by adjusting the

weighted average number of ordinary shares outstanding to assume

conversion of all dilutive potential ordinary shares (share

options). For share options a calculation is done to determine the

number of shares that could have been acquired at fair value

(determined as the average annual market share price of the

Company's shares) based on the monetary value of the subscriptions

rights and outstanding share based payment charges attached to

outstanding share options. The number of shares calculated as above

is compared with the number of shares that would have been issued

assuming the exercise price of the share options.

9. Dividends

2023 2022

Equity - ordinary GBP'000 GBP'000

----------------------------------------------- ------- -------

Final 2021 paid in 2022 (2.00 pence per share) - 2,542

Final 2022 paid in 2023 (2.50 pence per share) 3,246 -

3,246 2,542

----------------------------------------------- ------- -------

The directors are proposing a final dividend in respect of the

financial year ended 30 September 2023 of 2.75 pence per share

(2022: 2.50 pence per share) which will absorb an estimated

GBP3,587,000 of shareholders' funds. This dividend will be paid on

14 February 2024 to shareholders who are on the register of members

at close of business on 15 December 2023 subject to approval at the

AGM. These dividends have not been accrued in these financial

statements.

10. Prior year restatement

The Group presented its deferred tax assets and liabilities

arising in the same tax jurisdictions on a gross basis in prior

periods rather than netting them off in accordance with IAS 12. The

incorrect treatment resulted in a presentational error whereby both

the Group deferred tax asset and liability were overstated by

GBP1,588,000 at 30 September 2022.

Impact on financial statements

Group

2022

Deferred tax asset GBP'000

---------------------------------------- -------

Deferred tax asset originally presented 1,588

Net of to correct presentation (1,588)

Deferred tax asset as restated -

---------------------------------------- -------

Group

2022

Deferred tax liability GBP'000

-------------------------------------------- -------

Deferred tax liability originally presented (2,520)

Net of to correct presentation 1,588

Deferred tax liability as restated (932)

-------------------------------------------- -------

There is a corresponding error at the beginning of the prior

period - the error and its correction at 1 October 2021 are set out

below:

Group

2021

Deferred tax asset GBP'000

---------------------------------------- -------

Deferred tax asset originally presented 1,877

Net of to correct presentation (1,877)

Deferred tax asset as restated -

---------------------------------------- -------

Group

2021

Deferred tax liability GBP'000

-------------------------------------------- -------

Deferred tax liability originally presented (3,058)

Net of to correct presentation 1,877

Deferred tax liability as restated (1,181)

-------------------------------------------- -------

11. Copies of announcement

Copies of this announcement will be available from the Company's

registered office at 6 Oxford Pioneer Park, Yarnton, Oxfordshire,

OX5 1QU and from the Company's website: www.oxfordmetrics.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR MZMGZGKZGFZG

(END) Dow Jones Newswires

December 05, 2023 02:00 ET (07:00 GMT)

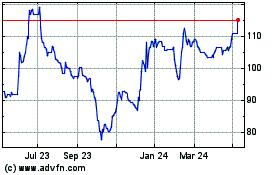

Oxford Metrics (LSE:OMG)

Historical Stock Chart

From Mar 2024 to Apr 2024

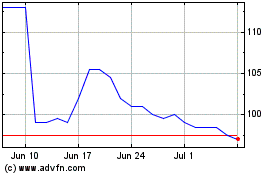

Oxford Metrics (LSE:OMG)

Historical Stock Chart

From Apr 2023 to Apr 2024